This week, we will present you with a detailed series – decomposition of Return on Equity (ROE) of selected Croatian companies, using the 5-Step DuPont Analysis. DuPont analysis breaks down the underlying components of the ROE in order to analyze the contribution of each component. ROE is a measure of the profitability of a company in relation to equity. The higher the ROE a company achieves, the more efficient the company is in generating profits, using its equity to do so.

ROE – Croatian Blue Chips [FY 2023]

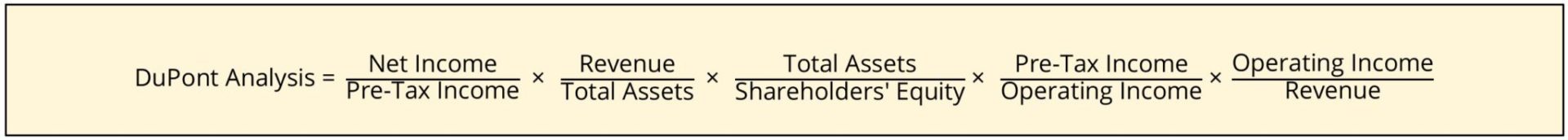

5-Step DuPont Analysis

When decomposed in the 5-step formula, ROE looks like this. If the same variable from the numerator and denominators is „cut out“, the aftermath would just be net profit divided by equity – which is in fact, nothing but ROE. Also, it should be noted that each component is the most useful when compared to companies within the same industry, as each industry has its own specific characteristics.

In other words, the company’s profitability ratio (ROE) is decomposed in five other ratios.

Operating margin gives us information on the company’s ability to generate profit from its operations and revenues. It calculates how much operating profit can a company make on a dollar of sales, after paying all costs of production (COGS, wages..), but before paying interest or tax. Overall, the operating margin represents the company’s operating efficiency.

Financial leverage divides a company’s total assets with a company’s equity, giving us information on how leveraged the company is with debt. Financial leverage can be useful as it emphasizes the financial stability of a company. Financial leverage equal to 1 would indicate that the company has no debt – that company financed its total assets with equity. The higher the financial leverage goes, the more leveraged the company.

Asset turnover compares a company’s assets to its sales. This ratio helps us to determine how efficiently a company uses its assets to generate revenue. This ratio is crucial as every company has to utilize its assets. The higher the ratio is, the more efficiently the company uses its assets to generate revenues. This means the company uses its equity and debt to produce higher revenues, compared to the company having a lower asset turnover ratio.

The last two components within DuPont are tax and interest burden. These components highlight how much do tax and interest weigh down a company’s net profitability. The tax burden gives us the proportion of profits retained after tax. This indicates how much does tax impacts on company’s bottom line. Interest burden tells us the extent to how much the interest expense of the company impacts its net profit.

Today, we will look at the Operating margin of a few Croatian Blue Chips, as a first DuPont component. Operating margin gives us insight into the company’s operating efficiency and ability to generate profit to equity from operating activities. The higher operating margin is a result of the company’s ability to generate more operating profit on each dollar of sales and it is a direct result of the company’s cost management efficiency. Looking at Podravka during 2023, operating profitability was stable as Podravka was able to mitigate the increase in the cost of production materials by improving production processes and procurement processes. Looking at Končar, Group improved op. profitability due to strong top line growth with overall strong 2023 for all KPIs.

Operating margin (%) – Croatian Blue Chips [FY 2023]

Tomorrow we will look into the second DuPont component of Croatian companies, Financial leverage, and compare them with peer companies operating within the same industry.

According to the latest release by Eurostat, in GDP per capita purchasing power parity (PPP) terms, Croatia reached 76% of the EU average in 2023, while Slovenia reached 91% of the EU average. In this overview, we’ll detail how other countries performed, and how they compared to these regional markets.

Recently, Eurostat, the EU’s statistical office, released the latest report on the GDP per capita PPP comparison between the EU countries.

EU countries GDP per capita PPPs comparison (2023, % of the EU average)

Source: Eurostat, InterCapital Research

As we can see in the graph above, there is a huge disparity between the wealthier members of the EU and the less wealthy countries. In fact, the wealthiest country in terms of GDP per capita PPPs in the EU during 2023 was Luxembourg, at 240% of the EU average, followed by Ireland at 212%, and the Netherlands at 130%. On the other hand, the least wealthy country was Bulgaria, which recorded 64% of the EU average, followed by Greece at 67%, and Latvia at 71%.

Croatia placed at 76% of the EU average, putting it squarely in the bottom group of the countries, while Slovenia recorded 91% of the EU average, putting it in the middle of the EU.

EU countries’ GDP per capita PPP change since the end of 2019 (2023 vs. 2019, p.p. change)

Source: Eurostat, InterCapital Research

If we compare the standard of living to 2019, we can see that more than a third of the countries recorded a decrease in the standard of living, with the largest decrease recorded by Luxembourg at -21 p.p., followed by Germany at -9 p.p., and Austria at -4 p.p. Others remained in the low to mid-single-digit level decreases, but decreases nonetheless in a 4 year period. On the other hand, we can see that excluding Ireland, most of the countries that recorded improvements in the standard of living were the ones that were below the EU average, which of course makes sense. This is due to the fact that various EU funds help these states the most to converge with the EU average, as these countries are net receivers of the funds from the EU funds.

Looking at the countries themselves, Ireland recorded a 22 p.p. improvement in the standard of living, followed by Bulgaria at 13 p.p., Romania at 12 p.p., and Croatia at 11 p.p. In other words, while many of the wealthier countries recorded slow to no GDP growth, due to the pandemic and later on, inflation, higher interest rates, and the war in Ukraine, developing countries managed to significantly close the gap.

EU countries’ GDP per capita PPP change since the end of 2010 (2023 vs. 2010, p.p. change)

Source: Eurostat, InterCapital Research

Compared to 2010, the differences are even more stark. Ireland recorded an increase of 81 p.p. compared to 2010, followed by Lithuania at 26 p.p., Romania at 25 p.p., Bulgaria at 19 p.p. Croatia stands at 15 p.p., while Slovenia stands at 6 p.p. On the other hand, Luxembourg recorded a 35 p.p. decrease, Greece recorded 18 p.p., Sweden 11 p.p., while Finland recorded a 10 p.p. decrease.

There are several points that can be taken away from this data. Firstly, excluding Ireland which is a case study by itself, the largest convergence with the EU average came from under-developed EU member states. This is even more true the longer time period we compare. Secondly, countries that usually recorded decreases, as for example compared to 2010 are the wealthiest countries, excluding in this case Greece. Greece itself had a lot of issues during the last financial crisis and the Euro debt crisis as we know, and as a result, a significant decline in the standard of living occurred.

Besides Greece, Luxembourg, Sweden, Finland, and others recorded an overall decrease in the standard of living, but looking at these numbers might be a little deceptive. The reason why is the fact that it is compared to the EU average, which is also comprised of the faster-growing less developed member states. In other words, as these countries grow, so does the EU average increase.

On the flip side, the more developed countries have a slower, but steadier GDP growth, and this slows down even further the more developed they become. As such, the only way for them to actually increase their GDP per capita PPP is to record above-average EU GDP growth, and to maintain their position, they would have to record the same GDP per capita PPS growth as compared to the EU average. Neither of these things usually happens, leading to the more developed countries recording a “deterioration” in the standard of living.

Of course, real deterioration did occur in many EU countries, especially in the last couple of years due to elevated inflation across the board, and wages having a hard time keeping up with said inflation.

Coming back to the region, Slovenia’s growth has been steady, although as it is a quite small and developed economy, further convergence to the EU average should be slower. Croatia on the other hand, has a lot more room to grow, and this growth is possible if we look at some other regional peers. For example, already in 2022, Romania managed to match Croatia in this metric and surpassed it by 2 p.p. in 2023.

Croatia is projected, in the 2021-2027 financial period through EU fund allocation to be allocated EUR 25bn at current prices. This represents app. a third of the 2023 GDP, while growth is also expected above the EU average. For example, the latest EC forecast for Croatia’s 2024 real GDP growth is 2.6%, as compared to 2% for the EU. Combined, this could lead to further convergence in the coming period.