Both the FED and ECB are forcing the markets to switch into a slower lane regarding rate cuts this year. Markets got the rate cut narrative wrong from the very beginning because history was not a proper guide this time: the fastest pace of rate hikes did not cause a deflationary recession regime that would become fixed income Eldorado and a true purgatory for equities. Actually, it was the other way around. What happens next and now that CROATI 4 06/14/2035€ is traded at B+103.6bps we ask ourselves: how low can it go?

In a deluge of central bank interviews and statements, we would like to draw your attention to the speech delivered by Philip Lane yesterday at the Hutchinson Center on Fiscal and Monetary Policy (a part of the Brookings Institution).

Lane explained the current stance of ECB staff regarding medium-term inflation forecasts, which are critical factors in determining the direction of monetary policy in the euro area. Two years ago, most of the euro area inflation came from food and energy, so for instance, in October 2022, energy inflation reached +41.5% YoY. Just a reminder that this was eight months after the Russian invasion of Ukraine and EU countries scrambled for LNG, pushing TTF natural gas prices to an all-time high of 340 EUR/MWh. Since then, energy inflation turned the corner and is now negative: in January 2024 it stood at -6.3% YoY. Food is the main source of disinflation, and energy is the only source of deflation, however, services remain sticky. Service inflation stands out from the pack at +4.0% YoY (January 2024) after peaking at +5.6% YoY in July 2023.

So far half of the decline in headline inflation rate peak to trough reflects a decline in energy inflation, while monetary policy tightening had an effect of anchoring inflation expectations and putting a lid on EUR weakness.

So why isn’t the ECB cutting rates already? Because energy deflation is coming to an end as prices are rising from low base levels. Furthermore, wage growth could dampen service sector disinflation, supporting the staff view that HICP inflation could decrease to +2.7% in 2024 and +1.9% in 2025. Upside risks come from geopolitical choke points and that’s the reason why GC members are carefully observing the development of the situation in the Red Sea that so far seems to be contained. That’s probably also the reason why hawks underline the possibility that there might be no cuts at all this year should the Middle East tensions escalate. So far this is not anybody’s headline scenario.

Oh, then there’s one more thing called EONIA curves that have already priced as much as 4.7 rate cuts by December, meaning that financial markets are easing way before the central banks. A splash of sovereign and corporate issuers have taken advantage of these expectations to lock in lower rates, to the dismay of buyers under the assumption that long positions were added unhedged.

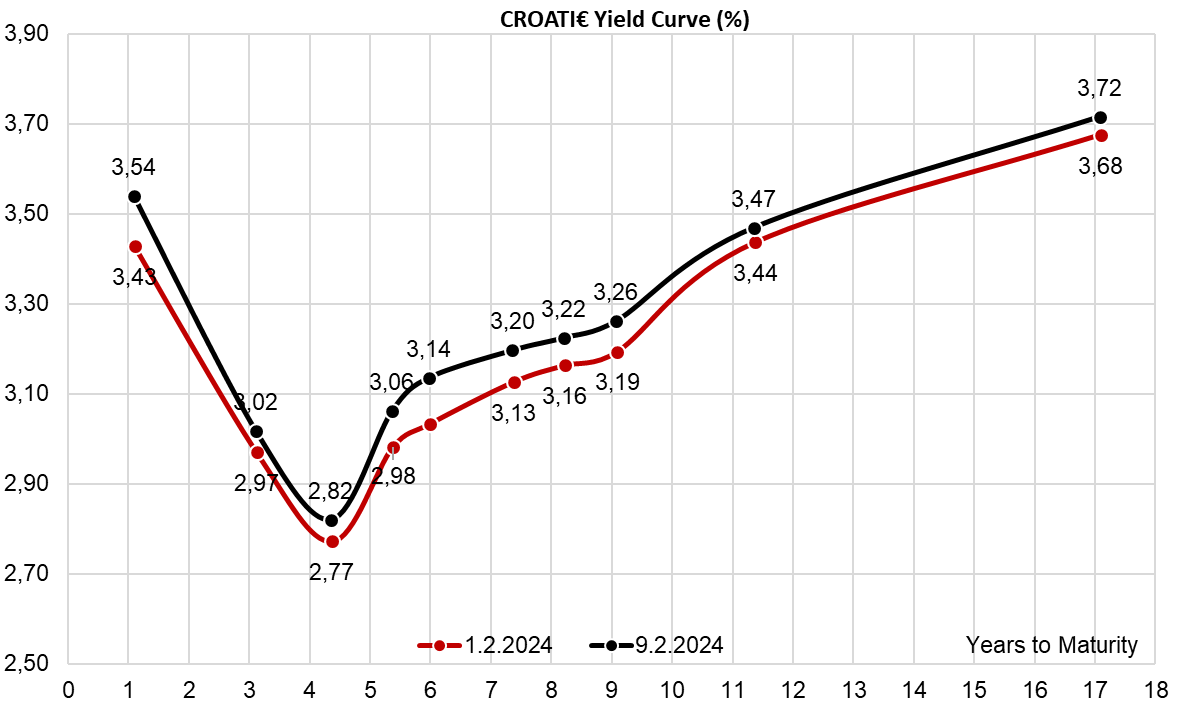

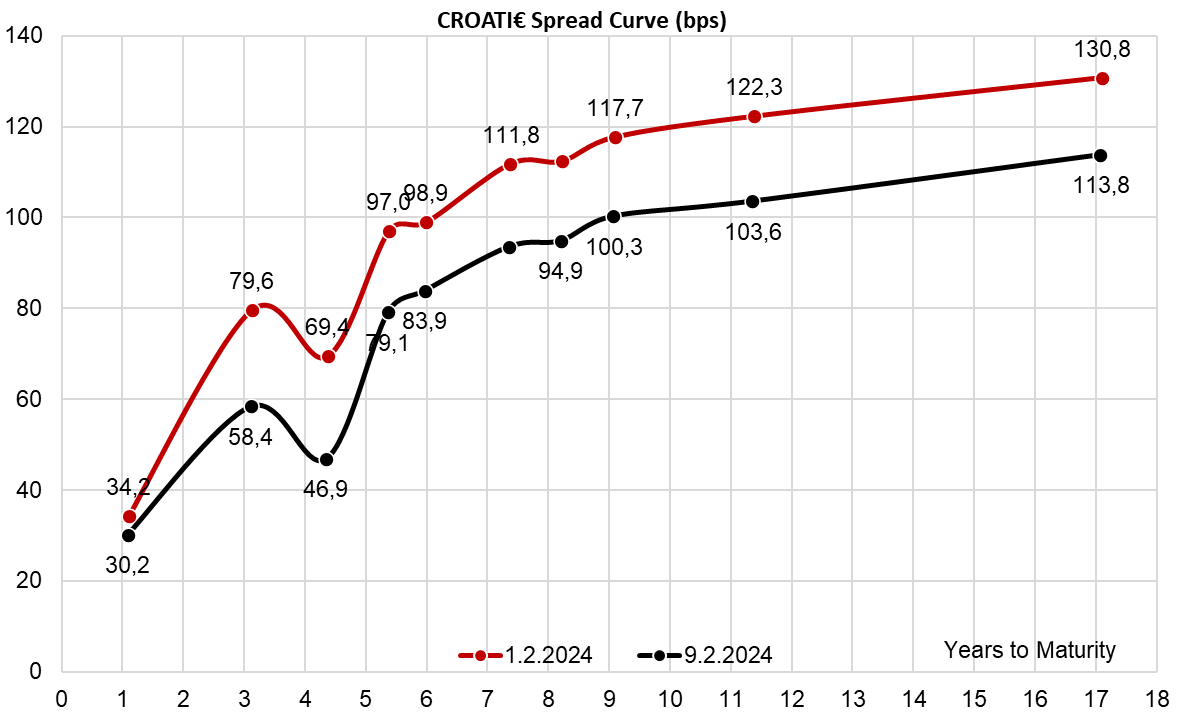

Source: Bloomberg, InterCapital

Croatia was one of the countries that skipped international bond placement and decided to tap the deep pool of domestic savings in the third retail instrument. There are repercussions for the CROATI€ curve stemming from this decision to skip the foreign market and tap the local – namely the splash of cash from CROATI 4 01/26/2024$ got swapped into EUR and reinvested into CROATI€, mostly longer part. Street dealers were lifted in big sizes of CROATI 4 06/14/2035€ and consequently, the bid couldn’t move lower when FGBL tanked. In turn, the spreads tightened and thanks to sound fundamentals and a potential rating upgrade this year, it’s quite likely that CROATI€ aficionados are not going away. Yes, the G-spread on CROATI 4 06/14/2035€ is at B+103.6bps. And yes. It’s probably getting tighter still.

Source: Bloomberg, InterCapital

According to the latest release by the Slovenian Statistical Office, the country’s CPI decreased by 0.6% MoM and increased by 3.3% YoY.

The trend of the Slovenian CPI decrease has been present for the last couple of months. This marks the 3rd month in a row that the MoM CPI decreased, this time by 0.6%. Furthermore, the YoY inflation has also been getting more and more under control, and the growth in January amounted to only 3.3%.

Slovenian CPI change (January 2011 – January 2024, YoY, %)

Source: Slovenian Statistical Office, InterCapital Research

As this slowdown continues, the target set by the ECB of 2% inflation is closer and closer to becoming a reality. Other countries in the EU have also recorded a slowdown in inflation growth, albeit the story differs from country to country. In any case, this is supportive of the interest rate cuts by the ECB, which seems more and more likely as we approach summer, as signaled by the ECB President.

Coming back to the Slovenian CPI, on the MoM basis, the price drop was mostly a result of winter sales of clothing and footwear, where an 8.3% decrease was recorded, contributing 0.6 p.p. to the deflation rate. Furthermore, 0.2 p.p. were added by cheaper motor fuels, as petrol prices decreased by 4.7%, and diesel prices by 4.5%.

On the flip side, 5% higher electricity prices contributed 0.2 p.p. to the increase in MoM inflation, an additional 0.1 p.p. was added by higher prices of natural gas, which grew by 7.7%, package domestic holidays, which increased by 4.1%, and meat, prices of which grew by 1.3%.

Moving on to the yearly data, service prices increased by 4.6%, while goods prices grew by 2.7%. In the goods category, non-durable and semi-durable goods increased by 3.9% and 2.1%, respectively, while durable goods prices decreased by 1.3%.

In terms of the impact on the YoY inflation rate, a 0.6 p.p. increase came from higher prices of food and non-alcoholic beverages, which grew by 3.2%. Following this, we have 0.5 p.p. higher prices in the groups housing, water, electricity, gas, and other fuels, with an increase of 3.6%, as well as 9.4% higher prices in the health group.

When compared to other countries in the EU, using the Harmonized Index of Consumer Prices (HICP), Slovenia places in the middle in terms of the YoY HICP, which amounted to 3.4%.

HICP comparison of select European countries (January 2024, YoY, %)

Source: Slovenian Statistical Office, Eurostat, InterCapital Research

On the other hand, with the -0.6% MoM HICP decrease, it places on the lower end as compared to other EU countries.

HICP comparison of select European countries (January 2024, MoM, %)

Source: Slovenian Statistical Office, Eurostat, InterCapital Research

During 2023, BRD Group recorded a net interest income growth of 15% YoY, NFCI decrease of 1%, net banking income increase of 11%, and a net income to majority of RON 1.66bn, an increase of 24% YoY.

Starting off with the net interest income, it amounted to RON 2.72bn, growing by 15% YoY. This was supported by the continued growth in loans issued to customers, which grew by 12% YoY to RON 40.8bn, but also by higher interest rates on loans. However, BRD does not provide details on its net interest margins so it is hard to quantify how much did the interest rates change. At the same time, according to various statistics, including the Romanian National Bank, Word Bank, OECD, and IMF, the average interest rate on loans in Romania ranged between 7-9%. While we empathize this does not refer to all loans, it did grow by several percentage points in the last couple of years. Lastly, unlike the Eurozone, Romanian Central Bank sets its own key interest rates due to the fact that it still uses its own currency (lei), and these range from 6-8%.

Coming back to BRD, for loans, the Group states that exceptional performance was noted in corporate financing, which grew by 23% YoY, and this included noteworthy growth in both SMEs (+18% YoY) and large corporate customers (+26% YoY). Furthermore, consumer loans recorded 20% YoY growth.

Moving on to net fee and commission income, it remained relatively unchanged, decreasing by 0.5% YoY to RON 750.2m, and BRD noted that this came due to counterbalancing effects. This would refer to lower revenue from card activity given the higher penetration of current account packages, in line with market trends, and contraction of fees on cash transactions mainly due to the base effect, which was offset by increased revenues from lending, insurance, and capital market activities.

Together, this led to an 11% YoY increase in net banking income, to RON 3.83bn. In terms of operating expenses, in total they amounted to RON 1.89bn, growing by 9% YoY. BRD notes that despite the inflation falling to the mid-single digit level by the end of 2023, the average for the year was still double-digit, leading to increased pressure on op. expenses. Furthermore, they note that through strong spending discipline, they were able to keep the growth at this level. Inside OPEX, the largest increase was recorded by other op. expenses, which grew by 12% YoY to RON 615.7m, and personnel expenses, which increased by 7% YoY to RON 962.9m. For other op. expenses, the increase came mainly due to higher costs of external services and increased IT&C related expenses. Meanwhile, personnel expenses grew due to the adjustments of salaries and other benefits within the collective labor agreement, in an inflationary context and highly competitive market for talents. The cost of risk amounted to RON 57.4m (2022: RON -95.1m), due to the fact that BRD recorded persistent recoveries on defaulted exposures and limited NPL formation. In fact, the NPL ratio fell to 1.9% by the end of the year, vs. 2.6% at the end of 2022. Taking all of this together, BRD recorded a net income to majority of RON 1.66bn, growing by 24% YoY.

BRD Group key financials (2023 preliminary vs. 2022, RONm)

Source: BRD, InterCapital Research

Moving on to the balance sheet, total assets grew by 14% YoY to RON 83.8bn, supported by higher financial assets at amortised cost (+18% YoY), and higher Cash and due from Central Banks (deposits held at the Central Banks), at 54% YoY. For the cash at the Central Banks, this is in line with the trend in other banks, as currently the interest rates are so high. Inside the financial assets at amortised cost, loans and advances to customers were the main drivers, increasing by 12% YoY to the aforementioned RON 40.8bn, while treasury bills at amortised cost also grew significantly, by 90% YoY to RON 5.18bn.

On the other hand, total liabilities grew by 12% YoY to RON 74.9bn. Inside this category, the largest increase was recorded by deposits from customers, which grew by 10% YoY to RON 62.4bn, helped by the higher interest rates offered on deposits. This was supported by both retail deposits (+9.9% YoY) and corporate deposits (+10.6% YoY), particularly of SME customers (+15.1% YoY).