CEE currencies have been hit hard since corona crisis emerged, depreciating more than 10.0% in some countries. Central banks were trying to ease their politics, decreasing interest rates, and starting QE while investors cut their exposure to EM. However, equity markets are recovering faster than most of market participants expected and some of them now think CEE currencies being undervalued. In this short article you can read short history of their performance, monetary policy in these countries and what we could expect next.

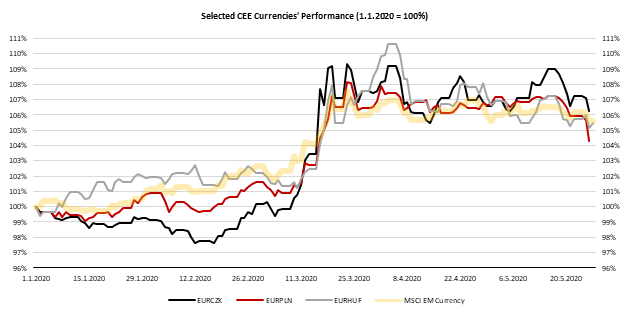

At the beginning of today’s blog, we want to highlight that most of EM currencies, such as CZK, HUF and PLN are trading with almost perfect correlation in times of strong foreign shocks as we have seen in the last two months. As you can see on the chart submitted below, all mentioned currencies followed move of large ETFs that are trading EM local currencies world-wide very closely. On the other hand, there are some currencies such as HRK and RON which are tied to EUR stronger due to central banks politics, so moves were rather muted.

Source: Bloomberg, InterCapital

We start with our neighbors, Hungarians, which currency have seen strong depreciation trend during crisis but also bounced back significantly as central bank made right moves. Namely, in February 2020 EURHUF was trading in 330 – 340 range, forint was constantly depreciating due to macroeconomic factors and very loose monetary policy. Nevertheless, in the end of March depreciation accelerated and EURHUF reached 370, reflecting strong outflow from EM funds. As interest rates were already low in Hungary and they started with QE before, they decided to step up on QE to limit long term rates while increasing short term rates to limit HUF depreciation. QE was not utilized in full while long term rates decreased significantly, and forint appreciated to 350 levels meaning that central bank was quite successful. In case economy shows signs of weakness (more than CB expects) we see rates decreasing in the next few months probable, so we see appreciation of forint limited in the short term.

Czech koruna has seen even larger move from February to peak of crisis. CZK was appreciating versus EUR constantly due to hawkish central bank that hiked rates in February to 2.25% and was the only bank in CEE to do such thing in 2020. EURCZK breached level of 24.80 back then but skyrocketed to almost 28.0 in the end of March, reflecting depreciation of almost 13.0%. CNB had lot of space to react so they cut their rates to 0.5%, resulting in solid yield decrease although they are still resisting from implementing asset purchases which makes its bank almost unique. Since peak of the crisis, CZK appreciated only 3.0% despite strong risk-on environment and we see two main factors. First is large involvement of foreign investors in Czech assets (due to FX peg) which were exiting from the position while the second one could be large cut of interest rates which decreased attractiveness of holding CZK. We do not expect EURCZK to move in any direction strongly, but in case of second shock we could see even faster jumps and breaching of 28.0 level.

Polish zloty did not have such a magnificent move but still depreciated almost 10.0% from down to peak. As it was the case in Czechia, Polish central banks had some space to react, but they also employed large QE programme. Looking at the chart, seems like EURPLN is trading almost perfectly with large EM local currency funds and we expect it to continue so, as PLN has the largest weight in these funds among currencies above mentioned. With high equity beta, we have witnessed strong appreciation this week with PLN coming towards 4.40 levels.

On the other hand, Romanian Leu does not have many correlations with any of foreign assets. Anyone who was trading or only watching their currencies knows that for a long time. Central bank is limiting depreciation of domestic currency and it cut its rates only mildly, by 50bps. Interesting to mention is that in the beginning of April we have seen forward points on EURRON jumping to above 10.0% which helped currency staying close to current levels.

Of that amount, Croatia can expect HRK 10bn, of which HRK 7.3bn are non-repayable, and EUR 2.65bn are possible loans.

The European Commission has put forward its proposal for a major recovery plan. To ensure the recovery is sustainable, even, inclusive and fair for all Member States, the European Commission is proposing to create a new recovery instrument, Next Generation EU. The Commission has also unveiled its adjusted Work Programme for 2020, which will prioritise the actions needed to propel Europe’s recovery and resilience.

Next Generation EU of EUR 750bn as well as targeted reinforcements to the long-term EU budget for 2021-2027 will bring the total financial firepower of the EU budget to EUR 1.85 trillion.

Of that amount, Croatia can expect HRK 10bn, of which HRK 7.3bn are non-repayable, and EUR 2.65bn are possible loans. Such news could bring a positive sentiment on the bond market.

Next Generation EU will raise money by temporarily lifting the own resources ceiling to 2.00% of EU Gross National Income, allowing the Commission to use its strong credit rating to borrow EUR 750bn on the financial markets. This additional funding will be channelled through EU programmes and repaid over a long period of time throughout future EU budgets – not before 2028 and not after 2058.

It is important to note that the member states will have to vote on the aforementioned proposal on European Council meeting in June.

The cancelled decision has ordered Atlantic Grupa to pay the amount of HRK 89.32 per share, to the minority shareholders of the company Kalničke Vode Bio Natura.

Atlantic Grupa published an announcement stating that they have received the Judgment of the Supreme Court of the Republic of Croatia which amends the judgment of the High Administrative Court of the Republic of Croatia and cancels the decision of the Croatian Financial Services Supervisory Agency (HANFA).

The cancelled Decision has ordered Atlantic Grupa to pay the amount of HRK 89.32 per share, to the minority shareholders of the company Kalničke Vode Bio Natura. The Supreme Court Judgment has been delivered following the initiated proceeding for the extraordinary review of lawfulness of the final Judgment of the High Administrative Court.

As a reminder, in September of 2010, Atlantic Grupa agreed with Badel 1862 on the takeover of company Kalničke vode Bio Natura for enterprise value of HRK 82m (HRK 27 per share). In late December of the same year, Atlantic announced the transferring shares from minority shareholders (3.27% of the share capital) of Kalničke Vode Bio Natura to the major shareholder (Atlantic Grupa). The mentioned transfer was concluded at HRK 7.7 per share, representing HRK 0.74m.

In July of 2011 HANFA brought a decision requiring Atlantic to pay the additional amount of HRK 89.32 per share to the shareholders which were squeezed out, which would have made the total payment for the minority interest of Kalničke Vode Bio Natura HRK 9.35m (higher by HRK 8.6m).