Special purpose acquisition companies or SPACs have attracted some serious attention from investors in 2020 as they managed to raise the same amount of funds as traditional IPOs. However, considering the high risk involved with investing in such companies one cannot but wonder if this is a sign of investor overconfidence or are SPACs really an attractive investment opportunity.

What is a SPAC?

For starters, lets define what a SPAC actually is.A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering for the purpose of acquiring an existing company. Also known as “blank check companies,” SPACs have been around for decades but have become more popular just recently. As a matter of fact, SPACs managed to raise a record amount of IPO money in 2019. However, it did not stop there, in 2020 SPACs were able to break the record once again by raising a whopping USD 82.1bn, according to data from Dealogic. Note that this amounts to roughly the same amount raised through traditional IPOs in the US.

Money Raised in U.S. IPOs

How do SPACs work?

As mentioned earlier, SPACs acquire funds through an IPO which typically consists of common shares combined with a warrant. The warrant gives the holder the right to buy more shares at a fixed price at a later date. Note that investors who participate in the SPAC IPO are attracted to the opportunity to exercise the warrants so they can get more common shares once the acquisition target is identified and the transaction closes.

After the funds have been acquired through an IPO, they are usually held in government bonds until the SPAC’s Sponsor finds a suitable target to acquire. During that time, one would expect SPAC shares to trade at around their IPO price, however, in practice, SPACs will often trade at a premium to the IPO price as shareholders believe management will identify a compelling acquisition target.

Once a target has been identified, and eventually acquired, a SPAC merges with the company and the acquired company gets the SPAC’s spot on a stock exchange, enabling it to sell shares to the public. Note that over the years companies that have been taken to the market through a SPAC deal were young companies in new industries such as the cannabis, green technology, and sports-betting arenas, where SPACs scooped up corporations like DraftKings and Nikola. Just how young these companies can be is probably best portraited by the fact that in 2020, at least 15 SPAC acquisitions were of targets that had no revenue in the year prior to the acquisition, according to SPACInsider.

Time wise, SPACs have a specified period to identify an acquisition target and close the deal, which usually amounts to two years. If the SPAC sponsor cannot close an acquisition within the designated period, then the money is returned to the shareholders. Furthermore, SPACs have a specific feature to protect investors: Before one does a deal, its investors may redeem their shares for cash, collecting its IPO price, usually USD 10 per share, plus interest.

Overview of the number of SPAC IPOs

SPAC Price Performance

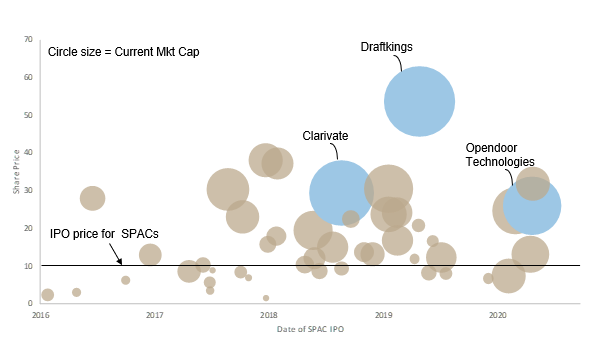

Although SPACs have clearly gained in popularity over the last couple of years, this can not be attributed to a steady return made by this asset class. Namely, we observed the largest 46 SPAC IPOs since 2016 which ended with an acquisition and as one can see from the chart below, more than a third of the observed SPACs are now trading below their IPO price. Note that we excluded warrants from our analysis. Considering the previously mentioned industries in which many popular SPAC acquisitions operate and the timing of the acquisition in the life cycle of the company, such volatile and uneven return aren’t really surprising. After all, many of these companies could easily still be considered as highly speculative.

Source: Bloomberg, InterCapital Research

Finally, despite the risk associate with them, SPACs seem to be successful at attracting investor interest which might also be attributed to the volatility of 2020’s markets which has forced many companies to delay going public. Second, it is possible that fears over a looming bear market have caused investors to seek opportunities to liquidate while markets are still relatively healthy. Therefore, an eventual calming of financial markets might also lead to the calming of SPAC activities and a focus shift back to more stable companies.