Over the past month, Emmanuel Macron called for snap parliamentary elections after terrible results of his party elections for the European parliament. The sudden move of the French president propped up the German 10-year bonds with most of the periphery bonds not adjusting their price leading to the widening of the spreads at first.

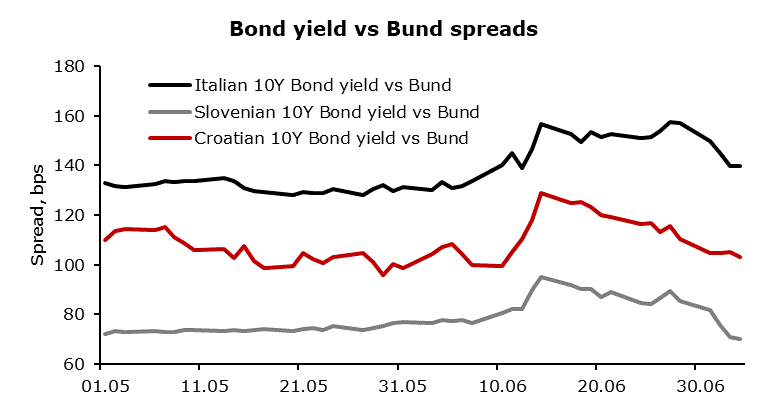

Following the results of elections for the European parliament, the French president called for parliamentary elections as Rassemblement National won more than 30% of the vote. However, left and far-left parties also managed to gain a significant part of the vote. Consequently, financial markets went through a risk-off session with the German 10-year bond (Bund) price skyrocketing over the week after calling for parliamentary elections and periphery and French bond prices not following through, thus spreads have widened significantly. French spread widened significantly at first, followed by the widening of Croatian, Slovenian, and Italian spreads to Bund as well. After the first round of parliamentary elections had taken place, the spread swiftly tightened to levels seen at the start of June with Bund yield rapidly rising and periphery bond yields rising slowly. Such rapid widening and compression of the spread have been a great trading opportunity as the Bund yield has risen since January back to 2.5%. The uptrend of the Bund yield is certainly not over as the economic situation and monetary policy in the Eurozone and across the Atlantic do not show signs of significant economic slowdown.

The spread of Slovenian 10-year mid-bond yield versus Bund yield has widened from 74.5bps to 93bps in a period from 7th June to 14th June. Over the same period, the Croatian 10-year mid-bond yield surged from 96bps to 129bps, and the Italian spread widened from 131bps to 157bps. Since 7th June, spreads have made a roundtrip, with Slovenian spread lying at the high 60’s, Croatian spread getting back below 100 and Italian spread still at 140, however rapidly compressing back to the low 130’s. The roundtrip is a result of an initial risk-off with Rassemblement National stating that the party is not interested in a significant rise in budget deficit as it was initially thought. Also, the anti-nationalist front has been created as centrist and left-wing candidates decided to unite and try to defeat the Marine Le Pen’s Rassemblement National. Trading of the European government bond spreads tightening versus the Bund after the roundtrip is a great time to take profits or at least terminate short Bund trades as election results can deliver chaos to the financial markets over the weekend. On Monday (8th July) after the election’s second round, spreads should not tighten further swiftly and spread trades might be better to be placed then or later after the results of the elections are going to be published. However, the risk of renewed significant widening is here to stay especially as the roundtrip has been made with a risk/reward ratio being poor as the spreads might explode once again after the election results.

In conclusion, the recent European parliamentary election results and subsequent French snap elections have significantly impacted bond spreads across the Eurozone. Initial risk-off sentiment led to widened spreads, particularly in French, Slovenian, Croatian, and Italian bonds compared to the Bund. However, the spreads have since compressed, presenting a trading opportunity. The upcoming elections carry the risk of renewed spread widening, suggesting that investors should consider taking profits or closing short Bund trades now. Careful monitoring of post-election developments is crucial, as the market remains volatile with a poor risk/reward ratio for further spread tightening.

Source: Bloomberg, InterCapital

Today is the ex-dividend date for Adris grupa’s regular (ADRS) and preferred (ADRS2) shares. Typically, on the ex-dividend date, share prices tend to decrease by approximately the amount of the dividend yield. For Adris grupa, the dividend yield is 3.1% for regular shares and 4.2% for preferred shares. Consequently, we should expect a similar decrease in the share prices. The dividend payment date is set for 24 July 2024.

This refers to the previously approved dividend of EUR 2.57, both for regular and preferred shares. Of this, EUR 2.28 will be paid from retained earnings from the 2005 – 2011 period, while the remaining EUR 0.29 will be paid from retained earnings from 2012 onwards. Based on the share price before the announcement, this would imply a DY of 3.1% for the regular, and 4.2% for the preferred shares.

Due to this, we expect today’s share prices to decrease in value for both share types. This is because the dividend payment incentive disappears on the ex-dividend date, leading to reduced incentives & a share price decline equivalent to the DY. This means we expect the regular share price (ADRS) to fall by around 3.1% and the preferred share price (ADRS2) to decline by approximately 4.2%.

Among other things such as the macroeconomic and geopolitical environment, as well as the performance of the company in question or the sector in general, this is one of the main indicators of the attractiveness of a given stock. To put things into perspective, on a YTD basis, the regular price grew by 1.3%, while the preferred share increased by 9.5%. Below, we present a historical overview of the company’s dividend per share and dividend yield:

Adris grupa dividend per share (EUR, left) and dividend yield (%, right) (2013 – 2024)

Source: Adris grupa, InterCapital Research