NAV of Croatian UCITS funds reached HRK 20.7bn, indicating a 2.4% MoM increase.

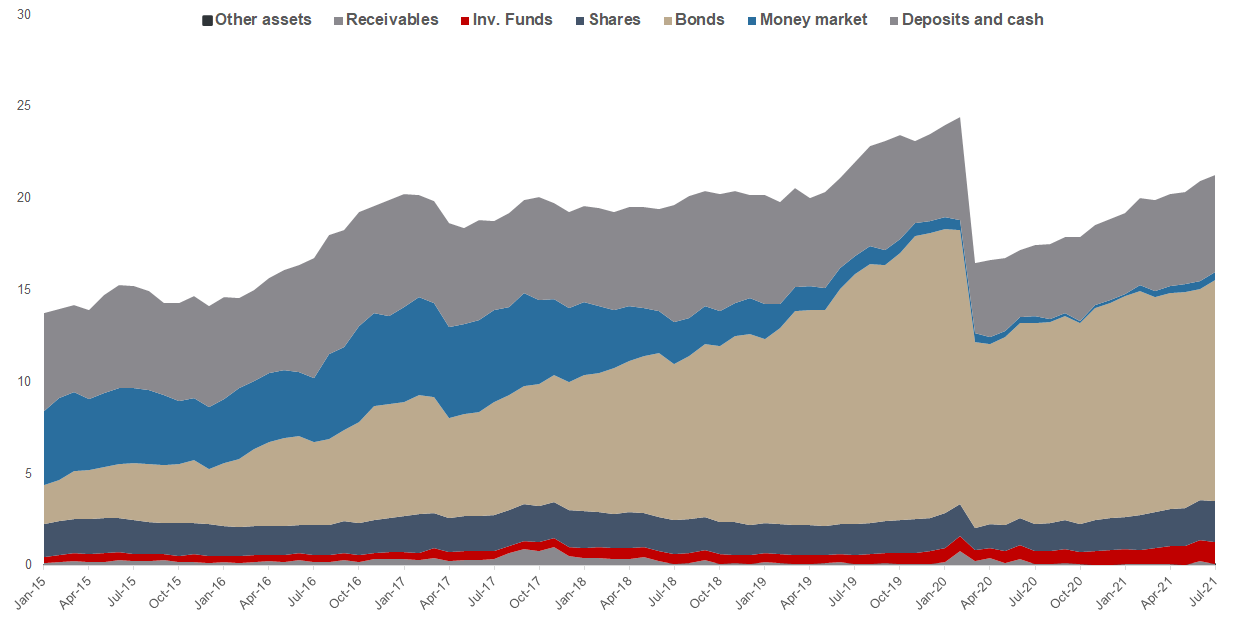

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing in 2021. As visible from the graph below, NAV of all funds has witnessed a steady increase for 16th consecutive month, and as of end July stood at HRK 20.73bn (+2.4% MoM). This represents an increase of 13.8% YTD, but still a decrease of 10.2% compared to the pre-pandemic highs (Feb 2020). On a positive note, this represents the 9th consecutive month of positive net contributions to funds. Meanwhile, in July net contributions amounted to HRK 384.4m. Of that 62% comes from bond funds, while only 7% comes from equity funds.

On a YTD basis, the biggest absolute increase of AUM was observed in deposits and cash by HRK 808m (+18%). Shares follow with an increase by as much as HRK 501.98m (+29%). On a MoM basis, bonds have observed the highest absolute increases by HRK 584m (+5%). Looking at the asset composition of Croatian UCITS funds, shares have noted a slight increase in total AUM by 1.3 p.p. YTD and currently account for 10.6% of the total AUM. This is still below the 10y average of 11.7%. We also note that domestic shares account for 26.3% of total equity holdings. Domestic equity has so far in 2021 seen a 16% YTD increase, while foreign equities have observed a 34% YTD increase.

Bond holdings continue to be the largest asset class of Croatian UCITS funds accounting for 56.6% of the total AUM. This does represent a decrease by as much as 5.6 p.p. YTD. We note that the shift in structure comes from the increase of other asset classes like shares, investments funds, deposits and cash. Total assets increased together for HRK 2.4bn YTD while bonds increased by 2.5% on YTD basis with its assets amounting to HRK 12bn.

Total Assets of All Croatian UCITS Funds (2015 – July 2021) (HRK bn)

Source: HANFA, InterCapital Research

According to the latest announcement from the Tax Administration of the Republic of Croatia the value of last week’s taxable invoices (23rd Aug – 29th Aug) increased by 41.5% YoY. Compared to the same period in 2019 the value of taxable invoices increased by 14.2%.

The weekly data issued by the Croatian Tax Administration, a department of the Ministry of Finance, stated that the total value of taxable invoices issued last week is up by 41.5% YoY (or HRK 1.6bn), reaching HRK 5.6bn. Compared to the same period in 2019 the value of taxable invoices is up by HRK 694m or 14.2% leading up to HRK 5.6bn.

Increase in taxable invoices in wholesale and retail trade in the same period was at 25.4% (or HRK 645m) which amounted to HRK 3.2bn. Compared to the same week in 2019, value of invoices is up by 12.6% (or HRK 357m).

Meanwhile, the value of taxable invoices from accommodation and food services activities increased by 101.5% YoY (HRK 680m) to 1.3bn. The reasons behind such a significant raise could arguably seen in a low base effect (travel restrictions and epidemiological measures which were in place in Croatia last year) as well as Croatia being one of the safer countries to travel to this summer as per European Centre for Disease Prevention and Control. Comparing the same period in 2019 the value of invoices increased by 20.5% (or HRK 229m).

We note that the accommodation and food services activities in Croatia are flourishing (on a YoY basis) as a result of more favorable epidemiological situation compared to other popular holiday destinations and because of more lenient travel restrictions.