At the current share price dividend yield is 5.2%

Krka’s Management and Supervisory board proposed to allocate the accumulated profit for 2019. Of the EUR 337.52m of 2020 profit, EUR 156.1m was proposed to be paid as dividends (payout ratio of 46.2%). This translates to a dividend per share of EUR 5 and is 17.6% higher compared to the dividend paid for 2018.

At the current share price dividend yield is 5.2% The dividend is subject to approval at the GSM, which will be held on 8 July 2021. Note that the ex-dividend date is not yet proposed.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield, where one can observe a stable growth of the dividends throughout the years.

Dividend per Share (EUR) and Dividend Yield (%) (2009 – 2021)

In Q1 2021, Croatia observed a fall in tourist arrivals by 44.72% and a fall in tourist nights by 39.17%.

According to the report of the Croatian National Tourist Board, in Q1 2021 Croatia observed a decrease in arrivals of 44.7% and a decrease in tourist nights by 39.2%. To be specific, Croatia noted 325.8k arrivals in Q1, compared to 636.8k in Q1 of 2020. Of total arrivals witnessed in Q1, foreign tourists account for only 90.8k or 26% (compared to 58% in Q1 2020). Such figures show a decrease in foreign arrivals of 75.5%, which could be attributed to the continued restrictions throughout Europe.

Moving on to tourist nights; in Q1 Croatia observed 1.16m tourist nights compared to 1.9m in Q1 of 2020. Such figures indicate that the average stay per person increased from 3 nights to 3.3 nights. When looking at solely foreign tourists, average stay per person amounted to 5.5 nights, compared to 3.1 nights in Q1 2020. Of total tourist nights realized, foreign tourists account for 500k (-56.8%). Of that, tourists from Germany lead the list, accounting for 6.6% of total nights, followed by tourists from Bosnia & Herzegovina (5.4%).

When observing the arrivals realized in Q1 by counties, Istria leads the list with 17.7% of the total arrivals and most tourist nights (22.4%). Turning our attention to the type of accommodation, one can observe that hotels observed a 49.7% decrease in arrivals to 220.9k, while nights realized in hotels stood at 467.9k (-48.8%). We note that nights realized in hotels account for 40.3% of total nights realized.

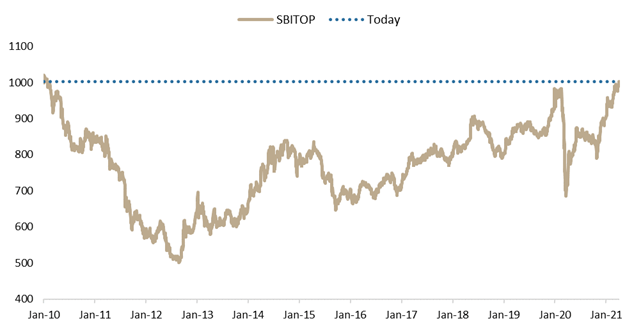

The index is up by as much as 11.4% YTD.

SBITOP has ended yesterday’s trading day with an increase of 0.78% and has therefore surpassed the 1,000-point mark. To be specific, the index ended the trading session at 1,003.38 points, which was last time seen more than 11 years ago (February 2010).

The index has noted quite a strong start to the year, as the positive sentiment in regional equities continued. The mentioned resulted in an increase of the index up by 11.4% YTD, thus outperforming the majority of global indices (S&P500, Dow Jones, Nasdaq etc.).

Performance of SBITOP since 2010

Source: Bloomberg, InterCapital

When looking at the Slovenian blue chips, all of them are YTD in green, while 5 of them observed a double-digit increase. Of that, Sava Re observed the highest share price increase of 27.6%, followed by Cinkara Celje (+19.1%). Petrol comes next with an increase of 15.4%, noting the highest individual impact on SBIPOT. Next come Telekom Slovenije and NLB with an increase of 14.7% and 12.7%, respectively.