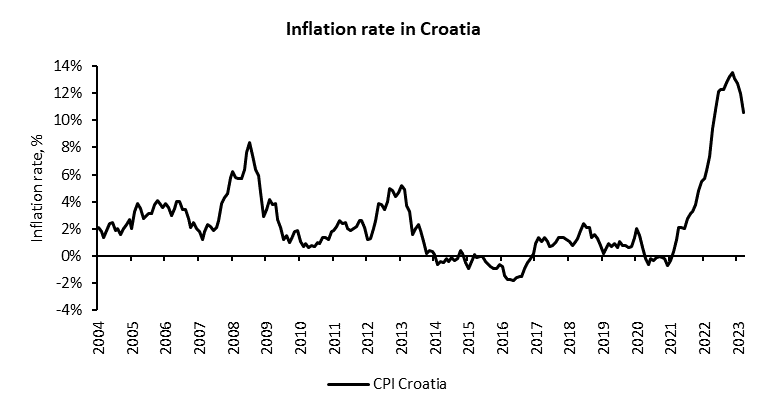

On Friday the 31st of March, the Croatian Bureau of Statistics released inflation data for March. As we expected, the disinflation is continuing as imported inflation scales back after a huge rise last year. Unfortunately, on monthly basis, inflation accelerated to 0.8% in March which is higher compared to January and February. Inflation has certainly peaked, but when we are going to reach a 2% inflation rate is still an ongoing discussion.

Inflation peaked in January at 13.6% and it currently stands at 10.6% YoY as slow annual disinflation is ongoing. Assuming previous inflation rates on a monthly basis remain stable in the following months and if the macroeconomic conditions do not change significantly, lowering the inflation rate on a yearly basis should continue.

Talking about components of the CPI, firstly, food inflation is the most significant contributor to the composite inflation rate. It is currently running at 15.3% YoY and keeps running hot both at home and abroad. Secondly, energy inflation was in the spotlight last year due to the start of the war in Ukraine when oil prices jumped over 100$ per barrel but since then oil prices fell significantly. Namely, energy inflation tumbled from 13.8% in January to 7.5% in March. Thirdly, services inflation is at 8.2% YoY and the impact of monetary policy on it is slow and reduced. Monthly values look much better than yearly values as services inflation dropped significantly since January when it amounted to 1.1% MoM and now it stands at 0.2%.

As it is often implicated that the switch from the local currency to the Euro results in inflation and price spikes, we should consider that the Euro was implemented in Croatia amid the worldwide inflation wave. According to the ECB research from March 7th, Croatia had one of the lowest increases in monthly inflation in February in the Eurozone. Also, their analysis concluded that 65% of products did not change their price after the implementation, 25% decreased in price and only 10% of products increased in price after the implementation of the common currency. Historically, the effect of euro implementation is mild and mostly concentrated in the services sector but is also considered to be a one-time effect. As I previously noted, services inflation was 1.1% MoM in January and 0.2% in March. The higher number in January might be due to the implementation of the Euro, but as noted, the first three months are in line with ECB’s expectations.

I think that the way to 5% inflation should be manifested in the following months. Natural gas and electricity prices plummeted since last year in the wholesale market, which further eased inflation pressures. But the way to 2% might be a bit longer due to the high wage growth in Croatia which amounted to 11.7% in January on yearly basis. That might prolong the return to a 2% inflation rate.

Source: Croatian Bureau of Statistics, InterCapital, ECB

At the share price before the announcement, this would amount to a DY of 6.2%. Ex-date is yet to be announced.

At the Supervisory Board meeting of Krka, held yesterday, 5 April 2023, Krka’s Supervisory and Management Boards made the proposal for the distribution of accumulated profit for 2022. According to the press release, out of the net profit of EUR 408.2m, Krka decided to pay out EUR 204.4m in the form of dividends, while the remaining amount, EUR 203.7m, will be split equally (EUR 101.9m) among other profits reserves, and the amount that will be carried forward to the next year.

This would imply a payout ratio of 50.1%, and a gross dividend of EUR 6.6 DPS, which at the share price before the announcement, would represent a dividend yield of 6.2%. Neither the ex-date nor the payment date was yet announced. The dividend proposal is subject to approval at the GSM, which will be held on 6 July 2023.

Below we provide you with the historical dividends per share and dividend yields of the Company.

Krka dividend per share (EUR) & dividend yield (%) (2009 – 2023)

Source: Krka, InterCapital Research

At the share price before the announcement, the DY amounted to 16.3%. Ex-date is set for 12 April 2023, while the payment date is set for 8 May 2023. Simultaneously, ZABA’s shareholders approved the start of the share buyback program.

Yesterday, ZABA’s General Meeting of Shareholders was held. At the meeting, approval for the distribution of profit and the start of the 2023 share buyback program was given. As was already proposed, ZABA will distribute EUR 0.74 per share from the 2022 net profit of the Bank, implying a payout ratio of 100%. This would imply a DY of 7.14%. Simultaneously, ZABA will pay out EUR 0.95 per share from the retained earnings, implying a DY of 9.13%. This would mean that out of the retained earnings of EUR 824.2m, EUR 304.2m will be paid out, implying a payout ratio of 36.9%.

Together, these dividend payments imply a DY of 16.3% before their announcement, which would also be one of the highest dividend yields in Croatia currently available. The ex-date is set for 12 April 2023, while the payment date is set for 8 May 2023.

ZABA dividends per share (EUR) & dividend yield (2012 – 2023)

Source: ZABA, InterCapital Research

Meanwhile, the GSM also approved the start of ZABA’s share buyback program. According to the program, they will buy a maximum of 120k shares on the market, with several of the expected conditions applied. These conditions include that the share price cannot be 10% higher/lower than the average market price on the day before the transaction, as well as that the shares can either be bought directly on the exchange, or through block trades. Lastly, the maximum amount that can be utilized for the share buyback is EUR 1.3m. The new share buyback program runs until 31 December 2023.