On its yesterday’s auction, Croatian Ministry of Finance issued three bonds worth HRK 15bn to refinance two maturing papers worth HRK 12.5bn. First time ever, Croatia issued 20Y EUR denominated paper, with yield of 1.28%. The shortest paper issued, 5y pure HRK, was issued at 0.37% while second tranche of RHMF-O-34BA yields 1.12%. In this article read more details about the auction and Croatian local bond market.

As announced last week in the media, Croatian Ministry of Finance decided to refinance two maturing bonds RHMF-O-203A and RHMF-O-203E with triple tranche on local market. Two maturing bonds were worth HRK 12.5bn in aggregate, which will be financed in full, while rest of the funds will most likely be used to fill the gap in this year’s budget balance. As papers mature on March 5th, holders of the maturing papers could choose between swapping the old paper for the new one on March 3rd or buying new ones and then receiving cash for the maturing paper two days later. The difference is in EURHRK rate, as new paper will be valued on March 3rd.

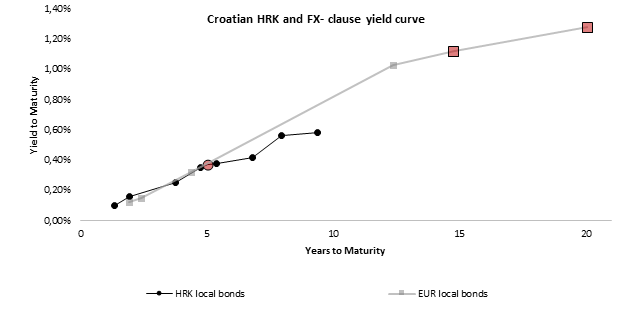

Now let’s talk about the auction and most important thing, prices. In the morning banks sent first indication of yield which stood at 0.37%-0.42% for the RHMF-O-253A, 1.12%-1.17% for existing RHMF-O-34BA and 1.28%-1.43% for 20Y RHMF-O-403E. Few hours later investors were informed that total demand for all three papers stands at HRK 16.5bn while yields were moved towards the lower bound of the first indication. In the end Ministry of Finance decided to issue HRK 5bn of RHMF-O-253A at 0.37% (coupon of 0.25% and clean price 99.406), HRK 4bn of RHMF-O-34BA at 1.12% translated in clean price of 98.374 which is mildly below market bids and EUR 800m (HRK 6bn) of RHMF-O-403E at 1.28% (coupon of 1.25% and clean price 99.472), resulting in the biggest auction recorded. Both RHMF-O-253A and RHMF-O-34BA were issued right on the curve (bid prices), without any premium left while 20Y EUR paper was issued close to its extrapolated value, reflecting solid bid for new paper. Total demand on aggregate stood at HRK 20.5bn, translated into bid to cover of 1.36, or 1.65 looking at the maturing amount.

Looking at the total demand in the past, this auction was one of the lightest in term of bid to cover but one has to bear in mind very long duration of the third paper and yields being on their bottom. On the other side, excess liquidity in banks’ balance is higher than ever (almost HRK 40bn) which stands at central bank at 0.00% while pension and investment funds are increasing their AUM every month due to wage and employment growth and no yield on deposits in banks. From market segmentation point, we could say that RHMF-O-253A was ‘made’ for banks and short-term funds, bond funds and insurances were mostly investing in RHMF-O-34BA while pensions funds poured their money in the new 20Y EUR denominated paper.

Talking about EUR denominated bonds, one should bear in mind that investors will buy new papers at EURHRK rate that will be set on Monday, March 2nd. In the last few days we saw significant volatility on EURHRK rate most likely due to auction as there are probably some investors that will leave their RHMF-O-203E to mature while not reinvesting proceeds to the new papers but instead buying single currency just to leave its balance unchanged. Just to put things into perspective, EURHRK yesterday jumped all the way to 7.4700 on bid side but then dropping to below 7.4600 as MinFin decided to issue more EUR papers (HRK 10bn) than was expected on the market.

To conclude, solid demand and current low-yield environment will benefit Croatian budget significantly. Just with the yesterday’s auction, Croatian Ministry of Finance will save HRK 600m as two bonds maturing cost us HRK 750m a year, while these three bonds will in aggregate cost us 140m a year. Assuming that Croatia will refinance its maturing CROATI 2020 in the summer at yield of 0.60% (EUR denominated 10Y Eurobond), total savings from auctions in 2020 will be around HRK 1bn. On top of all mentioned, Croatia proved that it could issue 20Y bond with no premium on the extrapolation, extending its curve and locking lower yields for longer.

Source: Bloomberg, InterCapital