Big QE package by ECB, PEPP, introduced two weeks ago is already in full force. Only in the first 5 days of PEPP, ECB spent EUR 30.2bn through the programme which envisages buying all assets eligible under existing APP but also buying Greek debt and non-financial commercial papers. ECB intends to buy up to EUR 750bn of eligible bonds and some investors hope that this will not be all. This week’s meeting of Eurogroup still didn’t deliver but we think they do not have much choice. ECB’s umbrella showed its full strength when announced, literally halving yields on Italian and Greece bonds. What are other consequences? Read in this short article.

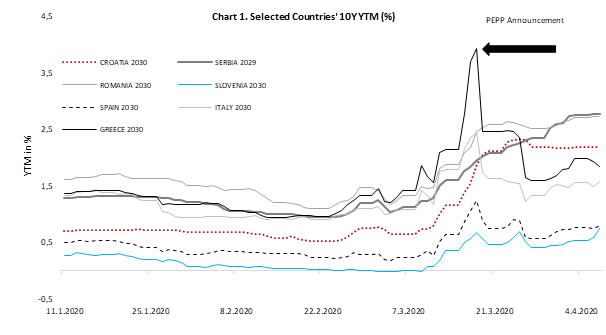

Last week we wrote about new issues on Eurobond market by Slovenia, Portugal and Latvia which have all seen great demand with bid to cover surpassing 2.0, resulting in yield being slightly above levels seen in February 2020. Off course, levels were there most likely due to bazooka from ECB rather than healthy demand from financial institutions. Peak of crisis (at least up to today) seemed to be on March 18th when Italian 10Y papers went above 3.0% while Greek peer surpassed 4.0%. Just to put things into perspective, only a bit more than month ago both Italian and Greek 10Y stood below 1.0% as yield hungry investors were buying every positive yield that they could find.

ECB’s long waited meeting on March 12th on which Ms Lagarde raised QE up to EUR 120bn didn’t get positive response from the market so periphery papers cratered. European periphery went down with speed that wasn’t seen since debt crisis and investors were selling bonds at every bid they found. Story turned around when Ms Lagarde announced PEPP (Pandemic Emergency Purchase Programme) only day after yields in periphery exploded and market was broken, resulting in massive recovery, i.e. periphery yields almost halved. Italian 10Y paper felt from almost 3.0% to around 1.5% while Greek one fell to below 2.0%. These were two most affected ones, but you get the point, bazooka it was.

After two weeks, we have some data by the ECB (only PSPP), showing that in March ECB purchased enormous amounts of Italian debt (almost 35% of all PSPP in March) which is way above capital key. In ECB’s data provided under PSPP, we could see that Italy, France and Spain bonds were the most beneficiaries of ECB’s programme in March as ECB bought EUR 11.85bn, 8.87bn and 5.40bn, respectively which amounts 70% of total March’s buying. Italian paper was bought in March in amount that was last time seen three years ago when ECB was buying EUR 80bn worth of papers a month. However, we still didn’t see detailed PEPP programme under which ECB bought another EUR 30.2bn worth of eligible papers in first 5 days.

So, it seems like yields in euro area are under control, at least for now. With pace of EUR30bn a week, ECB pandemic programme could last for at least 6 months but most likely market will not need such a support for long time. Looking at the equity markets, they were just waiting for new coronavirus numbers to decelerate and started to rocket again. Maybe that could be the case for bonds as well with renewed liquidity provided by central banks. At the moment we are not discussing the mountain of new debt that is coming every day as central banks seem to be eager to monetize the most of it and it’s a theme for another blog. When asked about rising debt, Mr Mario Draghi wrote in a recent article: “Much higher public debt levels will become a permanent feature of our economies”.

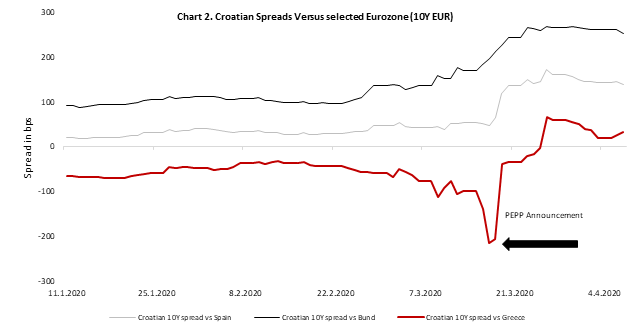

Talking about central bank’s umbrella, what happened with non-Eurozone sovereign yields? Well, they didn’t have ECB so spreads versus EA countries widened significantly. For the sake of this article, lets look at 10Y yield on several EU non-EA sovereign EUR papers and some eurozone peers. Before the pandemic outbreak all mentioned papers were below 1.0% with Serbia and Greece being the last one to reach that magic level. When selling pressure started in the beginning of March spreads versus benchmark started to widen as it’s the case with any minor risk-off event but Italian and Greek bonds took the strongest hit as investors became aware of economic damage. However, ECB came to the rescue and pushed yields to the South. On the other side, EUR Eurobonds issued by Croatia, Romania and CEE company didn’t have that “luck” to be eligible for PEPP, so yields continued to rise or at best stopped rising. To put things into perspective, look at chart 2. on which you could see spread between Croatia and Greece turning positive in the last two weeks. Most likely there will be some spillovers from QE but investors are waiting for some firm ground and to see clear picture, or at least clearer.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital

At the current share price dividend yield is 6.1%

Krka’s Management and Supervisory board proposed to allocate the accumulated profit for 2019. Of the EUR 270.87m of 2019 profit, EUR 133.85m was proposed to be paid as dividends. This translates to a dividend per share of EUR 4.25 and is 32.8% higher compared to the dividend paid for 2018.

At the current share price dividend yield is 6.1% The dividend is subject to approval at the GSM, which will be held on 9 July 2020. Note that the ex-dividend date is not yet proposed.

Given the current Covid-19 situation, if Krka approves the payment of the dividend, it would be one of a few regional companies to pay the dividend for 2019. In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield, where one can observe a stable growth of the dividends throughout the years. Note that this would be the highest dividend yield in the observed period.

Dividend per Share (EUR) and Dividend Yield (%) (2009 – 2020)*

*compared to the share price a day before the dividend proposal

INA Group witnesses declining sales, primarily in fuel segment, with the reduced travel needs of the general public and slowdown in economic activity. This resulted in a recent demand decrease between 30-50%.

INA published an announcement regarding the implications of Covid-19 on the company’s operations. Due to market developments which include drop in oil prices, introduction of measures against Covid 19 and demand drop, INA has switched to the crisis model and has introduced operational and financial measures, keeping the production on-going and the market supply safe.

Exploration and Production segment

Production has been uninterrupted and going as planned, however sharp drop in crude oil prices has significant impact on business profitability and cash flow. Due to the reduced cash flow generation investment projects for the upcoming period, profitability of existing fields and operational costs are reviewed to adjust the operation to the changed external environment.

Refining and Marketing

Lockdown in core markets have resulted in a significant drop in demand for key product groups, which will have a negative impact on cash flow of the segment. This creates operational challenges and continuous optimization across the assets. Safe supply of products in all core markets is ensured and remains INA’s top priority.

Consumer Services and Retail

Following a strong operational and financial performance in Q1, INA Group witnesses declining sales, primarily in fuel segment, with the reduced travel needs of the general public and slowdown in economic activity. This resulted in a recent demand decrease between 30-50%. INA has refocused operations to provide reliable and safe supply across our network and remain cash flow positive in the segment.

Towards the end of the quarter, retail fuel sales dropped sharply by more than 30% and the refinery utilization rate was adjusted to slightly above 80%.

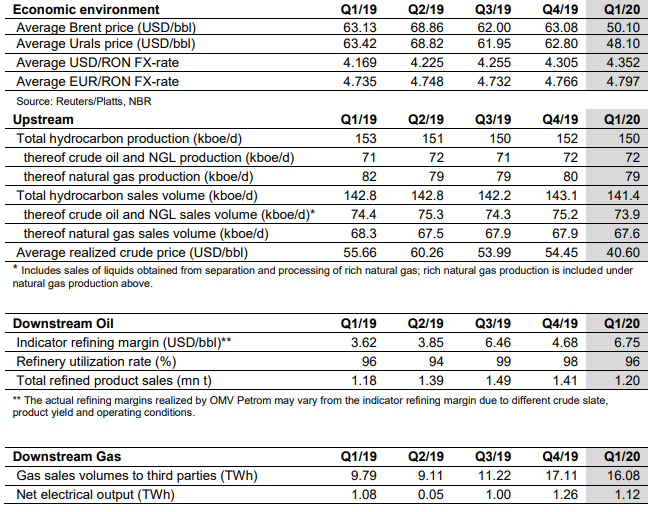

As OMV Petrom published their key performance indicators, we are bringing you their key takes. The company notes that the Q1 2020 report will be published on 29 April 2020 and that the information contained in this trading update may be subject to change and may differ from the final numbers of the quarterly report.

The company notes that lower oil prices and the COVID-19 crisis had a negative impact on Q1/20 Group performance. Towards the end of the quarter, retail fuel sales dropped sharply by more than 30% and the refinery utilization rate was adjusted to slightly above 80%.

Source: OMV Petrom, Bucharest Stock Exchange

In the fight against Covid-19, Electrica states that they have adopted all the necessary measures so that the activity of the companies within the Group continue to be carried out under normal conditions.

Electrica issued a statement on the Bucharest Stock Exchange regarding the Covid-19 implications on their operations. The company states that they guarantee their customers who are in permanent need of the services provided by Electrica Group that they have measure plans implemented in order to ensure the continuity of activities, parameterized depending on the situation’s evolution, and that they do not anticipate significant difficulties in continuing the electricity supply.

In the fight against COVID-19, Electrica has adopted all the necessary measures so that the activity of the companies within the Group continue to be carried out under normal conditions. Ever since the beginning of the crisis the resilience plan in force at Group level has been updated promptly to respond to the exceptional situation at the national level and to limit a potential expansion of Covid-19. Also, essential activities and critical roles have been identified, staff backup has been insured and three action scenarios on escalation levels depending on the evolution of the situation in the external environment of the company have been defined, based on which a resilience plan was developed for each company within the Group.

Up to this moment, activities that involve interaction with clients and / or access to clients’ homes have been limited and the scheduled works reprioritized, in order for the scheduled interruptions in the electricity supply to be diminished.

The management states that they permanently monitor the financial performance and liquidity of Group companies on several tiers, in order to ensure the availability of the necessary funds for carrying out the activity, by analyzing the cash flow with priority, including the potential impact of the legislative changes on Group’s activities. The aim is to secure the collection of receivables from customers, the use of the banking structures for liquidity concentration implemented earlier this year, as well as the financing facilities available for the Group companies.