The bond markets are still broken and it’s increasingly difficult to work as a fixed income trader at this time. Nevertheless, euro area primary markets carry some interesting insights about what’s going on below the surface. Now that it’s raining more than ever, who can stand under the investor’s umbrella? Find out in this brief article.

The most important event for Croatian bonds happening recently is Fitch revising sovereign outlook to stable from positive, although the rating was kept unchanged at BBB-. Regular reviews of Croatian rating were scheduled for June 05th and December 04th, but the credit rating agency decided to revise the outlook due to material changes in the Croatian economic blueprint. First of all, the agency expects Croatian GDP to contract by 5.5% YoY in 2020, followed by a recovery in size of roughly 3.0% YoY in 2021. According to their estimates, the aggregate fall in tourism demand is likely to reach 50% in 2020 alone since 45% of tourism arrivals come from Germany, Italy, Austria and Slovenia (i.e. four EU countries with severe travel restrictions). Speaking about the fiscal impact, Fitch estimated that about 7.5% GDP in deficit spending (30b HRK aggregate) would be used to shoulder the burden of falling economic activity, which would drive the public debt up to 77.7% GDP by the end of 2020. The deficit figure looks close to headline forecast, but the public debt figure might go a bit higher in this year, before (hopefully) finding itself firmly on a downward trajectory as soon as 2021.

So what do we make of this outlook deterioration? Both S&P and Fitch brought Croatian sovereign rating back into investment class on the same day, March 27th, 2019. The only difference was that in June of the same year Fitch revised the outlook to positive, while S&P kept it at stable all of the time. Basically, what Fitch did on Wednesday was merely aligning itself with it’s peer and no the agency longer sticks it’s neck out with a bullish outlook.

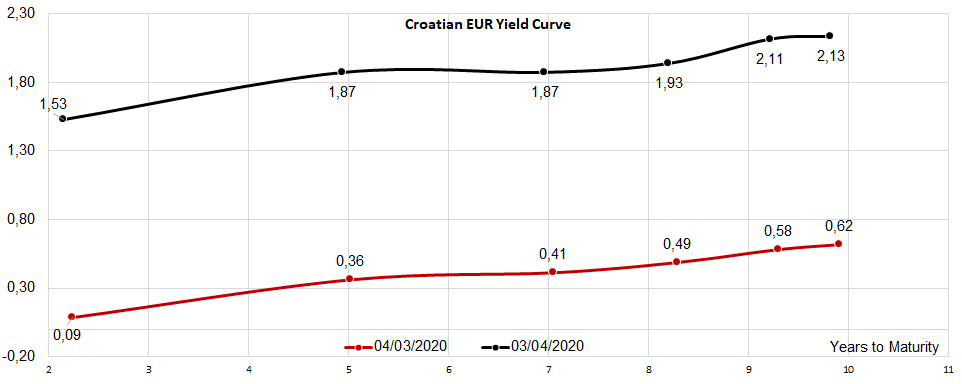

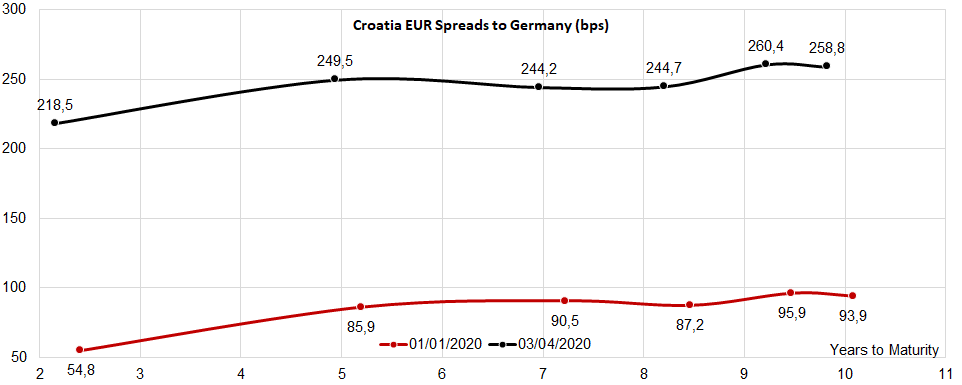

Speaking about Croatian international bonds, the market is still broken, but we can still say that it’s a buyer’s market in a sense that supply exceeds demand. Price discovery is an art itself, but it always comes down to the price that a potential buyer is willing to pay, with little or no concessions. Looking at CROATIs with longer maturities, although the screen prints yields around 2.10%, real bids are mostly concentrated in 2.30% region (if you’re lucky enough to find them).

A silver lining for CROATIs might have come from recent debt auctions held by Slovenia (March 24th), Latvia (March 26th) and Portugal (April 01st). Slovenia placed a dual tranche last week: 850mio EUR of 3Y paper (03/31/2023 maturity) @ 0.253% YTM (89.1 bps above Germany), coupled with 250m EUR of 9Y paper (March 2029 tap) @ 0.695% YTM (109.3bps above Germany). Looking at the Slovenian paper with a 9Y maturity, memories are still fresh of the first tranche being issued in early January @ 0.296% YTM (58.4bps above Germany), so at first it does seem that the yield impact is not so great after all: the yields have gone up by only 40bps, while the spread has widened by some 50.9bps. Nevertheless, Slovenian bonds are protected by a plethora of ECB’s facilities – the most prominent one is the gargantuan PEPP which seems to be designed to protect the periphery spreads from blowing up.

If you’re an investor in instruments issued by entities outside the reach of ECB’s umbrella, be careful before getting your hopes up. Here’s one more thing you should be aware when analysing Slovenian debt auction: back in early January most of the 9Y paper allocation went to investment funds (52%) and insurances/pension funds (18%); last week, the structure of the investors changed and banks/treasuries took 51% of allocation. French institutional investors took about 31% of allocation, which is not considered a frequent occurrence on Slovenian debt auctions (usually dominated by UK/Ireland, Germany, Austria and naturally Slovenia). In other words, it’s quite possible that the banks and treasury departments bought larger quantities in the anticipation that the ECB would have to buy these papers as well, some time around. And before it does, they provide a decent carry along the way. Now that it’s raining more than ever, it plays a big difference to be able to stand under ECB’s umbrella – but let’s look for the first debt auction held by a sovereign outside the euro monetary area to see how these countries fare.

Croatian Government confirmed yesterday further set of measures that are aimed at job protection and postponement or relief of taxes to aid the economy. Note that it is estimated that cost of all measures announced by the government for the three months could amount to HRK45 bn which is app. 11% of GDP.

The Croatian Prime Minister on Wednesday revealed the second set of measures to aid the economy while combating the coronavirus pandemic, which is the largest crisis of its kind in the world in recent years. He stated that for Croatia this is the biggest crisis since the Homeland War and the situation is demanding since they cannot with any certainty foresee how long the crisis will last. Therefore, the government has approved the proposed measures yesterday.

The approved measures are following:

- The amount of HRK 8.5bn is dedicated for job retention in March, April, and May. The support for wages in the amount of HRK 3,250 in March, is raised to a net salary of HRK 4,000 for April and May. At the same time, the state will pay the contributions on HRK 4,000 net income, which amounts to HRK 1,460 per employee. In total, the Croatian government will pay HRK 5,460 per employee for April and May.

- All taxpayers, which are due to regulation during current crises forbidden to produce goods or provide services or if the pandemic significantly impedes their business, will be fully or partially exempt from paying corporate income tax, payroll taxes and salary contributions due in April, May and June 2020. The companies with a drop in revenues between 20% to 50% will have the right to defer taxes and will be able to pay them in 24 monthly annuities with no interest. Businesses with a revenue of less than HRK 7.5m and with a drop in revenue higher than 50% will be fully exempted from corporate income tax, payroll taxes and salary contributions.

- Payment of the value added tax may be deferred until the invoices issued are collected.

- The deadline for submission of the 2019 annual financial statements is postponed to 30 June and the obligation to pay a fee to the Financial Agency (FINA) for their publication is abolished.

In addition to above-mentioned measures, the Government proposed to monitor implementation of the measures and economic aid packages brought to combat coronavirus crisis on the Financial Agency’s (FINA) digital platform. This platform will enable submitting an application for appropriate measures, collecting the information necessary for the decision making and creating a reporting system for monitoring the implementation of the measures.

The company notes that depending on further developments, considered for the eventual partial distribution towards the end of 2020 or later.

NLB Group published the convocation to the GSM scheduled for 15 June in which the Management Board and Supervisory Board will propose the distribution of distributable profit from 2019. The proposed distribution will be to keep the entire distributable profit generated by NLB amounting to EUR 228.04m (including the net profit generated in 2019, as well as the profit carried over from the previous years) undistributed as profit to be carried over, which implies no dividend payment. It is important to note that the company notes that depending on further developments, considered for the eventual partial distribution towards the end of 2020 or later. The proposal is in line with ECB’s recommendation for banks not to pay dividends at least until 1 October 2020.

Note that such a proposal does not come as a surprise, as NLB is currently faced with a challenge of absorbing both the acquisition of Komercijalna Banka and the current market situation posed by Covid 19 crisis, which led to temporary closure of many businesses during March.

In their conference call regarding the implications of Covid-19 situation, the management noted that NLB does not plan on revising their medium-term dividend policy and is comfortable with fulfilling the 70% payout ratio for the coming years.

NLB’s CEO Blaž Brodnjak noted that a strong capital position in the current environment is of key importance to go successfully through the upcoming uncertain and challenging period. This, along with systemic measures taken by the government and the Bank of Slovenia to help the economy, enable the bank to overcome the consequences of the epidemic and economic hibernation.

Trading statistics for March show an average daily turnover of EUR 3.92m (+230% YoY). Meanwhile, the major index CROBEX ended March with a sharp decrease of 20.55% ending at 1,480.51 points.

The selloff which started in late February and continued throughout March resulted in a very high total equity turnover on the Zagreb Stock Exchange (ZSE) of EUR 86.3m (HRK 651.2m). Of that block transactions account for EUR 17.68m (HRK 133.47m). This translates to an average daily turnover of EUR 3.92m (+230% YoY).

Of the total value traded in the period in March (excluding block transactions), Valamar Riviera generated 19%. HT comes second, accounting for 16.9%. Next come Adris preferred and Podravka with 10.4% and 7.3%, respectively. ZABA follows with 6.4%. These five shares generated 60% of the turnover recorded by the entire (equity) market, excluding block transactions.

When observing the total equity market capitalization, it observed sharp decrease of 13.3% MoM, amounting to HRK 126.11bn (EUR 16.7bn). Ina’s share is the biggest constituent of the total exchange’s equity market capitalization, accounting for about 23.3% of the total value. Next, come two Croatian banks – PBZ and ZABA with 12.9% and 12.3%, respectively. Further, HT holds 10.5% while Adris accounts for 3.4% of the total market capitalization value.

As a result of the above-mentioned selloff, CROBEX recorded a sharp decrease of 20.55%, ending at 1,480.51 points. Such a high monthly decrease of the index was last time recorded in November of 2008 when CROBEX dropped by 26.7%. It is also worth noting that all sector indices ended the month in red, with CROBEXindustrija recording the highest decrease of -25.88%.

Share Price Performance of Croatian Blue Chips in March (%)

In 2019, the Group recorded a decrease in sales of 6% YoY, an increase in EBITDA of 11% and a decrease in net profit of 96%.

Telekom Slovenije published their Annual report on Ljubljana Stock Exchange. According to the report the Group recorded a sales decrease of 6% YoY, amounting to EUR 675.4m. If we were to exclude the revenues generated by Blicnet (which was sold in 2018), the sales were down by 4%. Meanwhile, operating revenues amounted EUR 681.7m, which is a decrease of 7% YoY. The proportion of new revenue sources accounted for by eHealth, energy and financial and insurance services was up relative to 2018. Also, revenues of GVO and Planet TV generated on the market outside of the Group recorded an increase. However, those were not enough to offset in full lower revenues from mobile subscribers, who are migrating to new, more affordable packages, and the expected drop in revenues from traditional fixed voice telephony services, which are being replaced by mobile and IP telephony. Lower revenues on the wholesale market are the result of lower revenues from international traffic. Lower revenues in Kosovo could be attributed to a decrease in revenues from incoming calls due to the increasing use of free online voice applications.

When observing operating expenses, the Group recorded a decrease of 9% YoY, amounting to EUR 650.6m, with all operating expenses items down, besides D&A (+4% YoY). The most significant decrease was witnessed in the items other operating expenses (-53% YoY), due to one-off effects that are not part of ordinary operations, and the costs of services (-17%) mainly due to IFRS 16.

As a result of lower operating expenses, EBITDA recorded an increase of 11%, amounting to EUR 205.4m. Such a result puts the EBITDA margin at 30.4% (+4.5 p.p. YoY).

Going further down the P&L, in 2019 Telekom Slovenije recorded a net financial loss of EUR -28.14, compared to EUR 15.97m. Such a result could be attributed to two key reasons. The first one is that in 2018, finance income from the equity holdings was higher due to the sale of Blicnet, while the second one is that in 2019 other finance expenses include a loss of EUR 17.6m on the acquisition of a 34% minority interest in Planet TV (former Antenna TV SL), claimed on the basis of an arbitration award in the proceedings between Telekom Slovenije and Antenna TV SL Slovenia B.V.

As a result of the above mentioned, net profit sharply decreased (-96%) and amounted to EUR 1.2m. Excluding one-off events, the Telekom Slovenije would have generated a net profit of EUR 27.4m in 2019, representing an increase of 13% compared to 2018 adjusted net profit.

Turning our attention to CAPEX, in 2019 the company’s investment amounted to EUR 167.8m, which is an increase of 25% YoY. Of that, investments for the expansion of the fibre optic access network and customer equipment account for 56.6%.