With the government shutdown still looming over the U.S. economy, the Federal Reserve continues to operate largely in the dark when it comes to policy decisions. The 25-basis-point cut at the last meeting was almost a certainty, but Chair Powell made an unexpected remark, urging greater caution regarding potential additional rate cuts in December.

Although the market had already priced in the 25-basis-point rate cut as a done deal, it was not prepared for what Powell revealed during the press conference. The statement that surprised most observers was his comment that the December rate cut “is not a foregone conclusion, far from it.” The 10-year Treasury yield immediately dropped about 40 basis points as markets braced for another period of policy uncertainty. This Fed meeting also highlighted a slight shift in opinions among board members. Stephen Miran, unsurprisingly, continued to advocate for a 50-basis-point cut, while another member, Jeffrey Schmid, argued for no cuts at the October 29 meeting. With this remark from Powell, the Fed actually gained optionality and might deliver on another 25bps cut in December. The CME Fed watch tool prices a 69.3% probability of another 25bps rate cut in December.

Another notable development is the official end of quantitative tightening (QT), which will conclude on December 1. Why now? According to data on repurchase agreements with the Fed, there has been an uptick over the past month, potentially signaling a shift in market liquidity conditions as more depository institutions and money market participants draw on repo funding. Although reserves at the Fed remain in the “ample” or “abundant” territory, they have declined noticeably, indicating tightening liquidity in the Treasury market. One key gauge of how interest rates respond to reserve balances is the reserve demand elasticity curve, which measures the sensitivity of the federal funds rate to changes in reserve levels. Based on this metric and official data as of October, the elasticity remains very low, although an uptick is visible, suggesting that reserves, while declining, are still abundant.

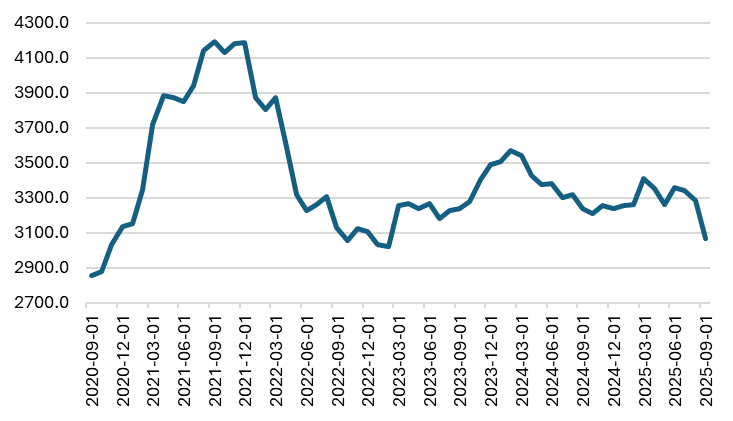

Reserves of Depository Institutions at the FED (in USDbn)

Source: Fed, InterCapital Research

The ECB meeting, held the following day, struck a similar tone to the previous one. President Lagarde once again reiterated that the ECB is in a “good spot” and that inflation remains on target. While there are concerns that the lagging Eurozone economy could prompt the ECB to implement another 25-basis-point rate cut, this remains to be seen.

As the government shutdown drags on with no end in sight, the Fed is effectively flying blind, lacking the concrete data needed to guide its decisions. Next week’s releases, including ISM Manufacturing PMI, JOLTS Job Openings, and ADP Nonfarm Employment, could provide some indication of what the Fed might do next.