Recently a few regional banks issued their bonds and one term that has been making waves – MREL, standing for “Minimum Requirement for Own Funds and Eligible Liabilities.” It may sound complex but fear not. In this blog, we will break down the basics of MREL, shedding light on its importance for banks and the overall financial system.

The Pillars of Bank Resilience

At its core, MREL serves as a safety net for banks during times of financial distress. Think of it as a two-fold requirement that banks must meet: having enough of their own funds and maintaining eligible liabilities that can absorb losses. These twin pillars work together to ensure banks can bounce back without relying on taxpayer bailouts. In the simplest terms, MREL is a regulatory measure saying that banks need to have collateral in case everything goes south.

- Own Funds: The Sturdy Foundation

First, let’s talk about own funds. These are the financial cushions that banks create to weather unexpected losses and sustain their operations. We’re not talking about just any funds here – we’re referring to the strong and resilient ones. Common equity tier 1 capital and additional tier 1 capital are the superheroes of own funds, known for their ability to absorb losses like champs.

- Eligible Liabilities: The Flexible Safety Net

Now, let’s shift our focus to eligible liabilities. These are the debt instruments issued by banks that can come to the rescue in a resolution scenario. Picture them as a safety net that banks can rely on when things get tough. These liabilities, such as specific types of senior unsecured debt and subordinated debt, can be converted into equity or written down if the bank faces insurmountable difficulties. Therefore, those debt instruments are cheaper than financing pure capital and can even be considered straightforward “cheap” – again, especially compared to equity.

One size does not fit all when it comes to MREL. Each bank’s requirements are tailor-made, considering factors like size, complexity, business model, and risk profile. This individualized approach ensures that banks maintain an appropriate level of resilience. The calculation of MREL is a collaborative effort between the bank, the resolution authority, and the central bank, all working together to set realistic targets.

Complying with MREL is not just a box-ticking exercise. Banks failing to meet their targets face serious repercussions. Regulatory sanctions, such as limitations on dividends, bonuses, and distributions, come into play. Moreover, resolution authorities may step in to ensure banks take necessary actions, like raising capital or issuing eligible liabilities, to bridge any gaps.

MREL development during Q4 2022

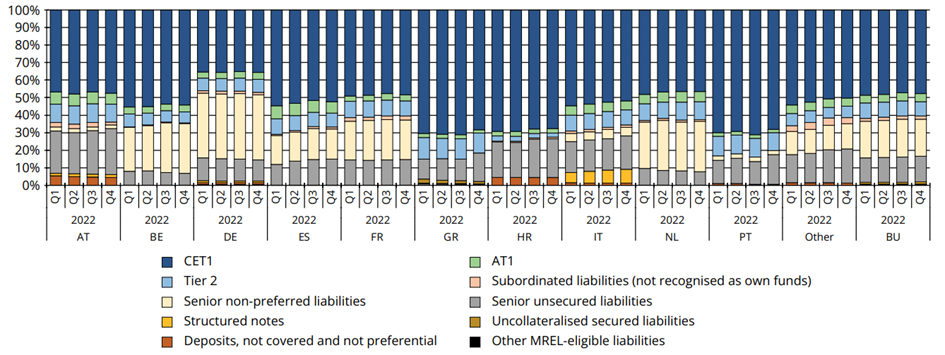

The average MREL target for banks under all strategies and tools rose compared to Q3 2022. Overall, the level of own funds and eligible liabilities (MREL resources) remained broadly stable compared to the previous quarter, while being slightly higher compared to Q4 2022. Also, the composition of MREL instruments remained broadly stable compared to the previous quarter and the previous year. However, the share of senior unsecured liabilities increased as a result of the issuance activity during the quarter.

We note that senior unsecured liabilities accounted for 15% of the overall MREL resources, while the share of senior non-preferred liabilities amounted to 21% of the total. Finally, it should be emphasized that non-covered non-preferred deposits continue to account for <1% of total MREL resources. Nothing major occurred in this category, which should offer some reinsurance.

Regarding maturity, almost 50% of total MREL resources are of a perpetual nature, while 40% with residual maturity between two 2 and 10 years.

MREL composition by country

Source: SRB Publication May 2023, InterCapital Research

MREL is an essential part of a broader regulatory framework designed to bolster the stability of the banking sector. It works hand in hand with capital adequacy requirements, liquidity standards, and stress testing. These regulations collectively strengthen banks, inspire investor confidence, and safeguard the wider economy from the risks associated with bank failures.

To sum up, MREL’s regulatory framework ensures banks have the necessary tools to weather storms and recover without resorting to public funds! By maintaining a robust level of own funds and eligible liabilities, banks contribute to a resilient financial system that can stand firm in the face of challenges. So, the next time you come across MREL, remember the two pillars: own funds and eligible liabilities.

As a reminder, at the last GSM meeting, the shareholders of the Company approved the payment of EUR 55m of the distributable profit, which would amount to a dividend of EUR 2.75 per share or a DY of 3.9%.

On Friday, NLB went ex-date, meaning that the approved dividend payment of EUR 2.75 per share would no longer be accessible to new investors. During the day, the stock decreased by 2.1%, which is less than the DY of 3.9%. The payment date for the dividend is set for 27 June 2023.

It should be noted that this dividend payment is half of the EUR 110m the Company expects for 2023, as outlined in their outlook. As such, there should be a 2nd dividend payment happening, somewhere in the second half of 2023.

Below we provide you with a historical overview of the Company’s dividends per share and dividend yields.

NLB Dividend Per Share (EUR) and Dividend Yield (%) (2019 – 2023)

Source: NLB, InterCapital Research

On Friday, Adris Group shares went ex-date. ADRS decreased by 2.1%, while ADRS2 decreased by 0.7%.

On Friday, ADRS and ADRS2 went ex-date. Adris’ regular share price decreased by 2.1%, while the preferred share price decreased by 0.7%, both less compared to their DY.

As a reminder, on 20 June, Adris held its GSM where the company announced that the company will pay out a dividend of EUR 2.35 per share, out of the retained earnings in the period from 2005 to 2011. Shareholders approved a dividend of EUR 2.35 per share (for both regular and preferred share). Note that, dividend yield for regular shares (ADRS) is 3.7% and dividend yield for preferred shares (ADRS2) is 4.1%.

In the graphs below, we are bringing you the historical overview of the company’s dividend per share and dividend yield. Note that the yields were calculated based on the closing price the day before the initial dividend proposal.

Adris grupa dividend per share (EUR*, left) and dividend yield (%, right) (2013 – 2023)

Source: Adris Grupa, InterCapital Research

*Converted using CNB’s EUR/HRK exchange rate for the periods in question

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 23 | 28.6.2023 | TLSG | Telekom Slovenije ex-date | Slovenia |

| 24 | 30.6.2023 | TTS | Transport Trade Services 2022 ESG Report | Romania |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

*Ex-dates present here also include companies that haven’t yet held the GSM meeting, and thus the approvals haven’t been made yet.