In yesterday’s long-awaited meeting, ECB decided to lift rates by 75bps from zero, to the highest level since February 2009. In the statement, the ECB said that it will continue lifting rates further while in the Q&A session Ms Lagarde said that QT is still not in the cards. In this brief article we are looking into more details on the decision and what could we expect in the following months.

On August 25th, some 15 minutes before Mr. Powell’s speech on Jackson Hole Symposium, Reuters published a story titled „Some ECB policymakers want 75 basis point hike discussed in Sept, sources say“ which obviously had a strong impact on the EUR rates market with forwards starting to include the possibility of 75bps rate hike. Before the story came out, there were some 20% chances of such a move. The Reuters story was confirmed by several ECB’s hawks with August’s CPI upside surprise and robust labor market being the strongest drivers for the call.

Fast forward to yesterday’s meeting, the ECB indeed decided to increase its reference rates by 75bps for the first time ever (Bundesbank did the same move in 1992 when rates were at 8.0%). Yesterday’s statement said that 75bps is a major step that frontloads the transition from a highly accommodative level and that over the several meetings it is expected that rates would be raised further to dampen demand and guard against the inflation expectations being entrenched. Furthermore, ECB decided to suspend tiering for the banks as the deposit facility is now above zero percent. APP and PEPP parts were left unchanged from July’s statement meaning that TPI is still some mythical creature that exists only in ECB’s statements, but no one still knows how it looks like, how big it is or how does it work. One of the most important things in yesterday’s statement was staff projections on inflation and growth in the following years. As you may guess, inflation projections increased compared to the latest projections while economic growth projections decreased. Namely, inflation is now expected to average 5.5% in 2023 and 2.3% in 2024 compared to June’s forecasts when ECB expected inflation to average 3.5% and 2.1% in 2023 and 2024 respectively. GDP projections for the euro area now stand at 0.9% in 2023 and 1.9% in 2024 i.e., ECB still does not see a recession in any of the years although Ms Lagarde said some strange things on the topic in her Q&A session.

In the Q&A session, Ms Lagarde sounded rather hawkish saying that ECB has to normalize its policy and that that process started in December when ECB said that it will end PEPP (as you may remember, that December Ms Lagarde also said that it is very unlikely that ECB will lift rates in 2022). When asked where the neutral or terminal rate is, Ms Lagarde said we are still not at neutral nor terminal but that she or the GC does not know where that is exactly, nor she did give any hints on that. The weakness of the single currency was also one of the hot topics, but we did not hear any news on that besides that ECB looks at the euro very carefully. The question on staff projections was the most interesting one as Ms Lagarde said that the negative scenario sees euro area’s GDP falling by 0.9% and that the negative scenario includes a full stop from Russian gas and rationing of the energy in Europe of which both cases look like a deal done now. So, we are still not sure which scenario is base and which is negative considering the facts on the energy.

To sum it all up, ECB showed willingness and strength to fight inflation at the same pace as the Fed does, despite the economic situation seems to be far worse in Europe than it is in the US. Nevertheless, inflation in Europe could rise even further and seems reasonable to frontload for the ECB at least until data do not show Europe is in recession. The ECB is really in a tough position but for the moment it has chosen to fight inflation at all costs, which we think is the right move. Also, in case ECB did not react and frontload this time, we would see EURUSD much lower than it is today which would add more pressure on prices on the old continent.

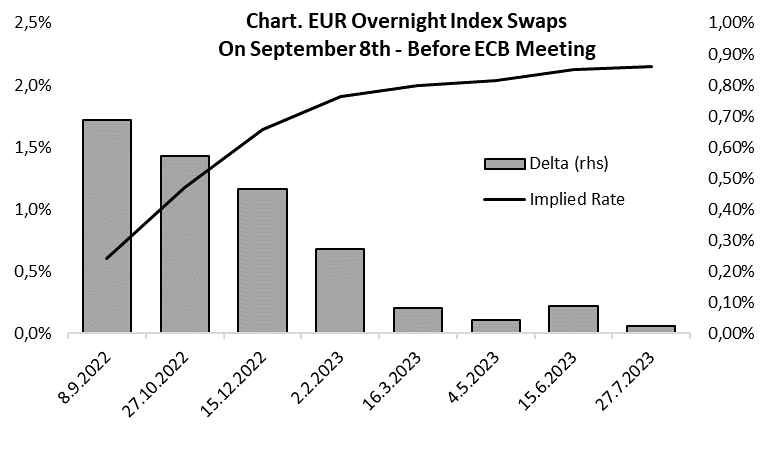

Talking about market reaction, yields showed that 75bps hike was not calculated in full as Schatz yield went from 1.12% to 1.33% (and further to 1.40% this morning) while bund yield overjumped 1.70% level. However, forward rates still show that the peak in EUR rates should be around 2.25%, somewhere in the end of H1 2023 with 50bps hikes in each of the two remaining meetings this year and then markets sees slower hiking until a peak in June 2023.

This week we have also seen Canadian central bank lifting rates by 75bps to 3.25%, and we expect Fed to deliver also. Economic data in the last several weeks showed that recession could be a few quarters away at least in US, contrary to the rhetoric that prevailed on the markets in the summer. Looking at the Fed, the move of 75bps is still not fully calculated as we have one more CPI data before the meeting that will occur on September 21st. The main question is whether we are at the peak of hawkishness with even ECB lifting by 75bps? For the last 8 months we have read or heard a lot of times that we have seen the peak of yields, the peak of forward rates and so on but central banks somehow managed to surprise us on the upside. As we still do not see an end of high inflation on the horizon, we expect yields to continue climbing but you should have one eye on the energy, as its current weakness will have a word on the matter also.

Source: Bloomberg, InterCapital

Yesterday, the Croatian Government has announced a comprehensive set of measures to help combat high inflation rates in Croatia, and offset the current macroeconomic turmoil. The whole package of measures is worth HRK 21bn while the measures targeting energy prices are estimated at around HRK 6bn. Capping the prices of basic food products are expected to be amortized through the whole value chain while it will positively influence the lowering of inflation measured by CPI. Last but not least, the Government has announced the introduction of a specific company income tax that will be targeted at companies that have made extraordinary profits during the energy crisis in order to make better distribution of the crisis burden among stakeholders. The enactment is envisioned by the year-end.

Out of the measures announced, we bring you highlights of the ones that could have the most impact on the current macroeconomic situation. Firstly, the electricity prices for households, in which as a category, schools, kindergartens, universities, etc. are added. These prices, from 1 October 2022 until 31 March 2023, for the consumption up to 2.500 kWh, will be capped at EUR 59/MWh, while anything above this, will have to be paid at the rate of EUR 88/MWh. This would mean that on average, the price would amount to EUR 62/MWh. This measure is estimated to be worth HRK 1bn (EUR 132.9m).

Current market electricity prices in Europe are running around their all-time highs inflicted by distortion of the market caused by the Russian invasion of Ukraine and the subsequent sanctions on Russia. As a response, Russia reduced its gas exports to Europe. All of this is affecting power prices as gas is used for power production in many countries and as a result, electricity prices have increased almost 10x compared to 2020. Currently, the European electricity benchmarks are running at app. EUR 500/MWh. However, it should also be noted that Croatia is quite self-sufficient in power production, and as such, it is producing enough power for export as well. Because of this, a fair price of energy for Croatian citizens and companies can be achieved.

In regards to businesses, the companies that in the next half-year period use 250k kWh will pay EUR 70/MWh for electricity, while for the half-year consumption above 250k kWh, they will pay EUR 180/MWh. For consumption above 2.5 GWh, the cost will amount to EUR 230/MWh, while below this amount, it will amount to EUR 180/MWh. The total value of this measure is estimated by the Government at HRK 266m (EUR 35.3m).

Moving on to gas prices, the wholesale gas prices in the EU amounted to between EUR 200-300/MWh, while due to govt. support, they are capping it to EUR 42/MWh for Croatia. On average, gas prices in the EU increased by 128%, while due to govt. support, it increased by 13% for Croatia. Also, Croatia is an important gas producer and as such, has to use its resources to protect its local economy and support consumer spending.

At the same time, there is an EU-wide movement for the price cap of wholesale gas prices currently being considered, due to the influence of gas prices on electricity prices. The stance of the Croatian govt. is that the electricity prices on the stock exchanges are not reflective of the prices of electricity production in the EU, and because of higher gas prices, they should be decoupled from the electricity price calculation.

Moving on to prices of heating, the govt. announced that the prices of heating will not change in the 2022 – 2023 heating season. The measure will include 159k buyers and over 98% of delivered heating energy. This measure is worth HRK 1.475bn (EUR 195.8m).

The government also announced price caps on basic food items prices, including milk (EUR 0.98/l), sugar (EUR 1.06/kg), and flour (EUR 0.8/kg), among others.

Measures also included tax reliefs for certain monetary rewards and reimbursements, worth HRK 580m (EUR 76.9m), as well as many other subsidies to different industries, for families, the retired, as well as unemployment and employment support/benefits, among many others.

The government also announces loans and guarantees in the amount of HRK 3.1bn (EUR 412m). If you would like to read the full report, click here (available in Croatian only).

Last but not least, the Government has announced the introduction of a specific company income tax that will be targeted at companies that have made extraordinary profits during the energy crisis in order to make better distribution of the crisis burden among stakeholders. The enactment is envisioned by the year-end. We believe that it will be introduced for energy companies that are selling produced energy at elevated prices due to market conditions like Hep-production and Ina. In this way, the Government would be able to compensate for part of the spending for these measures.

Belex (Belgrade Stock Exchange) has published the monthly report on the trading activity in August 2022. According to the report, the total equity turnover amounted to EUR 4.7m, an increase of almost 2x (96.7% compared to July), translating into an average daily turnover of EUR 204.9k.

Looking over the companies, the most traded company on the exchange was Alfa plam, with a turnover of EUR 3.1m, which reported a double-digit decrease of 10.5% during the month. Next up, we have Dunav osiguranje, with a turnover of EUR 661.1k, which reported a slight increase of 3.5% MoM. Following them, we have NIS with a turnover of EUR 328.8k, PP Feketić, with a turnover of EUR 184.3k, and Aerodrom Nikola Tesla, with a turnover of EUR 181.4k.

Meanwhile, the top gainers during the month were Transport Voždovac with an increase of 44% MoM, Impol Seval, with an increase of 21.2% and Putevi a.d. with a growth of 18.9%. On the other hand, Rapid has basically lost half of its value (50%), Iritel a.d. lost 12.5%, while third on the list is already mentioned Alfa palm, which lost the above-mentioned 10.5% of its value.

The main index on the Belgrade Stock Exchange, BELEX15, grew by 1.5% during the month and ended June at 848.18 points.