Big cats of fixed income were mindful of the law formulated by late Rudiger Dornbuscgh: some events take a much longer time coming than you think, and then they happen much faster than you would have thought. This time we are talking about the demand for Croatian bonds. We all had a feeling it would come eventually, but after EA accession became a sure thing and Fitch upgraded Croatia to BBB+ (July 13th), spreads have started to get domiciled below Italian ones.

Wednesday’s US CPI came slightly above the consensus estimate (9.1% read vs 8.8% BBG consensus) which initiated the well-known chain of events. In a couple of hours, chat rooms were red with messages about the prospects of FED going the extra mile and hiking by a full percentage point on July 27th. It didn’t take long before swaptions started to price a 75% probability of a 100bps rate hike and the only thing missing now is the WSJ front-pager that unnamed Fed officials support this decision. Naturally, greenback rallied and broke parity with EUR yesterday, albeit for a short period before returning above parity this morning (EURUSD @ 1.0012 ref). For the time being, we stick to the consensus 75bps hike, unless Nick Timiraos publishes another article in top business daily supporting a more aggressive hike.

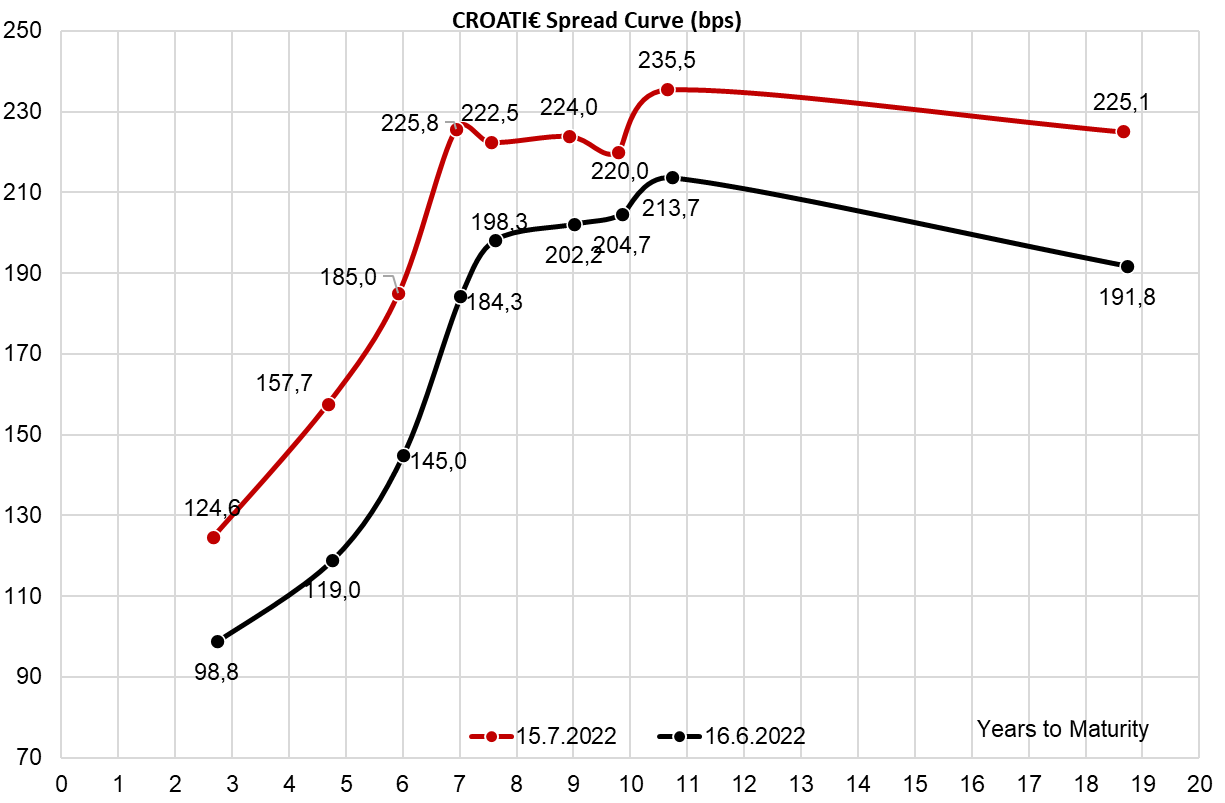

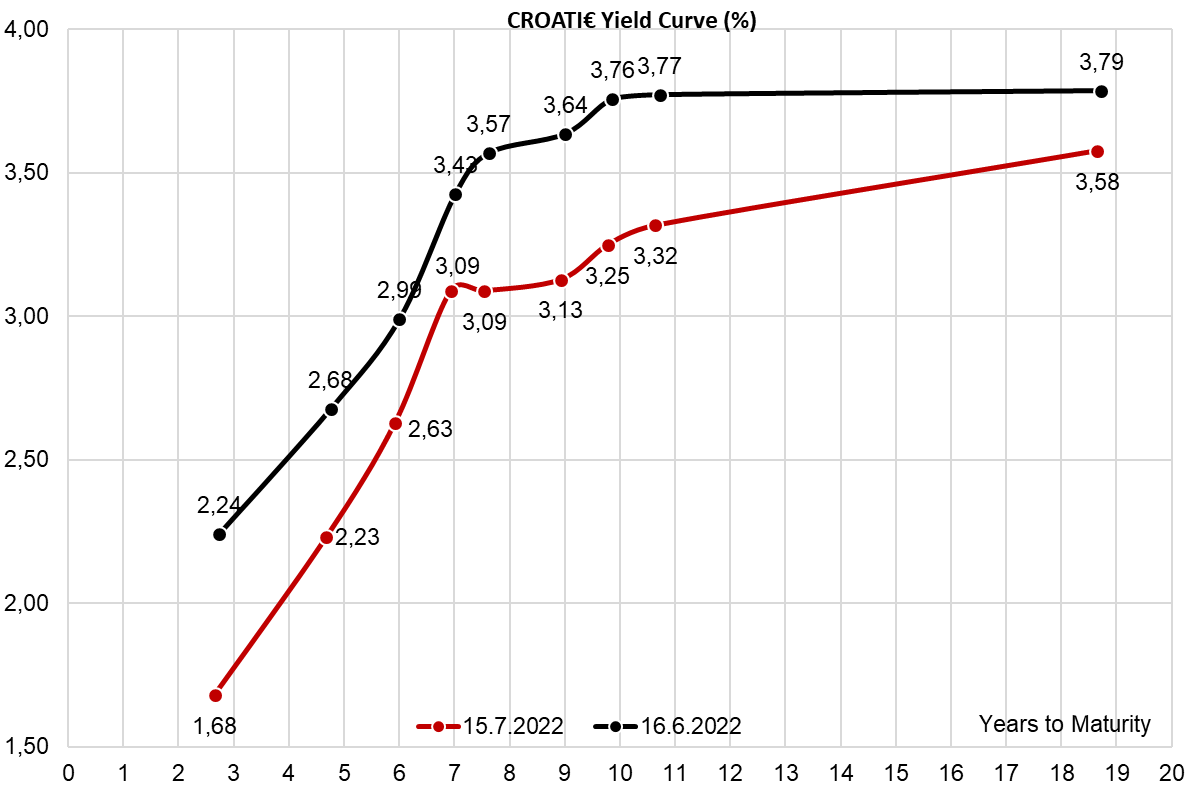

Now off to more important stuff – what do we make of new Croatian local bonds? Well, let’s take it from the beginning. On Monday Croatian business daily Poslovni dnevnik published an interview with Croatian central bank governor Boris Vujcic in which it became clear that CNB would lower the fractional reserve requirements on its path to euro area membership, as well as other bank requirements. Two days later the schedule became clear: in a nutshell, from August 10th about 35bn HRK of liquidity would be released in the banking system, accompanied by another 35bn HRK on December 14th. The schedule came roughly at the same time as the official conversion exchange rate (7.5345) and just one day after Fitch decided to raise the Croatian credit rating to BBB+. Croatia now has a higher rating than Italy, Spain, Portugal, Romania, etc. and it’s worth mentioning that this is the best credit rating the Mediterranean country has ever had. In the midst of all that jazz, Croatia placed two new domestic EUR-pegged bonds, 4Y @ 2.17% YTM and 10Y at 3.47% YTM. Take a look at the red curve below (Eurobond yield curve this morning) and see for yourself that the longer one looks quite attractive. That’s the reason we see a lot of demand in the coming days on the new 10Y (CROATE 3.375 07/15/2032) and expect it to get closer to 3.30% YTM (100.60 clean versus 99.20 reoffer) in the coming trade sessions. After 3.30% YTM cash starts to look for CROATI€ due to better liquidity.

Back to Earth now. We are not sure how much of the mentioned 35bn+35bn would go straight into bonds – as we mentioned earlier, local banks have a VaR problem and some of them are on hold with buying bonds. Some of them are strictly buying T bills; and don’t forget that once Croatia introduces euro, banks could go into BTPs, PGBs, and SPGBs, especially if these offer better returns and better liquidity. It’s also possible that foreign owners are preparing for one off dividend payout after euro area accession and besides, nobody could be able to buy a couple of billion EUR worth of Croatian debt on the secondary market in the first place. If you think otherwise, consult with whichever pension fund manager. However, we’re certain that some of the flow could gradually switch into Croatian debt securities, pushing yields and spreads lower/tighter. We are not bringing into question the demand for Croatian bonds, however, we are certainly being very mindful not to overestimate the effect of euro area accession on the demand for Croatian paper. What can we say – stay tuned for more!