In the last three weeks, we have witnessed a significant drop in yields across the globe due to renewed recession worries. The greatest risk of recession lies in Europe and German yields reflected that. Bund yield fell from 1.92% in mid-June to this week’s low 1.12%, meaning it fell by 80bps. In this brief article, we are looking at the drivers of such a move and what to expect in the summer lull.

Only three weeks ago, yields across the developing countries were jumping through the roof as inflation worries were predominant in the market while central banks pushed their hawkish stance forward with the Fed hiking by 75bps, the first time since 1994 while ECB announced it could hike stronger if needed. UST 10Y jumped to 3.50% while the most interesting move was seen in Europe where its EUR 10Y benchmark overjumped 1.90% level while Schatz yield stood above 1.20% on June 16th. Furthermore, BTPs 10Y yield skyrocketed to 4.30% level, with spread versus bund touching 250bps. However, spreads were once again closed by ECB which announced a new tool that should be used for anti-fragmentation.

As we saw several times this year, once inflation worries jump, bond yields go higher, and central banks react. But then we get some economic data that starts slowdown or recession worries which drive investors to pour some money into safe-haven assets. Also, investors start to question whether central banks will be able to deliver all the hikes calculated as recession could be coming and that cycle repeated several times this year. When you combine this narrative with very low liquidity on bond markets which seem to be broken you get 200 pip moves in bund being quite normal. For example, on Wednesday we saw bund going from 151.0 to almost 153.0 in only a few hours before solid ISM service numbers from the US pushed it 100pips in a matter of few minutes and below 151.0 the next morning.

When thinking about the extreme volatility in rates markets one should only look at the oil forecasts or tails risks that two big banks stated in their sell-side research recently. Namely, one of them said that in case of a total embargo from Russia, oil could hit USD 360 per barrel while another one says that recession could push WTI towards USD 60 per barrel! This represents the current situation in the financial markets where one camp is saying that recession is inevitable which will push commodity prices and inflation down, with central banks halting their planned hikes and yields would then once again fall towards the lows. On the other side, there are investors thinking that recession could be avoided or that it will be shallow but with heightened inflation rates that would force central banks to continue with the tightening of the monetary policy. I simplified the reasoning but that is only to get the picture of how far apart are these two camps. There are many different camps, and each new information is calculated with a bias depending on which camp you prefer.

Talking about commodities, in the last several weeks we have seen significant depreciation of copper and aluminum while wheat prices also followed. Also, this week we have seen WTI once again below 100 USD per barrel as investors price recession more likely than before. In the following weeks, we see volatility not falling due to the summer months as investors are kept on their feet with the extremely tough year and we think that yields could once again go higher before we see firm signals from inflation decelerating. The weakness of the commodity complex could be the first hint in that direction, but services are still holding their ground.

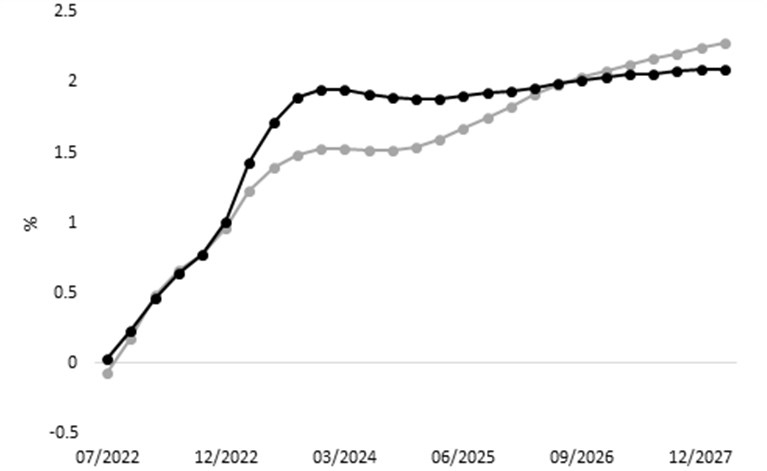

Chart. Euribor 3M

Source: Bloomberg, InterCapital

According to Krka’s estimate, sales revenue is up 6% YoY, (unadjusted) estimated EBITDA is down 25%, while the estimated net profit is up 33% YoY, at EUR 236.2m.

Krka published an estimate of the Q2 2022 results of the Company after its GSM meeting. According to the estimate, sales revenue amounted to EUR 853.4m, representing an increase of 6% YoY. Out of that, EUR 804m were sales of products outside Slovenia, meaning that 94% of the total product and services sales were outside the country. Sales volume amounted to 8.6bn of units (tablets, capsules, injections, etc…), representing a 5% increase YoY.

Breaking the sales by regions, Region East Europe, which accounts for 33.7% of the total sales, increased by 4% YoY (or EUR 11.2m) and amounted to EUR 287.7m. Breaking this down further, sales in Russia amounted to EUR 172.7m, an increase of 3% YoY. Meanwhile, in Ukraine, sales amounted to EUR 45.8m, a decrease of 1% YoY. The second-largest sales region was Region Central Europe, which accounts for 23% of the total sales. The region recorded EUR 196.1m of sales, a 4% growth YoY. In Poland, the 2nd largest individual market behind Russia, sales increased by 1% YoY to EUR 88.8m. Sales in the Czech Republic increased by 16% and amounted to EUR 30m. Moving on, Region West Europe, which accounts for 19.7% of the sales, recorded growth of 6% YoY and amounted to EUR 168.5m. In Region South-East Europe, product sales amounted to EUR 119.4m, or 14% of the total sales revenue, which is a growth of 6% YoY. Region Slovenia recorded a sales increase of 6% YoY, amounting to EUR 49.4m. Finally, Region Overseas Market generated sales of EUR 32.5m, which is an increase of 18% YoY.

Meanwhile, looking at the sales by the product type, sales of prescription pharmaceuticals amounted to EUR 709.2m, an increase of 3% YoY, accounting for 83.1% of the total sales. Non-prescription products generated growth of 31% and amounted to EUR 77.6m. Sales of animal health products increased by 5% to EUR 47.2m, while health resorts and tourist services generated EUR 19.4m, up 46% YoY.

Next up, we took a look at the EBITDA numbers, Krka provided both an estimate for the number as well as the adjusted figures. The estimate for the EBITDA in Q2 2022 is EUR 192.4m, which represents a decrease of 25% YoY. However, if we were to adjust this number, we would get an EBITDA of EUR 270.1m, an increase of 6% YoY. The adjustment refers to the fact that Krka continues its business operations in Russia, and has purchased necessary raw materials, materials, and bulk products to ensure the long-term supply of the pharmaceuticals to the Russian market. As the purchases of these items were done in roubles, and as the rouble appreciated significantly in the last few months, the value of these inventories increased significantly, which temporarily reduced the EBITDA. In essence, the adjusted EBITDA numbers do not include provisions for unrealized profit in the inventory of intragroup companies in the amount of EUR 77.7m as a result of the strengthening of the rouble.

EBIT was impacted in the same way as EBITDA, and the Company provided both estimated and adjusted numbers. Estimated EBIT amounted to EUR 139.2m, a decrease of 31% YoY, while the adjusted EBIT amounted to EUR 217.0m, an increase of 8% YoY. Moving on, the net financial result is estimated at EUR 138m, with the net foreign exchange gains from the Russian rouble estimated at EUR 123m. Of that, estimated unrealized foreign exchange gains totaled EUR 116m.

Finally, Krka’s net profit amounted to EUR 236.2m, an increase of 33%. This would also mean that the net profit margin amounted to 27.5%, an increase of 5.6 p.p. YoY.

Krka Q2 2022 key financials estimates and adjusted numbers (YoY, EURmn)

Krka also commented on the new products it launched, its investments, employees, as well as the 2022 business plan. It launched four products and invested a total of EUR 49m in H1 2022, of which more than EUR 35m into the controlling company. At the end of June, Krka had 11,618 employees, an increase of 1% or 107 YoY.

Lastly, taking a look at the 2022 business plan, Krka projects that the 2022 sales will amount to EUR 1.61bn and a net profit of EUR 300m. They plan on investing EUR 130m into investment projects, primarily to increase and upgrade the production facilities and infrastructure, and 10% to research and development.

At the same time, the results might be influenced by a new wave of COVID-19 restrictions, rising prices of raw materials, the situation in eastern Europe, as well as the exchange rate volatility. The Company remains committed to a stable dividend payment policy, which takes into account requirements for investments and acquisitions, and the expected allocation for dividend payment amounts to at least 50% of the net profit.

At the share price before the proposed dividend, the DY would amount to 5.85%. the ex-date is set for 19 July 2022.

Krka has announced the resolutions of its annual General Meeting of Shareholders held yesterday, 7 July 2022. According to the resolutions, the distribution of 2021 was approved, in the following manner: EUR 175m as dividend payment, EUR 71.8m as other profit reserves, and EUR 71.8m as retained earnings. This would mean that the dividend payout ratio amounts to app. 54.9%, with a gross dividend payment of EUR 5.63. This also represents a dividend yield of 5.85%.

The app. 55% of the dividend payout ratio follows the dividend payment policy outlined by the company, according to which at least 50% of the net profit will be distributed as dividends, after all the investments and acquisitions that the Company has plans for are accounted for.

The ex-date is set for 19 July 2022, while the payment date is set for 21 July 2022. Below we provide you with the historical dividends per share and dividend yields of the Company.

Krka dividend per share (EUR) & dividend yield (%) (2009 – 2022)