Have you noticed something unusual with this week’s risk-on environment? Core rates and equity are obviously up, SPX is again above 4.200, but USD appreciation is usually a mark of distress. This Bermudan triangle constituted of rates, equity and FX is a place where most of the explanations tend to disappear. What do we make of these unusual market circumstances? Our baseline explanation could be found in market segmentation theory (FX is looking at the debt ceiling, equity and rates at regional banks’ convalescence). And what are the implications on Croatian international bonds? Read in this brief research piece.

Confused with yesterday’s move in financial markets? Well. Let’s take it step by step.

Fixed income traders tend to exhibit market myopia in times like this since they focus only on macro data, turning a blind eye to the broader market sentiment. It’s true that US initial jobless claims came below the consensus estimate (242k actual versus 251k consensus, so 9k below market consensus), nevertheless, such a small difference is not sufficient to explain a sharp rise in yields and US equity. Instead, we focus on a small bit of information that came from US lender Western Alliance (WAL US Equity). It’s 67.7bn USD regional lender with 53.64bn USD of deposits (both figures are FY2022) that managed to report a +2bn USD rise in deposits from quarter end – a spark of information that together with positive news from PacWest Bancorp (PACW US Equity) managed to ignite a relief rally in US markets. Regarding PACW US Equity, in the most recent two trading sessions share price went from Tuesday’s close of 4.57 USD to yesterday’s 5.84 USD (staggering +27.8% gain).

In our talk with a handful of US equity traders, we found out that this move resembles a dead cat bounce since volumes were not special at all. Volumes were elevated, but they were not something extraordinarily high, a feature that would explain market sentiment turning a corner. In our opinion, it’s possible that an imminent end of US rate hikes that’s behind the corner and sound data about the return of deposits to troublesome regional banks might have caused investors to put some money into lenders like PacWest and Western Alliance. It was sufficient to launch the KBW Nasdaq Regional Banking Index by 7% yesterday and bring SPX north of 4.200 mark.

All of this looks like an ordinary risk-on event, right? Wrong. EURUSD went down from 1.840 to 1.0760 peak-to-through and USD appreciation is not normal in risk-on environment. EURUSD started coming down about three weeks ago when US debt ceiling debate intensified and gained momentum as June 01st started closing in.

This is odd, right? US politicians are assuring investors that US federal government would not let its debt come into arrears, nevertheless, the two sides of the aisle are reluctant to pass a deal. US federal debt market looks like an ocean compared to the small pond of US regional banks, meaning that the USD appreciation tells us we’re not out of the woods yet. On the other hand, when the debt ceiling debate gets cleared away and with pressures from around the world mounting to get it out of the way, EURUSD/US equities/US regional banks might be poised for more upside. In other words, if some of the equity traders were cutting their short exposure to US regional banks so they don’t get burned in a couple of weeks (this is a necessary condition to create a dead cat bounce), it was probably a smart thing to do.

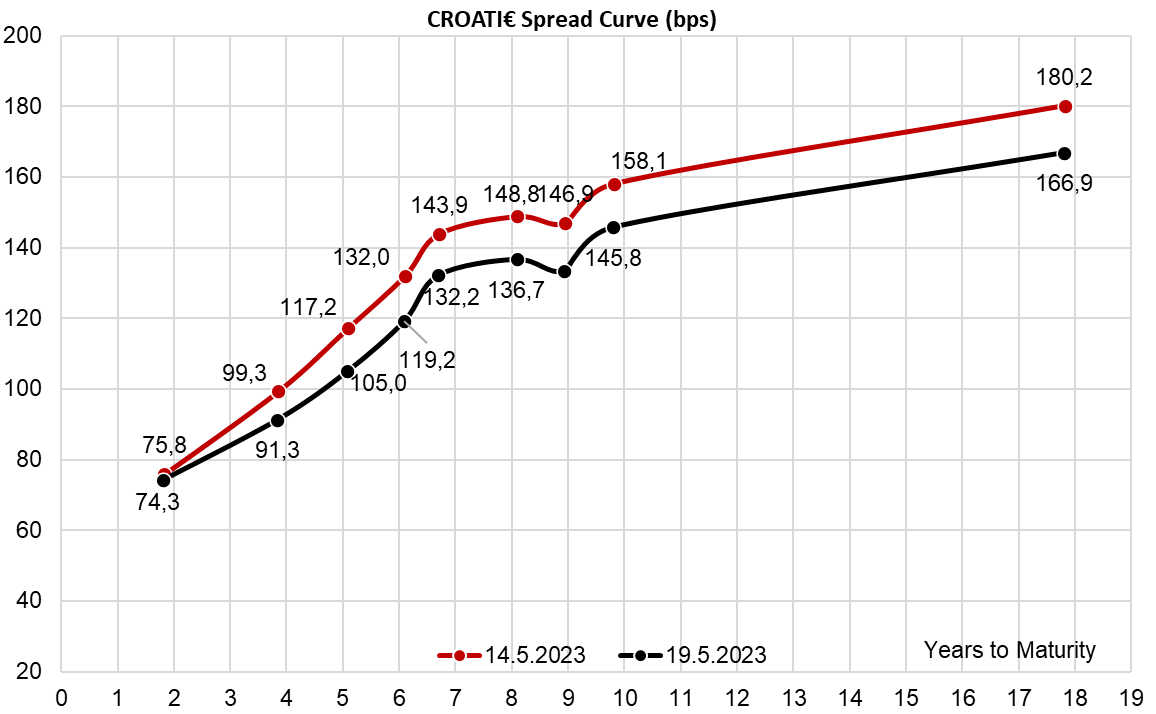

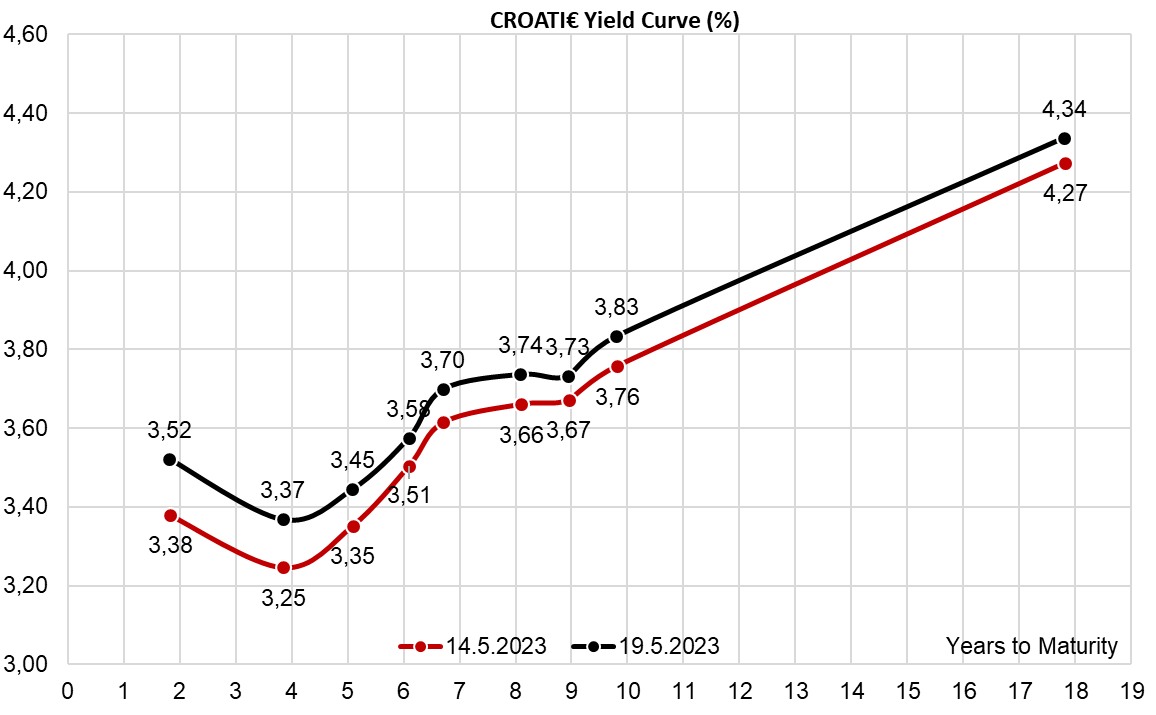

How are Croatian international bonds weathering the storm? It’s not a really big storm, but in a nutshell – yields are up, spreads are down. All of the sudden it was possible to buy larger chunks of CROATI 2.750 01/27/2030€ at 94.90 (3.62% YTM, B+126bps) and CROATI 1.500 06/17/2031€ at 85.00 (3.68% YTM, B+133bps). By taking a look at the black curves on both of the charts submitted, you can see that this is only a couple of bps above the BVAL mid, so nothing exceptional indeed. The reason Croatian accounts were reluctant to bid was the fact that new Croatian eurobond might be placed in a matter of weeks and most of our accounts are targeting high 140s above the Bund on maturity just slightly below 10 years.