Although she’s taken office merely five months ago, Christine Lagarde has done a fabulous job in steering European financial markets through one of the most troubling periods in history. Today she will make one more appearance before the press to clarify the stance of the ECB regarding the deteriorating economic conditions and lack of consensus among European governments in relation to fiscal support. What can we expect from today’s ECB? Find out in this brief article.

Yesterday’s FOMC went by in line with expectations regarding FED fund target range and guidance on asset purchase and rates. Nevertheless, something was a bit different yesterday: Chairman Powell shifted focus on the medium term risks the coronavirus poses on the US economy (medium term is equal to the next twelve months). Nevertheless, the Committee is now patient and will not use additional ammunition to fight the economic slowdown unless the economic situation starts to deteriorate all over again. It’s also worth mentioning that as the worst is behind us, the FED gradually moves away from traditional asset purchase towards a more targeted approach including an alphabet soup of acronyms: CPPF (Comercial Paper Funding Facility), MLF (Municipal Lending Facility), MMMFLF (Money Market Mutual Fund Liquidity Facility), MSLP (Main Street Lending Program), PMCCF (Primary Market Corporate Credit Facility), SMCCF (Secondary Market Corporate Credit Facility) to name a few.

The focus of investors today during the European session will clearly be on ECB Governing Council meeting – as usual, the rate decision will be delivered at 13.45 CET, followed by a more interesting Q&A at 14.30 CET.

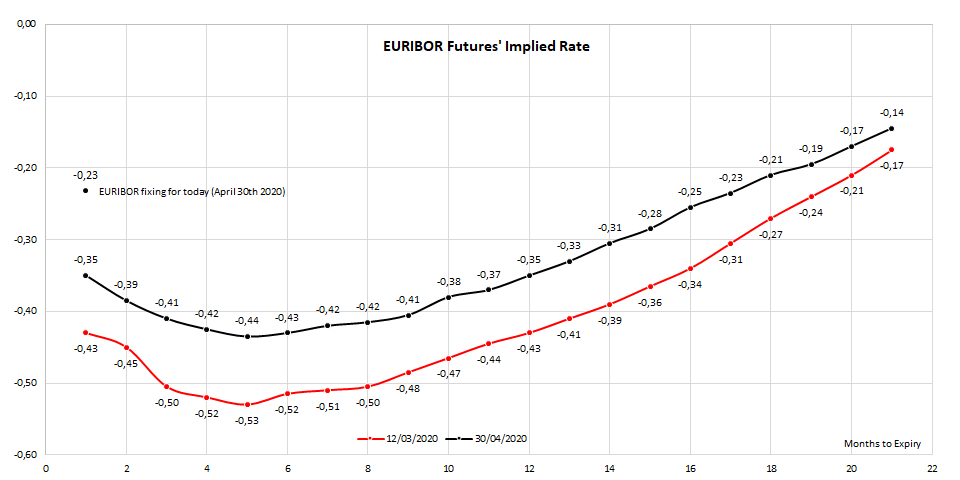

As an ouverture to today’s ECB GC, take a look at the chart submitted above. There is a considerable spread between EURIBOR fixing and the rate implied by the front month futures contract. Notice that the latest EURIBOR fixing stands at -0.232%, while the May futures contract implies a -0.35% rate. Since mid-March EURIBOR rate went much higher as European corporates went to the market to get necessary funding (this claim can be substantiated by the most recent Bank Lending Survey); this move was followed by sovereigns on the bond market a couple of weeks later, adding pressures to the funding costs to go up.

The most recent ECB communication has been highly critical of the inability of European ministers to reach a deal for supranational funding in order to bridge the galloping recession (Mme Lagarde’s exact words were that they did “too little, too late”). Also, ECB reminded of the severity of economic fallout in the block should fiscal support remain weak. In other words, Frankfurt might be putting pressure on the fiscal side to act sooner, than later. Additionally, these messages could also be interpreted in a way that Frankfurt might be ready to pick up the slack if Bruxelles fails to do it.

This is the reason why front month futures are implying a much lower EURIBOR than it is now. Asset managers are hedging themselves against the possible rate cut today (the ERK0 Comdty on BBG contract expires on May 18th, i.e. two days before the following ECB GC meeting). Here’s one more interesting fact: five days ago, front month futures contract was implying a -0.16% EURIBOR rate, while as of this morning this implied rate went all the way down to -0.35%. At the same time the Bund yield went in the same direction, half the magnitude: from -0.40% to about -0.50%. It’s quite likely that high expectations from Mme Lagarde are keeping the rate expectations low and if GC fails to deliver something today, the rates might go higher, pulling long term yields in the same direction.

Is ECB really set do deliver more support today? Well, quite unlikely. This doesn’t mean that ECB wouldn’t deliver more support in the coming months because at this pace the PEPP might run out of space by late summer/early autumn. It’s rather about the timing: ECB already did whatever it took to prevent the periphery spreads from blowing up, while EU ministers are still at the same table trying to hammer out a deal that would satisfy both core and periphery countries’ leaders. Therefor, it’s too early to act right now.

Croatian shipping company Tankerska Next Generation published their Q1 2020 results, showing a 5% YoY top line decrease. Meanwhile EBITDA increased by 60% YoY, while net profit soared to HRK 16.9m (+607% YoY).

TNG published their Q1 2020 results yesterday, showing a 5.3% YoY decrease in sales. Lower sales came as a result of lower exposure to the spot market, where the ship-owner achieves nominally higher revenue, but at the same time has increased voyage-related costs.

The average daily TCE of the fleet during the first quarter was recorded at USD 16,565, representing a 20.3% YoY increase. Meanwhile fleet utilization amounted to 99.8%.

EBITDA amounted to HRK 36.6m, representing a 60.1% YoY increase as TNG’s commissions and voyage associated costs amounted to HRK 7.8m, 68.4% lower than in Q1 2019. The decrease was due to the fleet’s less exposure to the spot market.

Below the operating line, TNG’s net financial loss amounted to HRK -6.3m, representing a 19.2% YoY improvement. Finally, net profit amounted to HRK 16.9m, representing an increase of 607% YoY.

Turning our attention to the balance sheet, TNG was able to decrease their net debt by 8.9% since the beginning of the year with net debt amounting to HRK 551.5m. This translates to 4.1x net debt/EBITDA. According to the Management, the decrease in debt is in accordance with the loan repayment plans of TNG and regular decrease in indebtedness, while a further decrease in the company’s debt is expected in the future.

The management provided a calculation of NAV per share, putting it at USD 10.54 (cca HRK 73.5). This would indicate that TNG is currently traded 25.1% below the NAV of their vessels. However, they highlighted that the assessment was based on current market conditions (revenue and cost assumptions of typical average product tanker) which show strong fluctuations and do not take into account TNG specifics and management expectations.

TNG’s Key Financials

In Q1, Končar recorded an increase in sales of 7%, increase in EBITDA of 23.5% and a net loss to majority of HRK -7m.

In Q1 Končar recorded an increase in sales of 7% YoY, amounting to 604.2m. Of that, the domestic market generated HRK 222.7m, representing an increase of 23%. In Q1 sales of products and services to companies within HEP amounted to HRK 82.3m, which is an increase by HRK 16.5m.

On the foreign market, the company generated HRK 381.8m in sales, remaining relatively flat.

When observing exports by individual market, the most significant export was realized on the German market, amounting to HRK 41.8m or 11% of total exports. Next come Sweden amounting to HRK 38m or 10%, Guinea HRK 32m or 8.4%, Austria HRK 30.3m or 7.9%. Compared to the same period of the previous year, a significant increase in sales in export occurred is in the following markets: Guinea (HRK +31.5m), USA (HRK +18.4m), Iraq (HRK +14.2m) and Slovenia (HRK +10.9m).

In Q1, the Končar Group companies contracted new business in the amount of HRK 676.1m. Of the total contracted amount, 29.2% was contracted for domestic market and 70.8% relates to export contracts. Backlog on 31 March 2020 amounted to HRK 3.4bn, which is an increase of 2.2% YoY.

Operating expenses amounted to HRK 614m, representing a slight decrease of 1% YoY. As a result of the above mentioned, EBITDA observed an increase of 23.5% YoY, amounting to HRK 34.7. Such a result puts the EBITDA margin at 5.6%.

Going further down the P&L, Končar recorded a net financial result of HRK 9.48m (HRK +7m), which mostly came on the back of FX gains.

In Q1, the company’s bottom line was affected by the realized loss in the associate of HRK 13.6m According to Končar’s estimates by the end of the year, the associate should end the year with a positive result as planned. Therefore, in Q1, Končar recorded a net profit of HRK 0.54m (-89%). When looking at the net profit to majority, the company recorded a loss of HRK -7m.

Regarding the current Covid-19 sitaution the company adds that the possible negative impact on the Group’s operations depends primarily on the length of the extraordinary measures in Croatia as well as in the world, since the Group’s market activity is exposed to worldwide disruptions in the supply chain and the delivery of products.

In Q1, Optima Recorded a decrease in sales of 17.9%, an increase in EBITDA of 4% and a net loss of HRK 4.1m.

In the first quarter of 2020, Optima Telekom recorded a decrease in sales of 17.9% YoY amounting to HRK 111.56m. Total revenues from telecommunication business in the Q1 2020 recorded a decrease of 18.6% YoY. Such decrease came mostly on the back of lower revenue from interconnection business activities of 66.8%, as a result of the reduction of business activities in the area of international voice services transit (75.8%). This decrease in transit revenue is proportionally followed by transit costs decrease, and therefore an impact on EBITDA margin was negligible.

The revenue from public voice service recorded a decrease of 12.0%, which has been a global trend for a longer period of time. In Q1, revenue from the internet recorded a decrease of 5.3%, mostly as a result of an increased demand for mobile network internet. Negative impacts of the above mentioned segments of revenue from telecommunications business are partly compensated with an increase in multimedia revenue of 9.8% (in the focus of Company business activities), as well as an increase in data revenue of 3.2%, as a result of selling new data services and stopping a significant outflow of data services.

In the first quarter of 2020, Optima reported EBITDA (before one time items after lease) of HRK 29.3m, representing an increase of 4% YoY. The increase could mainly be explained by improved business operations cost effectiveness. Such result puts the EBITDA margin at 26.1% (+6.1 p.p. YoY). Meanwhile, an increase in depreciation and amortization by HRK 2.1m lead to an operating profit decrease of 22.5% to HRK 5.6m.

Going further down the P&L, in Q1 Optima witnessed a further decrease of their net financial result which stood at HRK -9.56m (by HRK -2.45m) mostly on the back of FX losses (HRK -6m). This consequently led to a net loss of HRK 4.1m compared to a net loss of HRK -0.55m in Q1 2019.