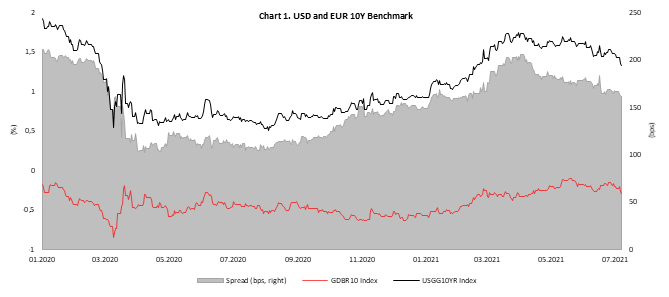

Once again, we are witnessing large drop in yields across the globe. Yesterday USD 10y benchmark reached 1.30%, level last time seen in the end of February 2021 while 30y paper decreased below 2.0% line. On the other side of the Atlantic 10y bund headed towards -30bps, resulting in tightening of peripheral spreads. In this article we are looking at the main drivers of the latest bull flattening and what could we expect in the following weeks.

Since late February, reflation trade has been the most scrutinized one and rates path still surprises investors to this day. In February, bond yields exploded due to investors’ scare of permanent increased inflation and that central banks could fall behind the curve which would lead to abrupt change of policy once they realize they are late with tightening. Back then, think-tanks across the globe were competing which forecast will be more bearish on rates. UST 10y peak was few basis points below 1.80% while 10y bund reached almost 0.0%. Today UST 10y stands at 1.30% while bund is at -30bps and now it seems that in April 2021 bonds were priced like central banks were already behind the curve.

However, let us look what happened in the last two weeks that pushed yields back to levels last time seen few months ago. First, new corona variant called delta is causing more and more countries in Europe into partial lockdowns meaning that pace of the recovery could be slower looking forward. Furthermore, vaccine process has been decelerating although countries are putting much effort into continuance of vaccination process which should ensure delta variant to have limited impact and less severe cases in relative terms.

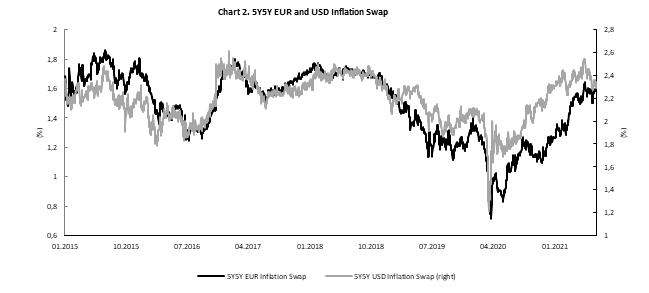

Second driver of renewed yield hunt could be found in constant communication from central bankers which are ensuring investors that inflation will decrease in 2022 and that a lot of help from central banks is still needed to safekeep economies before corona crisis is way behind us. However, US Fed is expected to announce tapering of its purchase program in Jackson Hole in the end of August, although that could disappoint bond vigilantes as they could only announce slower buying of its MBS part but that is still to be seen. Some analysts expect that tapering could start in the beginning of 2022 and that Fed will only mildly decrease pace of bond buying (currently USD 80bn of USTs and 40bn of MBSs per month).

Talking about inflation and economic recovery, there are some hints that growth in US reached its peak as ISM survey showed this week when service survey came significantly below expectations. On the other hand, last Friday NFP overjumped expectations, as US payrolls increased by 850k (720k expected) compared to 559k last month. However, NFP that came above expectations confirmed asymmetric expectations and market skew. On Friday afternoon rates actually fell slightly while ISM disappointment resulted in bonds skyrocketing. And the last thing missing for a perfect storm for the guys being short rates could be mild equity correction that would propel safe assets such as bunds and USTs in the territory where they have been in the beginning of the year.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital

In the 5M 2021, GWPs recorded an increase of 2.76%. Non-life observed an increase of 2.61%, while Life observed an increase of the 3.14%.

The Slovenian Insurance Association published their monthly update on the gross written premiums and by the end of May 2021, the Slovenian insurance market showed a continuous increase in the terms of GWPs. Total GWPs in the 5 months of 2021 increased by a 2.76% YoY to a total of the EUR 1.19bn. Of that Life segment stood at EUR 330m (+3.14% YoY), while non-life insurance stood at EUR 856m (+2.61% YoY).

The non-life insurance segment which accounts for the 72.14% of the total GWPs, showed a solid performance in the segment to other property damages (excluding fire and other natural forces) with an increase of EUR 10.3m or +13.14% YoY). We note that this increase is the largest contributor to the rise in non-life insurance segment. Positive performance can also be noted in the segment Land motor vehicles insurance where there was an increase of the total EUR 7m(+4.76% YoY). On the negative side there was the decrease in the motor vehicle liability segment, with the total decrease of the EUR -6.9m (-5.26% YoY).

Furthermore, Life segment recorded an increase of 3.14%, reaching total of the EUR 330.5m. This increase is linked to the 20.9% increase in the Unit-linked life insurance, which increased by the total of EUR 20.5m and now stands at the EUR 118.8m. On the other hand, Life assurance decreased by the total of the EUR 9.4m (-6.65% YoY) and now stands at the EUR 131.7m.