A recent JOLTS report catapulted the core yields to multidecade highs, but then a combination of weak ADP and FED speak managed to put a floor on the rise in yields. Some asset managers are espousing the view that if yields continue to march higher, equities will have to give and the knee-jerk reaction in switching away from equities and into fixed income might strip the momentum out of the potential further rise in yields. Do we make sense of this view at all? Read this in this brief research piece.

It’s been quite a volatile week if you are a fixed-income investor and most of the realized volatility came from US labour market data. It’s no coincidence that the eleven-year high on the German 10-year yield (3.02%) recorded during the October 04th trading session came just a day after the US JOLTS report that managed to beat the consensus by as much as +795k job openings (9.61mm reported versus 8.815mm expected by consensus). The sharpest reaction was reported on ultra-long bonds and HY (BTPS belong to this bracket as well) and just a day after the widow-maker JOLTS report, Bloomberg terminals were full of screens such as this:

This is the price of an Austrian ultra-long bond maturing on September 20th, 2117. Correct, it matures in merely 94 years, so your grandchildren might have the luxury of receiving the principal payment if you had such bad luck to buy it at an all-time high in early 2020. Bloomberg TV pointed out that with ultra-long bonds losing between 50% and 75% of their value since early 2021, the accumulated losses have roughly exceeded losses on equities reported after the dot com bubble. We’re going through an unprecedented period of fixed income volatility and very few people are confident in predicting the turning point. What most of the analysts are certain about is that the turning point in the direction of yields would be underpinned by a change of heart at the inner sanctum of G10 central banks (led of course by the FED) and the message delivered from there is quite the same: our job is not done, we’re going to continue the tightening by keeping the nominal short term rates high(er) (the “higher for longer” narrative). In other words, even if the inflation does come down in late 2023/early 2024, we’re going to keep on tightening through rising real yields. Until something breaks.

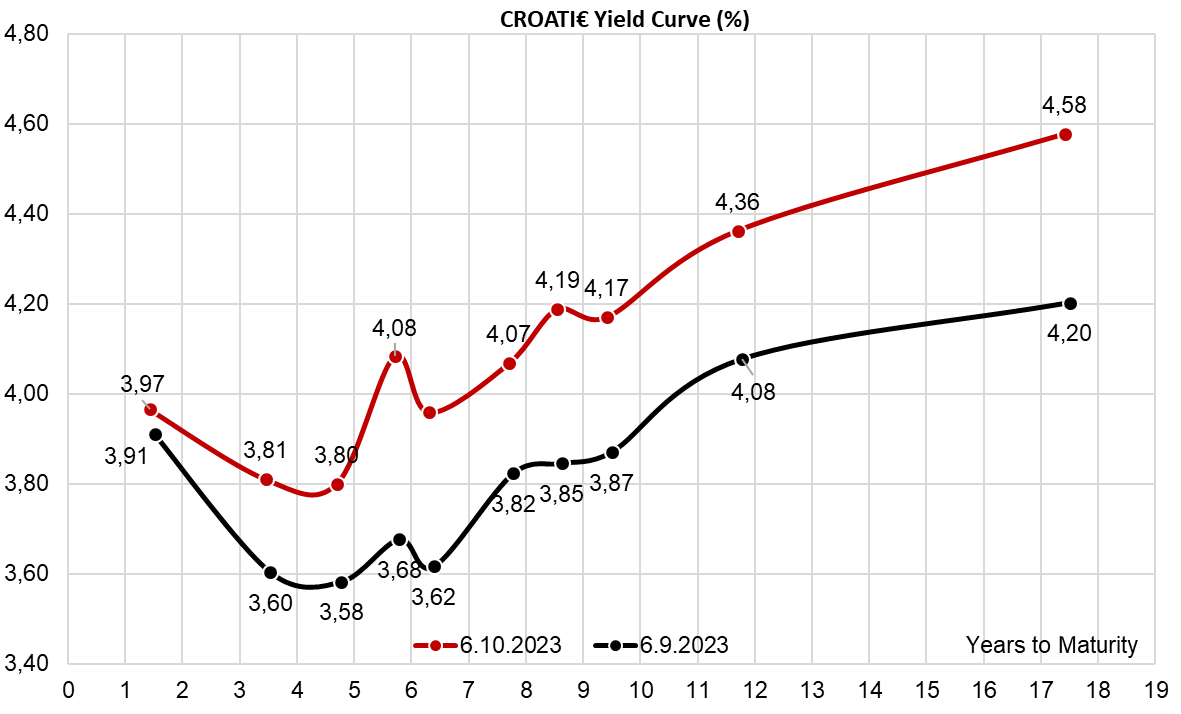

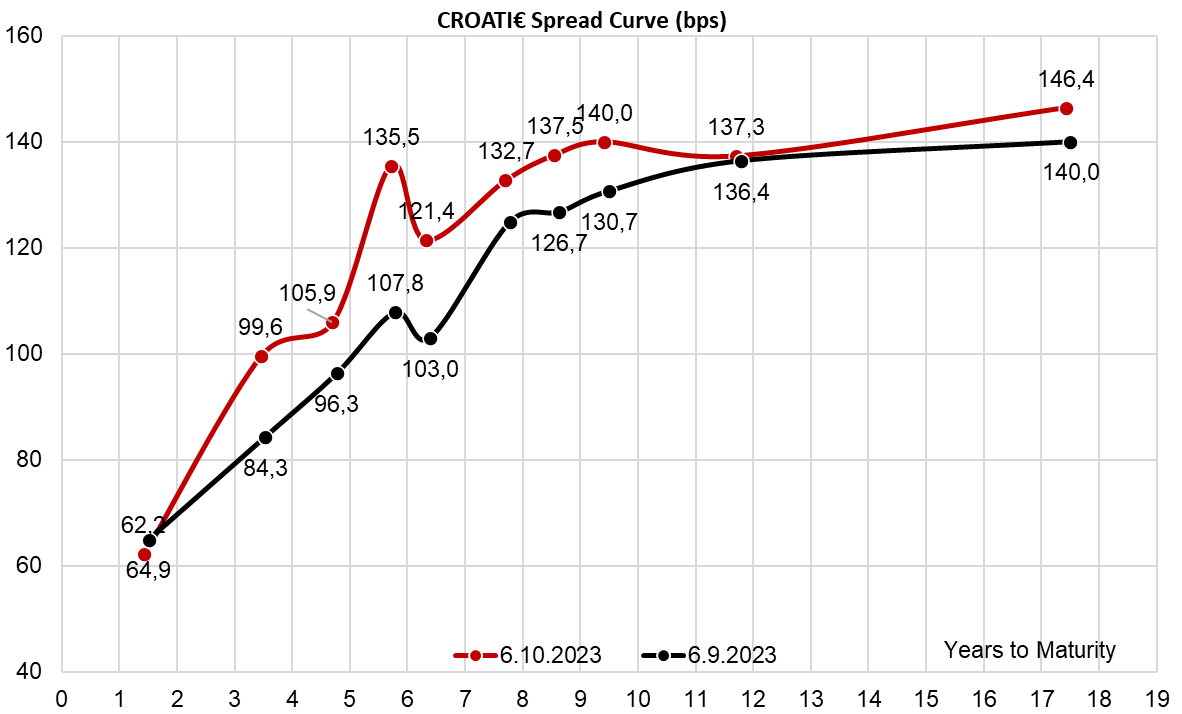

Croatian international bonds gave in to the moves lower in liquid benchmark bonds, nevertheless, the spreads seem to be contained, with some notable exceptions such as relatively illiquid CROATI 1.125 06/19/2029€ (that’s the spike at B+135.5bps you might have noticed on the spread chart submitted below). We have seen mostly buying interest while the German 10Y yield approached 3.00%, but after the round 3.0% mark the buyers got anxious and tried to make sense of the move altogether. After that, we have experienced some buying interest on the short-dated corporate paper, such as RABROM 7 10/12/2027€ placed yesterday (300mm EUR of 4NC3 paper placed by Raiffeisenbank Romania SA at a reoffer price of 100.00 and reoffer yield of 7.00%). The short-term paper priced at 7% is quite tempting for asset managers afraid of duration and the direction of long rates. As one asset manager (correctly) pointed out yesterday: “Once there was a saying that you can’t get fired for buying IBM. Today we say the same for short-term paper. Who can ever get fired for buying IG rated 1Y-4Y paper at 4.0%-7.0%?” We wonder as well.

In September 2023, the total number of tourist arrivals amounted to 2.5m, while the total number of tourist nights amounted to 13.5m. On a YoY basis, this represents growth of 15%, and 4%, respectively. Compared to 2019, September recorded 10% more tourist arrivals, and 6% more tourist nights. Finally, on a YTD basis compared to 2019, the total arrivals are roughly the same, while the total nights are only 1% lower.

The latest report on the performance of Croatian tourism has been released, for the month of September 2023. According to the report, the total number of tourist arrivals amounted to 2.5m, representing an increase of 15% YoY. Of this, foreign tourist arrivals amounted to 2.27m, an increase of 15%, while domestic tourist arrivals amounted to 242.2k, an increase of 14% YoY.

Moving on to tourist nights, it amounted to a total of 13.5m, representing an increase of 4% YoY. Of this number, foreign tourist nights amounted to 12.3m, an increase of 4% YoY, while domestic tourist nights amounted to 1.26m, an increase of 9% YoY. What this could tell us is that despite the fact that both the number of arrivals and tourist nights grew, the average stay per person amounted to 5.37 days, a decline of 9.5% YoY. This continues the trend, as both July and August recorded YoY declines as well, of 4% and 2.9%, respectively.

Total tourist arrivals and tourist nights in Croatia (January 2019 – September 2023)

Source: HTZ, InterCapital Research

Breaking down the tourist nights by the type of accommodation, 85% of the nights were registered in commercial accommodation, 10% in non-commercial, and 5% was registered in nautical accommodation. Inside the commercial accommodation, the largest share is held by private accommodation, which recorded 4.3m, or 38% of the total. Following them there is hotel accommodation at 29%, or 3.4m, and camps, at 25%, or 2.9m. The remaining 8% was recorded in the other types of accommodation. In terms of the performance of the markets from where the tourist nights were recorded, Germany recorded 32% of all tourist nights, followed by Austria at 10%, Croatia at 9%, as well as Slovenia and Poland, both at 7%, respectively.

Meanwhile, looking at best-performing counties, the largest number of tourist nights was recorded in Istra, which recorded 3.95m tourist nights, followed by Splitsko-dalmatinska at 2.69m, Kvarner at 2.27m, Zadarska at 1.7m, and Dubrovačko-neretvanska, at 1.21m. In terms of the YTD performance, by September 2023 9% higher arrivals were recorded, and 3% higher nights than the same period last year.

Meanwhile, compared to 2019, September 2023 recorded 10% higher arrivals and 6% higher nights. Of this, foreign arrivals increased by 8%, while domestic arrivals increased by 32%. On the other hand, foreign nights grew by 8%, while domestic nights decreased by 14%. Finally, on a YTD basis compared to 2019, the total arrivals remained roughly the same, supported by the 16% growth in domestic arrivals, but a 2% decrease in foreign arrivals. On the flipside, total nights decreased by 1%, driven by the 4% decline in domestic nights, while the foreign nights remained roughly the same.

There are several insights that can be made here. Firstly, the growth in September, both as compared to last year and 2019, could be attributed to the fact that the other 2 months, i.e. July and August recorded somewhat lower numbers. Since those 2 months, and especially the end of July/beginning of August, are what’s considered the peak of the seasons, so are the prices highest during those periods. Combined with the overall double-digit accommodation prices we have been witnessing being reported all summer in the media, this isn’t surprising. What is a positive development, however, is that at least some of those missed arrivals and nights were compensated in September, when the weather is still good, and the prices are more affordable. As such, the decline in the beginning and middle of the tourism season was compensated in September. Overall, this would mean that finally, after 4 years, Croatia was able to reach a parity in the number of arrivals and tourist nights.

Yesterday, the World Bank revised Croatia’s GDP forecast for 2023 to 2.7%, an increase of 0.8 p.p. compared to its last forecast in June of 1.9%.

According to the latest report by the World Bank, Croatia is projected to grow at 2.7% YoY, an increase from 1.9% in the last forecast made in June. Furthermore, as mentioned by the Bank: “Croatia’s economy remained on an expansion path in the first half of 2023 supported by robust private consumption and buoyant demand for travel services. Over the forecast horizon, economic growth is expected to stay close to 3 percent as inflation moderates, and the external outlook improves. Steady growth and a declining need for fiscal support are expected to keep the fiscal deficit contained and public debt on a declining path. Poverty in 2023 is expected to decline to 1.3 percent.”

Delving further into the report, Croatia had a GDP per capita (in PPP terms) that reached 73% of the average EU27 level in 2022. This was achieved despite significant headwinds such as high inflation, monetary tightening, and faltering external demand for goods. Due to tourism, Croatia managed to recover the fastest among all the EU member countries. However, continued demand for services in tourism is unlikely to be sustained in the medium to long term, and as such it will be crucial to address key structural issues that will support productivity and long-term growth acceleration. Some of these issues include low levels of R&D investments, low levels of innovation and technology adoption, weaknesses in managerial and organizational practices, administrative capacity, and judicial quality and efficiency. Furthermore, due to unfavorable demographic trends and a tight labour market, improvements in education and labour market policies will be necessary. Lastly, the War in Ukraine, the developments in energy and food commodity prices, as well as the impact of high-interest rates continue to pose risks to the outlook.

In the outlook itself, the World Bank notes that economic activity growth is expected to moderate in H2 2023, as demand for tourism services slows down and goods exports remain suppressed. Nonetheless, due to the relatively strong performance in H1 2023, real GDP growth is set at 2.7% in 2023. Personal consumption is projected to remain robust, as recovery in real incomes continues due to falling inflation and strong labour demand. Furthermore, EU funds are expected to continue supporting investment activity, especially government investments, while private sector investment growth might slow in the near term before strengthening towards the end of the forecast period in 2025, as monetary policy normalizes. Export of goods, which was quite weak in 2023, is expected to pick up in 2024 and 2025 as external demand strengthens. On the other hand, the growth of exports of services might become more moderate after strong results in 2021 – 2023.

Inflation is expected to remain elevated over the near term but could decline towards the ECB target of 2% by the end of 2025, following monetary measures implemented since the end of 2021, unwinding of global supply bottlenecks, and easing of commodity price growth. The fiscal deficit is set to remain contained, as growth continues and the need for fiscal support declines. This, in turn, will allow for further reduction in public debt which is expected to fall below 60% of GDP by YE 2025.

The full report can be accessed here.

World Bank Forecast for Croatia

| wdt_ID | Indicator | 2022 | 2023f | 2024f | 2025f |

|---|---|---|---|---|---|

| 1 | Real GDP growth, at constant market prices | 6,2 | 2,7 | 2,5 | 3,0 |

| 2 | Private consumption | 5,1 | 2,2 | 2,3 | 2,8 |

| 3 | Government consumption | 3,2 | 2,6 | 2,8 | 2,7 |

| 4 | Gross fixed capital investment | 5,8 | 4,7 | 3,1 | 3,5 |

| 5 | Exports, goods and services | 25,4 | -1,0 | 4,2 | 5,0 |

| 6 | Imports, goods and services | 25,0 | -0,9 | 4,2 | 4,5 |

| 7 | Inflation | 10,7 | 8,4 | 3,9 | 2,3 |

Source: World Bank, InterCapital Research