Almost a year after the Fed’s inaugural 50bps cut, which marked the beginning of its monetary easing process and was followed by two additional 25bps cuts, it seems that the cutting cycle is set to restart on September 17. While some more dovish proponents discussed a replay of a 50bps cut, the latest CPI print, which failed to decline, suggests that the market will have to settle with a 25bps cut. Meanwhile, the ECB was widely expected to hold their rates unchanged on the meeting that took place on September 11, which they did. But, as always, the bond market cares not just about the decision but rather about the level of dovishness/hawkishness that accompanies it. Stay with us in this brief research piece to find out where do we expect to find the respective 10y bonds in the remainder of the year after deciphering the ECB speak and forecasting how Jerome Powell might frame the Fed’s decision.

The market widely expected a hold from the ECB, which they promptly delivered along with updated staff projections. Most notable changes included upgraded growth in 2025 and slightly lower inflation in 2027. Despite that, the ECB’s President Christine Lagarde informed us that they see the disinflationary process as finished because it is hovering around the target and their assessment of the medium-term outlook is balanced with the labour market solid and domestic economy showing resilience. They are not overly concerned with the possibility of spreads widening, leaving troubled French bonds to wait for the resolution of the political gridlock. This puts the ECB on autopilot for the foreseeable future, shifting fiscal pressures back into focus and likely pushing German yields higher in the upcoming years. Nevertheless, if the economy were to show signs of faltering – the ECB could possibly step in with one extra adaptation cut. Still, the downside for the 10-year yields is likely capped given the balance of risks.

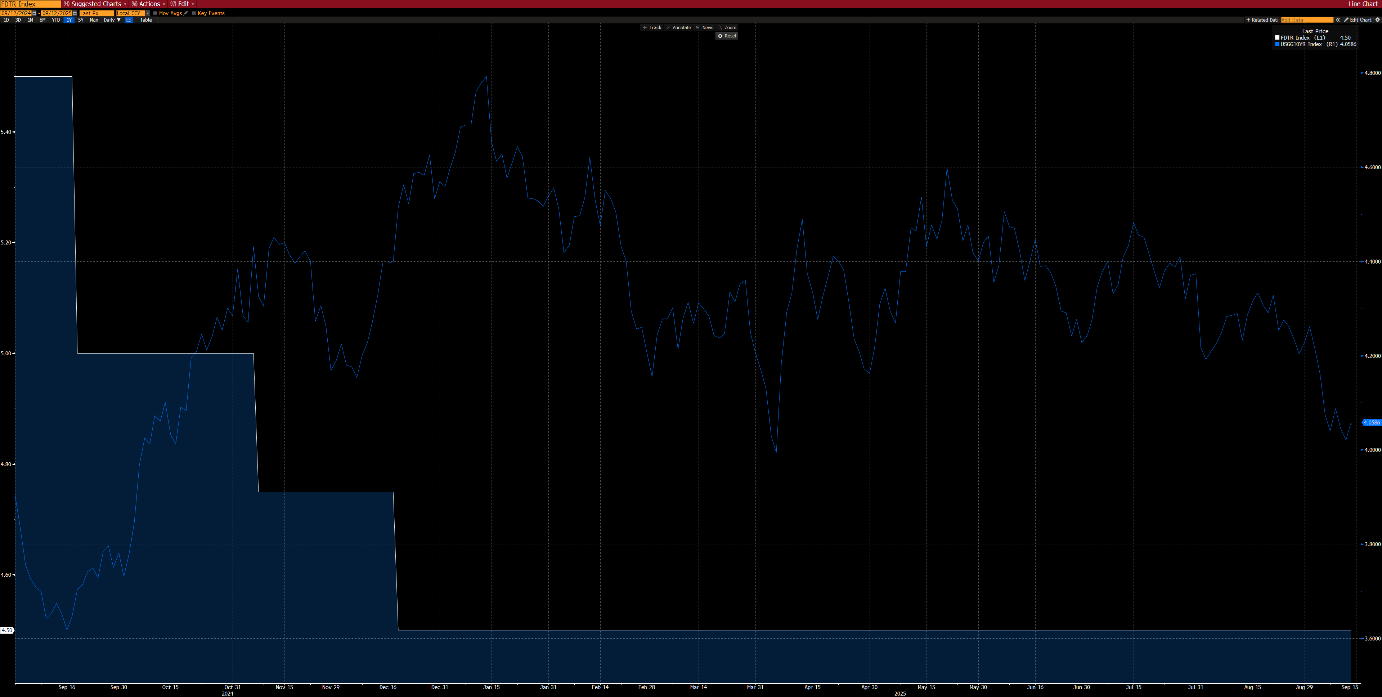

On the other side of the Atlantic, all eyes are on the upcoming FOMC meeting and updated Summary of Economic Projections. Evidence of a weakening job market, exemplified by non-farm payroll numbers lingering around zero in recent months and initial jobless claims reaching their highest levels in nearly four years, has tilted policymakers towards favouring lower interest rates. Although unemployment has remained benign, rising slightly to 4.3%, preliminary revisions of non-farm payrolls for twelve months up to March 2025 showed that the economy added less than half the jobs the BLS had previously reported, amplifying Donald Trump’s attacks on Fed Chair Jerome Powell’s purported tardiness with lowering the interest rate. We find any scenario other than him repudiating the likely 25bps cut as implausible, so the Fed’s Chair is likely to get another round of scolding from the President. Turning to the Fed’s other mandate, stable prices, it appears inflation has stabilized, albeit at a higher level, nigh 3% (core inflation stalling at 3.1% YoY). The Fed is presumably going to continue suggesting that the risks for inflation in the near-term are on the upside due to tariffs, even though they consider them a one-off shock. While the market expects four cuts before the end of 2026, the risk of stubbornly high inflation might not compel the Fed to cut more than four times during the same period. Some members are likely to further increase their dovish pressures – like Chris Waller and Michelle Bowman, who already voted for a cut in July, and a new appointee, Stephen Miran, who could potentially be approved by the Senate just in time to be eligible to vote at the upcoming FOMC’s meeting – supporting a heftier 50bps cut. The longer end of the yield curve is less concerned with immediate actions and more focused on the Fed’s ability to maintain independence and deliver on its 2% inflation target. After the 50bps cut that was delivered almost a year ago, the market reversed its decline (in yield terms) and has failed to come near those yield levels. As labour market data deteriorated and expectations for further rate cuts have built up, we anticipate that history may repeat itself, and long-term yields may have hit a local bottom, especially if the Fed delivers a hawkish 25bps cut.

Upper range of FED funds rate, US Treasury 10Y yield

Source: Bloomberg, InterCapital

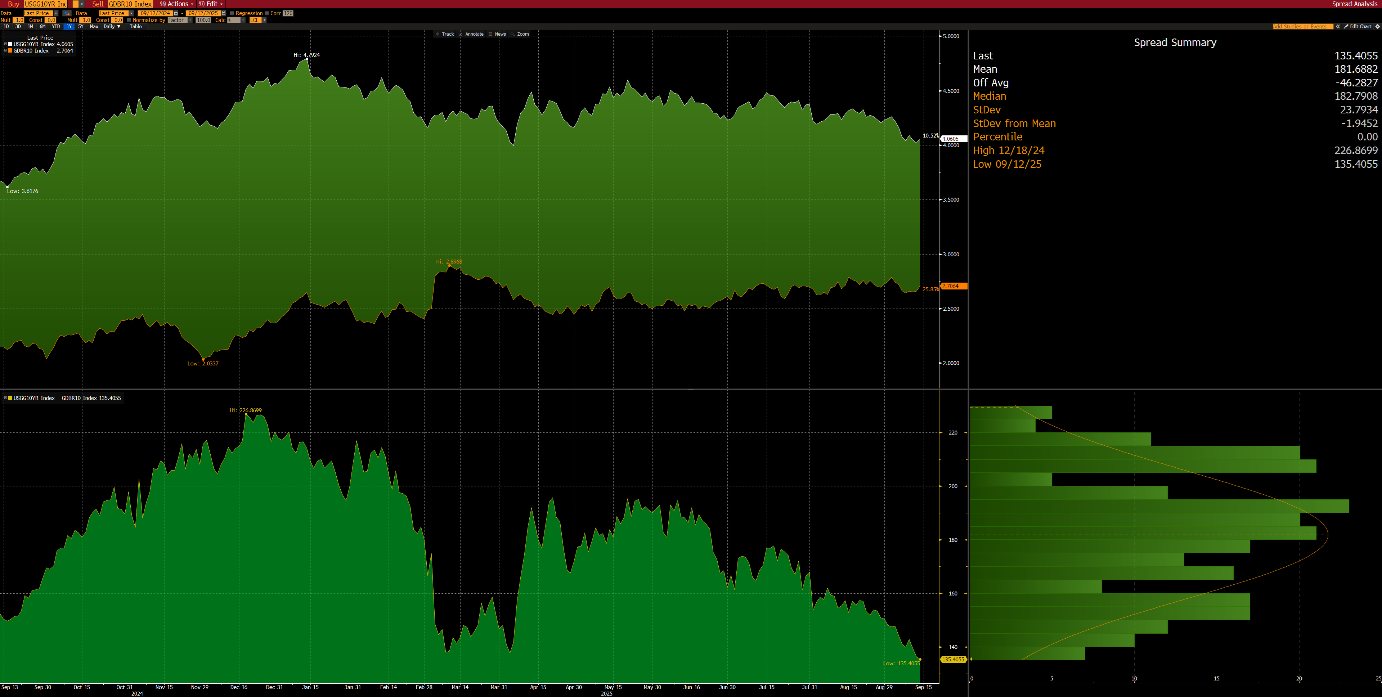

To summarize, the Fed-ECB divergence on the short-end is likely to persist, but that doesn’t necessarily apply to the longer end of the curve. With the market pricing in nearly six cuts by the end of 2026 and with the ongoing tug-of-war between maximum employment and price stability, there is little room for the bond rally to continue. We find the 10-year Treasury more likely to succumb first and see a possible widening of the 10-year cross-Atlantic spread, driven chiefly by rising yields in the US.

Spread between US 10Y and Germany 10Y

Source: Bloomberg, InterCapital