Have we reached peak rates already? Central banks are communicating a hawkish hold, meaning that no change would be factored in the benchmark rates any time soon, however, they should be kept unchanged for several quarters from now. How is the market digesting the news? Read in this brief piece.

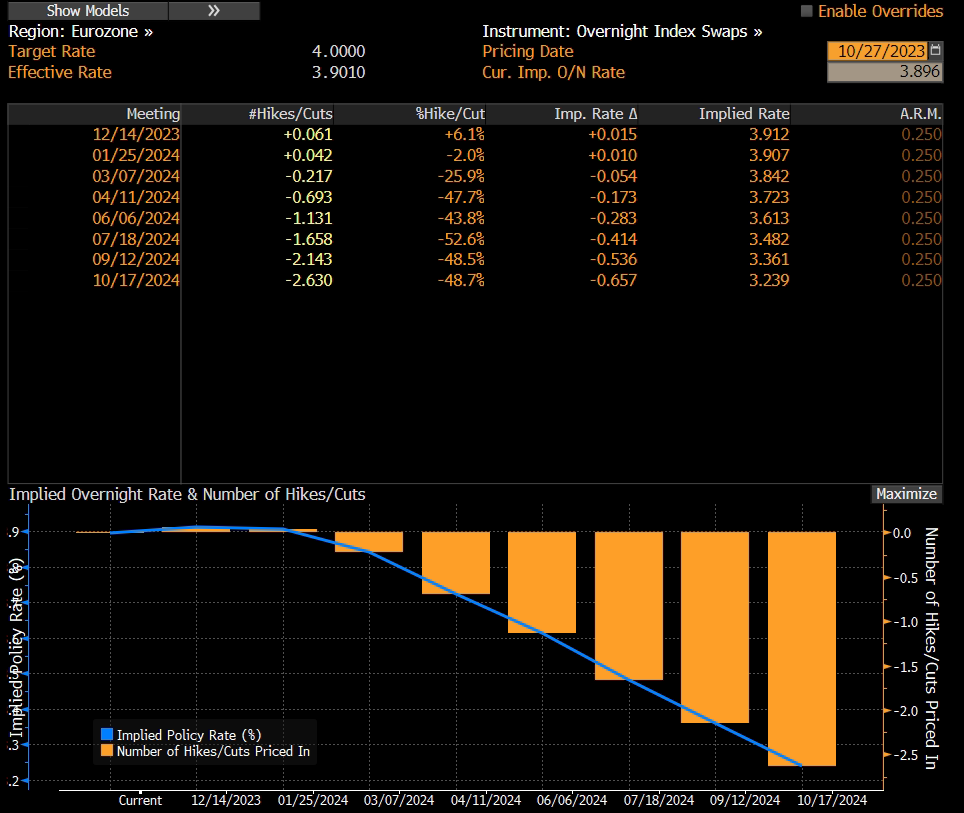

Yesterday’s ECB Governing Council meeting went by with no surprises at all, nevertheless, something might be brewing under the hood. A change is becoming quite visible in the facts underpinning the current forward guidance (expected to be amended in December by the latest macroeconomic forecasts of ECB staff). Benchmark interest rates were left unchanged as expected and STIR futures point out that the Frankfurt-based institution is done with rate hikes:

Nevertheless, STIR futures also point out in the direction of the first rate cut happening as early as in April, an expectation that President Lagarde tried to defuse in the Q&A session by saying that the inflation is expected to remain too high for too long. Markets were unmoved by the rhetoric because recent anecdotal evidence of an economic slowdown in the European manufacturing heartland pointed out that the slowdown might be ahead, which could in turn bring inflation figures lower in the absence of geopolitical shocks. Markets are right about one thing – “higher for longer” does not override data dependence. So once you put all the pieces of the puzzle it becomes clear where is the beginning of the drift between STIR futures and ECB. It’s completely in the data and markets think they are better connected to the real economy than the ECB. Traders would put it: Frankfurt is behind the curve. Again?(!)

US GDP figures published yesterday are actually quite well aligned with President Lagarde’s rhetoric about “higher for longer” because vibrant GDP growth might curb the central bank’s efforts to bring inflation down. US real GDP growth ended up at +4.9% YoY, the strongest figure since 2Q 2021, a quarter marked by post-pandemic recovery. Personal consumption and investment (read between the lines: IRA+CHIPS etc.) are leading the way and it’s not clear when this stellar growth might come to an end. There is one thing analysts agree on: the current trajectory of US CPI is determined by the services inflation, which could not come down unless wages’ growth decelerates and presumably we would need a recession and at least 4.3% unemployment to get there. We are far from the target – in other words, good US economic indicator is bad for US bond prices which through correlations have ripple effects on other parts of the rates universe (EGBs in particular). Truth be told, the US10-Bund spread has been widening, but the correlation is alive and well, thanks for asking.

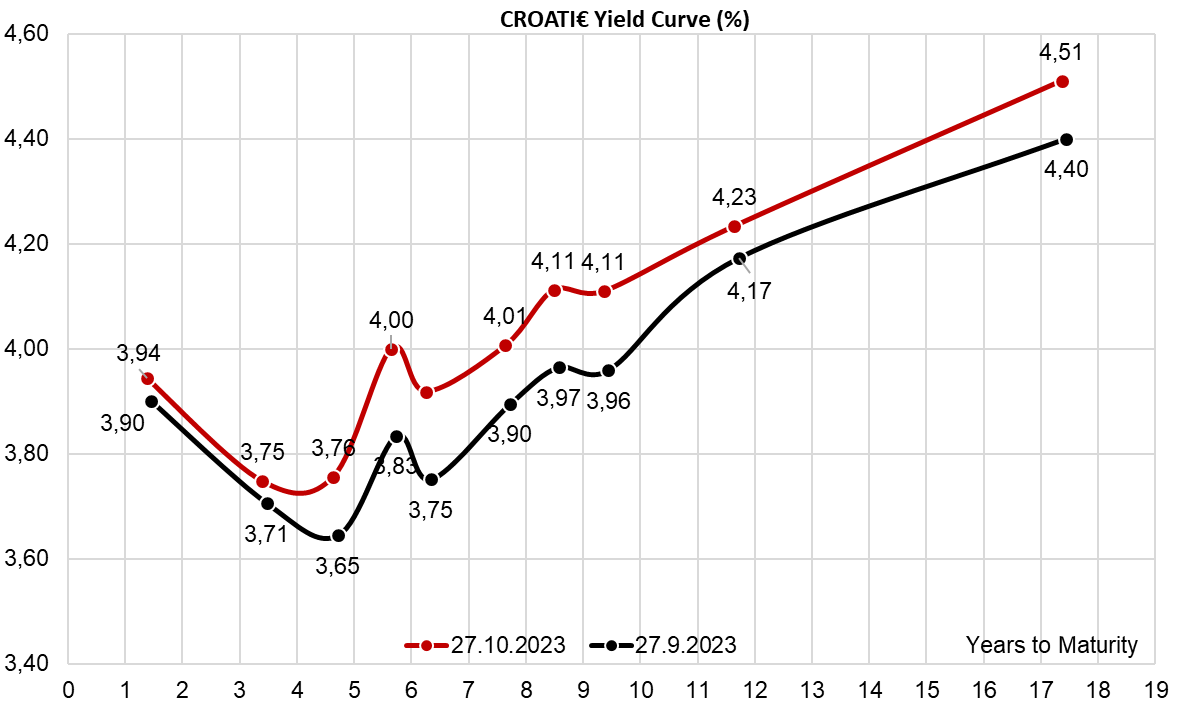

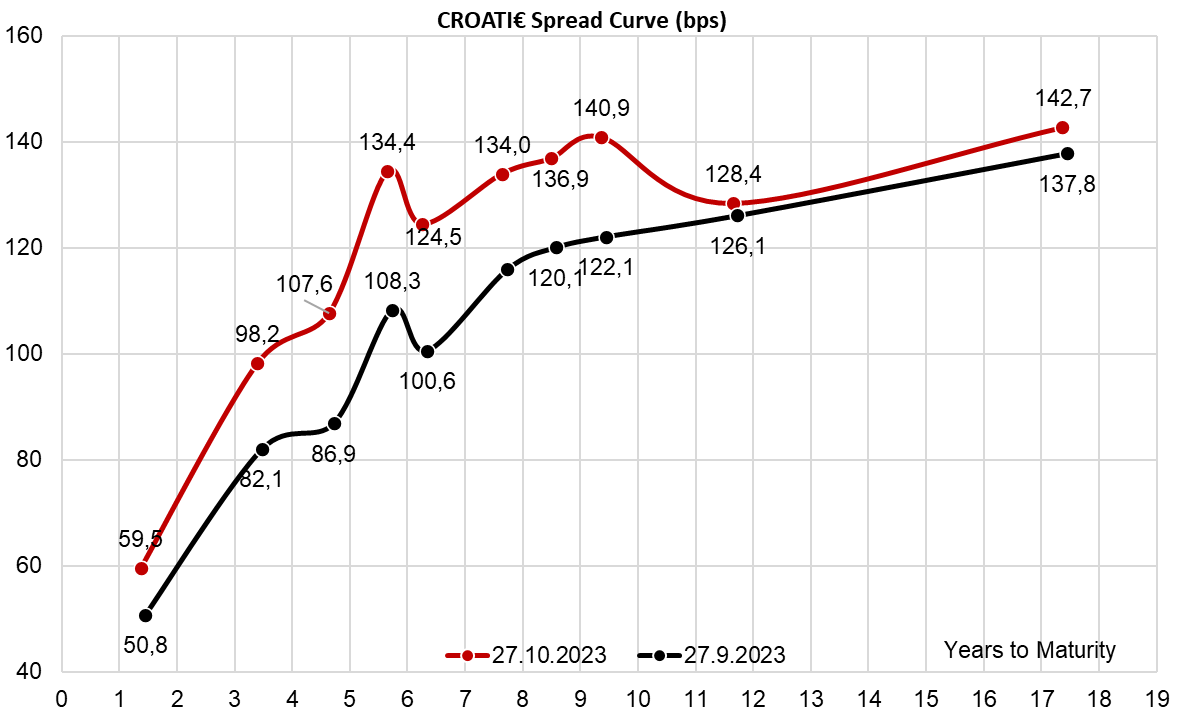

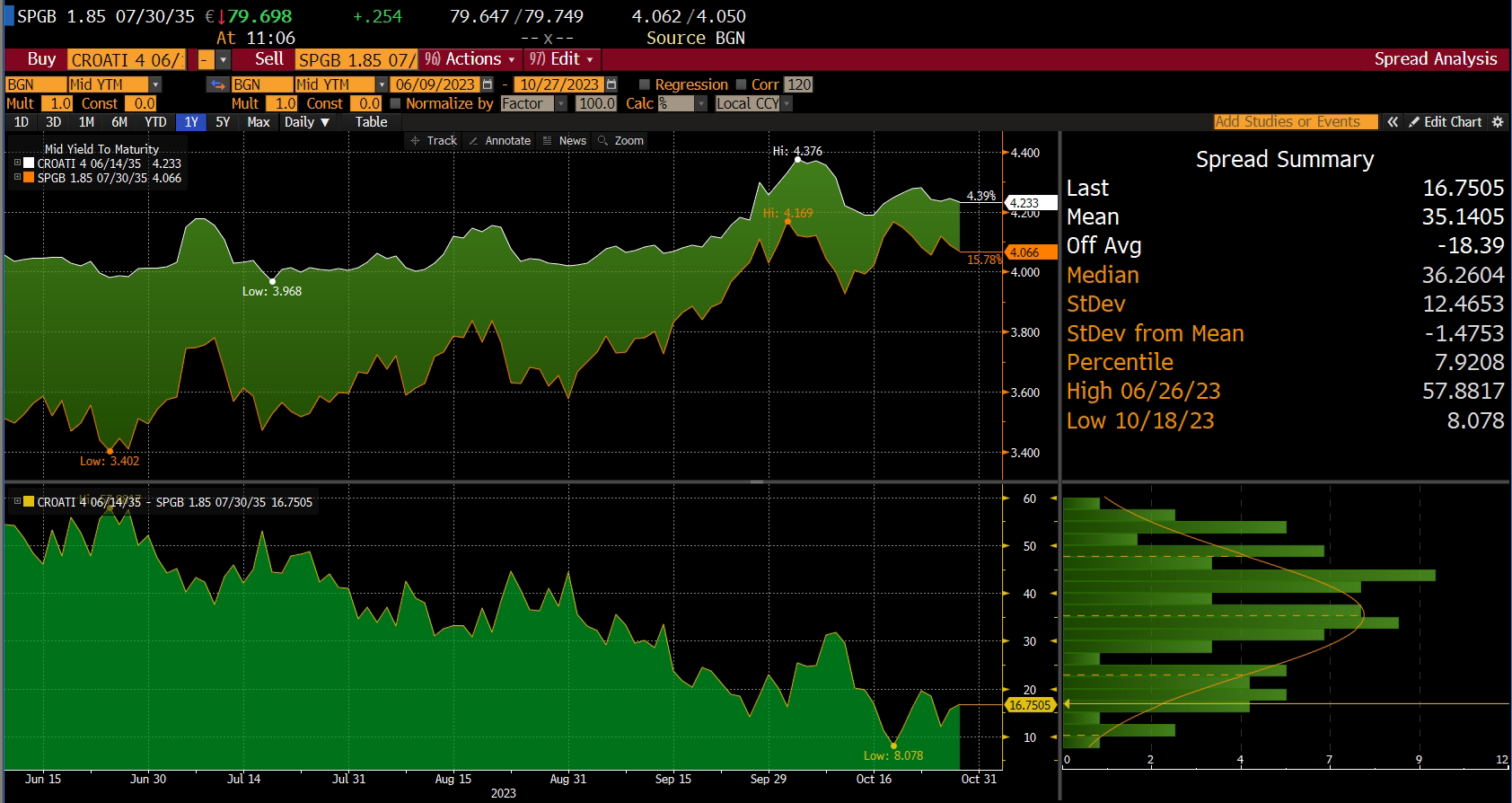

How are Croatian international bonds faring? The spreads on the long end have been well-behaved and notice on the second chart that the CROATI 4 06/14/2035€ hasn’t widened a bit compared to one month ago (B+128bps versus B+126bps). If you were trading this bond in the past month, you could notice that the bid almost mechanically moves around levels of B+130bps in respectable sizes, indicating perhaps real money buying.

The spread to Spain didn’t widen enough to make it a breaking news, but it did come off the October lows (it’s 16.75bps currently). Just a quick reminder – it was around 30bps a month ago and most of the spread narrowing came through the channel of rising SPGB yield. But You don’t need us to tell You that, You can easily see for Yourself.

At the share price before the announcement, this would amount to a DY of 3.8%. The ex-date is set for 18 December 2023.

NLB announced the convocation of its GSM, which will be held on 11 December 2023. Inside the announcement, they also proposed the dividend payment of EUR 55m, which on a per share basis, would imply a gross dividend of EUR 2.75. At the share price before the announcement, this would amount to a DY of 3.8%. The dividend would be paid out from the 2022 profit, which amounted to EUR 447m. This would imply a payout ratio of app. 12.3%.

It should be noted that this dividend proposal represents the 2nd dividend tranche that NLB proposed (and for the first one, approved) this year. Back in June 2023, NLB already paid out EUR 55m, also EUR 2.75 DPS to shareholders. The DY for that payment, based on the share price back then amounted to 3.9%. Combined, this would mean that the overall DY amounted to 7.7%.

For this dividend proposal, the ex-date is set for 18 December 2023, while the payment date is set for 19 December 2023. In total, from the period from 2022-2025, NLB plans to pay out EUR 500m in the form of dividends, and if this dividend payment is approved, that plan is certainly on track to be completed.

Below we provide you with NLB’s historical dividends per share and dividend yields.

NLB dividend per share (EUR) and dividend yield (%) (2019 – 2023)*

Source: NLB, InterCapital Research

*2023 DPS and DY also includes the proposed numbers, subject to approval

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 13 | 31.10.2023 | SNP | OMV Petrom Q3 2023 Results, Conference Call | Romania |

| 14 | 31.10.2023 | RIVP | Valamar Riviera Q3 2023 Results | Croatia |

| 15 | 31.10.2023 | HT | Hrvatski Telekom Q3 2023 Results, Conference Call for analysts and investors | Croatia |

| 16 | 31.10.2023 | KOEI | Končar Q3 2023 Results | Croatia |

| 17 | 31.10.2023 | SPAN | Span Q3 2023 Results | Croatia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).