Recently yields have been drifting higher as the market began to believe that higher rates for longer is the path that both ECB and Fed will follow. In addition to that, the market raised expectations of the terminal rate for both central banks. Currently, inflation seems to be stickier than previously thought and soft data is pointing out that both economies are in good shape, in better shape than we thought in the third quarter of 2022. Consequently, the start of the year for risky assets was terrific – growth expectations revised higher, and a hard landing seems to be an implausible scenario.

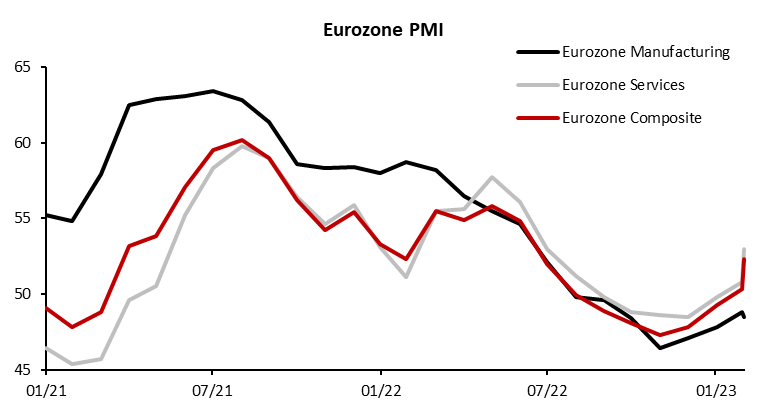

The Purchasing Managers Index for both Eurozone and US are pointing to growth. Composite PMI in Eurozone reached 52.3 in February which indicates an expansion of the economy, a level that was last seen eight months ago. In the second half of 2022, everyone feared the energy crisis in Europe, so it is reasonable that the PMI was below 50 from August 2022 until February 2023. The same situation applies to the US, but the soft data isn’t as optimistic as in Europe.

The two main components of the composite PMI are manufacturing and services PMI. The former is in the contractionary territory for both US and Eurozone. In the Eurozone, I would justify it with the deterioration of energy security and rapid price increases of gas, oil, and derivatives. On the other hand, contractions in the US can be attributed to the appreciation of the dollar which led to costlier exports and cheaper imports.

As the service sector accounts for a larger share of GDP than manufacturing, services PMI is recognized as more crucial data, and the market is much more sensitive to changes in services PMI than to changes in manufacturing PMI. Services PMI in Eurozone is deep in the expansionary territory at a level of 53 (February 2023) which was last seen last summer. As the soft data improved every month in the fourth quarter of 2022 and at the start of this year, the index of the German stock market DAX rose to the levels seen before the war in Ukraine. According to the market, it seems nothing happened to the valuation of German companies even as German 10-year and 2-year bond yields rose from the negative territory to 2.7% and 3.2%, respectively. Soft data in the US is surprisingly not as bright as in Europe. Consequently, S&P 500 is still pinned to the level of 4000 with oscillations of 5% lower and higher since November.

Unfortunately, a growth outlook focused on the services sector raised concerns about persisting inflation and delayed the fall in inflation to 2% as the hawkishness of central banks is in the spotlight again. Further expansion of the services sector accompanied by a tight labor market should further stimulate wage growth and make the task of bringing down inflation more difficult for central banks. Thus, the expectation of terminal rates has risen to new highs, reaching 3.87% for ECB and 5.45% for the Fed. Furthermore, Schatz’s yield rose 50bps over the course of February (2.60% to 3.15%).

A hard landing in both economies is improbable, but expectations in this volatile market environment are changing swiftly. At least the toughest winter that the Eurozone had to survive is behind us and prices of natural gas are down 86%. In case of inflation drops to 2% in 2024 and growth remains solid, it would be a goldilocks scenario for both the bond and equity market in 2024. The only thing I fear is the long-term relocation of energy-intensive European industry in case of natural gas prices ticking higher after the restoration of demand.

Source: Bloomberg, InterCapital

The flash estimate of the Croatian CPI, one of the newest additions to the Croatian Statistical Office, DZS, shows that the CPI in Croatia increased by 11.9% YoY, and 0.2% MoM in February 2023. Compared to January 2023, when the CPI grew by 12.7% YoY, this is a 0.8 p.p. decline.

However, is this decline due to the decrease in the CPI or something else? In this case, it would be the latter. In the same period of 2022 (January to February), the CPI increased from 5.7% to 6.3%. This would yield a MoM increase of 0.6 p.p., meaning that the YoY data we are comparing the February 2023 numbers to, has a base that is 0.6 p.p. higher. If the base remained the same as in January 2023, then the YoY CPI would be 0.6 p.p. higher, and amount to 12.5%. In this case, it seems more prudent to track the MoM changes. Even though last month the CPI did not really increase (0% MoM), in February 2023, it grew by 0.2% MoM. This would mean that despite the higher base in February 2022, the numbers are still increasing, meaning that high inflation is not only present but still not showing real signs of slowing down.

One can also roughly estimate the numbers for the next month by looking at the same period last year. Between February and March 2022, the YoY inflation grew from 6.3% to 7.3%, an increase of 1 p.p. overall. There have been some musings and rumors in the media, that there would be noteworthy price increases, ranging from single to double digits in March/April 2023, mainly coming from Food&beverage, as well as energy prices. Furthermore, as the Government’s aid package ends by the end of March (31 March to be exact), there could also be some price increases because of that, but this is still speculative as they have also announced a new aid package beginning in April. Nevertheless, taking both of these factors into account, it could be summarized that we could see two things next month: CPI increase on a MoM basis, but also on a YoY basis, although this could appear as lower than the 11.9% growth we are seeing this month, only due to the higher base in March 2022 (+1 p.p. compared to February 2022).

Croatian CPI (February 2013 – February 2023*, YoY, %)

Source: DZS, InterCapital Research

*Based on the first flash estimate for February 2023

Coming back to the CPI for February, DZS does provide a basic breakdown by categories. On a YoY basis, Food, beverages and tobacco grew by 15%, Energy grew by 13.4%, Non-food industrial goods without energy increased by 10.3%, and finally, Services grew by 8.9%.

Moving on to the MoM basis, price growth in Energy amounted to 0.8%, while in Services, it amounted to 0.1%. DZS also notes that the prices of Non-food industrial goods without energy, as well as prices of Food, beverages and tobacco, remained roughly the same on average. Furthermore, looking at the Harmonized Index of Consumer Prices (HICP), a comparable CPI measure between EU countries, Croatia’s YoY HICP estimate stood at 11.7%. In contrast, on a MoM basis, it stood at 0.2%. Compared to the Euro area annual inflation estimate, which stood at 8.5% in February 2023, we can see that Croatia’s inflation is several points (3.2 p.p.) higher. However, if we looked at a breakdown by countries, we can see that there are several countries that are recording a lot higher HICP numbers (e.g. Latvia at 20.1%, Estonia at 17.8%, Lithuania at 17.2%, Slovakia at 15.5%). At the same time, there are many countries that haven’t recorded double-digit inflation, with the lowest HICP recorded by Luxembourg (+4.8% YoY), Belgium (+5.5% YoY), Spain (+6.1% YoY), as well as Greece (+6.5% YoY). Overall then, it would seem that Croatia is in the middle, albeit at the higher end compared to other countries. The full Eurostat report can be accessed here.

Finally, DZS notes that the final data for the CPI will be released on 17 March 2023.