Last two weeks we have seen both ECB and FED decreasing their reference rates due to economic slowdown and slower than expected rise of inflation. While US economy still looks quite solid, last PMI data show that German economy could enter recession in Q3 which could drag the whole Europe down. In this article we are looking at the central banks in CEE and their last and expected actions on monetary policy.

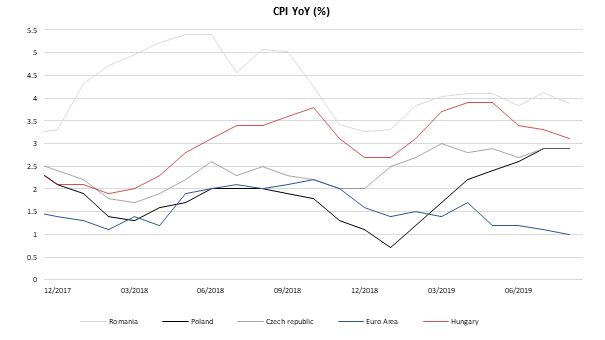

As we wrote in our article few weeks ago, CEE countries are still not showing real signs of weakness driven by slowdown among main trading partners in EU due to strong domestic demand. Demand is driven by increased disposable income of households but also due to solid rise of investment. Three out of four countries (besides Czech Republic) are among this years’ champions regarding GDP growth but also in rise of inflation hence central banks are on brink whether to follow ECB or to tighten their policy to curb inflation and preserve economy from overheating. As we have seen in the last two weeks, banks are mainly on hold, to see whether Euro Area slowdown is only temporary and what are going to be consequences of several geo-political challenges.

On Tuesday Hungarian central bank decided to stay on hold regarding rates but it raised the average amount of excess liquidity from HUF 200-400bn to HUF 300-500bn. In their statement they said that monetary policy stance will continue to be accommodative as previously symmetric risks to inflation became asymmetric in the last quarter due to slowdown in European economic activity. Despite central bank expects inflation to be above for 3.0% for the whole 2019 and maybe decrease towards their goal only after, the whole statement in general seemed rather dovish confirming its status as one of the most dovish banks in EU. Although some analysts expected central bank to comment moves on EURHUF, it seemed that bank wasn’t impressed with pair reaching new highs every day.

Polish central bank is also known as a dovish one as it didn’t move one meter when inflation surpassed its target of 2.5%. Central bank acknowledged that inflation could rise further in the beginning of 2020 due to fiscal policy but they expect it to come towards its goal in the second half of 2020 so there is no necessity to tighten its policy right away. After the last meeting (almost the same sentence as in Hungary) they stated that foreign risks are increasing while domestic economy stays strong, so rates are to “…remain at the current level which is conductive to keeping Polish economy on a sustainable growth path”.

Going south-east, yesterday we witnessed Czech central bank being slightly hawkish, leaving rates unchanged. In their presentation after the last meeting that occurred in August it was showed that bank expects rates to be hiked and then cut which was in Q&A explained as tactic of smoothing out the interest rate curve. Furthermore, last week Mr Holub stated that he can’t imagine debating whether to hold or cut rates as it should just be whether to hike or not. Although he is known as most hawkish official in Czech central bank, one could agree with his view bearing in mind inflation being at 2.9% in August, rapid wage growth, record low level of unemployment and EURCZK close to highs of last year (EM sell-off in June and July). In their statement from yesterday CNB said that risks to the current inflation forecast at the monetary policy horizon are in balance and slightly inflationary overall hence Bank Board discussed possibility of rising rates with two officials voting for hike. However, they decided to stay put and to return to the debate on the next meeting.

NBR made its moves last year when it hiked its reference rate several times to fight surging inflation driven by extreme fiscal easing. This year bank is on hold but occasionally, the governor comments that fiscal policy should tighten due to widening of both current and budget deficit and risks of overheating. As inflation decelerated in August from 4.1% YoY to 3.9% YoY and is expected to diminish further but at modest pace (still above target band of 2.5% ± 1.0%) , we do not expect central bank to change its rates this year but only to monitor Romanian Leu and its possible slippages due to political excursions.

Source: Bloomberg, InterCapital

For today, we decided to bring you a brief overview of the standard deviations of weekly returns of the SBI TOP components, in order to see their volatility since the beginning of the year.

We used candle stick charts to show the range of the returns. The thin vertical lines represent the maximum and the minimum weekly return, while the inner gold column represents the range of one standard deviation around the average return. Higher volatility means that the price of the security has changed significantly in both ways in the course of the year.

YTD Volatility of SBI TOP Constituents

When looking at the SBI TOP components, one can notice that the highest volatility was recorded by shares that usually record very low liquidity in the market. Therefore, the leader in volatility up to this point in the year was Intereuropa with a standard deviation of 8.6% followed by KD Group (4.8%).

Intereuropa also recorded the lowest single weekly return, amounting to -46.2% which occurred this week. The mentioned decrease occurred after the announcement that Pošta Slovenije concluded the agreement for the sale and purchase of shares of Intereuropa. The mentioned agreement was concluded with a consortium of banks which include SID Banka, NLB, Nova KBM, Gorenjska Banka, SKB and Banka Intesa Sanpaolo. According to the announcement, Pošta Slovenije will acquire 9,168,425 ordinary shares and 10,657,965 preference shares at a single price of EUR 1.45 per share.

Cinkarna Celje follows, with a single week return of -10.3%, which occurred in the week of the company’s ex-date. As a reminder, Cinkarna had the highest dividend yield of all SBI TOP components of 13%.

On the flip side, two components of the SBI TOP index recorded a double-digit single week return – KD Group (+21%) and Telekom Slovenije (13%).

As observable in the graph, Petrol and Sava Re observed the lowest standard deviation of 1.8%, followed by Krka with 1.9%.