This week we have seen most important central banks in the world doing their last move for the year and they justified the thrill. Fed decided to end its purchase program in March, while dots showed 3 hikes in 2022. Then yesterday first BoE decided to hike its reference rate by 15bps, and ECB announced it will close its PEPP in March 2022 as expected. In this article we are looking into more details on Fed’s and ECB’s decisions and what could we expect in the following year.

Few weeks ago, Fed’s chair Jerome Powell on the Senate Banking Committee stated that it is time to retire the word transitory and that Fed’s purchases could be wrapped up few months sooner than previously expected. This was Powell’s U-turn and market started to calculate those purchases should end in March or April while 2-3 hikes were priced in for next year. Fast forward to Wednesday, Fed decided to double its taper starting from January 2022 meaning that Fed’s program will end in mid-March next year. Namely, In November 2021 it was announced that USD 120bn program a month should decrease by modest 15bn in both November and December while latest Fed’s decision means that in 2022 Fed plans to buy “only” USD 180bn of both treasuries and MBSs. Furthermore, dot plot showed that officials expect 3 hikes in 2022, up from only one hike expected in September. 10 out of 18 Committee members expect three hikes while dot plot shows fed funds rate at 2.1% in 2024. Regarding forward guidance, Mr Powell stated that inflation targets have been met and now there is another mandate to be met, namely maximum employment. Talking about labor market, new economic projections see unemployment rate at 4.3% in 2021 and 3.5% afterwards. Inflation in terms of PCE is expected to average 5.3% in 2021, 2.6% in 2022 and 2.3% in 2023, reflecting Feds surrender in respect of transitory.

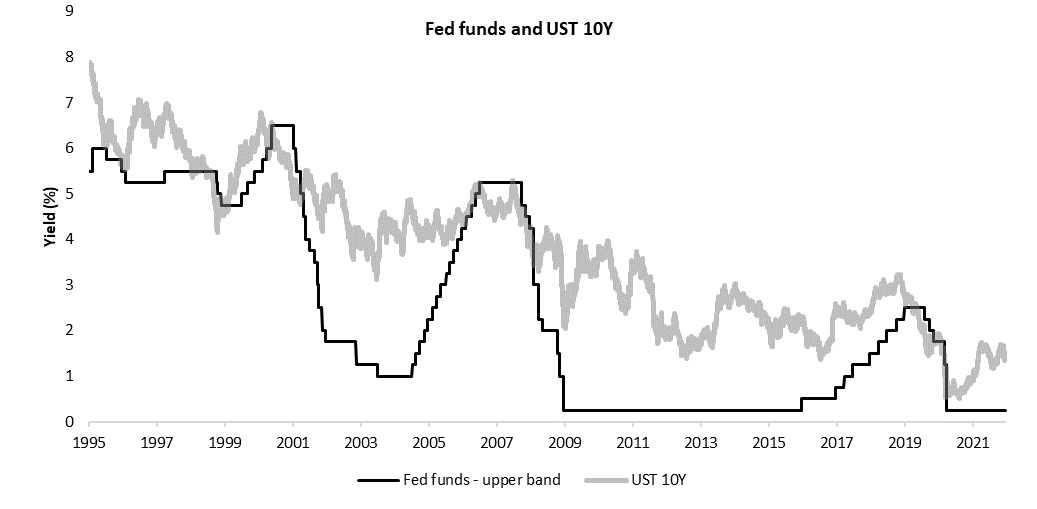

To sum it up, this week’s FOMC meeting went as expected as Mr Powell announced all the moves several weeks ago. Purchase program will end in March, and most likely there will be 3 hikes in 2022. Questions that remain are whether Fed could hike already in March or wait a bit longer i.e., May or June while another one is when Fed is to start with its QT. Furthermore, market now expects that Fed will stop with its tightening somewhere in 2024 with fed fund rates being slightly above 2.0% which seems likely looking at the past, but the thing is that 2020 recession was way different than the ones in the past. Looking at the move in long dated USTs (10Y close to 1.40%) one would correctly conclude that all actions were already calculated in the market although we saw quite significant fall of volatility and rise of equity markets, most likely due to another uncertainty being behind us.

On the other side of the Atlantic, Ms Lagarde did not telegraph ECB’s intentions last month, so a lot of scrutiny was on yesterday’s meeting. First, as expected, ECB decided to shut its PEPP program in March, however it decided to start decreasing PEPP purchases already in January 2022, meaning that they do not expect EUR 1.85t to be spent in full. Staying a bit more with PEPP, ECB’s statement says that principal payments will be reinvested until at least 2024, extending reinvestments by one year. ECB thought about Greece as well as it said that “PEPP reinvestments can be adjusted flexibly across time, asset classes and jurisdictions at any time which include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions..”. To be sure that financial conditions would not deteriorate too much, ECB decided to increase APP by EUR 20bn in Q2 to 40bn a month, and to EUR 30bn in Q3 while after October 1st, APP should continue at pace of EUR 20bn a month for the foreseeable future, as confirmed by Ms Lagarde in the Q&A session. As in the previous meeting, Ms Lagarde stated that rates are very unlikely to be lifted in 2023 as there is still work to be done to see inflation to stabilize at the 2.0% in the medium term. Talking about inflation aim, ECB now expects inflation to reach 3.2% in the next year and 1.8% in both 2022 and 2023 which ensures ECB to keep accommodative monetary policy for some time. After the meeting bund stood at -35bps meaning that it did not move significantly in any way.

To wrap it up, it seems that central banks in developed world are finally starting to tighten their policies as inflation showed to be more stubborn than previously expected. However, market still does not expect tightening to last long which is best seen in yield curves which are flattening day by day. So the question is whether market really expects economy to decelerate drastically which would drive central banks to stop tightening process or flow is still the most important thing to focus on as central banks are decreasing their purchases, but sovereign deficits are expected to decrease even faster next year. Let’s see in 2022, when we hopefully get rid of corona virus.

Source: Bloomberg, InterCapital