In the last few weeks, we witnessed several events that made perfect combination for EM assets to rise. Joe Biden winning US presidential elections, deceleration of new corona cases in EU and news regarding vaccine, to name a few. CEE currencies did appreciate on the news but there were some country specifics that dragged few of them the other way. In this brief article we are looking at the main drivers and what to expect next on two interesting currencies, Hungarian forint and Czech koruna.

Second wave of corona virus cases started in the end of August 2020 and number of new cases overjumped the ones from spring very fast. In early September, governments across Europe were denying another lockdown bearing in mind price that economy paid in second quarter of 2020. Nevertheless, new cases rose so fast that health systems were significantly damaged, and governments did not have much choice but to impose another lockdown. From being one of the winners in the first wave, Czech Republic saw one of the highest rises of new cases (in relative terms) with more than 15.000 cases a day versus around 300 in the peak of first wave in spring. Despite Mr Babis being reluctant to close his country again and his health ministers resigning one by one, Czech Republic went into lockdown mode again on October 22nd and still is in the same mode. Countries across Europe followed, imposing partial or full lockdowns as numbers were hitting records.

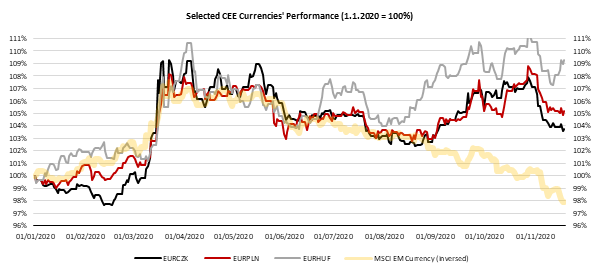

What market had to say on the above-mentioned scenario? Well, as you may see on the chart submitted below, Czech koruna depreciated strongly, coming close to its March’s lows (highs in terms of EURCZK) of 27.50 while its regional peer, Hungarian forint even overjumped these levels, but there were also other specific drivers.

Source: InterCapital, Bloomberg

Nevertheless, since October 22nd, there were few events that supported EM assets and number of new coronavirus cases did decelerate in Czech Republic. Namely, new cases started to decelerate even before lockdown was introduced hence number of active cases dropped significantly from the peak two weeks ago, from 150k people to 100k and is expected to continue falling. On the other hand, Mr Biden narrowly won US election which was characterized as EM positive event and Pfizer announced that its vaccine is 90% effective which made strong case for CZK to appreciate once again and today it is traded at 26.35 versus 27.50 two weeks ago, reflecting appreciation of 4.0%. Czech central bank also said a few words that encouraged local currency investors as it still forecasts higher interest rates next year. Some of the analysts called CNB a bit two hawkish, however I can see scenario in which much of the gap is filed next year and we see at least blip of inflation.

A bit south, situation in Hungary was similar considering that risk-on sentiment driven by global macroeconomic events supported the currency but not for long as there were few specific factors that dragged forint. Namely, as I type this article, EU leaders are gathering to discuss latest issues regarding EU budget and recovery funds as Hungarian and Polish governments vetoed the EU’s recovery fund due to a new mechanism linking EU funds to the rule of law. Rule of law mechanism was questioned by Poland and Hungary for the several months now but most of the investors thought of it as a bluff rather than serious note as both countries are great beneficiaries of the agreed EU funding programs. Now there is still not clear whether the rest of the countries will try to be harsher with Hungary and Poland or will they give them whatever they ask in favor of not vetoing and proceeding with the enormous EU fiscal packages as soon as possible. Due to its veto on the EU funding program and its possible consequences for Hungarian economy, Hungarian forint did reverse all the gains from global risk-on sentiment and is once again trading above 360 versus the single currency. Latest depreciation due to political reasons was not stopped by the central bank which stated that it will continue pumping money through its QE and will lower deposit rate in the future as it has more room for easing due to lower inflation rates in the last two months.

Both these currencies have high beta at global equity markets, they are both strongly (positively) correlated with euro and EM assets. However, their foreign and monetary policies are quite different. Hungarian government seems to be one of the loudest contesters of EU policies while its central bank is one of the most dovish banks in EU. On the other side, CNB is consistent with its modest hawkishness. That, among all other differences between two countries has driven the divergency between two currencies in the last several years.