For today, we decided to present you with an updated asset structure analysis of Croatian Mandatory Pension funds.

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. Therefore, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation. As the global financial markets, as well as the Croatian capital market, observed a partial rebound in April and the following months, it is worth seeing how Croatian mandatory pension funds performed during that period.

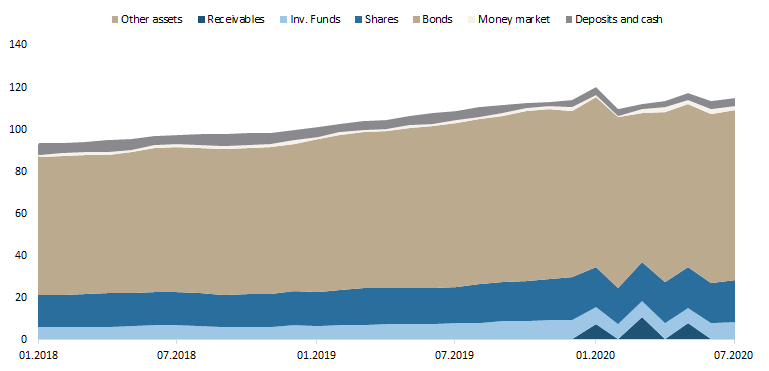

NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end August stood at HRK 114.84bn (+1.5% MoM or HRK 1.65bn). This also represents an increase of 2% YTD. As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn.

It is also worth adding that in August net contribution payments amounted to HRK 609.3m, which is by HRK 106.9m lower compared to the previous month. As a reminder, in July we observed higher net contribution payments due to later payments regarding the grants to preserve jobs given during the lockdown (March & April). Meanwhile, net contribution payments since the beginning of 2020 amount to HRK 4.4bn.

Asset Structure of Croatian Mandatory Pension Funds (August 2020)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Bonds account for the vast majority of total assets (70.2%) which as of August amounted to HRK 80.85bn (increase of HRK 524.48m MoM). Shares come next, with 17.4% or HRK 20.05bn. Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 57.5% (or HRK 11.52bn) of their equity holdings allocated in domestic shares. Note that since the beginning of the pandemic, August represents the first-time that the shares are up on a YTD basis (+1%). Deposits and cash which account for only 3.4% of total assets, observed a 5.8% decrease MoM (or HRK 239.2m).

Total Assets of Croatian Mandatory Pension Funds (2018 – August 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Compared to July 2019, the drop is industrial turnover has amounted to 10.9% YoY, caused by introduction of pandemic measures, and decrease in demand and industrial activity since March 2020.

On Monday Croatian Bureau of Statistics has published the newest statistics for industrial turnover index in July 2020. According to the publication, the total seasonally and working day adjusted industrial turnover increased by 0.7%, as compared to the previous month. Compared to July last year the drop is industrial turnover has amounted to 10.9% YoY, caused by introduction of pandemic measures, and decrease in demand and industrial activity since March 2020 when negative turnover was first evidenced (-6.6% YoY). On yearly basis, the industrial turnover decreased by 8.2% YoY in 7M of 2020 out of which the domestic market went down by 5.6%, while foreign market down by 11.7% in the same period. Breakdown on product types shows that turnover of Energy recorded the biggest decrease in 7-month period (-17.6%), followed by durable consumer goods (-17.4%) and non-durable consumer goods (-9.4%).

The Croatian industrial sector index CROBEXindustrija has noted a significant improvement since its low (19 March) after which the index increased by as much as 57%. Meanwhile, the index is flat on a YTD basis closing yesterday at 878.54 points. Meanwhile on a YTD basis, its constituents show mixed share price performance. Petrokemija leads the list of gainers with +31.8%. On the flip side, 4 companies observed double-digit decreases Varteks (-46.6%) and AD Plastik (-30.9%) leading the losers.

YTD Performance of CROBEXindu

YTD Performance of CROBEXindu constituents