Oil has had a tough year as the demand outlook worsens due to the slowing of the economy across the world as the pressure of higher interest rates takes a toll on economic growth. On Tuesday the 4th of September, Brent prices briefly reached the 90$ level which was last recorded in November of 2022. The sharp spike on Tuesday in both Brent and West Texas Intermediate (WTI) crude oil prices happened after Saudi Arabia and Russia decided to prolong production cuts which were implemented earlier this year to boost prices.

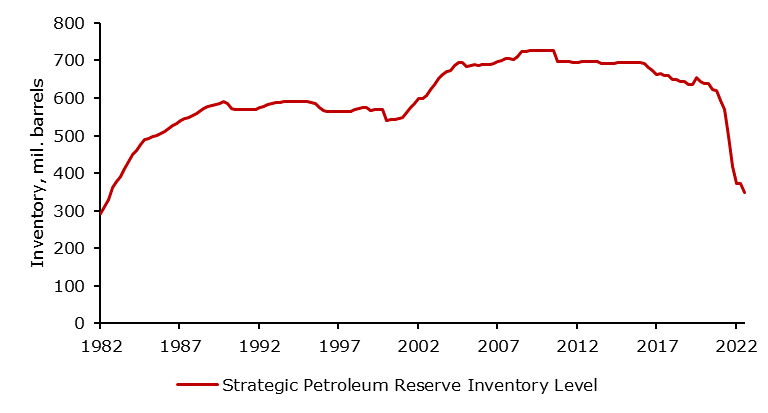

The strong performance of the oil in 2021 and 2022 can be attributed to the economy growing with the labor market at levels of historical tightness. Furthermore, as the war in Ukraine started, prices spiked to 130$ per barrel as the fear of insufficient supply flooded the market with oil at levels double than the year before. Swiftly, it transferred to retail prices and pushed headline inflation into double-digit territory, and produced second-round effects as employees were demanding higher wages. Consequently, central banks across the world were raising interest rates at a pace not seen since the 1980s to levels above 2008 to subdue the wage-price spiral. Since June of 2022, oil has been in a clear downward trend as the market was pricing the effect of interest hikes on the economy thus lowering demand expectations. The average price of WTI in June of 2022 was 114$ per barrel. In June of 2023, the average price in June was around 70$ per barrel which is a 39% drop over the course of a year. Since June, prices of oil have skyrocketed as Saudi Arabia and Russia agreed to cut production to push prices higher. Since the end of June, WTI price increased by 27% even as the growth outlook for China and Europe looks increasingly worrying. Recently, European Purchasing Manager Indexes have indicated a recession in Europe, especially Germany. Additionally, the European Central Bank is staying at its path of holding rates higher for longer as the core inflation remains adamant. In China, economic problems in the construction and real estate sector related to Evergrande and Country Garden are still on the table with China trying to stimulate the economy by lowering mortgage rates, but no major stimulus package to revitalize the economy. The market is expecting a major catalyst, but as time passes it seems that the “bazooka” stimulus is not going to materialize. Bearish signs for oil prices out of China and Europe are evolving from week to week. On the other hand, the US economy is holding better than expected with GDP growth significantly higher than in Europe with PMI still in expansionary territory which is a supportive circumstance for oil prices. The main problem is the major drawdown of the Strategic Petroleum Reserve (SPR) which was created in 1975 to prevent OPEC countries from manipulating the price. The US used it in 2022 to mitigate inflation shock. The US used 40% of the SPR inventory available at the end of 2021. with total inventory falling to levels that were last recorded in 1983. The remaining SPR inventory can be used to prevent Saudi Arabia from manipulating prices which is exactly what it is intended for, but the only reasonable way of solving the problem with high oil prices is diplomatic action. Over the past year, Venezuelan and Iranian oil has been brought back to the market combined with the US raising its production. However, the US did not manage to pass its production peak from 2019, but it is surely on the way to surpass it.

To conclude, the oil market’s tumultuous journey over the past year has been marked by price swings influenced by a multitude of global factors. From highs driven by supply fears and tight labor markets to a sharp decline amid interest rate hikes, it now faces fresh volatility due to geopolitical and economic uncertainties in Europe and China. The US, with robust economic growth and higher GDP, remains a stabilizing force. However, the major drawdown of the Strategic Petroleum Reserve highlights the need for diplomatic solutions in managing oil prices, as the world watches closely for developments due to the ongoing fight for inflation.

US Strategic Petroleum Reserve levels

Source: Bloomberg, InterCapital