This week we have seen yields in the euro area reaching multi-year highs on the narrative that ECB could accelerate their rate hikes and that was just into for today’s policy meeting. We expect Ms Lagarde to announce the end of APP and to present plans for rate hikes. In this brief article, we are looking into the details of the latest increase in rates and what to expect further.

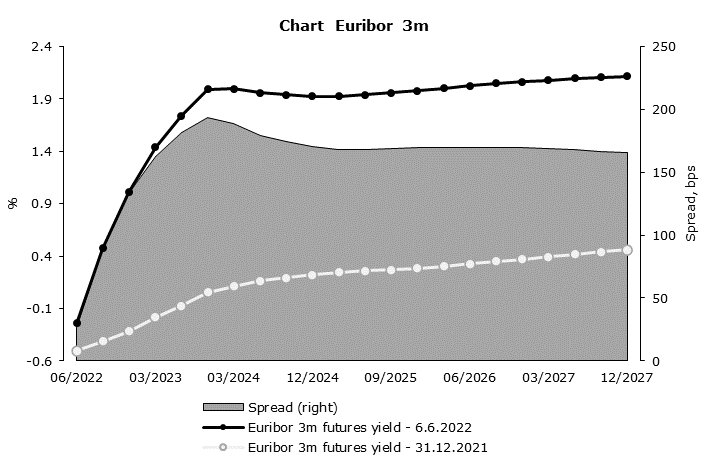

In 2022 we witnessed a significant rise in yields around the globe but also saw several mini cycles. First, we saw strong growth in yields due to inflation reports and central banks becoming more hawkish than expected. Then equity markets dropped due to lower valuations, with some worrying economic data which pushes one or two central bankers to announce a pause in rate hikes in the future. However, then inflation reports surprised the markets once again, driving hawkish central bankers to become louder, pushing rates even higher and repeating the process. In the last two weeks, we have seen another leg higher in EUR rate markets as inflation in euro area came higher than expected i.e., at 8.1% vs 7.8% expected, while core inflation stood at 3.8% YoY. Yields shoot up with bund yield overjumping 1.30%, while 5Y German paper was above 1.0%, a level last time seen in 2014. Furthermore, Euribor futures reveal that market expects 3 hikes until September which would mean that ECB must hike rates already today if they want to go with 25bps steps or will have to lift by 50bps in July or September. Well, some of the uncertainties should be solved today with the long awaited monetary policy meeting.

Several ECB officials could vote for the rate hike already today, although that would be contrary to what Ms Lagarde was saying at the last meeting. Namely, Ms Lagarde insisted on the gradualism, saying that rates will be lifted sometime after exiting from APP (“could be days, weeks”). Nevertheless, inflation is creeping higher and central banks around the world are hiking almost every day with RBA being the last, lifting rates by 50bps versus 25bps expected. Also, that would not be the first time that ECB changed its opinion rather quickly (remember Lagarde in December 2021 saying that rate hikes are unlikely in 2022). So, in respect of rate hikes, we would not be surprised in case ECB decides to lift rates today to come ahead of the curve. Furthermore, it will be important to see what tools is ECB planning to use to signal that fragmentation will not be allowed. Just to bear in mind, the Italian 10Y spread jumped to 215bps last week and then decreased towards 200bps once again as FT sources said that ECB will support a new bond-buying program to close the spreads.

Talking about yield spreads, in the last few weeks, we have seen a solid tightening of the spread between USD and EUR benchmarks. Namely, US 2Y is still off their highs, currently at 2.75% while German Schatz sky-rocketed to 0.70%, resulting in a spread coming close to 200bps versus 250bps in mid-May 2022. Furthermore, 10Y papers tightened from above 200bps to below 170bps today. This reflects renewed hawkishness in the euro area on one side and fear of recession in the US on the other side. Nevertheless, data from the US are still mixed and some of them are showing that consumer spending is still strong in US while inflation still did not decelerate, and we will not have to wait for long to see new data. Tomorrow, we have another blockbuster event, namely, US May’s inflation data which is expected to land at 8.2% YoY and 0.7% in MoM terms.

Source: Bloomberg, InterCapital