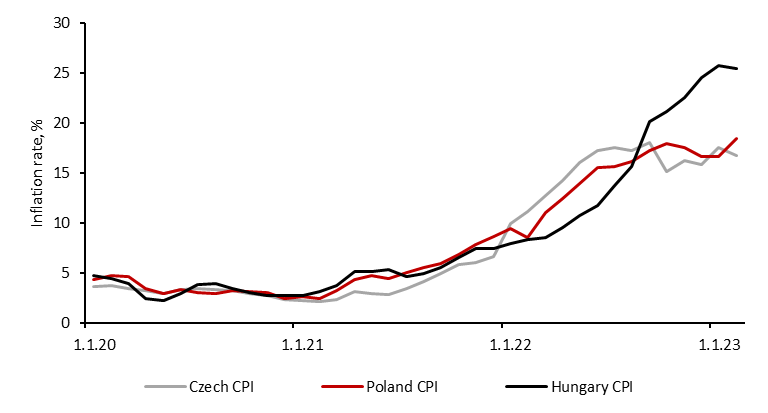

As high inflation is still a problem in Eastern Europe countries, central banks decided to hold rates high until inflation drops to more acceptable levels. Loosening monetary policy should not be on the table for double-digit inflation in Poland, Hungary, and the Czech Republic with inflation at 18.4%, 25.4%, and 16.7%, respectively. The Czech Republic certainly reached the peak of inflation and the downtrend is clear, however, Hungary and Poland are still keeping up with their battle with their stratospheric inflation. How long tight monetary policy is going to last will be seen later in the year.

Growth slowing across the world as a result of tightening monetary policy led to money market pricing rate cuts as central banks might try to evade recession or at least soften it up. Unfortunately, growth concerns proved to be exaggerated as the growth outlook improved this year. Consequently, this is the case for delaying rate cuts in CEE countries. As central banks’ rhetoric developed over the first quarter of 2023, it is clear that the rate cuts this year are unthinkable as inflation is sky high and the severe recession should not be the scenario for this year.

Firstly, yesterday the Czech National Bank left the interest rate at the level of 7.00%. Recently, Czech central banker Zamrazilova strongly ruled out the rate cuts at least until the inflation returns to the single digits. In addition to that, she pointed out the importance of strong koruna as it is helping to curb inflation. However, wage growth is a matter of concern and further rate hikes are not unthinkable in case of the labor market tightening even more.

Secondly, the National Bank of Poland holds the current interest rate at 6.75% and at this level of inflation, there is no incentive to cut them anytime soon. As the Polish monetary council pointed out, further rate hikes are not ruled out. It was expected at the last meeting (8th of March) that Governor Glapinski will formally end the tightening cycle, however, there was little guidance for that. The positive news is related to the downward revision of the inflation for 2023 and 2024 and the upward revision for the growth in this year. The monetary council was united about this decision as only two members wanted to raise rates by 0.25% and a single member was in favor of a 1.00% rate hike.

Thirdly, on Tuesday the 28th of March, Hungary’s central bank decided to leave its interest rate on hold at 13.00% as inflation is the highest among the mentioned countries. Thus, there is little scope to cut rates this year. In addition to holding rates stable, other currency stabilization tools which are used to support the forint are in place longer than previously expected. In the case of phasing out, this could lead to renewed volatility in EURHUF as it was in 2022 until it stabilized at the sub-400 level.

To conclude, according to the central banks of the three mentioned countries, there is little scope for rate cuts as high wage growth supports inflation in the future. Thus, the idea of rates higher for longer in these countries is the most likely scenario. One thing is certain, getting back to 2% inflation is not in the cards for this year.

Inflation rates in CEE economies (2020-2023 YTD, %)

Source: Bloomberg, InterCapital