Krka published their preliminary FY 2022 results yesterday, showing a 10% YoY increase in sales, a 5% YoY increase in EBITDA and a 17% YoY increase in net profit (EUR 361.1m). Overall estimated net profit is just slightly under our estimates. Further, Krka published its plans for 2023 with estimated sales amounting to EUR 1,755m and net profit of app. EUR 300m. Krka’s top line is fully in line with our 2023 estimates, while net profit is slightly above our expectations if the plans are to be achieved.

Krka announced preliminary 2022 results stating that its sales have amounted EUR 1,717.5m, realizing an increase of 10% YoY, which is also the Company’s best-recorded sales result so far. Further, the Company’s EBITDA has increased by 5% YoY, while the bottom line is has increased by as much as 17%. Overall, we note that the expected net profit of EUR 361.1m is just slightly below our expectations.

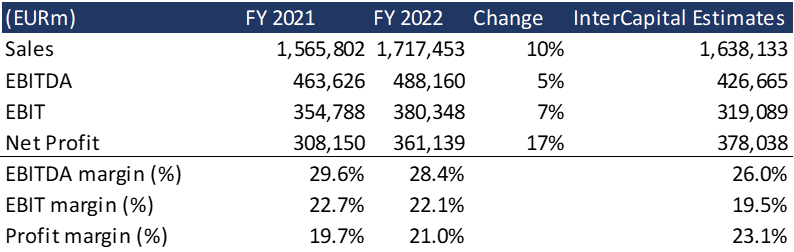

Krka Key Financials

Source: Krka, InterCapital Research

Further, looking at the Company’s recorded net profit, a 17% increase can be noted with the bottom line amounting to EUR 361.1m. The result is just slightly under our estimates, which amounted to EUR 376.8m. However, we emphasize the bottom line was exceptionally hard to anticipate due to the unstable geopolitical situation, which could’ve easily manifested in Krka’s top line and consequently spill over to the company’s profitability margins. The main differences between our estimates and the reported numbers occurred in higher top line than our estimates, which annually advanced at 10% YoY vs. our estimate of 4.6% YoY growth, as a result of exceptionally strong Q4 where top-line increased 22.1% YoY. In our report we expected slow-down in revenue in Russia, but in Q3 sales accelerated by 9.3% spurred by growth in OTC medicine, while in Q4 sales surged by 44%. Quantities are not yet published but the important factor in Russia were that appreciation of rouble also impacted the inventories valued at the Russian rouble, which were later sold at much higher quantities that we have estimated so realized EBITDA advanced 4% YoY and was higher than our estimated EBITDA. The amount of inventories on the balance sheet are also not yet published, but from the amount of realized revenue, we can say this is where the majority of impact comes from. Another important difference in our estimate was with the exchange rate of EUR/RUB as we used an exchange rate of 62 RUB to 1 EUR, while the exchange rate stood at 78.4 RUB to 1 EUR at the end of December 2022. So positive exchange rate was lower than we have estimated, but since the exchange rate differences also impacted inventory the difference is levelled out on the net profit line.

Krka FY 2022 Key Financials along with InterCapital estimates [EUR m]

Source: Krka, InterCapital Research

The recorded revenues for FY 2022 amounted to EUR 1,717.5m. First, the recorded revenues were 4.8% stronger than our estimate. It was due to stronger than expected product sales in Russia, totalling EUR 387m and consequently, resulting in a 16% YoY increase compared to FY 2021. From the 2022 preliminary results published by Krka yesterday, it is evidenced that Q4 was another strong quarter for most of its regions with Q4 growth of 22.1%, due to fact that secondary sales were higher than primary sales in Krka’s main region of East Europe. Wholesalers decreased their stock previously, while OTC drugs and antibiotics sales increased strongly due to surge in flu and winter illnesses.

When looking at the revenue by markets, Region East Europe remains the largest market, accounting for 36.5% of the Company’s total sales and increasing by 14% YoY. Russia, the largest individual market in the region, generated sales revenue of EUR 387m, representing an increase of 16% YoY. Sales growth was also recorded in all other markets in this region with the only exception being Ukraine, where the product sales noted a flattish development with a 1% YoY decline. But compared to 3Q when Ukraine sales were down 44%, they increased up back by 32% YoY. Therefore, this remains important market for Krka and they are carefully monitoring announced draft of law where Ukraine is reconsidering to cancel marketing authorizations for pharmaceuticals held by companies with ties to pharmaceutical manufacturing in Russia or Belarus. Krka could potentially be threatened but the management has not announced any new developments concerning this matter on the Conference Call held yesterday afternoon with its investors. Rest of East Europe markets’ sales growth were also strong in Q4 (31%YoY growth), while total annual 2022 sales on these markets stand at EUR 141m and they were up 20% YoY.

The Region Central Europe, which is composed of the Visegrad Group and the Baltic states, had a sales revenue of EUR 364.2m, which makes 21.3% of total Krka Group sales. This represents a 4% increase YoY. Poland, which is the leading market in this region, generated EUR 168.2m in product sales, growing by 1% YoY. Poland market sales in 4Q were down 2.1% YoY. Further, in West Europe, where a total of EUR 327.3m was generated, Germany generated the strongest sales. Germany is followed by the Scandinavian countries, France, Italy, and Portugal, while the highest growth rates were recorded in Benelux, Portugal and Germany. Region South-East Europe recorded sales revenue of EUR 224.5m, contributing to 13.1% of the Company’s total sales, and growing by 7% YoY. In Slovenia, sales amounted to EUR 103m, accounting for 6% of total sales, and increasing by 11% YoY. Lastly, we have Overseas markets, which experienced the largest relative increase of 23%, growing to EUR 66.1m. This is due to strong growth of China market which reached EUR 30m of sales, while sales more than doubled.

EBITDA amounted to EUR 488.2m, representing an increase of 5% YoY. This growth in EBITDA can be attributed to mentioned growth in Krka’s top line. Meanwhile, the EBITDA margin declined to 28.4% from 29.6%. It is expected that EBITDA margin is suppose to decrease further as this level is deemed by the management as unsustainable. It is expected to decrease due inflation of all coast and services, increase in labours costs, further increase in marketing expenses, etc. In 2022 EBITDA margin stood at 28.4%, which is quite high profitability margin and is last 5-year average. Managements plan is to efficiently manage rising costs and to keep EBITDA profitability margin above strategic threshold that stands above 25%. Our business plan envisages EBITDA margin in 2023 around 26%.

Investments

Looking over at investments, CAPEX in 2022 amounted to EUR 106m and it is expected to increase further in this year to EUR130m. One of Krka’s main projects in is its API plant in Slovenia that has already received environmental permit, while construction works are expected to start soon. This total investment is estimated at EUR 163m and is in line with their strategy of vertical integration. Increase in API in-hose production will result in faster launces of products and faster placements, while it is competitive advantage to own such a factory and constant investment is needed to sustain growth.

New Marketing Authorizations

In 2022, Krka was granted marketing authorizations for 11 new products, out of which 9 were prescription pharmaceuticals, and two were non-prescription products.

Plan for 2023

According to the Management’s outlook, the Company estimates a sale revenue of EUR 1,755m and a net profit of app. EUR 300m in 2022. It should be noted that the expected revenue and net profit are in line with estimates made in our analysis. The Company also plans to allocate EUR 130m for CAPEX in 2022 and an increase in the number of employees by 2%.

Krka FY 2023 Plan along with InterCapital estimates [EUR m]

Source: Krka, InterCapital Research

Today, Petrol published the business plan for the Grup for 2023. Overall, Petrol expects that the petroleum product price regulation and the conditions in energy markets will continue in 2023. Consequently, growth will slow down and inflationary pressures will be present. Petrol plans the sales revenues to amount to EUR 10.2bn, adjusted gross profit of EUR 675m, EBITDA to EUR 250.4 and net profit to EUR 117.1m.

Petrol expects for challenging environment to continue, particularly related to the situation in the energy markets. Group expects economic growth to slow down, while also for petroleum product price regulation and inflationary pressure to continue in 2023. Further, Petrol emphasizes that its operations will be under the impact of many factors like uncertain geopolitical and economic situations and changes in the USD exchange rate. Nevertheless, Group’s plan remains optimistic on the back of the Group’s cost optimization. Petrol plans for its operations to remain stable in 2023 and that the company’s net profit will be positive.

Based on economic forecasts, Petrol expects that the sales of petroleum product volumes will increase in 2023 compared to the plan from 2022. The Group should maintain its market share in electricity and natural gas sales in Slovenia. Further, it will actively increase its energy independence. Also, the company will continue its focus on cost efficiency.

Also, the company emphasized the main risks in 2023. Besides supply chain disruption, the company noted that potential risk is an intensification of petroleum products purchase conditions, even stricter regulation of the selling prices of energy commodities and overall uncertainty in sales to EU markets which are extremely volatile at the moment.

Overall, the Group expects to generate sales revenue of EUR 10.2bn in 2023. The Petrol plans to achieve mentioned sales revenue by selling 4.0m tons of fuels and petroleum products, 11.6 TWh of natural gas, 12.9m TWh of electricity (both trading and sales to end customers), 154.6 thousand MWh of heat and by producing 188.4 thousand MWh of electricity. Consequently, Petrol plans its EBITDA to amount to EUR 250.4m and its net profit of EUR 117.1m in 2023.

Further, Petrol’s investment policy in 2023 will be focused on business expansion in the field of renewable electricity generation, supply chain digitalization and the expansion of operations in the field of energy and environmental solutions. The company estimates EUR 75m for investments in 2023, which represents 55% of planned investment in the strategic plan.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 2 | 26.1.2023 | PETG | Petrol Supervisory Board Meeting: Discussion of business plan and key targets for 2023 | Slovenia |

| 3 | 26.1.2023 | KRKG | Krka Preliminary Results for 2022, Press Conference | Slovenia |

| 4 | 27.1.2023 | PETG | Petrol Business Plan and key targets for 2023 | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).