Last week ECB announced new financing operations and loosened the terms of current operations. Furthermore, it opened the way for increasing its PEPP envelope so until this week seemed like ECB will save the day. However, German Constitutional Court questioned its APP and now ECB has another challenge. What happened and what we expect next read in this week’s article.

A week ago, ECB delivered once again on its monetary meeting issuing statement with six decisions. The first one and most important was cutting TLTRO III rates further (from 25bps below average rate) to 50bps below the average main refinancing rate (0.00%) from June 2020 to June 2021 but also as low as 50bps below the average deposit rate (-0.50%) for counterparties whose eligible net lending reaches the lending threshold. This means that some banks could borrow at rates as low as -1.0% resulting in solid carry opportunities. Second decision was to introduce new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) which will consist of seven operations starting in May 2020 at rate that is 25bps below the average rate of the main refinancing operations. In the end of the statement ECB said that Governing Council is fully prepared to increase the size of the PEPP and adjust its composition by as much as necessary and for as long as needed. All in all, ECB did its job providing as much monetary stimulus it has in its toolbox.

Well, ECB’s toolbox was questioned this week as German Constitutional Court surprised market saying that ECB’s purchase programme that started in 2015 partly violated German constitution. Namely, GCC was asked few years ago whether ECB’s PSPP was compliant with EU Treaty provision on prohibition of monetary financing of member states. The verdict first said that “it is not ascertainable that the PSPP violates the constitutional identity of the Basic Law in general or the overall budgetary responsibilities of the German Bundestag in particular”. However, it said that ECB disregarded the principle of proportionality and exceeded its mandate due to volumes and time span of the programme. Moreover, it said that Bundestag should take active steps against PSPP in its current form and gave ECB three months to adopt new decisions which will demonstrate proportionality principles and prove that there weren’t any negative side effects of the programme.

We did not have to wait long for the answer from ECB. “The Governing Council remains fully committed to doing everything necessary within its mandate to ensure that inflation rises to levels consistent with its medium-term aim and that the monetary policy action taken in pursuit of the objective of maintaining price stability is transmitted to all parts of the economy and to all jurisdictions of the euro area”. To conclude, we do not expect BundesBank to start selling bonds that it bought through the programme and do not expect ECB to be stopped from its mission to increase inflation and stabilize financial sector. Most likely it will only have to show why their decision to introduce asset purchases was inevitable and justified in such manner. However, this decision shows that Euro area still has the same problems it had several years ago despite new virus which will dent the economy at such scale that was not seen since GFC and maybe even longer. Ms Lagarde and the company in Frankfurt are still looking like the only ones pushing to the limit while state governments are pulling in their own way with days passing by and we are waiting for the next meeting of the Euro group to see whether we could have united and proper answer for the crisis.

Market reaction on GCC decision was quite interesting but most likely that was due to different interpretations of decision among traders. Namely, bund first futures first fell by almost 100pps and then in the end of Europe hours bounced back above 174.0 level translated into -0.56% in YTM. On the other side periphery spreads moved in the opposite direction with Italian spread once again widening to 240bps.

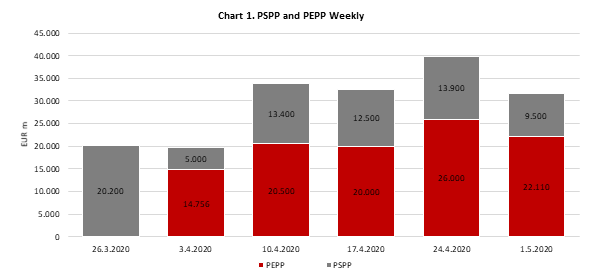

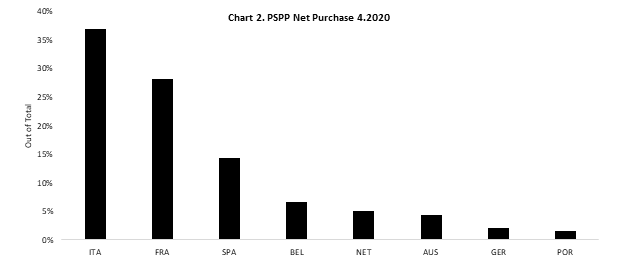

Talking about periphery, ECB published its April APP data once again showing that Italy and France were the biggest beneficiaries of the programme as 36.8% of total April PSPP was aimed to Italy while another 28.1% were French papers. Furthermore, in the end of last week (May 1st) ECB posted that it bought EUR 118.81bn in total under PEPP meaning that it bought EUR 22.21bn last week. As ECB does not provide detailed data on PEPP we could only assume that under PEPP periphery was also main target. Nevertheless, spreads are widening once again, and we expect them to continue so at least until we see some firm decision from the finance ministers; or until ECB announces it will start to control the yield curves.

Source: ECB, InterCapital

At the current share price, dividend yield is 2.1%. Ex-date is 24 June 2020.

Atlantic Grupa published the convocation to the GSM in which they proposed dividend in the amount of HRK 83.14m to be paid out as dividend to their shareholders. This would translate into a dividend of HRK 25 per share, which would be paid out from the part of retained earnings of the company from the year 2018 as well as from the part of the profit from 2019. Such a dividend per share is 22% lower compared to the one paid in 2019.

At the curret share price, the dividend yield is 2.1%. Note that the ex-date is 24 June 2020, while the payment date is proposed for 15 July 2020. The dividend is subject to approval at the GSM, which will be held on 18 June 2020.

In the graphs below, we are bringing you the company’s historical dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2013 – 2020)

Zavod VZMD proposed a dividend payment of EUR 1.05 per share, compared to initially no dividend payment proposed by the Management Board. Dividend yield is 6.8%.

Earlier today, Sava Re received a counterproposal by the shareholder Zavod VZMD (Pan-Slovenian Shareholders’ Association) regarding the dividend payment in 2020. Zavod VZMD proposed a dividend payment EUR 16.27m or EUR 1.05 per share, compared to initially no dividend payment proposed by the Management Board. The newly proposed dividend translates into a yield of 6.8%.

The proposed ex-date is 19 June 2020. The counterproposal is subject to approval at the GSM which will be held on 16 June 2020.

VZMD stated that they believe that it is appropriate and inevitable that the Company distribute in dividends at least the promised, guaranteed and previously approved dividend or share of the generated distributable profit. As the proposer, they believe that the Company is capable of paying such a dividend to its shareholders without adverse impacts or otherwise compromising its plans.

As a reminder, Sava Re’s strategic plan for 2020 – 2022 states that the company will ensure its shareholders stable growth in dividends (on average by 10% annually) therefore distributing between 35% and 45% of Sava Insurance Group’s profits. Last year, Sava Re paid out a dividend of EUR 0.95 per share which, translated into a yield of 5.6%.

Given the current situation regarding the Covid-19 pandemic and the implications and uncertainties which come with the situation, we do not see the counterproposal being approved on the GSM.

Dividend per Share (EUR) and Dividend Yield (%) (2014 – 2019)

In Q1, the Group recorded a decrease in net banking income of 2.2% YoY and a decrease in net profit of 20%.

In the first 3 months of 2020, BRD Group recorded a strong increase in net interest income by +6.6% YoY to RON 547.3m. Such an increase came on the back of expanding loan volume and favorable structure shifts. Meanwhile, the bank recorded RON 177.1m in net fee and commissions, which represents a decrease of 4% YoY. The decrease could be attributed mainly to the price alignment of EUR denominated payments to domestic ones, following the recently enforced SEPA regulation, and by ceasing of the Western Union activity starting August 2019. Other banking income was impacted by the volatile March context driven by pandemic, which brought a decrease of trading and revaluation results.

As a result, BRD Group’s net banking income reached RON 766.7m in Q1 2020, lower by -2.2% YoY

Operating expenses amounted to RON 425m, which is a decrease of 3.8% YoY. The decrease came from reduced regulatory costs (Deposit Guarantee and Resolution Fund cumulated contribution, RON 43m, recognized in full in Q1 2020, compared to RON 72m in 2019) and good control of sundry expenses. Staff costs increased by +4.4% YoY. As a result, CIR stood at 55.5% (-0.9 p.p. YoY).

The loan book quality o remained solid throughout the period as represented by the further decrease in NPL ratio to 3.3% (-0.7 p.p. YoY). The bank states that they built a high coverage with provisions of NPLs, standing at 73.3% at March 2020 end. Cost of risk stood at RON -60m (compared to RON 26m release in Q1 2019) as a result of the recognition of a provision overlay related to COVID-19 economic context.

In Q1, net profit amounted to RON 241m, representing a decrease of 19.9%. The result was mostly influenced by the above mentioned by cost of risk charge after the recognition of a specific COVID-19 crisis provision overlay.

Turning our attention to the balance sheet, total assets amounted to RON 58.93bn, an increase of 2% YoY. BRD operates with a strong balance sheet, with a capital adequacy ratio of 22.6% after decision to entirely retain the 2019 net profit.

The bank’s net loans, including leasing receivables, increased by +2.4% YoY.

Deposits from customers, founded on a solid retail base, saw strong growth (+4.2% YoY) which was driven by larger inflows in individuals’ savings, with current accounts up by +30% YoY. As a result, L/D ratio stood at 66.7% (-2.3 p.p. YoY).

The rating reflects a low business risk profile of Transelectrica, given the strategic importance of the natural monopoly Company, in the context of a continuous improvement of the regulatory framework.

For the third year in a row, Credit rating agency Moody’s reconfirmed Transelectrica’s Baa1 rating (Corporate Family Rating), with positive outlook.

The rating reflects a low business risk profile of Transelectrica, given the strategic importance of the natural monopoly Company, in the context of a continuous improvement of the regulatory framework.

In addition, the Company’s rating at individual level (Baseline Credit Assessments) has improved, rising from Ba2 to Ba1. The individual rating is the inherent ability of a company to meet financial obligations without government support.

The company notes that the mentioned rating, strengthens a favorable position regarding the its ability to meet its present and future financial obligations, showing that Transelectrica has a solid financial profile, with a low leverage ratio and strong, stable and predictable financial values, in the context of a process characterized by the continuous and consistent application of the regulatory framework’s key principles.