As of September 2021, Slovenian mutual funds manage EUR 3.98bn, representing a decrease of 1.6% MoM and an increase of 23.3% YTD.

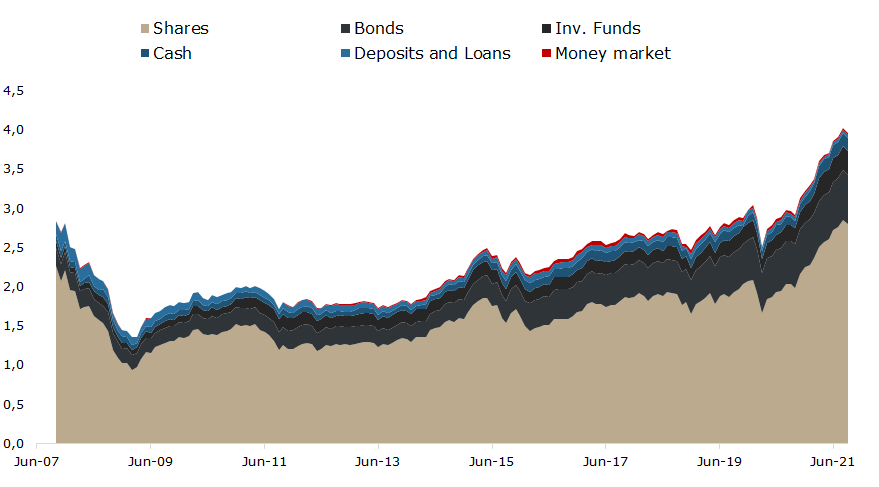

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

As of September 2021, Slovenian mutual funds manage EUR 3.98bn (-1.6% MoM). Meanwhile, total assets under management are up by as much as 23.3 % YTD. It is worth noting that net contributions to the funds amounted to EUR 17.97m.

Turning our attention to the asset structure, as of September 2021, shares account for 70.2% of the total assets (or EUR 2.79bn). Shares observed a decrease of 1.92% MoM. We note that the vast majority (97.6%) of equity holdings of Slovenian mutual funds come from the foreign market. Domestic equity holdings are up by 14.1% YTD and are currently amounting to EUR 67.9m.

Total Assets of All Slovenian UCITS Funds (EUR bn)

For today, we decided to present you with a YTD performance of Croatian, Slovenian and Romanian Companies.

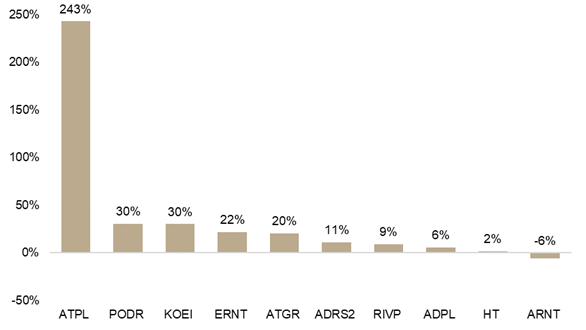

As visible from the graph, among the CROBEX10 companies, 9 out of 10 are in green on a YTD basis. To be specific, Atlantska Plovidba leads the list by far with a YTD increase of as much as 243%. Podravka and Končar follow with an increase of 30.3% and 30.2%. On the flip side, Arena Hospitality Group was the only one to note a YTD decrease of 5.9%.

YTD Performance of Croatian Companies

Source: Bloomberg, InterCapital Research

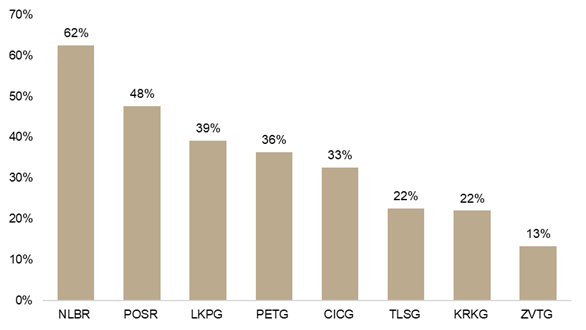

In Slovenia, all blue chips noted a double-digit YTD increase, with NLB leading the list (+62.4% YTD). Sava Re follows with an increase of 47.6%, while Krka as the index heavy weight noted a 22% increase. Meanwhile, Triglav noted a 13.3% YTD increase, putting the company, in relative terms, in the last place among the blue chips.

YTD Performance of Slovenian Companies

Source: Bloomberg, InterCapital Research

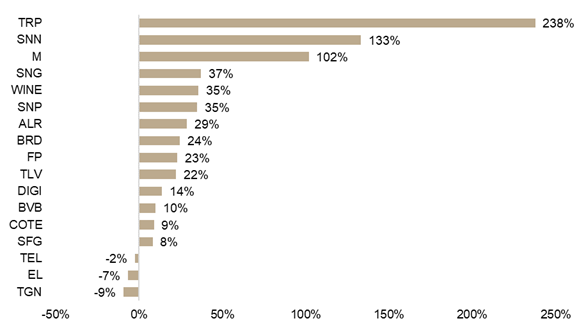

Turning our attention to Romania, one can note that 3 BET constituents have noted a triple-digit YTD increase, that being Teraplast, Nuclearelectrica and MedLife. On the flip side, 3 constituents (Transgaz, Electrica and and Transelectrica) have noted a YTD decrease.

YTD Performance of Romanian Companies

Source: Bloomberg, InterCapital Research