Friday’s US NFP was a cold shower for the market hooked up on the FED pivot. So now what ?- it looks like we’re back on square one with markets not knowing what lies behind the corner. We beg to differ because hard economic indicators (namely strong labour market and headline inflation barely coming off the tops) offer a glimpse into the future. But for a complete review, you will have to read our article.

Last week a lot of attention has been focused on Nick Timiraos’ (WSJ) piece on the effect recent rate hikes will have on the real economy. The piece was published before FED/ECB rate decisions (Wednesday and Thursday, respectively) and was dealing with the question of how much time does it take for rate hikes to make their way into the real economy. The very essence of the question is this: is the effect of last year’s rate hikes completely factored into the real economy, or do we still have some runway? Because if rate hikes have already done their bang!, then FED/ECB have more heavy lifting to do and short-term rates would need to go somewhat higher, probably after Jackson Hole in August (they would need some coordination with other global levers of monetary power). On the other hand, if the effect is not factored in and some residual effects could be expected in the coming months, then the most sensible thing for central bankers to do is to wait and not get ahead of themselves. With that in mind, take a look at the one-week change in Bloomberg WIRP US function:

Notice that in the past week, short-term US rate expectations for mid-December went up from 4.476% to 4.809% (+33.3bps), which is the main reason why longer rates went higher in the meantime. Borrowing the framework from Nick Timiraos, we could argue that last week markets were expecting that the lags from monetary policy take longer to come into effect, i.e. enough was done, but needs time to take effect. On the other hand, central bank ambiguity delivered last week was offset by a strong NFP report on Friday (+517k, way above the three-month average of +356k). On a similar line, average hourly earnings grew +4.4% YoY in January, just slightly down from 4.8% YoY in December. Rate hikes are either:

a) not working in the magnitude needed to push inflation closer to the 2.0% target, or

b) need more time to work.

Last week markets were unequivocally choosing b). These days they are thinking that a) might be the correct answer and the 33.3bps higher December rate expected today (as calculated by BBG WIRP function) is an indication of this change of heart.

What do we expect going forward? Both FED and the ECB would deliver the hikes they promised by early spring and then probably wait for signs that wage growth is slowing. The wait will probably extend for a few months until Jackson Hole, but after that chances are the central banks might do just a bit more to curb inflation pressures. Markets are slightly coming to terms with the idea that rate hikes are not a done deal, although we might be at the bottom of the seventh or eighth innings (for our European readers, a baseball game has nine innings).

Ok, so the war against inflation started off with the hope that it would be a Blitzkrieg, but instead turned out to be a prolonged conflict, just like another, more messy war in Eastern Europe.

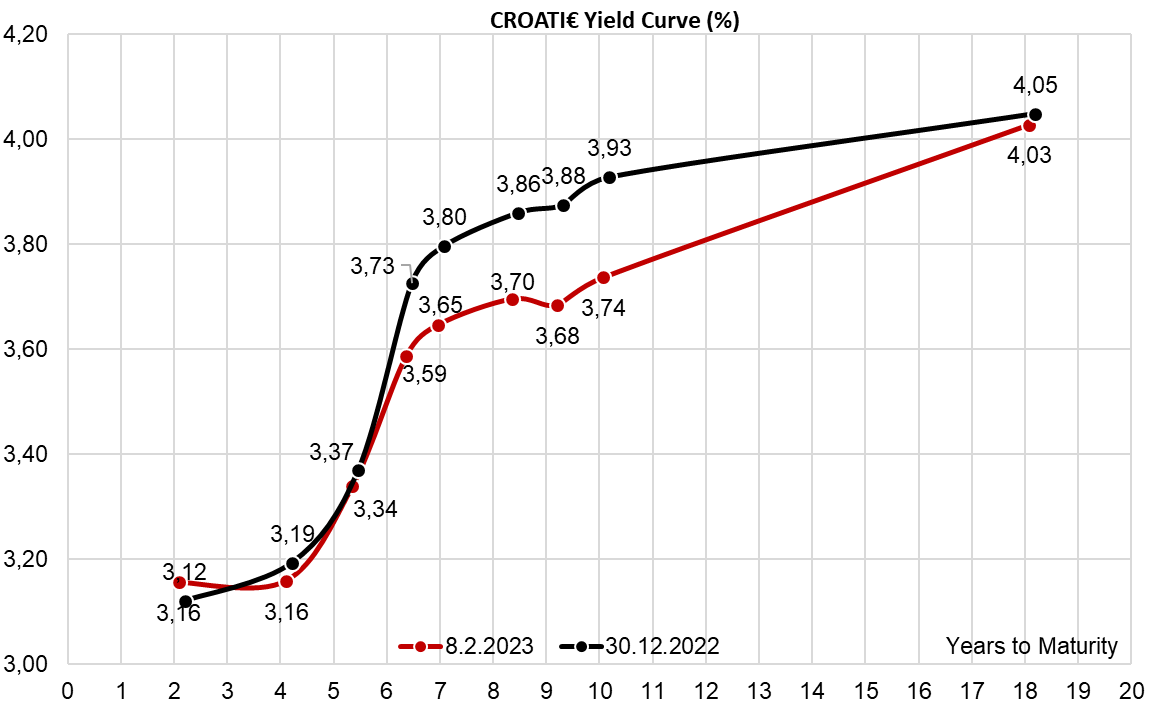

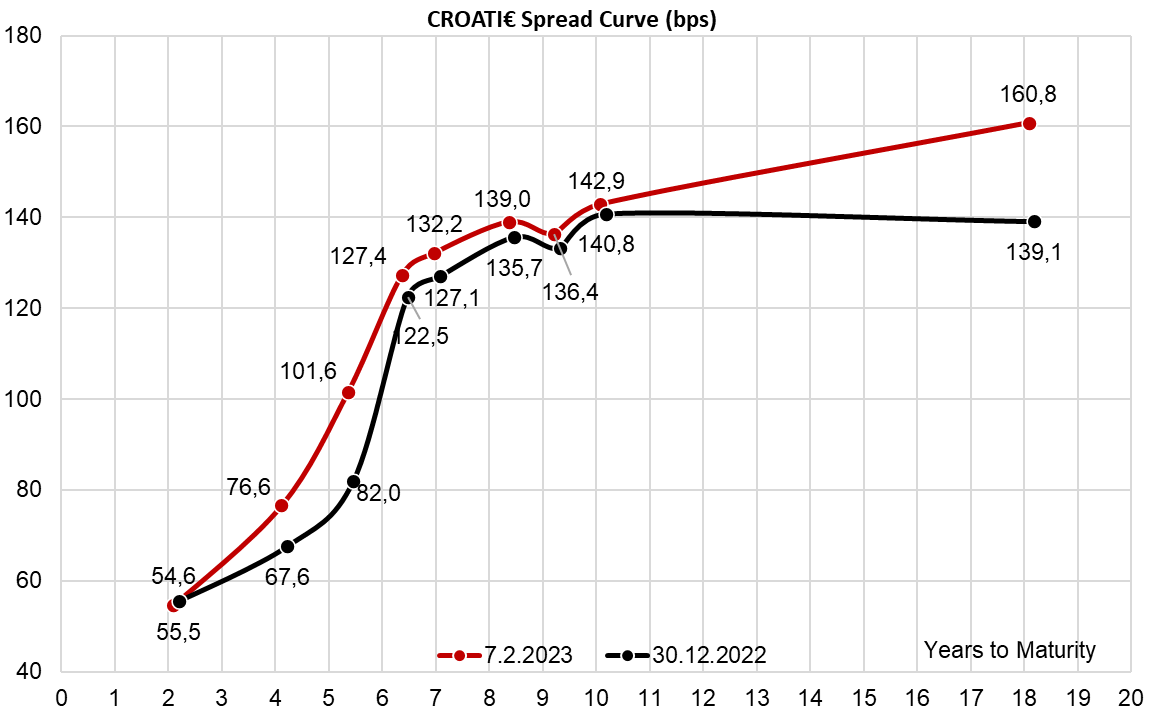

What can we expect going forward? With recent international bond placements from Poland and Macedonia, Croatia is one of the laggards in the CEE region. It’s quite likely that the Ministry of Finance would push for a retail bond, probably by the end of February and after that check the conditions for the international placement. It’s quite likely 1.5bn EUR might be in store, so keep your antennas up for any signal about new international placement. So far, CROATI€ has been trading steady at 120bps-130bps over Germany, a spread so tight that it was detrimental to non-systematic buyers.

By the end of December 2022, the loans of Croatian financial institutions continued their growth, increasing by 9.1% YoY, 0.84% MoM, and amounting to a total of EUR 40.58bn.

At the end of December 2022, and as such 2022 as a whole, the loans of Croatian financial institutions continued growing despite the expectation of a slowdown due to the possibility of a recession, and high inflation rates. In fact, according to the latest report published by the Croatian National Bank, HNB, the total loans of Croatian financial institutions increased by 9.1% YoY, and 0.84% MoM, amounting to a total of EUR 40.58bn by the end of the year. As mentioned, this marks a continuation of the positive trend of growth, and it will be interesting to see what the main growth drivers are.

Breaking the loans into household and corporate loans, we can see that on a YoY basis, both household and corporate loans experienced growth. Household loans increased by 5.38% YoY, but did experience a tiny decrease of 0.05% MoM, and amounted to EUR 19.79bn. Meanwhile, corporate loans amounted to EUR 13.78bn, increasing by 20.67% YoY, and 0.44% MoM.

With corporate loans being the main driver of growth, breaking them down further can give us an overview of what drives their growth. In this way, we can see that all 3 categories of corporate loans (working capital loans, investment loans, and other loans) experienced an increase YoY. Starting off with the largest category, investment loans, they amounted to EUR 5.57bn in December 2022, increasing by 18% YoY (or EUR 853.1m), and 1.1% MoM (or EUR 59m). Working capital loans also increased by 18% YoY (or EUR 640.5m) but decreased by 1.2% MoM (or EUR 50.6m) and amounted to EUR 4.29bn. Finally, other loans increased by 28% YoY (or EUR 867.2m), and 1.3% MoM (or EUR 51.7m) and amounted to EUR 3.92bn. This data is quite positive, meaning that companies are not only continuing their investments, but are able to keep their business operations going smoothly, and most importantly, they are not stopping their plans. Even the monthly decrease in working capital loans could be attributed to the seasonality of requirements for these loans and doesn’t have to be a negative data point.

Corporate and household loans growth rate (January 2015 – December 2022, %)

Source: HNB, InterCapital Research

Looking at the household loans, as expected, the largest category of these loans is housing loans. They account for over 50% of the total household loans and have increased by 0.86% MoM (or EUR 84.3m), and 10.26% YoY (or EUR 922.8m). The 2nd largest category, consumer loans, decreased by 0.14% MoM (or EUR 10.2m) but experienced an increase of 2.4% YoY (or EUR 169.2m) and amounted to EUR 7.21bn at the end of the period.

Composition of Croatian loans to households (October 2011 – December 2022, EURm)

Source: HNB, InterCapital Research

The growth in housing loans in particular is a piece of really positive news, especially if we consider the expected increases in interest rates. In fact, as Croatia is part of the Eurozone and thus is also under the effect of the interest rate hikes by the ECB, it is expected that the newly issued loans will record an increase. How large of an increase, is difficult to say, due to the demand for loans, the risk levels, the growth of the economy, inflation, and many, many other factors. Looking at the effective interest rates, however, one might think that the situation is not changing that much, especially for housing loans. The effective interest rate for housing loans actually recorded a noteworthy decrease MoM, dropping by 0.84 p.p. to 3.16% by the end of December 2022. On a YoY basis, this is an increase of only 0.17 p.p. This would mean that compared to a period when the inflation was much lower, the interest rate hikes were yet to occur, there were no energy cost pressures, and the expectations for the global economy’s development were a lot more positive, the effective interest rates only increased a tiny bit.

For corporate clients, however, the story is a bit different. Looking at the effective interest rates on newly issued corporate loans, which are smaller or equal to EUR 1m, the interest rate amounted to 3.37%, an increase of 0.68 p.p. MoM, and 1.95 p.p. YoY. The increase is even more noteworthy for loans over EUR 1m, where they increased by 0.96 p.p. MoM, and 2.05 p.p. YoY, to reach a similar level of 3.38%.

Corporate and housing loans in EUR effective interest rates (January 2012 – December 2022, %)

Source: HNB, InterCapital Research

Here we can see the discrepancy between the corporate and housing loans. Even though the demand for both categories is still quite high, the interest rates on corporate loans have experienced a lot higher increase. But, this could indicate an adjustment more than anything else, as corporate loans have increased to levels not too different than housing loans. ECB already increased the key interest rates in January, by 50 bps, and this is to be implemented in Croatia starting 8 February 2023. A second 50 bps interest rate hike is expected in March. Because of these developments, it will be worth following how this will affect the end users. Historically, the interest rates on loans to corporate clients usually increased first and faster than the ones to households, and as such it will be interesting to see if history repeats itself, and to what degree.