As we approach the end of the year, it’s clear that 2025 will be remembered as a year of heightened volatility. Financial market swings often mirror global uncertainty, and given the macro backdrop, this shouldn’t come as a surprise. Volatile markets create unique opportunities. For some, a chance to capture outsized gains, and for others, a risk of significant losses.

In times like these, you’ve likely seen headlines about the VIX index spiking and wondered: Can I profit from that? Often called the market’s “fear gauge” or fear index, VIX measures expected volatility in the S&P 500 and serves as a key indicator of risk sentiment. Higher implied volatility signals greater uncertainty, which usually corresponds with higher perceived risk. Market selloffs often go hand in hand with VIX spikes. But can VIX be the perfect portfolio diversifier, or is the reality more complex than it appears? In this post, we’ll explore what VIX really represents, how it behaves in practice, and the common pitfalls investors face when trying to trade volatility directly.

We mentioned the inverse relationship between the VIX index and the SPX index. To explain that phenomenon, the key point is that the VIX index is calculated from all active SPX option prices with roughly 30 days to expiry (23-37 days to be precise), in simpler words, from SPX implied volatilities in 30 days. The formula takes a weighted average of SPX at-the-money and out-of-the-money (OTM) call and put options prices, using every strike that has a bid (two consecutive strikes without a bid is the cutoff). Because VIX is literally derived from SPX implied volatility surface (smile, or rather smirk), its spikes are influenced by investors bidding options, pushing their implied volatilities higher, changing the volatility surface, and adding new, further OTM options in the VIX basket. Intuitively and without overcomplicating, VIX rises when investors seek protection for their portfolios, which happens when there is fear on the market, hence its nickname, the “fear index”.

SPX and VIX inverse relationship

Source: Bloomberg, InterCapital

After understanding the mechanics and the inverse relationship, you might think: Why not use VIX as a portfolio diversifier all the time? Unfortunately, it’s not that simple. First, VIX is an index; it is not directly tradable. Its value comes from a mathematical formula derived from the basket of options, and you can’t replicate it. The only ways to gain exposure are through VIX futures, ETFs, or options. But here’s the catch: options are written on VIX futures, and ETFs also use futures. There is no way to trade the spot VIX index, the number you see on the screen.

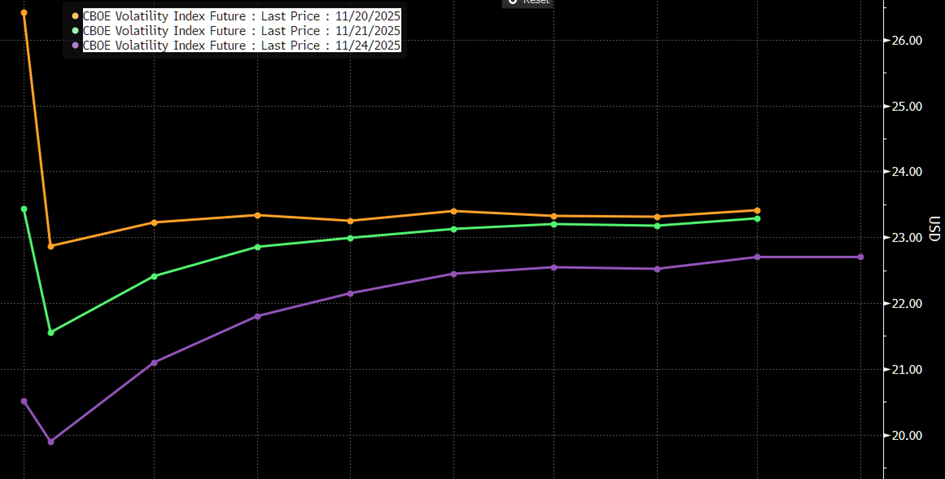

To demonstrate why using VIX futures for trading VIX is problematic, you need one look at their term structure. VIX futures are usually priced in for a reversal in the future. In high volatility environments, long-dated futures trade below spot (backwardation). In calm markets, they trade above spot (contango), signalling a chance of potential disturbance in the future. Even the front-month future, the most reactive one, doesn’t fully capture VIX spikes. Due to the fact that VIX spikes are short-lived, there is often more money to be made by shorting the VIX futures, similar to going long equity indices. But every spike carries the risk of wiping out the whole position.

Changes in VIX term structure

Source: Bloomberg, InterCapital

A real-world example that illustrates the complexity of trading or investing in VIX products is the performance of long and short VIX ETFs. Since the start of 2025, both ETFs have posted negative returns, a clear reminder that volatility products are far from straightforward.

Long vs. Short VIX ETF performance (2025 YTD, %)

Source: Bloomberg, InterCapital

To conclude, VIX may look like a good way to hedge your portfolio, but in reality, it is a complex instrument with hidden risks. Understanding its mechanics is essential before trying to trade it directly.