If You missed yesterday’s FOMC press conference because You were at the pub watching the Chelsea-Dinamo match, then good news – we have compiled a research piece tracking all the highlights. The football match started as if Dinamo was going to turn a corner and record a victory against Chelsea, similar to FOMC’s statement looking as if a dovish turn (i.e. FED pivot) might actually take place. However, as time moved on it became clear that Chelsea was not going to let Dinamo get away with one early goal, eventually evening out the result at 1:1. Same with the FOMC press conference – it basically offset the initial dovish tilt stemming from the statement published earlier, strengthening the core message that the struggle to get inflation figures down is still underway.

Financial markets entered yesterday’s FOMC press conference with a significant dovish bias, although there was almost no hard data evidence to substantiate expectations of a FED pivot any time soon. Core inflation was not easing, economic activity was not slowing down, unemployment was not increasing and wage dynamics were still upbeat. Fintweets and dealer chat rooms were full of charts depicting deteriorating US government securities liquidity, such as this one:

GVLQUSD Index measures average yield error across the universe of US Treasury notes and bonds with a remaining maturity 1-year or greater. In this context 3.5bps is the highest level in about 12 years, excluding the pandemic-induced illiquidity of March 2020 (a clear outlier). However, FOMC Chairman Jerome Powell seemed unintimidated by declining liquidity in the US Treasury market and instead focused on what really falls within the limits of the FED’s dual mandate: consumer prices and unemployment. He almost ritually acknowledged the resilience of the US labor market and stated that the resilient wage growth might be one of the reasons why he seriously doubts the FED’s job is over. He also reiterated the notion that in these circumstances it’s better to overtighten and then provide relief to the overall economy by using the instruments inaugurated during the pandemic, instead of being too cautious and letting inflation expectations de-anchor.

Once FED’s Powell said that the main question on the table is not when will the interest rate plateau come, but rather how high will it be and how long will it last. Notice that when we talk about the end of monetary tightening, we’re no longer talking about the peak, but rather about a plateau – implying that higher interest rates might stay with us for a while. Critics of the FED have already pointed out that the FOMC is behind the curve since the median dot tends to follow the core PCE YoY; currently, core PCI YoY is at +5.1% YoY, while the median dot is at +4.4%. Nevertheless, if the PCE stays above +5.0%, you can bet the median dot moving closer to +5.0%. Actually, markets have already figured it out and currently price the beginning of the plateau in May at 5.138%:

We believe the FED fund plateau instead of the FED fund pivot is the main takeaway from yesterday’s FOMC press conference. To substantiate this, compare the upper (November 03rd) WIRP US snip with the snip taken just six days before (October 27th):

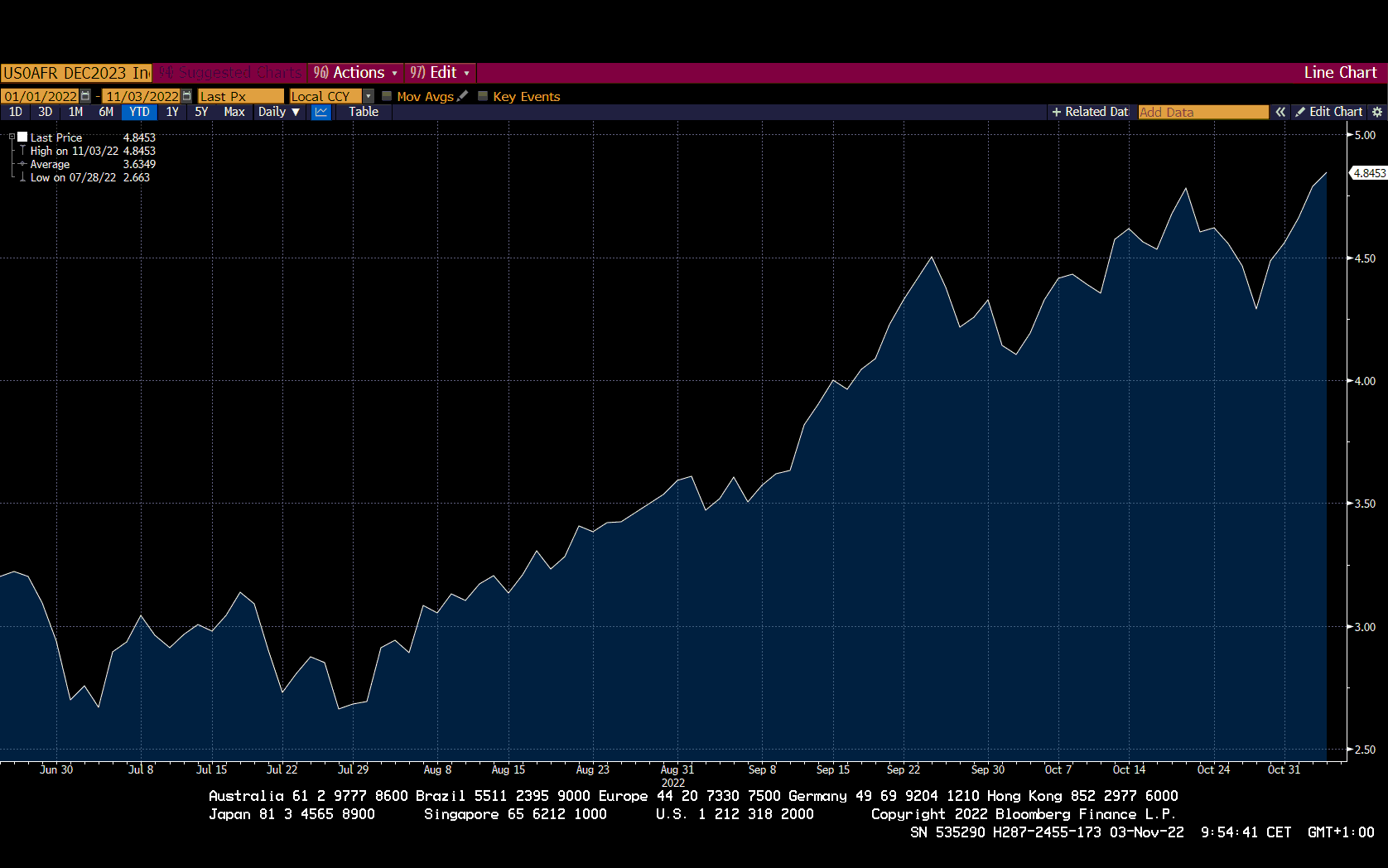

Now compare the expectations for December 2023 meeting: these have gone from 4.29% to the current value of 4.83%. Actually, you can see the whole time series by typing US0AFR DEC2023 Index in Your Bloomberg terminal, but if You’re too lazy to do it, we’ll do it for You:

This is actually the underlying reason why bond markets fell apart yesterday, taking with them global equities and causing depreciation of all the majors against the greenback. Three large dealers sent us their morning notes arguing for USD long positions, however, we remain slightly skeptical since it’s clear that the FED plateau is already baked into the prices of currencies and bonds.

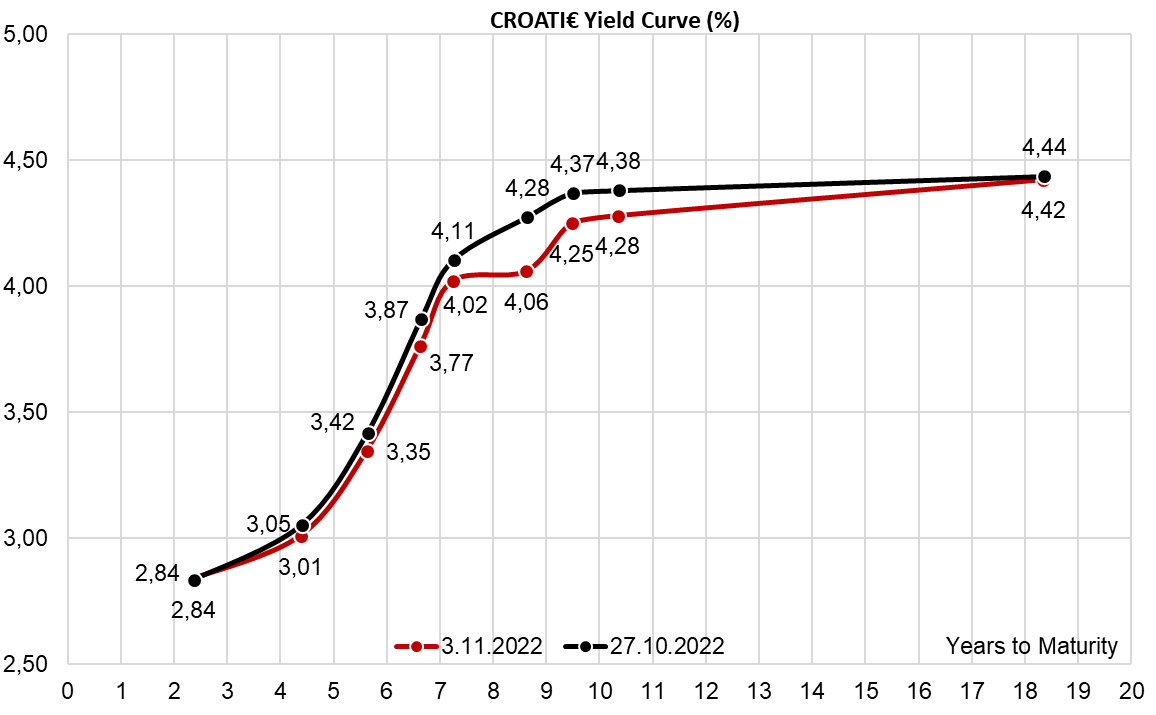

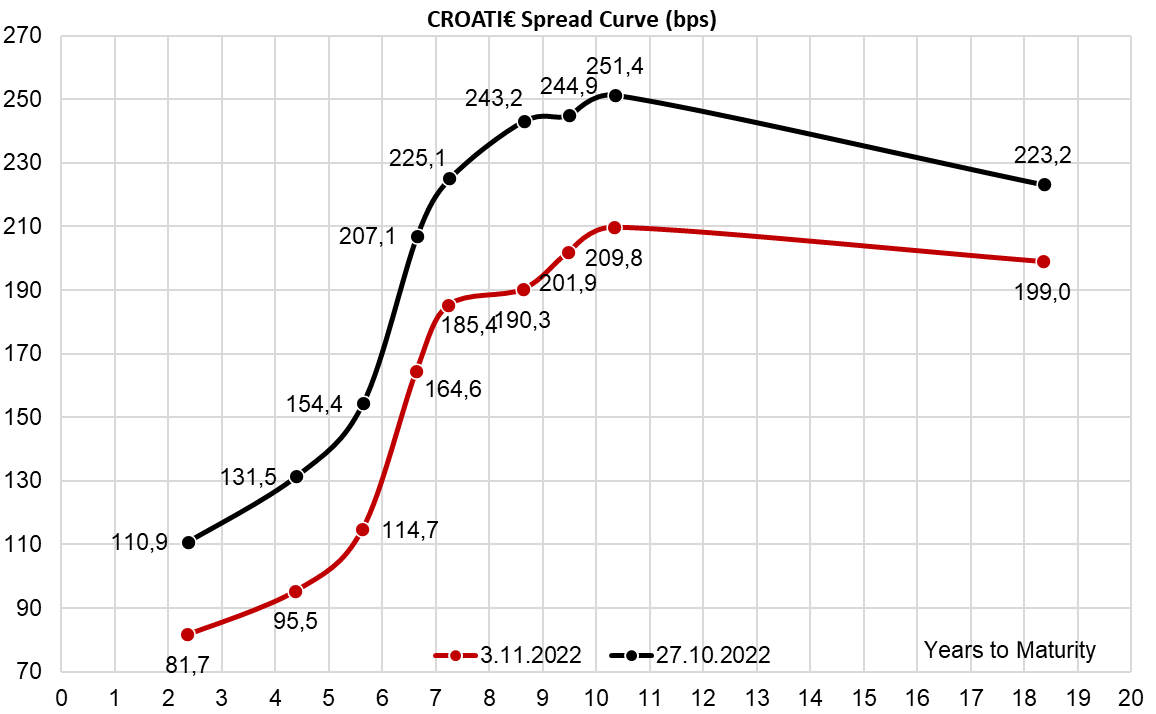

How are Croatian bonds going through this change of heart? The spreads were contained at first and this morning staged another bout of tightening. This morning bigger sizes of CROATI 2.875 03/04/2032€ could be bought around 89.60 (4.23% YTM, B+200bps), signaling that CROATI€ is still well supported by real money bids, both domestic and offshore.

Yesterday, Petrol announced that it completed the legal merger of Crodux derivati dva d.o.o. into Petrol d.o.o., Zagreb two months ahead of schedule.

This marks the successful completion of one of Petrol Group’s major business mergers in its almost 80-year-long history. Through this, Petrol has become the 2nd largest provider of petroleum products in Croatia and one of the largest Croatian companies, consolidating its position as an integrated energy solutions provider. By doing so, the Petrol Group is consolidating its strategic position in SEE markets.

The merger of Crodux derivati dva d.o.o. into Petrol d.o.o., Zagreb was entered into the Croatian Register of Companies on 2 November 2022. As a result, Crodux derivati dva d.o.o. was dissolved and its entire operations, including assets and liabilities, were transferred to Petrol d.o.o. Zagreb.

Nada Drobne Popović, President of the Management Board of Petrol d.d., Ljubljana, commented on the occasion, saying: “A year of intensive activities connected to the integration, cooperation and creation of synergies in merging two companies into one, the merger of Crodux derivati dva d.o.o. into Petrol d.o.o. Zagreb – is behind us. This is one of the Petrol Group’s major mergers in the last ten years. Together, we are now stronger, larger and more effective in pursuing our goal, which is to offer the best customer experience. By purchasing petroleum products and merchandise as one entity and having two strong brands, we have become an even stronger player in the field of petroleum product sales in Croatia where we have also boosted sales of supplementary assortment (gastro, merchandise, services…), increased the value of the loyalty programme for all customers, and enhanced sales of energy solutions. Together, we are also upgrading the wholesale network. In line with the Petrol Group’s strategy for 2021–2025, we will expand the portfolio of customers in the fields of energy commodities and energy transition services via our sales network in Croatia, and invest in the renewable electricity generation,”.

The contract on the acquisition of the 100% business share in Crodux derivati dva, d.o.o. was signed on 12 January 2021 and the transaction closing took place on 6 October 2021. This was followed by the integration of operations into the Petrol Group. As the last step of integration, the merger was scheduled to be executed by the end of 2022; however, all related procedures and tasks were successfully completed two months before the scheduled deadline.

By acquiring Crodux derivati dva d.o.o., the Petrol group has gained 93 additional service stations. With a total of 202 points of sale, the Petrol Group’s market share in Croatia has increased from 13 to 23%. In 2021, both companies together sold 887k tons of petroleum products.

Petrol d.o.o. Zagreb has around 2,200 employees who, after the merger of the two companies into one, together pursue the Petrol Group’s vision to become an integrated partner in the energy transition. The planning and execution of integration involved all business segments: sales, purchasing, IT, marketing and communications, logistics, HRM, legal affairs, investments and maintenance, and finance. Each business function was represented by an integrated working group comprised of representatives from all three companies, and the integration project group together included more than 100 persons.

In the last five years, Petrol Group invested EUR 276.7m in Croatia. The Petrol Group also runs renewable electricity generation in Croatia. The Glunča and Ljubač Wind Power Plants produce enough electricity to supply 45k average households. Moreover, the Petrol Group is building three solar power plants, Suknovci, Vrbnik and Pliskovo with a total installed capacity of 22 MW and an expected electricity output of 29 GWh in 2021, which will start operating in the spring of 2023 in Croatia. Additionally, the Petrol Group owns 66 EV charging stations, has three petroleum product storage facilities, and five liquefied petroleum gas storage facilities in lease, and three concessions for natural gas under its own company, Zagorski Metalac d.o.o., with 18k active connections.

During 9M 2022, Span recorded an increase in revenue of 11% YoY, EBITDA after one-off items increase of 38%, and a net profit after one-off items of HRK 39.4m, an increase of 162% YoY.

The total consolidated revenue of Span increased by 11% (or HRK 66.1m) YoY. Of this, operating revenue grew by HRK 65.5m, of which revenues in the segment of IT services with high added value increased by HRK 73.1m, whereas revenues in the segment of software asset management and licensing recorded a decline of HRK 7.6m. The decline in revenues comes from the fall of revenue in the Ukrainian market given that Microsoft has enabled Span’s users in Ukraine the use of its products and services without compensation, in the period from 1st April until 12th December 2022.

Breaking the revenue down into segments, the largest absolute increase was recorded by Infrastructure Services, Cloud & Cyber Security, which increased by HRK 32.6m, or 56% YoY. Following them, we have Service Center Management and Technical Support, which increased by HRK 22.1m, or 32%, and Software and Business Solution Development, which increased by HRK 18.3m, or 66% YoY.

Meanwhile, OPEX grew by HRK 41.6m (or 7% YoY) and amounted to HRK 601.7m. Of this, Staff costs increased the most, by HRK 42.8m, or 45% YoY. This came as a result of a higher number of employees and one-off expenses arising from the allocation of shares to employees in Ekobit. Furthermore, the growth in staff expenses follows an increase in revenues in the segment of IT services with high-added value. The average number of employees in the 9M 2022 amounted to 676, which is an increase of 28%, or 149 new employees YoY. COGS decreased by 3% of HRK 11.1m, mainly as a result of lower COGS in the Ukrainian market, whereas other members of Span Group recorded an increase in direct costs due to higher revenues. Finally, other op. expenses increased by HRK 5.9m, mainly as a result of higher business activities and a higher number of employees.

EBITDA after one-off items increased significantly, growing by HRK 10.5m or 38% YoY, mainly as a result of higher revenue from IT services with high-added value. The one-off items relate to the expenses arising from the Plan for the allocation of shares to Ekobit employees, OPEX derived from the acquisition, as well as reserved expenses for the ESOP program for the allocation of shares to employees. The net financial result amounted to HRK 4.9m, an increase of almost 5x YoY. However, this does include an HRK 2.3m one-off item relating to the acquisition of Ekobit. This came as a result of a positive difference in the prices of own shares of Ekobit, i.e., a difference in the prices at which Span purchased them and Ekobit acquired them in 2017. This would mean that the net profit after one-off items amounted to HRK 39.4m, an increase of 162% YoY, or HRK 24.3m.

Span key financials (9M 2022 vs. 9M 2021, HRKm)

Source: Span, InterCapital Research

*After one-off items

Moving on to the balance sheet, the total assets of Span on 30 September 2022 amounted to HRK 486.1m, an increase of 38.3% or HRK 134.5m YoY. This was mainly driven by growth in the current assets, which increased by 147% YoY (or HRK 129.4m) and amounted to HRK 217.2m. This in turn came mainly as a result of an increase in short-term receivables as a result of the business operations of the Group during the year. Fixed assets also increased, growing by 39.2% (or HRK 34.2m), mainly as a result of the goodwill from Ekobit in the amount of HRK 27.9m.

On the other hand, liabilities growth was driven by the increase in current liabilities, which increased by 93% YoY (or HRK 99.1m) to HRK 205.6m. This came as a result of an increase in liabilities toward suppliers, short-term liabilities to employees, and short-term liabilities for the purchase of the business share of Ekobit.

Span also commented on the results of its subsidiary TOV Span Ukraine. The revenue decreased by 78% YoY and amounted to HRK 28.1m. The revenues of TOV Span account for 4% of the total revenues of Span Group in 9M 2022. EBITDA was negative at HRK 1.4m, which is an improvement of 43% YoY. Meanwhile, the net loss amounted to HRK 2.96m, a decline of 290% YoY. If you would like to read the full report, click here.