The Q1 2021 report will be published on 14 May 2021.

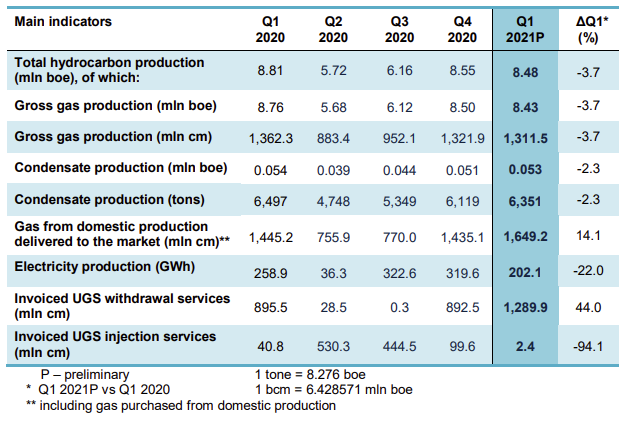

Romgaz published their preliminary KPI’s for Q1 2021, which can be found in the table below

The Q1 2021 consolidated financial results will be published on May 14, 2021. The information on this report may undergo changes and may differ from those that will be published in the Q1 2021 report.

Source: Romgaz

Ex-date is 7 June 2021, while dividend yield is 5.7%.

Nuclearelectrica published the resolutions from the GSM in which the shareholders approved the distribution of the net profit from 2020. To be specific, the shareholder approved a total value of the gross dividends in amount of RON 472.1m, which translates into a dividend of RON 1.565 per share.

We note that the ex-date is 7 June 2021, while dividend yield is 5.7%.

Dividend yield is 4.3%, while ex-date is 5 May 2021.

HT published the resolutions from the GSM in which the shareholders approved the distribution of the net profit from 2020. To be specific, net profit amounting to HRK 641.90m would be used for the pay-out of dividend to shareholders, while the remaining part of the net profit in the amount of HRK 61.9m would be allocated to retained earnings.

Such a dividend payment translated to HRK 8 per share, the same as paid in the previous year, while the pay-out ratio of Croatian Telecom Inc. stands at 91%.

Dividend yield is 4.3%, compared to the share price a day before the dividend proposal. Note that the ex-dividend date is 5 May 2021.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2008 – 2021)*

*compared to the share price a day before the dividend proposal