In November, equities surged in the region on the back of positive vaccine development, while banks seemed to be the top gainers in most regional markets. For today we decided to take a closer look at credit activity of regional banks during the pandemic, with an emphasis on the Slovenian market.

Banking represent one of those sectors which have been hurt quite considerably by the ongoing crisis. Since the beginning of the year banks in our wider coverage have observed an average share price drop of 18.8%. Meanwhile, the positive sentiment regarding the vaccine development led to a surge in equities across Europe in November, while in our region of coverage, banks came out on top. To be specific, NLB was the top gainer in Slovenia, noting its best monthly share price performance (+34.9%) since the public offering in November of 2018. Despite such a rally, the bank is still traded at a relatively low P/B of 0.5, which is still one of the lowest multiples in the region. Komercijalna Banka (pref.) led the gainers in Serbia with a monthly share price increase of 11.62%, closing at RSD 3,000 per share and converging to the acquisition price concluded with NLB Group in late February. Furthermore, in Romania, BRD and Banca Transilvania were among the top gainers with increases of 17% and 16.1%, respectively. Meanwhile, in Croatia, ZABA recorded a solid performance of +8.2%.

Therefore, it is worth revisiting once again a few sectoral trends in the region to help us further understand how the banks are currently doing.

Market Consolidation Halted in Short Term

The pre-pandemic times marked a period of continued market consolidation in the CEE and SEE region. In less than 10 years, the SEE region has seen a decrease in the number of banks by slightly less than a third, while there are roughly 120 banks currently operating in this region. The consolidation in these markets also went hand in hand with privatisations, while in the recent years in Slovenia and Serbia we have seen the privatisation of NKBM, NLB Group, Abanka and Komercijalna Banka (ongoing). However, the pandemic has led to a halt in M&A activity even in the wider region, while the most notable cancelled transaction was the one announced by Commerzbank. As a reminder, Commerzbank has decided to retain its majority stake of 69.3% in its Polish subsidiary mBank and to terminate the sales process which was announced in September of 2019. In the coming period, including 2021, we deem that M&A activity in the SEE region is highly unlikely in the banking sector, aside from the finalization of ongoing transactions, such as the acquisition of Komercijalna Banka, while the merger of NKBM and Abanka has already been concluded.

Loan Development

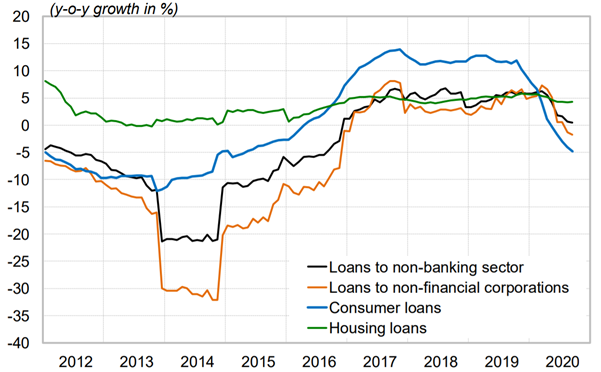

Unlike in a “usual” macroeconomic crisis, credit growth was still quite strong during the Covid-19 crisis. In Croatia, loans by financial institutions have been steadily increasing and are currently up by 4.5% YTD (as of Oct). Corporate loans have spiked in March (both in Croatia and Slovenia) which arguably came on the back of higher demand for working capital loans and revolving loans. To be specific, in Croatia, corporate loans have increased by as much as 6.6% in Q1 (of which the majority came in March). Meanwhile in Slovenia corporate loans have increased by 5.4% or EUR 480m in Q1, of which EUR 197m came in March alone. Short term loans have accounted for almost half of Q1’s increase, further backing the claim that these were mostly aforementioned working capital loans. In the months that followed, both markets have seen steady MoM decreases in this loan segment and this seems to be the trend leading into 2021. We expect that the negative trend in both markets will likely come to an end throughout 2021 which would come on the back of stronger growth of the economy. Besides that, the vaccine, as the light at the end of the tunnel, could play a significant role not only in corporate lending but in credit growth in general.

In terms of loans to households, the Croatian market has proven to be very resilient even in times of uncertainty, as these loans are up by 3.5% YoY and 2.2% YTD (as of Oct). Such a development could mostly be attributed to a very solid performance of housing loans (+5.7% YTD as of Oct), the largest segment of loans to households. Meanwhile, consumer loans have been observing MoM decreases for almost entirety of the pandemic due to the shaken consumer confidence. In Slovenia, loans to households are up by 1.4% YoY (as of Sep). The decline in loans to households was particularly evident during H1, while they have been on the rise since July. Of that housing loans were up by 4.3% (as of Sep), while the contraction in consumer loans continued (-4.8% YoY). Besides the pandemic, consumer loans are quite affected by the restrictions imposed by the Bank of Slovenia in the end of 2019, which we see as a burden to the segment even in post-pandemic times. In the times ahead loans to households are likely to be modestly increasing in both markets, mostly on the back of housing loans.

Loans by Sector and Type in Slovenia

Source: Bank of Slovenia

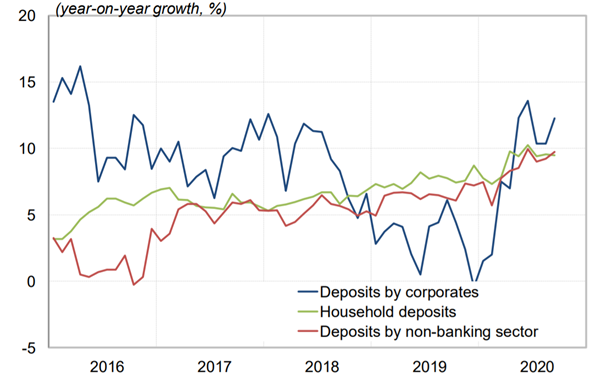

Deposit development

Banks entered the COVID-19 crisis with a continued focus on deposits on their liability side. The share of customer deposits in banks’ financial liabilities has continuously increased in the past years despite no or little remuneration for depositors. This has not only been a trend in the SEE region but has also been witnessed in the EU as well. As of October, deposits in Croatia are on their all time high at HRK 325.4bn, which notes an increase of 7.5% YoY and 8% YTD.

In Slovenia deposits by the non-banking sector rose 9.7% YoY (as of Sep), primarily due to growth in corporate deposits (12.2%). Growth in the amount of household deposits slowed in Q3 relative to Q2, most likely on account of the recovery of spending on goods and services, and the deteriorating situation on the labour market. Also, deposits by households growth remained high and stood at 9.5% YoY. We note that the continuing inflow of deposits to Slovenian banks represents a burden for their net interest income, as ECB’s rate on the deposit facility stands at -50bps. In the following periods it is likely that we will continue to see growth of deposits, but at quite lower rates.

Deposits by Sector in Slovenia

Source: Bank of Slovenia

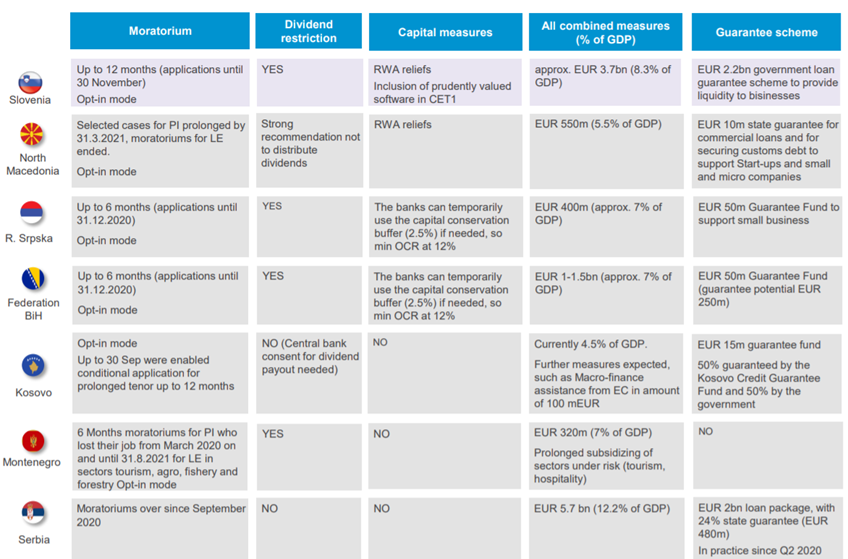

Moratoriums and NPLs/NPEs

As a consequence of the pandemic, countries deployed relief measures such as moratoria on loan repayments and public guarantee schemes, as well as fiscal measures, in order to mitigate the immediate impact of the sudden halt in economic activity. Banks provided special support measures, including standstill liabilities, repayment delays (moratoriums) and new liquidity credit lines to legal entities and citizens. In the table below, you can see the measures brought by markets in which NLB Group operates as of end Sep.

Source: NLB Group

We note that the availability of these support measures to clients does not in itself constitute an automatic criterion for classification into “forborne” category or to conclude that all clients who took advantage of the available measures occurred significant increase in credit risk. This in a way indicates that we will not see high NPEs in 2020, but will rather see potentially higher NPEs when the mentioned moratoriums expire.

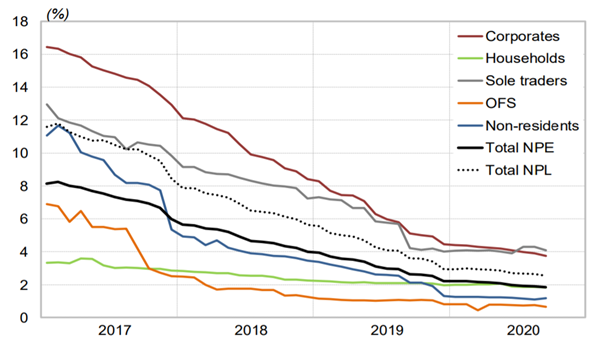

In Croatia, NPLs increased by HRK 1.1bn to HRK 20.65bn, while the NPL ratio stood at 5.54% as of end September, remaining flat since the beginning of the year. Corporate loans account for the largest amount of NPLs, that being 55%. Although corporates already have a fairly high NPL ratio of 13.2%, we expect to see quite higher NPLs and NPL ratio in the quarters to come.

September figures in Slovenia further back the above-mentioned claim as the amount of NPEs was down and stood at EUR 886m, while the NPE ratio was 1.8%. The NPE ratio declined to 3.7% in the corporate portfolio, while that ratio remains higher for SMEs compared to large enterprises. The NPE ratio in the housing loans segment has stabilised at 1.7% and at 2.7% in the consumer loans segment since June. These figures are expected to be quite higher in 2021, due to the aforementioned.

According to the latest figures by the Bank of Slovenia, banks received 23,705 applications for moratoriums in the total amount of EUR 401.1m which represents c.16% of total loans to the non-banking sector. On an EU level, as of June 2020, a nominal loan volume of EUR 871bn was granted EBA-compliant moratoria on loan repayments, comprising around 6% of banks’ total loans. However we note that these figures are not necessarily comparable as the classification of moratoriums might vary.

NPE by Client Ratio in Slovenia

Source: Bank of Slovenia

Slovenia’s largest bank, NLB Group approved moratoriums in the amount of EUR 1.7bn (15.7% of total gross book). Note that of total Covid-19 moratorium approved, EUR 501m has already expired; while EUR 760.7m will expire by the end of the year and EUR 445.7m after 2020.It is important to add that the bank has limited exposure to sectors which could be considered as sensitive. To be specific, Accommodation, Manufacturing (Car industry only) and Transport represents 9.32% (0.34bn EUR) of corporate exposure.

Conclusion

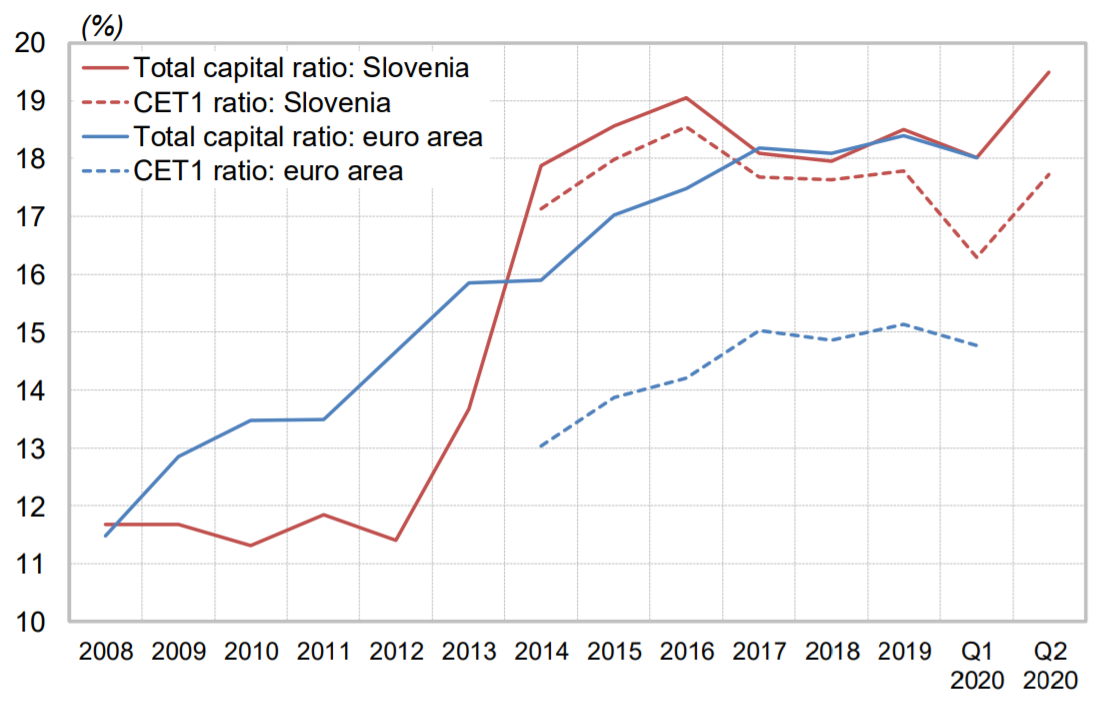

Banks entered the Covid-19 crisis in better shape than they did in previous crises. Compared with the Financial crisis in 2008-2009, banks now hold larger capital and liquidity buffers, while the Common Equity Tier 1 (CET1) and total capital ratio are well above the regulatory requirements, which can be seen in the graph below. Similarly, prior to the pandemic outbreak, banks’ liquidity coverage ratios were significantly above the regulatory minimum. As prior stated, credit activity has not stopped in Slovenia and Croatia, but it rather observed a slowdown in growth in many segments. Although banks are definitely going through tough times, we don’t expect to see huge drops in pre-provision income for FY 2020 in the region. Meanwhile, it is likely that we will observe higher pre-prevision income in 2021, while provisions will depend on the moratorium development.

Capital Ratios in Slovenia vs Euro Area

Source: Bank of Slovenia