Last two weeks we witnessed significant safe heaven demand as equity markets are seeing bear markets and investors price recession. Yields on US treasuries fell strongly while bund trading was mixed due to hawkish comments. In this brief article, we are looking at the most recent macro news and consequences for bond markets.

On May 9th, yield on US10Y paper went up to 3.2% as bond investors threw the towel as inflation kept rising and Fed kept increasing its hawkishness. However, only two weeks later, yield on the same paper stood at 2.70% i.e., 50bps lower as fear of recession started to push investors into safe heaven assets such as US treasuries. This week we saw several high indicators showing that economic slowdown is already here while new home sales was the largest miss with 591k new sales (annualized) versus 748k expected and 763k in March. One should not be surprised with slower home sales as the monthly payment for an average home increased from USD 1.245 in 2021 to USD 1.991, reflecting an increase of 60%.

For the last few months, the rhetoric on the market was clear. Fed will be tightening monetary policy as long as inflation numbers are way off their target of 2.0% or until financial markets are not showing any signs of weakness (Fed put). Equity indices were falling, and bonds were falling together with them. However, below 4.000 level for SPX index, it seems that a negative correlation between equity and US treasuries is here once again as investors bet that Fed’s put is close and that Fed will not be able to lift rates as much as markets calculated once the economy tanks in recession in this or next year. All in all, investors poured their money into US treasuries for the last two weeks and 10Y paper is almost 50bps below highs while 2Y paper currently yields 2.50% versus above 2.80% in the beginning of May. Also, it is worth noting that this week we saw a comment from Atlanta Fed Raphael Bostic who said that a pause in rate hikes in September might be justified while Esther George said that after the Fed pushes rates to 2.0% in August it could see inflation decelerating. In case inflation does not decelerate as both Fed’s doves hope for, Fed will most likely have to hike its rates much higher which would lift yields and harm the economy and push investors in bonds and so on.

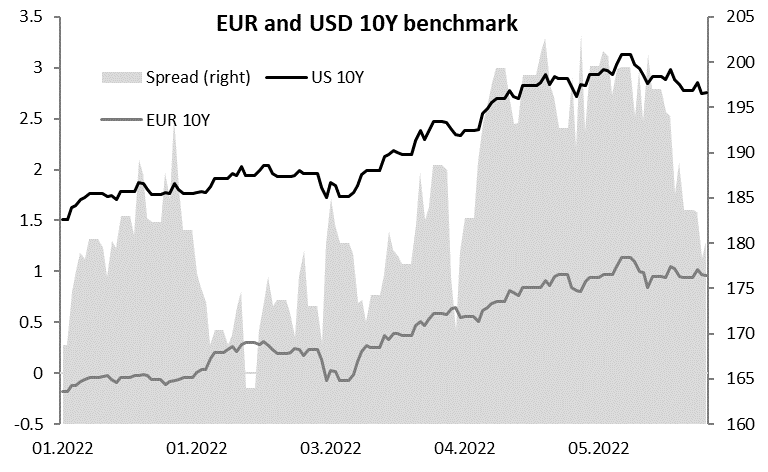

On the other side of the Atlantic we have seen a bit different picture as it is 2021 once again. Namely, ECB’s officials started to communicate way more hawkish than before as inflation in Europe is even more “scarier” than in US due to the energy embargo. Klaas Knot said that 50bps hike in July is not off the table while French governor said that rate hikes in both July and September are very likely. Also, Ms. Lagarde in one of her speeches this week said that rates are expected to be at zero or slightly above until the end of third quarter of 2022. To see how central banks’ stance changed in just half a year period, see Ms. Lagarde’s presentation after the last monetary policy meeting in 2021 on which she said that lifting rates in 2022 is highly unlikely. So, one should not be surprised if markets do not believe ECB’s governor once she says that lifting will be gradual and there is some pricing in June’s hike also. On their recent comments, the market reacted as one would expect, yields on short-term papers went up while they finally managed to lift EURUSD rates from its lowest level in years. Looking at the spread between EUR and USD 10y benchmarks one could see that bund trading was quite unclear compared to US papers, as spread tightened by almost 20bps. Nevertheless, very high levels and strong risk-off sentiment eventually managed to push bunds a bit higher in price, meaning that yield went below 1.0%.

Source: Bloomberg, InterCapital

By the end of April 2022, the NAV of Croatian Mandatory Pension Funds amounted to HRK 131.4bn or EUR 17.5bn, an increase of 5.5% YoY.

The Croatian Financial Services Supervisory Agency (HANFA) has published its monthly report on the developments of the Croatian mandatory pension funds. Looking at how well they performed and what changed in their asset structure can give us a good overview of how the Croatian capital market is doing, as these pension funds hold a significant share of investments in the market.

The NAV of the pension funds stood at HRK 131.4bn (EUR 17.5bn) in April 2022, which means that it grew by 5.5% YoY, but decreased by -0.5% MoM. Furthermore, net contributions into the funds amounted to HRK 670.6m, or HRK 2.58bn since the beginning of 2022.

Mandatory pension funds AUM structure change (HRKbn, January 2018 – April 2022, %)

Taking a look at the asset structure of the pension funds, bond holding still represent the largest share of the total, at 64.2% (or HRK 84.4bn), an increase of 0.8 p.p. MoM, but still a decrease of -0.1 p.p. YoY. Next up we have shares, which amounted to 20.6% (or HRK 27.1bn), and decreased by -0.36 p.p. MoM, but increased its share by 0.9 p.p. YoY. The only other asset class with over 10% of holdings, i.e. investment funds at 11.7% (or HRK 15.3bn) decreased by -0.19 p.p. MoM, but grew by 1.5 p.p. YoY.

As April was a period of relative calm in the equity market as compared to March and February (and especially the end of February), investments into bond holdings, which are perceived as some of the least risky assets, increased. The focus on less risky assets is also evident if we look at deposits and cash, which amounted to HRK 4.4bn (or 3.4% of total) in April 2022, an increase of 0.2 p.p. MoM, but a decrease of -1.3 p.p. YoY.

As the current geopolitical situation is making the inflationary pressures even worse, there is an expectation that ECB (like the Fed) will start raising interest rates, somewhere in H2 2022. As such, the investments into riskier and more volatile asset classes like shares are expected to continue decreasing, a trend we have seen for the last few months.

Current mandatory pension funds AUM (April 2022, %)

Dividing the holdings into domestic and foreign holdings, we can see that domestic bond holdings account for 94.3% of total bond holdings, a decrease of 0.6 p.p. MoM. On the other hand, domestic equity holdings accounted for 58.3% of total equity holdings, a decrease of 1.5 p.p. MoM.