This year we have seen several rounds of inflation and recession ‘fights’ that push rates in the opposite direction. For the last few weeks, inflation rhetoric has been all around us with natural gas in Europe going wild and yields are once again marching higher. In this article we are looking at the latest macro news and what to expect from central banks in the following months.

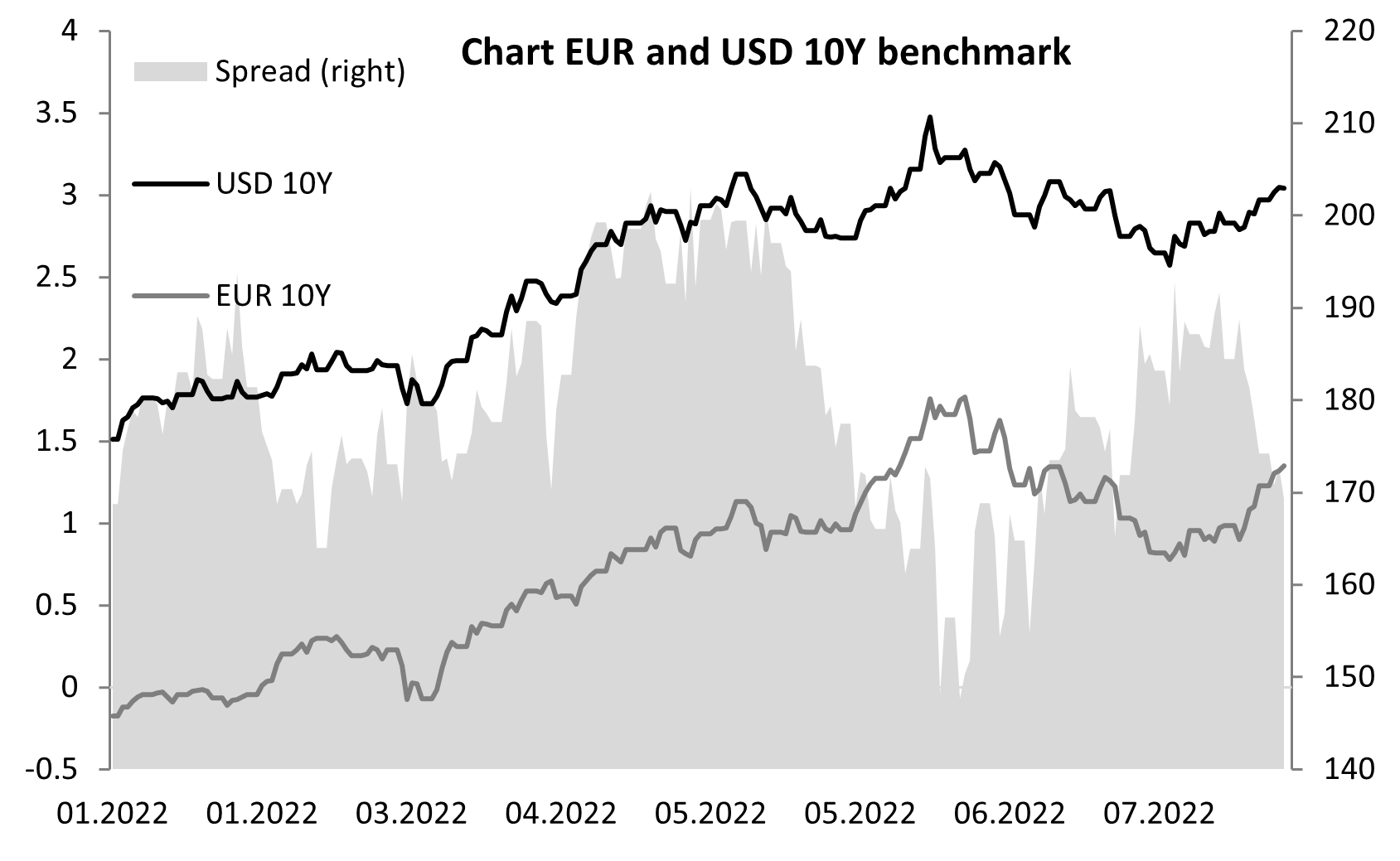

In mid-June, yields reached their peak (for now) as fear of higher inflation i.e., more, and faster rate hikes had driven investors to sell most of their fixed income assets. Nevertheless, this trend reversed with several economic data showing that recession is almost inevitable and market participants started to price that central banks will have to decelerate their pace of hikes and cut rates in the US already in March 2023. On top of that, many long only managers were underinvested in bonds while traders were net short, which had driven the race for the last bond – the story we have seen for the last few summers. Scare of recession and positioning pushed yields on the EUR 10Y benchmark from 1.90% to below 0.70% in the 45 days while many rate hikes were erased from 2023.

However, every summer must end, and summer for bondholders ended at the beginning of August, with the bond sell-off accelerating since then. The drivers were rather obvious. Despite CPI data in the US showing that the YoY CPI peak could be behind us, the inflation story is all but over. Yes, prices of many commodities have fallen significantly, and oil is trading around USD 90 per barrel (WTI) but the service sector has been showing more and more pressure in terms of prices. So, the market once again decided to swing to the inflation side with the same 10Y EUR benchmark we mentioned before reaching the 1.38% level yesterday after being at 0.70% at the beginning of the month, meaning that bund futures have fallen by 900 pips in terms of three weeks!

We saw several senior market analysts saying that they have never seen the market being so polarized with one camp believing that a strong recession will dampen inflation and force central bankers into looser monetary policy while the other camp believes that inflation could decelerate but still to the levels way above central banks’ targets and CBs will have a tough call but will choose their primary objective (only objective for ECB) and leave rates higher for longer.

As we said before, in July we saw data showing that price pressures eased across the globe due to energy falling below peaks but the situation in Europe with prices of natural gas and electricity seems to be quite different than all the others as utility prices for companies could go up by almost ten times. This does not represent inflation worries anymore but state emergency and full economic worries. However, we still have not seen any European country with concrete measures besides the instructions to reduce energy usage. There are several options and none of them seems to be perfect for the European economy. The first one is to leave the market to go on its own, which would force many companies into bankruptcy while the European economy would go into a deep recession. Another option for the EU is to give some allowances to companies and households but that will come at the cost of more inflation and larger deficits.

The reality will be somewhere in between, meaning that we will see even more polarization in market participants. This means even more swings in bond markets at least until ECB decides what is their priority and how it will deal with it. Now, we think that the market is right pricing the terminal rate in Europe at 2.0% and we think that central bankers will leave rates for longer this time to be sure that double-digit inflation is behind us, even with the large cost for the economy.

Chart 1. EUR and USD 10Y Benchmark

Source: Bloomberg, InterCapital

In H1 2022, Telekom Slovenije recorded a sales revenue decrease of 1% YoY, an EBITDA decrease of 1.3% YoY, and a net profit of EUR 23.4m, an increase of 9.5% YoY.

Starting with the sales revenue, it amounted to EUR 314.2m, a decrease of 1% YoY. Telekom Slovenije recorded growth in financial services, eHealth service, and insurance segments. In Slovenia, Telekom Slovenije recorded a sales revenue of EUR 280.3m, representing a decrease of 3% YoY, while other companies in Slovenia recorded a sales revenue of EUR 36.5m, a decrease of 96% YoY. Meanwhile, internationally, Telekom Slovenije’s subsidiaries recorded higher market revenues, with IPKO Kosovo’s revenue amounting to EUR 36.5m, an increase of 16% YoY, while other companies abroad increased their revenue by 1% YoY. This was driven by the increase in revenues from international voice services.

On the other hand, revenues from the mobile segment of the end-user market were down due to the optimization of subscribers whose basic subscription fee includes an increasing number of services. Revenues from the fixed segment of the end-user market were down primarily due to a declining number of traditional connections and lower revenues from the sale of fixed merchandise, resulting in lower costs. Furthermore, Telekom Slovenije stopped selling electricity to end users (starting 1 January 2022), which can be seen in the revenues.

Operating expenses amounted to EUR 285.4m, a decrease of 2% YoY. Breaking this down further, COGS decreased by 4% YoY, and amounted to EUR 40.3m, costs of materials and energy increased by 37.8% YoY, and amounted to EUR 10.6m, cost of services decreased by 4.7%, and amounted to EUR 98.6m, while labour costs increased by 6.6% YoY, and amounted to EUR 53.3m. EBITDA amounted to EUR 112.2m, a decrease of 1.3% YoY, mainly as a result of higher energy and electricity prices. This would also mean that the EBITDA margin amounted to 35.7%, a reduction of 0.1 p.p. YoY.

Moving on, the net financial result amounted to a negative EUR 3.3m, a 5.4% improvement, mainly as a result of lower financial expenses. Income tax remained roughly the same YoY, while the net income amounted to EUR 23.4m, an increase of 9.6% YoY. Total investments amounted to EUR 77m, a decrease of 48% YoY, mainly as a result of lower investments in Telekom Slovenije, a reduction of 60%. This is due to the fact that in 2021, the acquisition of the radio frequency spectrum in the amount of EUR 52.1m was made, increasing the investment in 2021.

Telekom Slovenije key financials (H1 2022 vs. H1 2021, EURm)

The Company also commented on the impact of the Russian-Ukrainian conflict on its operations. Telekom Slovenije is not directly linked to the Russian and Ukrainian markets. Due to this, they assess that the conflict will not have a significant impact on the Company’s cash flows and financial sources. Indirectly, however, the Company is impacted by rising energy and electricity prices, as well as some risks in the supply chain. The Company is monitoring the situation closely. At the same time, they commented on the increased risks in the area of cyber security and said they are focused on ensuring a higher level of security, reliability, and confidence, in the management of the said risks.

Finally, Telekom Slovenije also outlined its key objectives for 2022. According to the Company, they estimate an operating revenue of EUR 660.6m, an EBITDA of EUR 211.2m, a net profit of EUR 27.9m, and investments in the total amount of EUR 203.1m.

By the end of June 2022, the total loans of the Croatian financial institutions amounted to HRK 296.2bn, an increase of 6.4% YoY, and 0.5% MoM.

The Croatian National Bank (HNB) has published its latest monthly report on the changes recorded by the Croatian financial institutions recently. As can be seen in the report, by the end of June 2022, the total loans of all financial institutions amounted to HRK 296.2bn, representing an increase of 6.36% YoY, and 0.52% MoM.

Taking a look at the household loans (the single largest segment of the loans), in June 2022, they increased by 5.4% (or HRK 7.53bn) YoY and 0.94% (or HRK 1.37bn) MoM. Meanwhile, corporate loans increased by 12.1% YoY (or HRK 10.4bn), 0.33% MoM (or HRK 313m), and amounted to HRK 95.8bn.

Corporate and household loans growth rate (YoY, %)

Overall, the loans issued to households at the end of June 2022 equaled HRK 146.4bn. Breaking this down by categories that drove the increase, housing loans still remain the main driver of growth, increasing by HRK 6.4bn YoY (or 9.9%), while on a monthly basis, they increased by HRK 1.2bn or 1.7%. Housing loans also retain their position as the largest segment of household loans, at app. 48.7%, representing an increase of 1.97 p.p. YoY, and 0.37 p.p. MoM. Meanwhile, the 2nd largest category of household loans, i.e. consumer loans, accounted for 37% of the total household loans, growing by HRK 1.49bn or 2.84% YoY, and HRK 138.8m, or 0.26% MoM.

The 3rd largest category of household loans, other loans, increased by HRK 103.5m (or 1.15%) YoY and amounted to HRK 9.1bn. On a MoM basis, these loans remained roughly the same, and are currently accounting for 6.24% of the total household loans, representing a decrease of 0.26 p.p. YoY.

In July Croatia experienced the highest inflation rates in the country’s history being recorded (link) and this is having a negative influence on the disposable income of Croatia’s residents. All the underlying factors influencing the inflation are not improving so it appears that the current inflationary environment is not transitory. Steady growth of consumer-loans is evidenced, while housing loans growth has accelerated. Despite inflation growth consumers are still not putting off buying cars and other expensive items. Still quite high growth of housing loans could be driven by borrowers rushing to lock in rates before they rise more. Positive sentiment is also coming from the businesses side, as in the first half of 2022 we have seen a flood of new applications and loans issued to corporates surged in July to 12.1% YoY. This is trend we expect to continue throughout this quarter, while deterioration in operating profitability could make them put on the break on new investments some time at the end of the year. However, the sentiment, at least when it comes to banks and loans issued is still quite positive, as can be seen with the increase in the largest loan categories. This could change, however, as higher interest rates which are expected by ECB will increase the interest rates on all loans issued, which could cool their growth.

Composition of Croatian loans to households (HRKm)

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 187 | 30.8.2022 | LKPG | Luka Koper dividend shareholders' record date | Slovenia |

| 186 | 31.8.2022 | UKIG | Unior Q2 2022 Results | Slovenia |

| 185 | 31.8.2022 | LKPG | Luka Koper dividend payment | Slovenia |

| 184 | 31.8.2022 | CICG | Cinkarna Celje Q2 2022 Results | Slovenia |

| 183 | 31.8.2022 | FP | Fondul Proprietatea Q2 2022 Results | Romania |

| 182 | 31.8.2022 | FP | Fondul Proprietatea conference call - Q2 2022 Results | Romania |

| 181 | 31.8.2022 | - | LJSE Investor Webinar, in partnership with InterCapital Securities | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).