American journalist Ambrose Bierce is usually credited with the saying that “wars are God’s way of teaching us geography“. If he was alive today, he would probably say that disease is God’s way of teaching us the Greek alphabet. Omicron is the 15th letter of the 24-word Greek alphabet and fortunately the disease would drift away before we get to omega. Meanwhile how did global financial assets react to the new variant and what can we expect going forward? Find out in this brief research piece.

Just when you thought it will soon be over, Sars-Cov-2 pulled another trick from its sleeve. There are currently 1.500 recognized versions of the virus, but one variant detected in Botswana last week gave another reason for concern. The mutation in B.1.1.529 strain was nicknamed omicron by World Health Organization. A bit of a history lesson – alpha variant was detected in the UK some time ago. After delta was detected in India and nu detected in South Africa, the latest strain originated from Botswana and has a mild symptoms. On the other hand this clinical blueprint was recorded on relatively younger population that make up significant partitions of African demography. Nobody can really know what’s going to happen once omicron strain heads up north and starts spreading across older populations with plenty of pre-existing conditions. This is the reason why some countries such as UK blocked incoming flights from south Africa, while others such as Israel closed borders altogether.

The possibility of shutting down air traffic to mitigate the spread of omicron strain brought down prices of financial assets, so WTI took a hit of about 10.5% on Friday alone (to 73.6 USD per barrel) and managed to print another move down to 71.6 USD per barrel as of this morning. S&P500 made a move down by as much as 2.3%, while bitcoin is holding up steady.

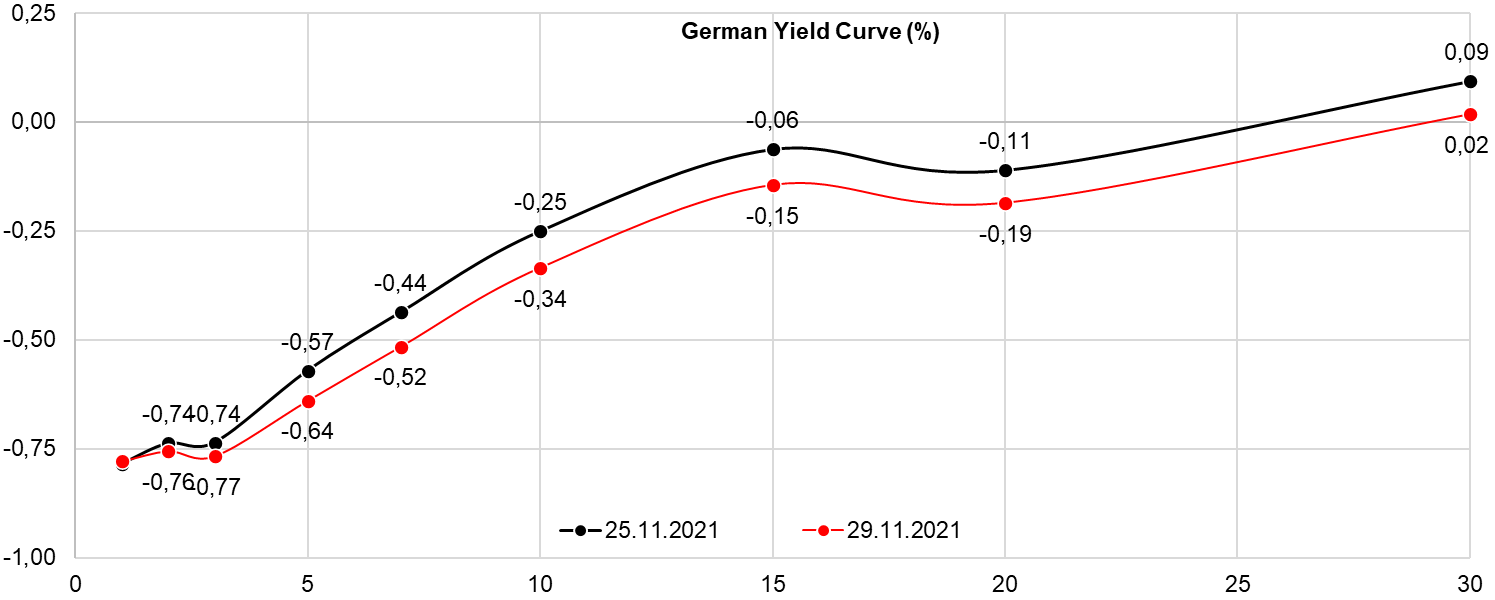

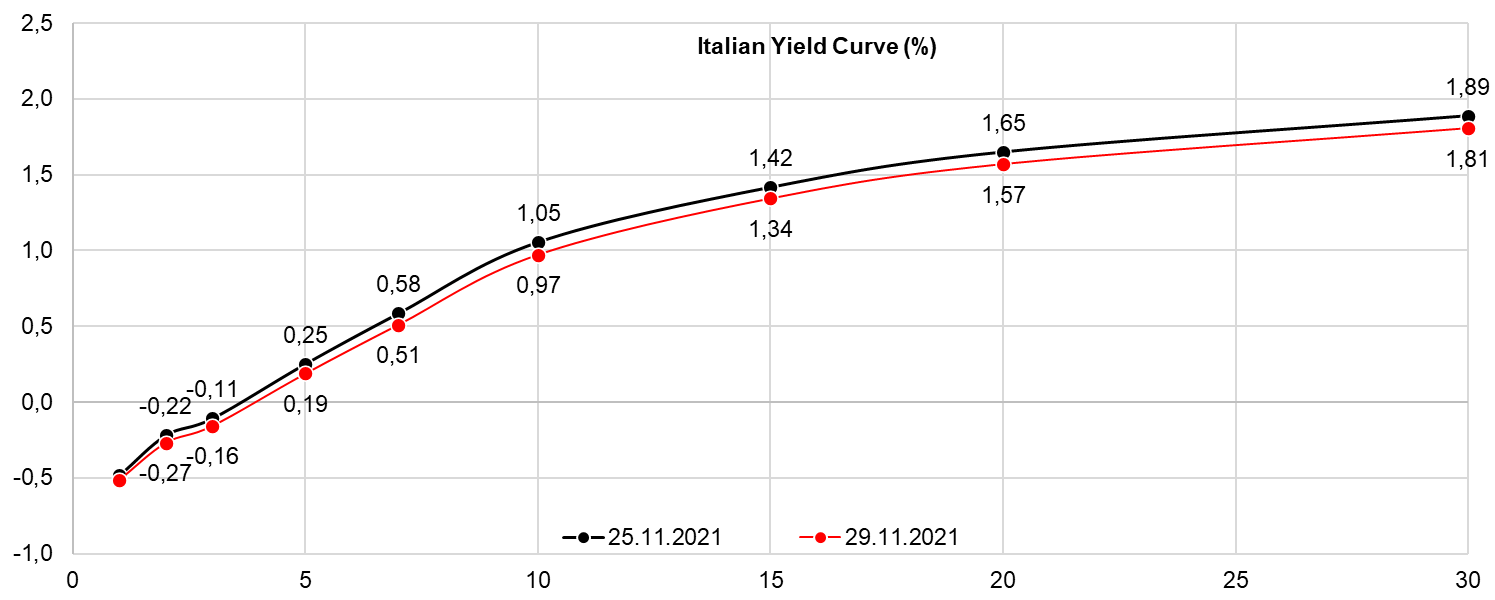

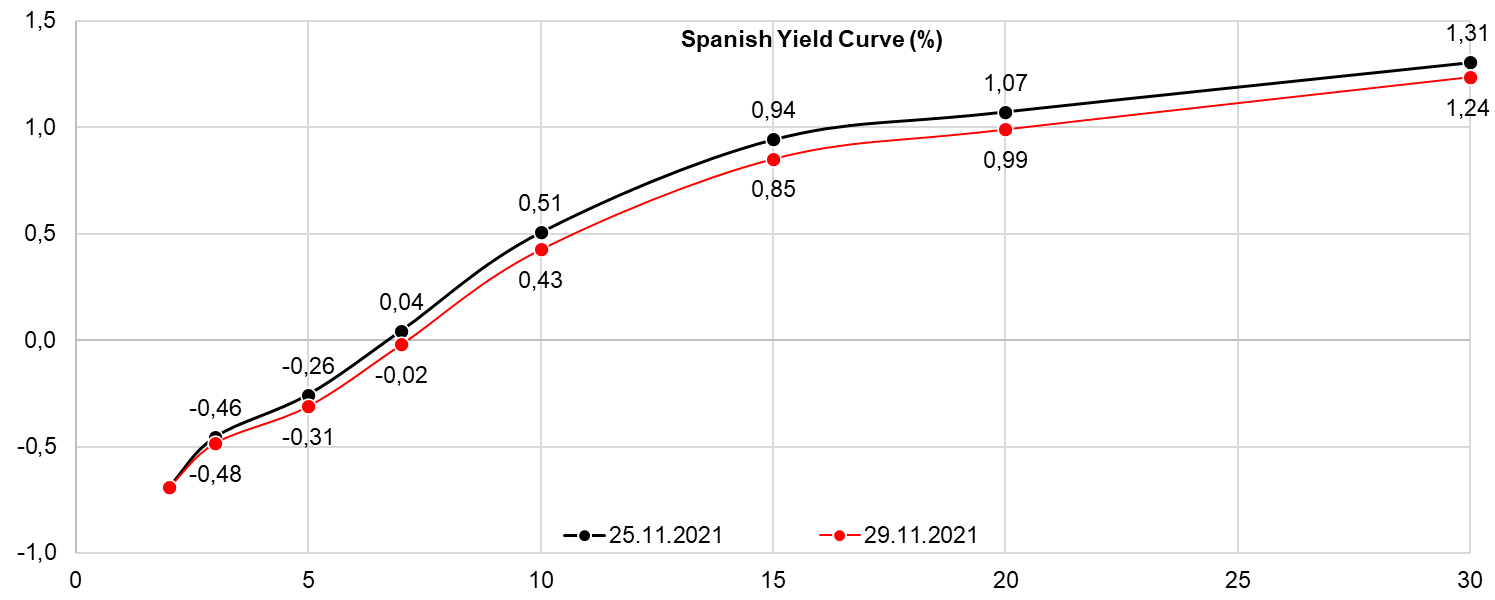

Bonds went through a melt up in the aftermath of omicron strain news as safe haven was bid heavily. German yield curve bull flattened in the response, the same being quite visible on Italian and Spanish curve. Here’s something worth thinking about: EDZ2 (Eurodollar futures expiring in December 2022) was traded at 98.935 on Thursday and closed on 99.075 after Friday trading session. We can easily conclude that omicron strain cut about half of one expected interest rate hike by December 2022 and with the market being so short in rates, it’s quite possible that the next leg could be up again (in terms of price).

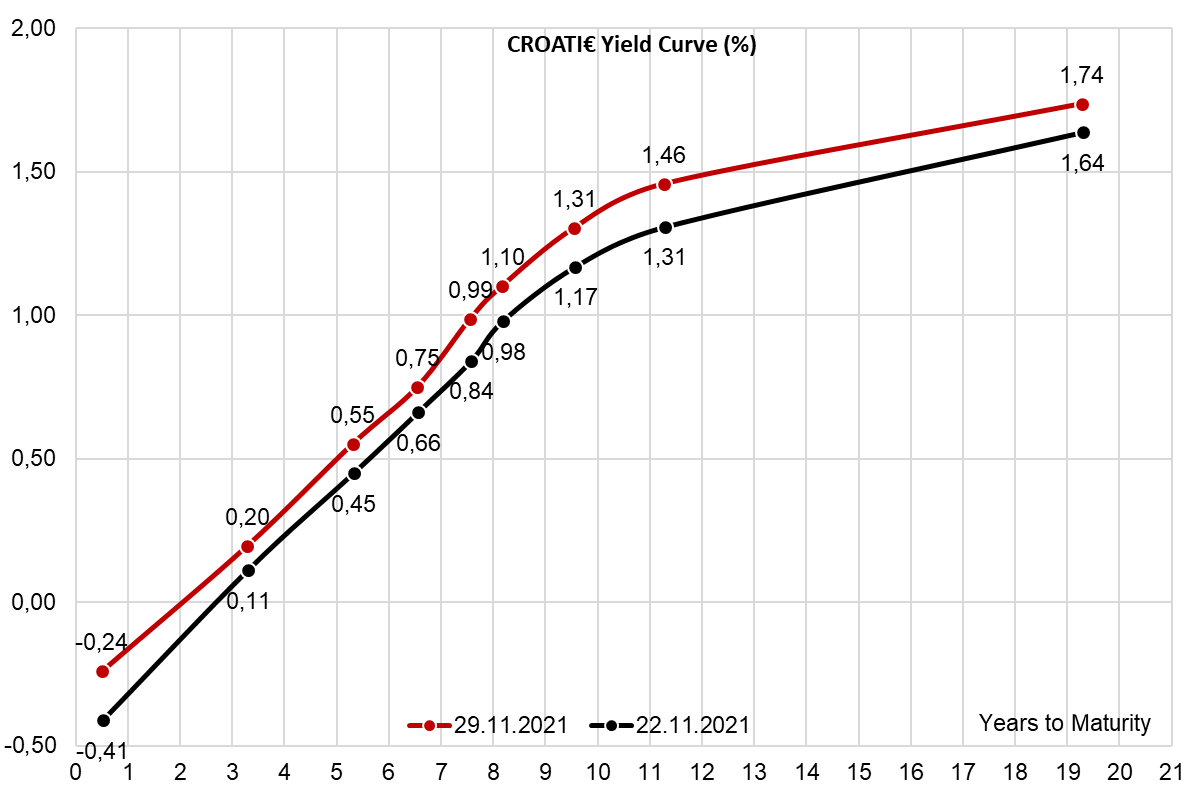

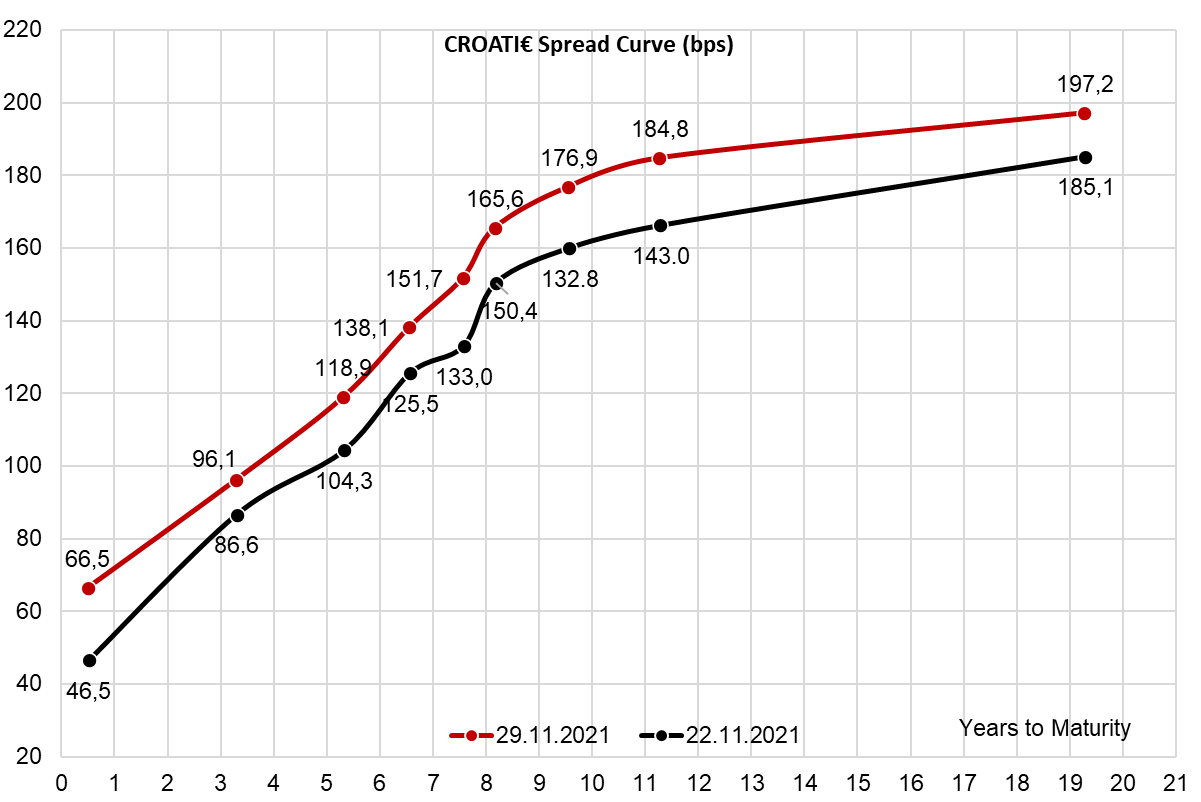

Croatian international bond curve has been intransigent to data, but with all the cash on the sidelines coming from Croatian LDIs and pension funds, it’s quite possible the bids might start popping up after the turn of the month. This is when unused cash tends to spill over into buying assets in order to fill in the under-weight gaps in their portfolios, which we believe are abundant because the recent flow from long term investors was not matched by their predictable cash inflows. With Croatian G-spreads as wide as they get, it’s easy to comprehend what happens next. It’s quite likely the fast UCITS and hedge funds would quickly collect the low hanging fruit and then larger chunks of CROATI€ would probably start trading at spreads significantly tighter compared to the ones recorded this morning.

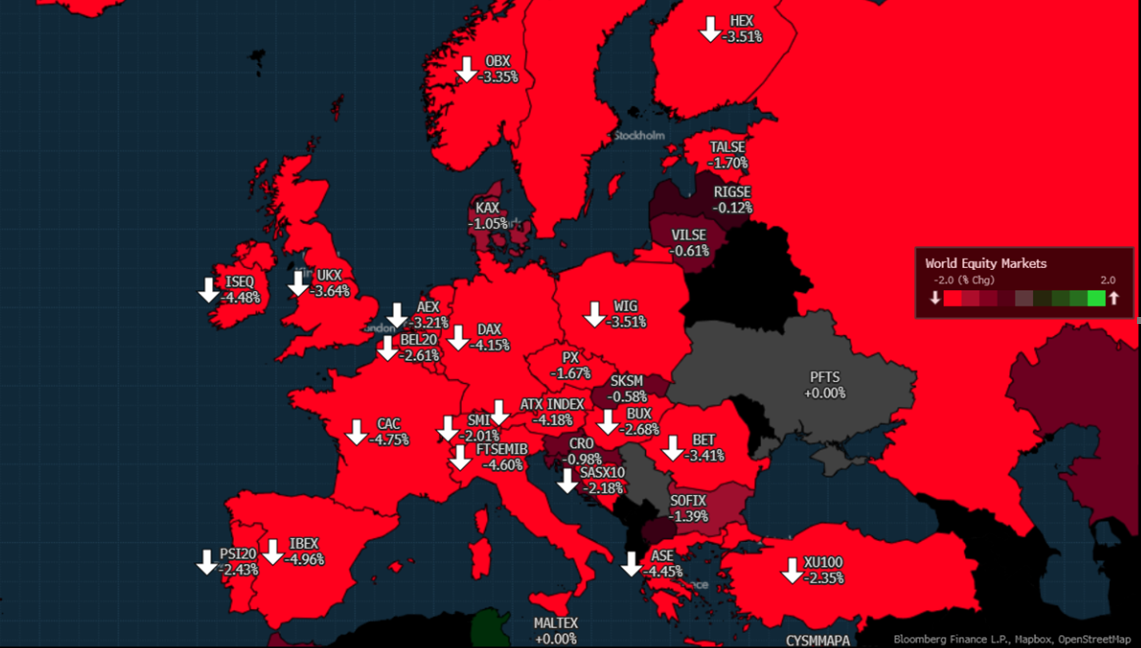

A new COVID-19 variant from South Africa sends fears across the global equity markets.

On Friday a new COVID-19 variant, currently named Omnicron, originating in South Africa sent fears across equity markets across the world. This new variant, currently thought more infectious than the previous variants due to mutations in spike protein ( a key part that the virus uses to enter cells in the body) is also the part of the virus that’s targeted by vaccines.

As of Thursday, there were almost 100 cases detected in South Africa, where it’s become the dominant strain among new infections. There were also four cases recorded in neighboring Botswana, in people who were fully vaccinated. In Hong Kong, a traveler from South Africa was found to have the new variant, while Israel identified one case in a man who recently traveled to Malawi.

Due to the nature of the new variant, countries across the world have started responding. The UK issued a temporary ban on flights from six African countries, Singapore restricted entry for people from South Africa and neighboring countries within the last 14 days, the European Union proposed halting air travel from southern Africa, Australia is considering tightening border rules for travelers from South Africa, while India stepped up screening incoming travelers from South Africa, Botswana, and Hong Kong.

All of the above stated had an effect on global financial markets on Friday as stocks, treasury yields, and oil sank. In the US, S&P 500 decreased by 2.27%, the highest decrease since February 2021. Meanwhile, Dow Jones was down by 2.53%.

Across Europe, virtually all major indices have ended the trading day in red. . As of closing on Friday, DAX has dropped by as much as 4.15%, representing the highest decrease since October 2020.

The region seemed to be less affected by the news, as CROBEX dropped by 0.98%, while SBITOP noted a decrease of 0.71%

European Equity Markets (26 Nov 2021)

Source: Bloomberg

The change rate of seasonally adjusted quarterly GDP was positive at 2.7% QoQ.

According to Croatian Bureau of Statistics, Croatia’s Q3 GDP in real terms increased by 15.8% YoY, which can be considered above market expectations. The change rate of seasonally adjusted quarterly GDP was positive at 2.7% QoQ, while it increased by 15.5% in real terms compared to the same quarter of 2020.

Breaking it down by segment, one can note that domestic demand showed strong support to GDP, with final consumption increasing 9.7%. Meanwhile, household consumption noted an increase oof 16% YoY

Looking at external developments, exports of goods and services accelerated by 48.8% YoY. To be specific, this was mostly driven by a very strong tourism season, so services increased by as much as 71.6% YoY. Export of goods, on the other hand, noted a very solid increase of 13.1% as well.

On the import side, we witnessed an increase of 13.9%. Of that services showed a double digit increase of 22.3%, while goods were up by 12.4%.

Croatian GDP, Real Growth Rates (%, YoY)*

*Quarterly Gross Domestic Product, seasonally adjusted real growth rates

Luka Koper published their 9M 2021 results last week, showing a 9% YoY increase in net revenue, a 7% YoY increase in EBITDA, and a net profit of EUR 22.5m (+3% YoY)

In 9M 2021, Luka Koper posted sales in the amount of EUR 168.2m, representing a 9% YoY increase. Sales from market activity amounted to EUR 163.4m and were up 9% YoY, whilst revenue from the performance of the public utility service of regular maintenance of port’s infrastructure intended for the public transport amounted to EUR 4.8m and was down 6% YoY. When looking at the throughput, Luka Koper achieved higher throughput in two strategic cargo types, containers, and cars. It should also be noted that the Company achieved higher throughput of dry bulk cargoes (+10% YoY) in comparison with 2020 as well as compared to the plan. In total, the Company had a container throughput of 756k, a 6% increase YoY. At the same time, they had a car throughput of 472k, which is an increase of 11% YoY.

Maritime throughput in tons per cargo groups in 9M 2020 and 9M 2021

On the flipside, in comparison to the previous year, the throughput of liquid cargoes decreased, mostly due to suspension of passenger air traffic and lower volume of throughput of petroleum products due to the COVID-19 pandemic.

Throughput of containers (number containers and TEU) and cars (in units) in 9M 2020 and 9M 2021

EBITDA amounted to EUR 45.6m, representing a 7% increase YoY. This increase can be attributed to higher sales revenue, mostly due to the higher throughput of containers. At the same time, operating expenses increased to EUR 146.9m, a 6% increase YoY, slower than the net revenue from sales growth. The cost of the material decreased, while the costs of services, labour costs, costs of amortization, and other operating costs increased. Cost of services amounted to EUR 42.6m, a 10% or EUR 3.7m increase YoY. This is mostly due to the increase in the cost of port services, which alone increased by EUR 2.1m due to the aforementioned higher throughput. In 9M 2021, labour costs amounted to EUR 63.6m, and were up 6% YoY, mostly due to higher payments for job performance.

Finally, net profit amounted to EUR 22.5m, representing a 3% increase YoY.

CAPEX amounted to EUR 41.1m, a decrease of 18% YoY. This was used to complete the construction of the parking garage for cars, complete the construction of the additional entrance to the Port, as well as other improvements.

Luka Koper Key Financials (EUR)

Cinkarna Celje published their 9M results, recording a YoY increase of 11.9% in net sales revenue, 68.5% increase in EBITDA and net profit rise of 90% YoY.

In the first nine months of 2021, Cinkarna Celje noted net sales revenues of EUR 146m, which represents a growth of 11.9% YoY. The increase in sales is mostly driven by a higher value of sales of their main product – titanium dioxide, with sales of it amounting to EUR 119.1m (10% Y0Y increase) due to higher demand for pigment towards the end of the year. Sales of titanium dioxide have a share of 81.6% in total net sales revenue. Furthermore, sales of pigments and ink also reported an increase of 9% YoY, amounting to EUR 13.16m.

EBITDA witnessed a steep increase of 68.5% YoY and amounted EUR 42.6m. This increase is mostly driven by growth in sales revenue by 11.9% (EUR 15.5m) with operating expenses being almost flat (1.85% increase YoY). On the expense side, Cost of goods, materials and services increased by 2% YoY. This is because purchase prices of titanium-bearing raw materials did not increase from last year. It is important to note that management does not expect those prices to remain flat and expects them to increase in the near future.

Labour costs were down 3%. The largest share of labour costs, gross wages (c. 70%), decreased by 6% YoY. Therefore, EBITDA margin reached 29.19%, representing an increase of 9.8 p.p. compared to the same period last year. Operating profit amounted to EUR 32.3m, increasing 98% YoY.

With all stated, Cinkarna Celje documented a net profit of EUR 26.16m, which translates to a YoY increase of 90%. Profit margin amounted 17.92% and increased by 6.74 p.p. YoY.

Cinkarna Celje Key Financials (EUR)

As of 1st January 2023 NLB must meet the buffer at the highest level of consolidation in Slovenia, through common equity Tier 1 capital at the level of 1.25% as proportion of total risk exposure amount.

NLB published an announcement stating that they received the decision of the Bank of Slovenia relating to the macro-prudential measure capital buffer for other systemically important institutions. Capital buffer is set based on following criterion: size of the banking group, importance for the financial system infrastructure, complexity and cross-border activity and interconnectedness. Bank of Slovenia at least once a year conducts the O-SII identification process and sets the capital buffers for the identified O-SIIs.

As of 1st January 2023 NLB must meet the buffer at the highest level of consolidation in Slovenia, through common equity Tier 1 capital at the level of 1.25% as proportion of total risk exposure amount. This represents an increase by 25 basis points to the previous decision.

BELEX and ATHEX have signed an agreement announcing the migration of the BELEX stock exchange trading activities as market operator to the trading platform of ATHEX

The signing of this agreement is the next step of the mutual desire of both organizations to promote broader regional cooperation, which was initially realized back on August 5th, when ATHEX started participating in BELEX’s shareholding structure.

With this agreement, the deployment of activities aimed at migrating BELEX’s trading activities to the Common Trading Platform has started. This will affect all the partners (Athens Exchange, Belgrade Stock Exchange, Cyprus Stock Exchange) and their associated investment community in improving their operational efficiency, market liquidity, business opportunities, and thus efficiently supporting local economic development.

This also puts forth ATHEX’s commitment to actively support BELEX’s strategic endeavor to develop the Serbian capital market into an international benchmarked market.