It’s perhaps a coincidence that a WWII pivot and the ECB pivot take place on the same date, just 80 years apart. The D-Day (June 06th, 1944) and ECB’s first-in-a-while interest rate cut (June 06th,2024) both mark turning points, although the first pivot is a truly historic milestone, while the second date is something noticed only by financial experts. Luckily a lot of these are in the ranks of our readers. What do we make of ECB rate cuts this year? Find out in this brief research piece.

We’re looking at the quite intensive week in terms of hard data and central bank decisions, so let’s take it step by step.

On the last day of May S&P downgraded France from AA to AA- with a stable outlook. If you missed the news, you didn’t miss anything really because market reaction has been muted. With EGB spreads to Germany already razor-tight across the board, it would be unreasonable to expect a sharp rise in borrowing costs for the second-biggest auro area economy. And now onto more important things.

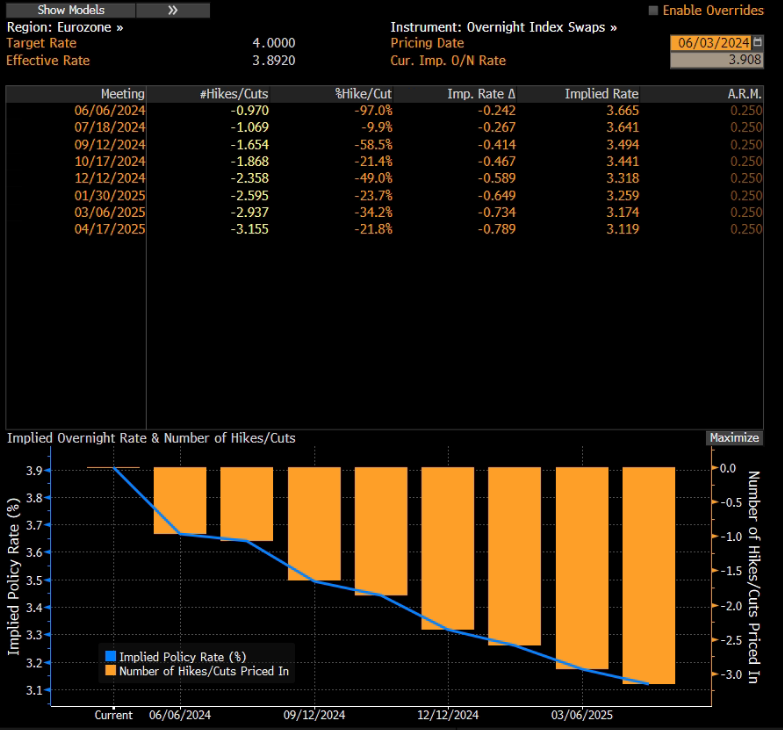

This Thursday is marked by ECB pivoting to rate cuts with an inaugural 25bps rate cut – this promise is so rock solid that you can take it to the bank and use it as collateral for a loan. The real question is what happens next? Isabel Schnabel discarded the probability of a July cut because there simply won’t be enough hard data to corroborate a consecutive cut, although there is a consensus within the ECB that more cuts would be warranted. ECB Vice President de Guindos, Bank of Greece Governor Stournaras and Bank of Lithuania Chairman Simkus are the three GC members advocating for three cuts this year and it’s quite unclear whether they will really get it. In our view, Isabel Schnabel is trying to buy time in order to coordinate actions with other G4 central banks in Jackson Hole (end August), a move that might warrant no EUR depreciation even if the FED decides to abstain from cuts this year (not our baseline scenario, but quite possible). This would mean that hawks and doves within the ECB might find common ground on the September cut, with a bit of luck with no EUR weakness warranted.

What are the odds of the ECB turning the corner in the same manner that the FED did just a couple of months earlier? In plain English – what if ECB GC members get cold feet and put cuts on pause because of EURUSD nosedives 2022-style? Let’s take a look at the US hard data to find an answer for this. Seems that US stagflation scenario is a particular issue for the FOMC and that members currently have no playbook to address it. Remember, stagflation essentially means the environment where FED wants to cut rates, but the inflation data doesn’t allow it. Be mindful of the most recent beige book and GDP data. Although one is a really, really soft indicator, and the other one is prone to seasonality, meaning that one bad quarter essentially means nothing at all. At the very source of the stagflation scenario are sticky service prices that won’t come down that easily, but we also point out that contrary to Neel Kashkari’s remarks hiking rates are not a panacea for stagflation. We also think that it is possible that if the FED does delay cuts and elevated interest rates actually do work with a long and variable lag, FOMC will have to frontload severe rate cuts in early 2025. With that in mind, the ECB can proceed with two or even three rate cuts this year. EURUSD won’t break parity.

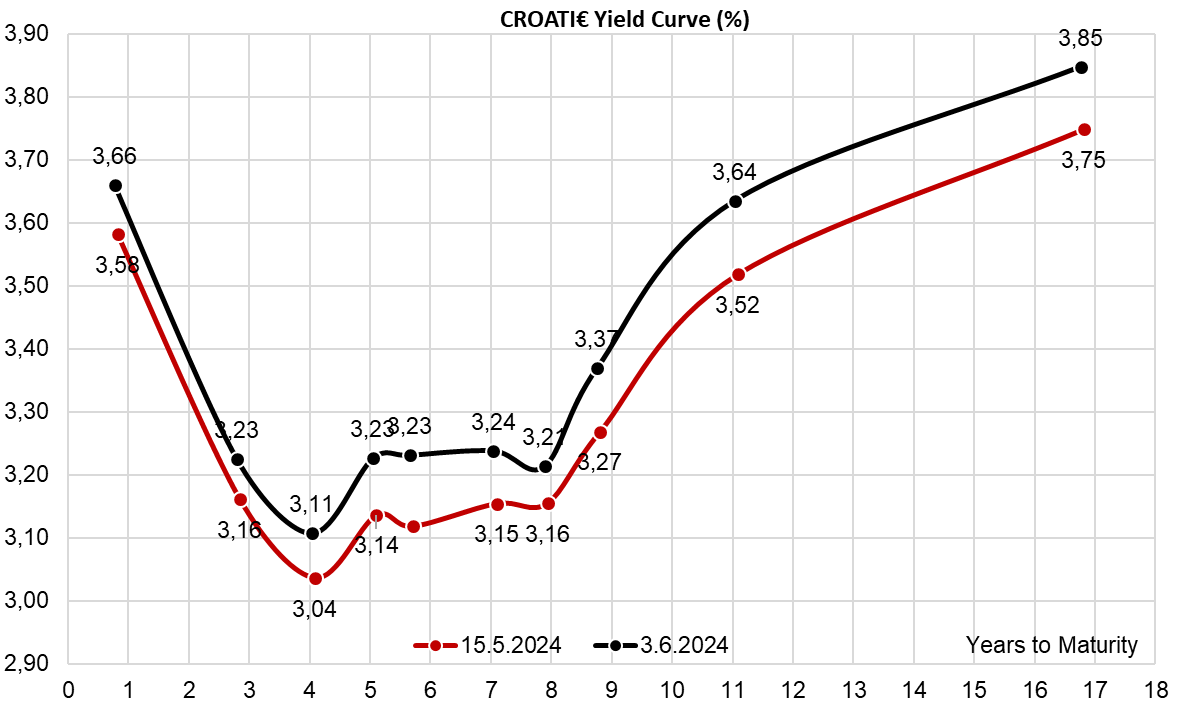

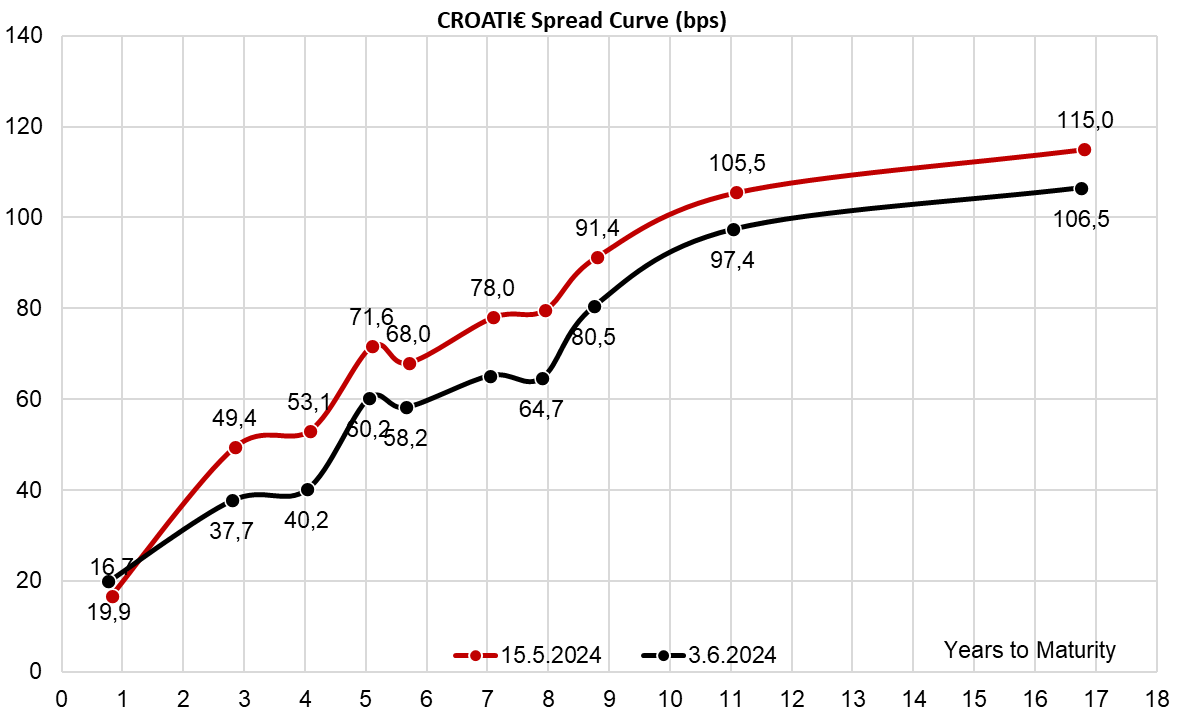

Finally, what’s going on with CROATI€ curve? We find the recent spread tightening quite curious but notice that it wasn’t isolated just on CROATI€ paper, meaning that it has nothing to do with prospects of Croatian credit rating moving deeper into IG. With no international placements this year and only retail bonds on schedule for the remainder of the year, it is possible for CROATI€ spread to Germany to continue contracting. Yes, you read it correctly. Croatia is below 100bps on Germany still has room to tighten. However, be mindful that in March 2025 Croatia will have to go through a mega-bond rollover with CROATI 3 01/11/2025€ (that’s 1.5bn EUR), CROATE 0.25 03/03/2025€ (another 663mm EUR) and CROATE 3.65 03/08/2025€ (1.85bn EUR – a true bazooka) all mature in a span of eight days. Our point: keep some dry powder for a splash of issuances in March 2025. It’s not that far away.

According to the first flash estimate of the Croatian CPI, in May 2024, it grew by 0.1% MoM, and 3.3% YoY. Furthermore, the Croatian HICP, which allows comparisons to other European countries, is expected to grow by 0.2% MoM, and 4.3% YoY, being 2nd to only Belgium on the YoY basis.

The latest CPI flash estimate for Croatia has been released on Friday. In the release, we can see that the Croatian CPI grew by 0.1% MoM and 3.3% YoY. This would indicate that the Croatian inflation rate remains one of the highest in Europe, and also that it has yet to cool off.

If we were to look at the main drivers of growth, on the MoM basis, Services further grew by 0.5%, just like Non-food industrial goods without energy, while beverages and tobacco both grew at 0.2%. On the other hand, prices in Energy further decreased by 1.2%. Meanwhile, on a YoY basis, prices in the Services segment grew by 6.1%, in Food, beverages and tobacco by 3.2%, in Non-food industrial goods without energy by 1,5%, while in Energy they increased by 1.9%.

Croatian CPI YoY growth rate (February 2013 – May 2024, %)

Source: Croatian Bureau of Statistics, InterCapital Research

If we wanted to make comparisons to other European countries, then the HICP (Harmonized Index of Consumer Prices) has to be used. In general, the Euro area inflation rate (E) stands at 2.6% YoY in May 2024. In Croatia meanwhile, it stands at 4.3% YoY, and 0.2% MoM. Comparing it to other European countries, on the YoY basis, Croatia is 2nd to only Belgium, which is expected to record a YoY inflation rate of 4.9%, and these were the only 2 countries that recorded a YoY inflation rate of >4%. The closest regional peer, Slovenia, is expected to record an inflation rate of 2.5% YoY.

HICP comparison between Euro area countries (May 2024, YoY, %)

Source: Eurostat, InterCapital Research

Meanwhile, on a monthly basis, the largest increase is expected to be experienced by Malta and Cyprus, at 1.6% and 1.2%, respectively, which is quite an outlier and the only country to experience >1% MoM HICP. Following them there is only Portugal at >1% with MoM inflation expected to amount to 1.1%.

HICP comparison between Euro area countries (May 2024, MoM, %)

Source: Eurostat, InterCapital Research

Overall, the Croatian inflation seems to be still far above the 2% target set by the ECB. Inflation did get tempered in the Euro area overall, at 2.6% as already mentioned. However, what’s more worrying for Croatia is the fact that as part of the Euro area, if the inflation continues to decline in the area, and Croatian inflation remains elevated, interest rate cuts could fuel its growth even further. At the same time, the inflation is mostly seen in Services, which is mostly related to tourism activities, and in food, beverages & tobacco, which is more related to personal consumption. Neither of these categories is influenced directly by higher/lower interest rates. As such, it will be interesting to see how the situation will develop moving forward.