For today we decided to present you with a brief analysis of how correlated have been CROBEX and S&P500 since the beginning of the year.

If you have recently been following the Croatian and the US equity market, you might have seen certain similarities in the movement of CROBEX and S&P500. Like most major indices, both have witnessed a sharp double-digit decrease since the beginning of the year. In the graph below, you can see the YTD performance of CROBEX and S&P500, which does show a similarity in the movements of the indices.

YTD Performnace of CROBEX and S&P500

If we were to take a closer look at daily movements of the indices, one can observe an interesting correlation, which is visible in the graph below. Since the Covid-19 outbreak, one can notice that almost every time when S&P500 recorded a sharp daily increase or decrease, the same movement of CROBEX was observed. This can be also confirmed when calculating the coefficient of correlation of YTD daily returns of both indices, which amounts to 0.76, showing a solid correlation between the movement of the indices. This has not been historically the case (to such extent) as the coefficient of correlation for the same parameters since 2015 amounts to 0.42, while since 2007 amounts to only 0.37.

YTD Daily Change of CROBEX and S&P500 (%)

Such a correlation could imply that many investors in the Croatian equity market are not necessarily basing their investment decisions on fundamentals or the local news, but rather on the global sentiment. This would not surprise us as many fundamental parameters are still in a very unknown territory such as the end of the Covid crisis, relaxation of local measures regarding the virus or impact on the macro picture across economies

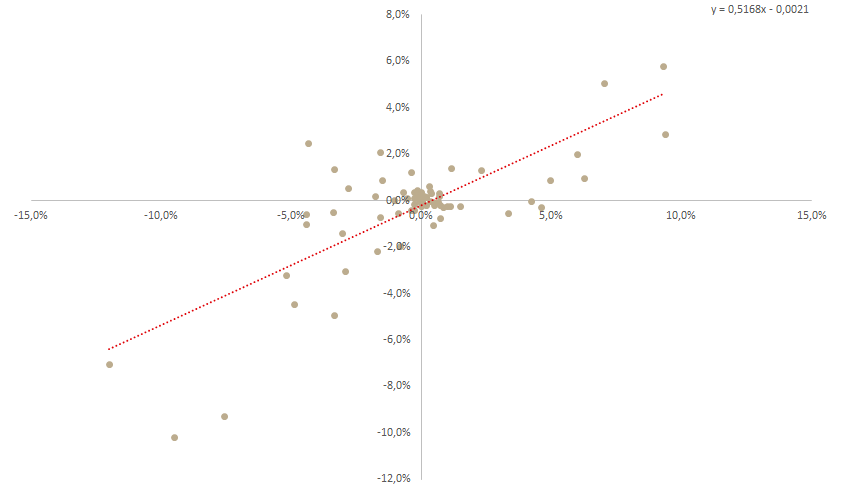

If we were to run a regression of YTD daily returns of CROBEX and S&P500, the slope of the regression gives us additional information of relative volatility of CROBEX. In the graph below, you can see that the slope of the regression amounts to 0.52 indicating that CROBEX has been roughly half as volatile as S&P500. So for example, an increase of 10% of the S&P500 would indicate a 5.2% increase of CROBEX.

Regression of YTD Daily Changes of CROBEX Against S&P500

Yesterday, SBITOP recorded an increase of 6.11%, ending at 780.64 points.

Slovenian equity market recorded another day in green, with SBITOP recording the highest daily increase this year of 6.11%.

The main index of the LJSE ended the trading session at 780.64 points, which is still a decrease of 15.7% YTD.

Of the SBITOP constituents, all ended the trading day in green, with Luka Koper leading the list with an increase of 10.59%. Next comes Sava Re with an increase of 9.15%. Of the index heavy weights, Krka recorded an increase of 6.38%, ending the trading session at EUR 70 per share. Note that at the current share price Krka is traded at a P/E of 9.8 and EV/EBITDA of 5.5. Petrol recorded a 4.61% increase, while NLB, which is currently the worst performing constituent, recorded an increase of 2.58%, closing at 39.7 per share. Note that at the current share price, NLB is traded at a P/B of 0.44.

Share Price Performance of SBITOP Constitunets (%) (7 April 2020)

Turning our attention to the turnover, LJSE once again witnessed a very high turnover of EUR 3.07m, of which Krka accounted EUR 1m, while Petrol accounted for EUR 0.58m.

With the exception of the discontinuation of the HoReCa sales and drop in the consumption of their products in the on-the-go and impulse segment, Atlantic did not have other significant negative effects on operations.

Atlantic Grupa published an announcement on the Zagreb Stock Exchange regarding the impact of Covid-19 on the business performance in 2020. The company stated that they do not expect that the targets given in their outlook for 2020 (published on 27 February) will be achieved.

Atlantic adds that that until now, with the exception of the discontinuation of the HoReCa sales and drop in the consumption of their products in the on-the-go and impulse segment, they did not have other significant negative effects on operations, and in the part where they do exist, they were entirely compensated by the improved performance of Farmacia, Savoury Spreads, Coffee and the portfolio of baby food, personal care and food overall, be it from their own production portfolio or from the portfolios of our principals. The company adds that they have entered into this situation from a very strong financial position and record-high results in 2019, which enables their business continuity even in these difficult market circumstances.