This week we have seen continued sell-off in bonds across the globe although there was not much news on the macroeconomic front until today when US September’s CPI is to be released. The market expects CPI growth to decelerate to 8.1% from 8.3% in August while the core reaches the peak seen in March. In this brief article, we are looking at the possible drivers that would mark the peak of global yields.

If you are looking at the CPI and PPI releases this year, you would notice that almost every month the US data exceeded consensus expectations and the result was a quick drop in bond prices. The same thing happened yesterday after the US Bureau of Labor Statistics released data on September’s PPI data which showed that PPI Index for final demand increased by 0.4% MoM vs 0.2% expected which was the strongest growth since May when it increased by 0.5% MoM. In YoY terms, PPI increased by 8.5% which represents a modest deceleration from August when it increased by 8.7%. In any case, bond prices fell immediately on the data showing that the market still widely expects (hopes) that inflation will come lower, and the story repeats every month.

Today we are waiting for the CPI release, and the market expects the rate to fall to 8.1% YoY vs 8.3% in August due to lower gasoline prices, but the service sector is still expected to push core rates even higher to 6.5% compared to 6.3% last month. 6.5% level was seen in March 2022 but since then core rates have been constantly slowing until August, so it is to be seen whether August was just noise or another turn that confirms that inflation is here to stay until the Fed really breaks something.

Talking about breaks, the UK is still fighting with its kind of financial crisis after several UK pension funds had problems with liquidity and gilt market liquidity evaporated. Although the BoE stepped in to save pension funds and announced a temporary asset-buying program, this week the central bank had to include inflation-linked bonds in the program as well. However, on Tuesday BoE’s governor, Bailey said that pension funds have only three days to get this done before the program ends (October 14th) which put additional pressure on financial markets, pushing yields up even more. Furthermore, in the morning after Bailey’s speech, there were some speculations that BoE told banks in private that the program could be extended in case there is a need for the tool to stabilize the markets. So, if you were thinking that UK’s situation is a complex one and a bit confusing, you got a confirmation right there. Anyhow, gilts’ yields topped the levels reached right before the BOE’s intervention meaning that investors still refuse to long UK’s bonds before we have some confirmation that the program will become more permanent or that tax cuts will be reversed.

Gilts reached the peak levels seen two weeks ago and the same story goes with US treasuries and EUR yields. Currently, it looks like there is no story that could break the inflation – the central bank tightening mantra that resulted in the biggest and fastest sell-off of bonds in history. Although yields across the world are close to their 10-year lows investors are refraining from buying them as volatility is just too high. However, we do not see volatility settling down soon, as many subjects are underinvested meaning that on any sign that inflation is decelerating there will be a lot of demand and no supply, resulting in a jump of bund by 1000 pips. This results in looser financial conditions that result in tighter policies from central banks. And repeat.

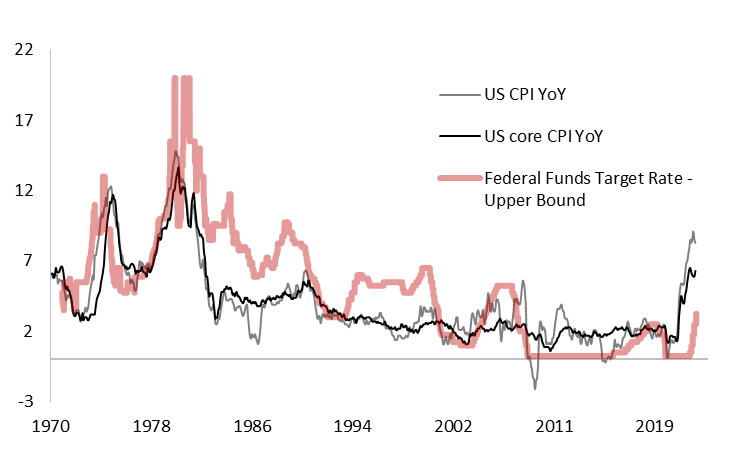

US Inflation and Fed Funds Rate

Source: Bloomberg, InterCapital