Today, we are taking a look at Croatian tourism, how it has developed thus far in 2024, what we might expect, and why there might be some short-term benefits, but also long-term costs to the current focus in the industry.

Croatian tourism has proven quite resilient in the last couple of years, despite challenges ranging from the pandemic to inflation and geopolitical instability. 2024 until now, is proving to be the first year where we actually see growth in Croatian tourism, and notable double-digit growth, as presented below:

Total Croatian tourist arrivals and nights in Croatia (January 2019 – June 2024)

Source: HTZ, InterCapital Research

In relative terms, in the first half of 2024, total arrivals and nights increased by 8% and 6% YoY, respectively, while compared to the same period in 2019, they grew by 5%, and 10%, respectively. In other words, one of the main expectations, i.e. that of a slowdown in the tourism industry hasn’t occurred, especially when we consider the fact that revenue growth has in the last couple of years been significant, while the number of arrivals and nights struggled in 2022 and 2023 to surpass 2019’s numbers. Of course, the numbers might turn out differently in the main season, but if the current trend continues, growth could be expected, both in terms of arrivals and nights, but also for revenue and profitability.

This is also supported by the recent European Travel Commission (ETC) surveys, released in May 2024, and done between March and April. It should be noted that none of these surveys are 100% correct, nor do they perfectly present preferences and sentiment, but given the sample size (>4.4k people) they can give us some insights into the trends that are occurring.

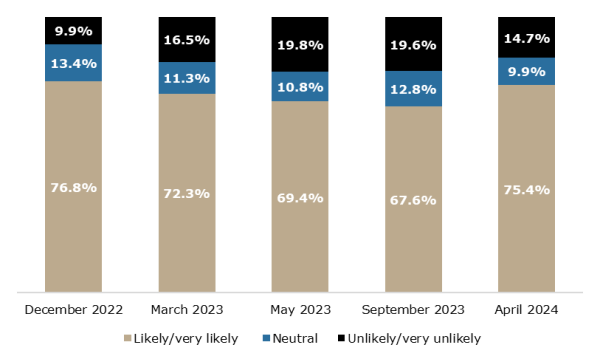

ETC intention to travel in the next six months (December 2022 – April 2024, %)

Source: ETC, InterCapital Research

Starting off with the intention to travel survey, compared to a year ago, we can see a several p.p. uptick to 75.4%, and the majority of the decrease came from people who were unlikely to travel.

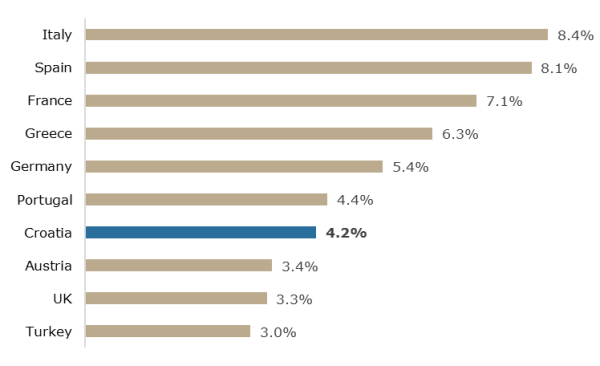

ETC preferred countries to travel to in Europe (May 2024, %)

Source: ETC, InterCapital Research

Meanwhile, on the countries of preference list, Croatia does rank quite low, but it has to be noted that many of the comparable countries are many times larger than Croatia, so this might not tell the entire picture. After all, if the sample is taken as an indication of the population, then >4% is more than enough tourists, and in line with the numbers we have seen.

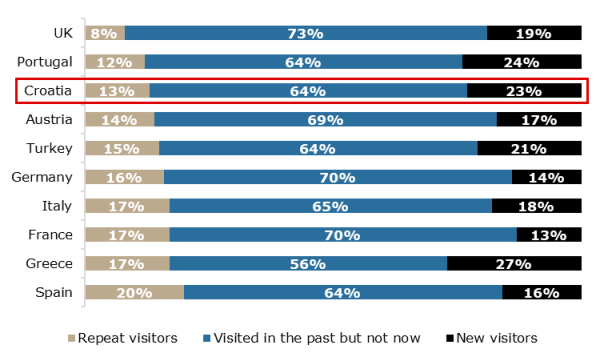

Destination focus: past and future visitors per destination (May 2024, %)

Source: ETC, InterCapital Research

One other interesting graph is the destination focus, dividing the survey participants into repeated visitors to a country, those who have visited in the past but won’t this year, and visitors who might visit for the first time. Here we actually see some of the first signs of the negative sentiment towards Croatia in general, i.e. many of the tourists that have visited before will not visit this year.

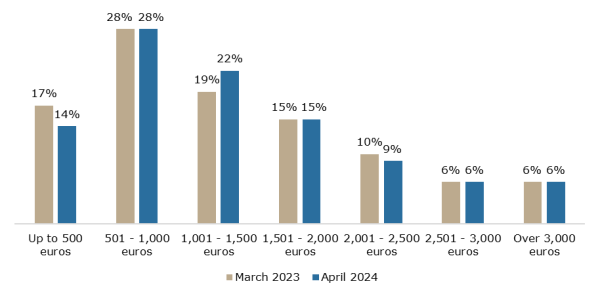

Planned travel budget (April 2024, March 2023)

Source: ETC, InterCapital Research

The reason why might be hidden in the next graph, i.e. the planned travel budget. As we can see, there has been a noteworthy downtick in the lower budget allocation, while at the same time, the largest increase in the 1,001 – 1,500 euro range, with most other categories, except the 2,001 – 2,500 euro range, which changed by 1 p.p., remaining the same. This can indicate several things for us: firstly, the increase in lower budget does indicate that people are willing to spend more. However, the uptick towards the medium-sized budget indicates that while an increase was recorded, people are still looking towards more affordable options. After all, for a 1-2 week vacation, it is unlikely (in Croatia for example) that people would be able to cover all the costs with this type of budget.

Which brings us to a 2nd major point. While budgets did increase, the surveys do indicate that the trend is towards affordability. In fact, if we read more into the research by ETC, 22.3% of respondents claimed that inflation was the main issue, followed by 16.6% stating that economic situation and personal finances were, 11.8% stating that the ongoing war in Ukraine was their main concern, and 10% stating that the potential impact on travel safety due to the tensions in the Middle East was their main concern. In other words, inflation/personal finances/available funds, and safety.

While Croatia is known throughout its history to be one of the safest countries in the world, the inflation and the rise in prices are for sure one issue that affects tourists the most when they choose where they will spend their holidays. In the last couple of years, we have seen a steady increase in the focus towards higher-end and luxury tourism, by hospitality companies & private accommodation owners alike. While thus far this has proven to be stable, with higher revenue and profits as compared to 2019 even with the same number of arrivals and nights, this might present itself to be an issue in the longer term.

Croatia has always been known for being quite affordable, offering mainly good weather, beautiful landscapes, and relaxation, although in the last couple of years, the amount of content and events has been increasing. The switch towards the higher end would end up in the short term offering higher revenues & profits, but if stories, especially in the foreign press such as the ones in Germany continue of how Croatia isn’t as affordable as it seemed before, and that there are other options with more competitive prices in the Mediterranean, in the longer term this type of strategy in the tourism industry might end up hurting the overall economy.

During this year, however, given the higher number of arrivals & tourists, as well as the general growth in prices, we might end up with app. 10-15% higher arrivals YoY, similar or slightly lower/higher nights, and app. 15-25% higher revenue across the board. After years of waiting, this would at last make 2024 a new “record” year. However, given these long-term trends, will we have to wait several more years for another record? And this time, without the pandemic to justify the drop? Only time will tell.

As of the end of May 2024, Croatian pension funds reported an NAV of EUR 21.3bn, marking a 1.1% MoM increase and a 15.1% YoY increase.

According to the latest data from the Croatian Financial Services Supervisory Agency (HANFA), the NAV of Croatian pension funds amounted to EUR 21.3bn, growing by 1.1% MoM, and 15.1% YoY. In terms of net contributions, in May 2024 they totaled EUR 127.3m. Of this, 83.6% went to Category B funds, 10.6% to Category A, and 5.8% to Category C. Over the past twelve months leading to May, net contributions amounted to EUR 1.36bn.

In terms of absolute changes in NAV, the MoM increase was EUR 230.5m, while the YoY increase amounted to EUR 2.8bn. As such, 55% of the monthly NAV increase came from net contributions, while the remaining 45% came from the growth in the value of assets. Meanwhile, on an annual basis, 48% of the increase came from net contributions, while the larger 52% growth came from the asset value appreciation. It should also be noted that the number of subscribers, as of May amounted to 2.27m, growing by 3.3% YoY. What’s also interesting is how is this supported by the foreign workers’ contributions to the funds. According to the latest data from the Ministry of the Interior, the number of issued work permits in the first half of 2024 amounted to 112.4k, representing 65% of the total amount issued in 2023, or on an annualized basis, app. 224.8k working permits, or a 30% increase YoY. In other words, the net yearly increase in the number of subscribers amounted to 73k, which when we take into account people leaving to their pensions as well as the mortality rate, would mean that a lot of this contribution came from foreign workers. Why is this interesting? According to Croatian law, people have to contribute for 15 years to be eligible for pension payments, and in most cases, foreign workers do not stay for that long in a given country, which in a sense means that they pay money towards a system from which they will not be eligible to receive their pensions afterward unless they stay for the said time period.

Net contributions into the Croatian pension funds (January 2019 – May 2024, EURm)

Source: HANFA, InterCapital Research

Examining asset value changes on a MoM basis, the largest increase was seen in bond holdings, which grew by EUR 156m, or 1.2%. Investment funds and shares followed, growing by EUR 36.7m and EUR 33.1m, respectively, or 1.7% and 0.7%, respectively. On the other hand, receivables and money market holdings declined by EUR 27m or 66.8%, and EUR 21.3m, or 10.2%, respectively.

Looking at annual changes, bond holdings saw the largest absolute increase of EUR 1.57bn or 13.5%, followed by shares with EUR 958m, or 24%, and deposits with EUR 329m, or 55%. On the flipside, money market holdings and receivables declined by EUR 132.8m, or 41%, and EUR 34.6m, or 72%, respectively.

Croatian mandatory pension funds AUM structure change (January 2018 – May 2024, EURm)

Source: HANFA, InterCapital Research

Meanwhile, securities and deposits totaled EUR 16.38bn, increasing by 0.7% MoM and 11.4% YoY. Domestic securities and deposits rose by 0.4%, or EUR 52m, while foreign securities and deposits grew by 3% or EUR 60m MoM. On an annual basis, domestic holdings increased by EUR 1.3bn, or 10%, while foreign holdings increased by EUR 368m, or 11.4%.

Lastly, taking a look at the current asset structure of the funds, bonds remained the largest asset category at 61.7% of total assets, increasing by 0.07 p.p. MoM but decreasing by 0.86 p.p. YoY. Shares accounted for 23.1% of the total, with a MoM decrease of 0.10 p.p. but a YoY increase of 1.67 p.p., while investment funds represented 10.2% of the total, increasing by 0.06 p.p. MoM but decreasing by 0.90 p.p. YoY.

Current AUM of Croatian mandatory pension funds (May 2024, % of the total)

Source: HANFA, InterCapital Research