Last week we participated at the annual conference of the Zagreb Stock Exchange in Rovinj. As a part of the conference, a panel titled „How to Increase Free Float of The ZSE Listed Companies“ was held. Consequently, here are brief takeaways from the panel.

The panellists were: Mr. Darko Brborović (Advisor, OTP Bank), Mr. Stjepan Čuraj (State secretary at Ministry of Finance), Mr. Nikola Dujmović (CEO, Span) and Mr. Andrija Hren (CIO at Erste Mandatory and Voluntary Pension Funds Management Company). Meanwhile, the panel was moderated by Mr. Matko Maravić (CEO, InterCapital Securities).

The opening presentation emphasised some important points, noting that the perception of investors is that the relatively low levels of liquidity can be mostly explained by the lack of new listings on the ZSE. On the other hand, the potential issuers are discouraged by that same low liquidity, which leads to new issues and capital (investments) shifting towards foreign markets.

From the first glance, ZSE’s relatively large market cap compared to Croatia’s GDP does not seem to be the issue/challenge, especially given that its stands at c.34%. This does definitely seem low for a frontier classified market. However, that such a figure does not necessarily depict a completely „accurate illustration“ of the ZSE. If we were to look at the market cap to GDP without companies which do not satisfy the free float criteria (exclude companies with less than 15% of free float), we reach a figure of 15%. This stated figure could be considered as “real” market cap/GDP and it only shows that there are many large cap companies whose shares are being held in the hands of only a few large shareholders. At the same time, if we were to then look at the free float “real” market cap /GDP, we would reach a figure of only 9%. And of those 9%, roughly one third is being held by mandatory pension funds.

The presentation also touched upon the listed companies, noting that there are currently close to 100 of them on the ZSE. However, almost 70% of them have an average daily turnover of less than EUR 2k, indicating that the majority of listed companies are basically “inactive”. Additionally in the last 5 years, the ZSE has seen 16 new listings (none of which were large cap listings), which have witnessed a turnover of HRK 90m in the past 1 year. Of that, SPAN (which has been listed for only a month) and 2 ETFs account for more than 80% of the turnover.

The above stated leads to a conclusion that in order to increase the free float and liquidity of the market, ZSE definitely needs a large cap listing. Virtually all panellists have agreed with the mentioned, while most have pointed to the State, arguing that the large listing from a State would be beneficial for all market participants.

The panellists have also agreed that the ZSE both needs a top down and bottom up approach when it comes to new listings, meaning that besides the mentioned state listings the exchange needs also more new products and “interesting stories” such as the ETFs listed in November of 2020. The panellists have also agreed that the market needs more equity coverage and that there needs to be a higher emphasis on general interest for stock exchange investing.

Additionally, almost all panellists have agreed that the capital gains tax introduced back in 2016 negatively affected ZSE’s liquidity and agreed that such tax should be abolished, especially for small (retail investors). The State secretary has noted that the tax was reduced from 12% to 10% in 2021 and noted that the tax abolishment itself is not sufficient to lead to higher liquidity levels on the ZSE. Some have partially disagreed, stating that the tax per se is not necessarily high (or low), but that the process regarding the tax filing is tedious and is discouraging investors from short term trades.

As of end September 2021, NAV of Croatian UCITS funds stood at HRK 21.5bn (+24.6% YoY).

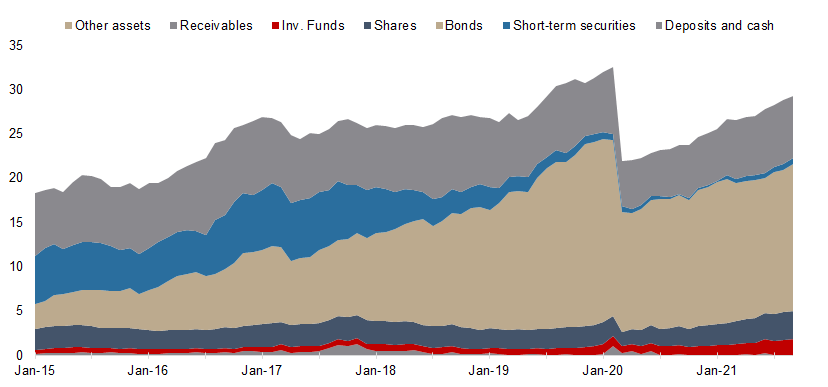

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing since the beginning of 2021. As visible from the graph below, NAV of all funds has witnessed a steady increase for 18th consecutive month, and as of end September stood at HRK 21.5bn (+1.7% MoM or +24.6% YoY).

The biggest absolute increase on a YTD basis of AUM was observed in deposits and cash, which grew by HRK 827.9m (+19% ). Bonds followed with HRK 766.3m (+6.5%). Investment funds recorded an absolute increase of HRK 544m (+69%). On a MoM basis, bonds and shares have observed the highest absolute increases by HRK 456m (+4%) and HRK 53m (+2.3%), respectively.

Looking at the asset composition of Croatian UCITS funds, investment funds have noted a slight increase in total AUM by 1.9 p.p. YTD and currently account for 6% of the total AUM, which is over 10y average of 2.9%.

We also note that domestic shares account for 26.3% of total equity holdings. Domestic equity has so far in 2021 seen a 22.2% YTD increase, while foreign equities have observed a 40.4% YTD increase.

Bond holdings continue to be the largest asset class of Croatian UCITS funds accounting for 56.8% of the total AUM. This represents a decrease by as much as 5.4 p.p. YTD. We note that the shift in structure comes from the increase of other asset classes like shares, investments funds, loans on money market. Bonds remained relatively flat YTD with its assets amounting to HRK 12.5bn (EUR 1.6bn).

Total Assets of All Croatian UCITS Funds (2015 – September 2021) (HRK bn)

Source: HANFA, InterCapital Research

Net contributions in September amounted to HRK 493.6m, reaching a total of HRK 3.1bn YTD. Investments have increased significantly in 2021 as net contributions in September are up 39% MoM and 49% YoY. When comparing with pandemic year of 2020 when net contributions were in 9M 2020 at HRK -5.6bn, strong improvement is evidenced in this year. In 9M 55% of net contributions went to bond funds, namely HRK. 1.7bn. Other type of investment funds grew to become a sought-after category as net contributions amounted to HRK 568m.