In H1, tourist arrivals increased by 54.9% YoY, reaching 2.6m. Meanwhile, tourist nights noted an increase of 53.2% YoY to 11.9m.

In H1 of 2021 arrivals in Croatia reached 2.6m, noting an increase of 54.9% (or 913k). During the first six months of the 2021 the most tourists arrived from the Germany (22% of foreign arrivals). Slovenian and Austrians follow with 17.6% and 11% of total foreign arrivals.

When observing tourist arrivals, one can note an increase of 53.2% to 11.9m. This indicates that the average stay in H1 stood at 4.6 nights (compared to 4.7 in H1 2020). We note that German tourists accounted for 20.4% of the foreign nights.

In H1 Istria witnessed the most arrivals (27.45%), noting an increase of 78.5% YoY (up by 310.9k). Meanwhile, the region that experienced the highest relative increase in the tourist arrivals was Split-Dalmatia county with more than a 90% YoY increase.

Turning our attention to accommodation types, one can note that camps noted 22.5% of all nights realized, while hotels accounted for 23.11%. In terms of arrivals, hotels noted an increase of 49% YoY, while camps noted an increase of 88.3% YoY.

When observing solely June, one can note an increase in tourist arrivals of 63.7%, to 1.52m. Meanwhile, tourist nights reached 7.94m (+61.56% YoY). Of that, foreign tourists account for 83.3%. We add that the average stay per tourist stood at 5.2 nights.

Where does Croatia’s summer season stand currently?

Looking at the table below we can see how the tourist segment must perform in the following 3 months to reach the numbers of the pre-pandemic year of 2019.

Arrivals & Nights needed to reach 9M 2019 levels (in the next 3 months)

| wdt_ID | 9M 2019 | to reach 2019 arrivals | to reach 2019 nights |

|---|---|---|---|

| 1 | 100% | 16.217.252,00 | 91.034.519,00 |

| 2 | 90% | 14.338.006,00 | 80.744.459,00 |

| 3 | 80% | 12.458.760,00 | 70.454.399,00 |

| 4 | 70% | 10.579.514,00 | 60.164.339,00 |

| 5 | 60% | 8.700.268,00 | 49.874.279,00 |

| 6 | 50% | 6.821.022,00 | 39.584.219,00 |

Source: Croatian National Tourist Board, InterCapital Research

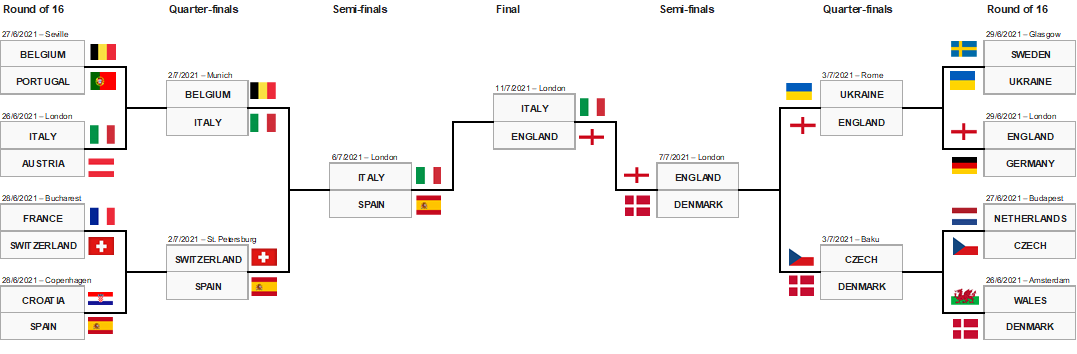

For today we bring you our estimates on who will be successful in the EURO 2020 Semifinals.

After successfully estimating EURO 2020 quarterfinal results, we decided to present you with our predictions for Euro 2020 Semifinals.

Below, you can find our new match predictions. We note that the stated predictions are a consensus of the InterCapital Group’s employees. We are by no means football experts, but there are definitely a couple football enthusiasts among us.

EURO 2020 Knockout Stage – InterCapital Estimates

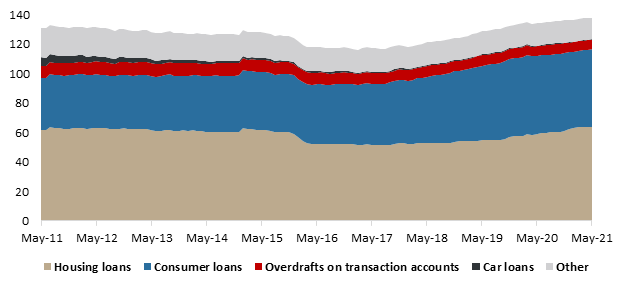

As of end May, total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY.

According to the monthly statistical report as of end May published monthly by Croatian National Bank (HNB), total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY and remain flat on MoM. Such figures do indicate that credit activity, especially certain segments, showed very solid resilience during the pandemic.

Its biggest categories household loans and corporate loans evidenced growth rates of 2.7% YoY and -0.7% YoY. Note that corporate loans have been observing negative trend for the third consecutive month, both on YoY and MoM (-0.7 YoY and -0.46% MoM). It is worth mentioning that in May Government still provided pandemic support measures, while moratorium on many loans were still active. When looking on a YTD basis, corporate loans decreased by 0.4%, while household loans are up by 1.3%.

Corporate and Household Loans Growth Rates (YoY)

Total loans issued to households amounted to HRK 137.93bn, representing an increase of 2.7% YoY (or HRK 3.62bn). Such an increase was mainly driven by a rise in housing loans (+8.7% YoY or HRK 5.15bn). Housing loans growth was partially offset by a lower result of mostly credit card loans (-5.6% YoY) and consumer loans (-0.8% YoY). The mentioned segments account for more than 87% of total household loans.

We also note that car loans continue to observe a negative long-lasting trend (MoM decrease for each consecutive month), first time evidenced in March 2016, and are down by 9.7% YTD.

Loans to Households (HRK bn)