Today we bring you an interesting overview of how long it would take to turn over the current free float of CROBEX10 components. To calculate this, we divided the current free float (all individual shareholdings lower than 5%) with the average daily volume recorded during the 9M period of 2020 (including block transactions). We excluded the 2 largest transactions for each individual share to exclude outliers.

With all of the company’s shares being considered as free float, Koncar tops the list as the company which would take the longest amount of time to turn over the company’s free float. However, one should note that a high level of free float isn’t the only reason why the company topped the list, the other reason is also the fact that Koncar posted the lowest average daily volume of all the CROBEX10 constituents during the first nine months. Following Koncar, come two food companies, Podravka and Atlantic Grupa. While Podravka recorded 18 years needed to fully turn over their free float, Atlantic Grupa needs 17. The similarity can be contributed to the similar state of both companies as they are both operating at record low indebtedness and are similarly impacted by the coronavirus pandemic. Meanwhile, Adris’s preferred share recorded 13 years needed to fully turn over their free float, which isn’t surprising considering that the company has a high free float (95%) which takes a longer time to be fully turned over. HT also recorded a long amount of time needed, despite a lower free float of 45%.

Optima Telekom recorded the shortest amount needed to turn over all of their shares with only one year needed. This can be attributed to the high trading activity which the company generated amid the speculation about a potential sale.

Number of Years Needed to Turn Over the Free Float of CROBEX10 Components

When looking at the company’s market cap, HT tops the list with a free-floating market share of HRK 6.4bn. Note that this amounts to more than double the market cap of their closest follower, Podravka, whose current free float market share amounts to HRK 2.7bn. On the flip side Optima Telekom recorded the lowest free float market share value among the selected companies.

It is important to note that multiple factors have influence on the results presented above (i.e. the results for some companies would be different if we included large one-off transactions). However, this can serve as another interesting and rough overview of market liquidity.

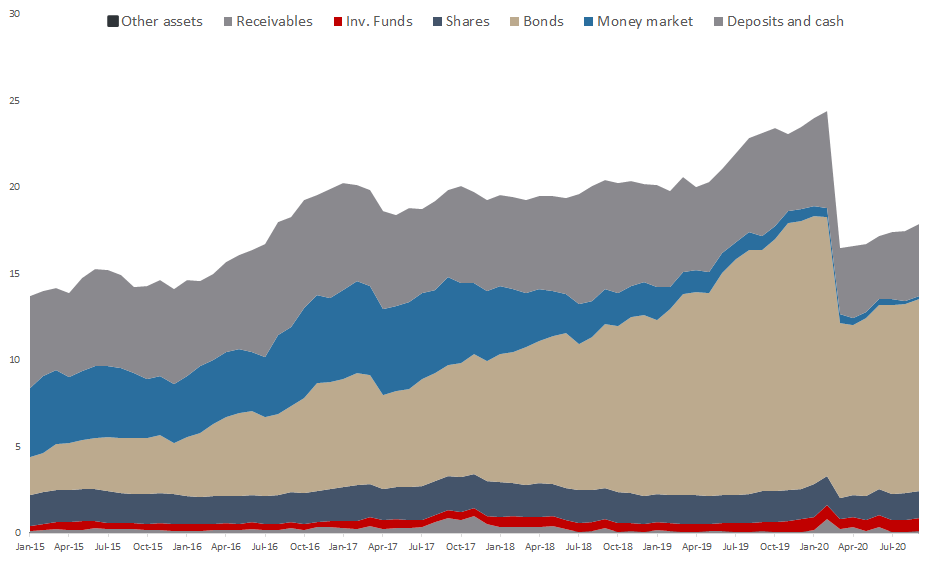

For today, we decided to present you with an updated asset structure analysis of Croatian UCITS funds.

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been affected by the ongoing Covid-19 situation.

As visible from the graph below, NAV of all funds has witnessed a steady increase for each consecutive month since April, and as of end September stood at HRK 17.269bn (+2.4% MoM or HRK 403.4m). This still represents a decrease of 23.5% YTD (or HRK 5.8bn).

As a reminder, in March, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in. As turmoil on financial market subsided withdrawals from funds were halted, but the value of most financial instruments has not yet returned to pre-crisis levels.

The biggest decrease of a YTD basis was observed in bond holdings, which decreased by 28% or HRK 4.4bn. Meanwhile shares observed a decrease of 11% or HRK 204.2m.

On a MoM basis, Bonds observed the highest increase of HRK 165.93m or 1.5%. Despite the negative sentiment observed on the global equity markets, equity holdings increased by 3.1% or HRK 46.9m. We note that 93% of that increase came from foreign equity holdings.

Asset Structure of UCITS funds (September 2020)

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not significantly changed their composition, which can be seen in the graph above. Since the beginning of 2020, we witnessed a considerable decrease of bonds in the assets structure which went from 65% in January 2020 to as low as 59% (April), while as of September 2020 bonds take up for 62.1% of the total assets. Such a decrease could mainly be attributed to the above-mentioned withdrawals from funds which (predominantly) invest in the mentioned asset class. Of the aforementioned bond holdings, domestic government bonds account for 42.3% of the total assets under management (or HRK 7.555bn) which is the single largest item of UCITS funds.

Shares have observed a gradual increase in total assets since February, and currently account for 8.9% of the total assets (or HRK 1.581bn). Note that domestic shares account for 28.5% (or HRK 450m) of the total equity held by Croatian UCITS funds. Domestic equity holdings are down by 24.9% YTD, representing a decrease of HRK 149m.

Total Assets of All Croatian UCITS Funds (2015 – September 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

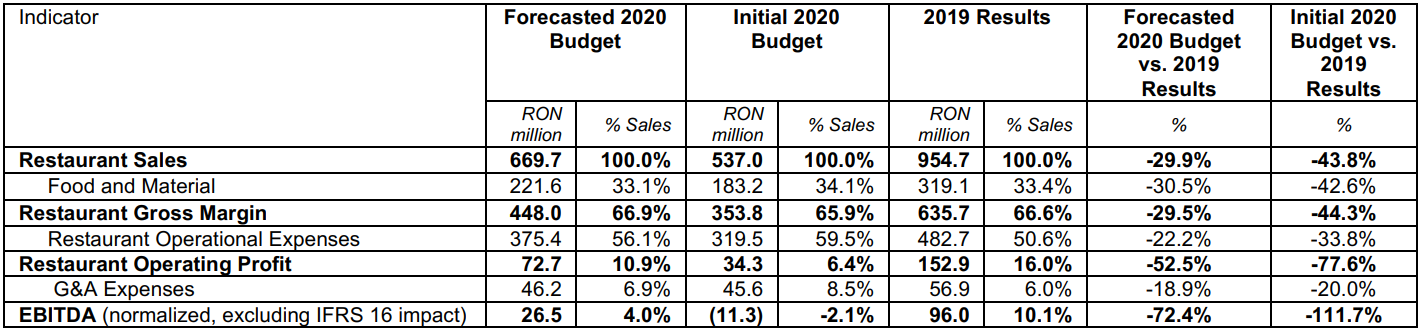

In 2020 the company is expecting to witness a decrease in sales of 29.9% YoY, to RON 669.7m.

Sphera Franchise Group published their Forecasted 2020 budget on the Bucharest Stock Exchange.

The company notes that following the measures taken by the management as a response to the COVID-19 pandemic and the gradual restrictions introduced by authorities regarding the operation of restaurants in Romania, the results of Sphera Franchise Group have recorded a net positive evolution. Therefore, the Company shared the updated forecasts for full year 2020. Sphera notes that new forecasts are much closer to the operational reality than the budget adopted by the Ordinary General Meeting of Shareholders in May 2020.

Source: Sphera Franchise Group

As visible from the table, the company is expecting to witness a decrease in sales of 29.9% YoY, to RON 669.7m. Meanwhile, normalized EBITDA us expected to observe a decrease of 72.4% YoY, to RON 26.5m. Such a result would put the EBITDA margin at 4%.

In the first half of 2020, Sphera was one of the most affected of all BET constituents by the Covid-19 pandemic. The management has previously refrained from providing any updates to the budget or guidance. The new forecasted budget reflects the positive evolution of the company since the lifting of the state of emergency in Romania, the primary market of the activity of Sphera Franchise Group, as well as in Italy.

The company further notes that following actions implemented by the management in the past 6 months have helped improve the performance of the Company: extension of delivery services, improvement of menus, redesigning client and production flows, analysis and improvement of cost and cost structures.