In the most recent bond sell off induced by US CPI print and consequential FED speak, it was quite weird that our prospective buyers didn’t manage to get much bonds at significantly higher yields. Across the CEE board spreads are tightening. What do we make of this new regime? Find out in this brief research piece.

If you are puzzled about the current state of the financial markets, well at first so were we. On Tuesday afternoon Tesla reported 1Q2024 earnings and both top and bottom line came in below expectations (EPS @ 45 cents versus 52 cents; topline was about a billion USD below consensus estimate). However, the company also presented a colorful slide deck with forecasts about introducing new models nobody ever heard of and consequently the stock is now +11.8% up (162.13 USD versus 145 USD before the close Tuesday). At the same time, Meta reported earnings significantly above the consensus estimate (EPS @ 4.71 USD versus 4.30 USD consensus estimate) but is virtually flat versus the previous close.

Does this make any sense to you? Well, if you believe we’re in the narrative economics and if you were a close student of Aswath Damodaran, then maybe it does.

Here’s where things get really tricky. Bond yields are at a six-month high and gold prices are at an all time highs. How is that possible? Rumour from the dealing desks has it that Asian buyers are behind this, but we’re waiting for a plausible research piece from bulge bracket investment bank to confirm it. Either way, the old playbook of earnings-stock performance and bond/gold correlation has obviously been torn apart and new rules of the game are being settled down.

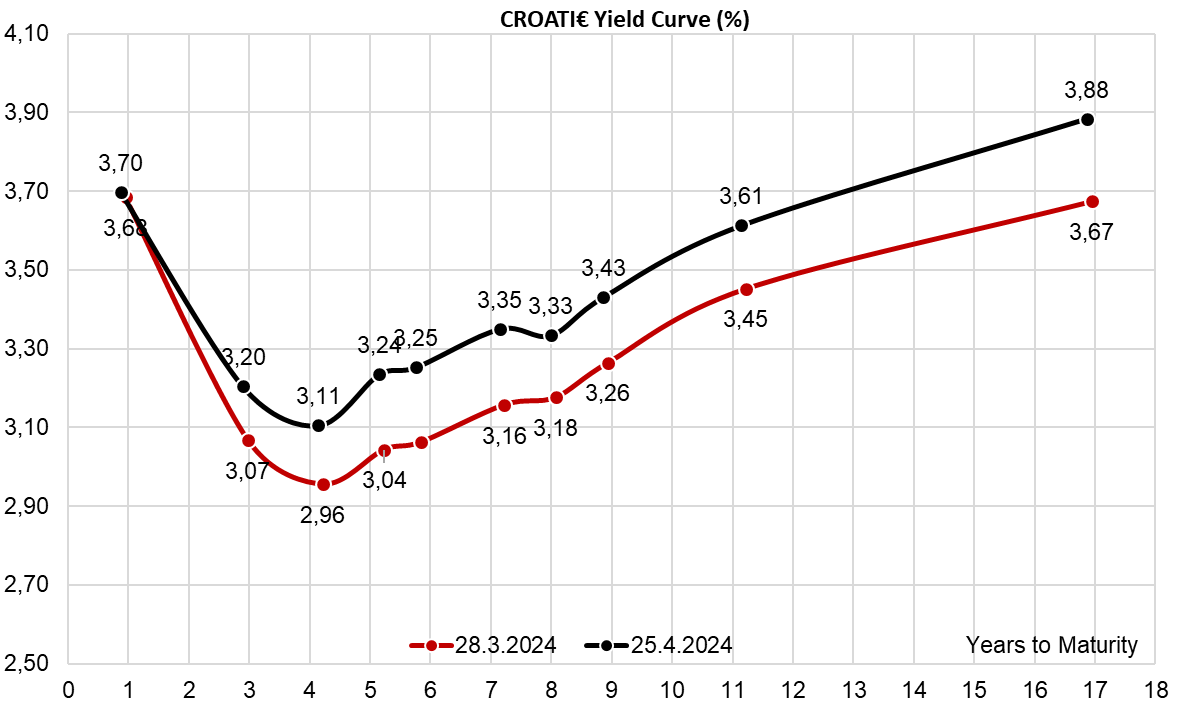

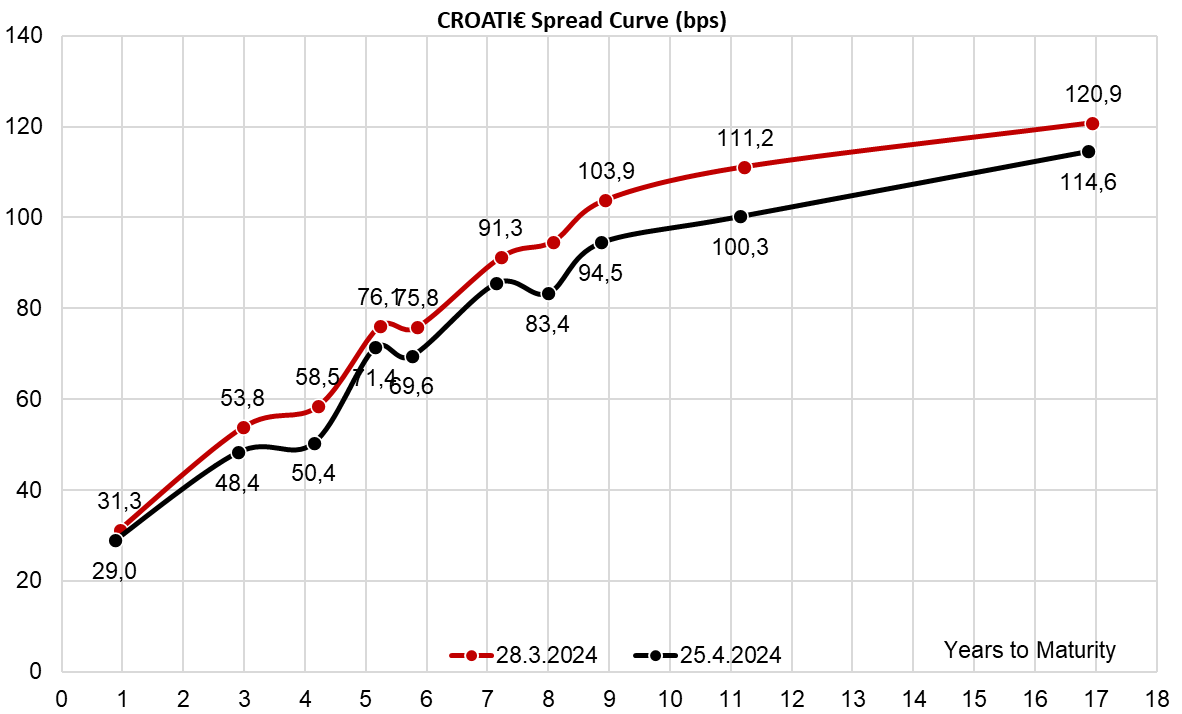

Now that we went through the context, let’s get to some of the finer details. Bond prices are at a 6-month low, however, the spreads appear to be trading tighter and rumors from dealing desks tell us that rise in yields was met with respectable buying interest from real money clients, preventing spreads from widening (take a look at CROATI€ spreads submitted above). Certain bonds such as POLAND€ are currently reporting a significant short interest, which is confirmed by anecdotal evidence of dealers asking around for POLAND€ through reverse repo. But actually, this is not such a surprise if you take a brief look at the two latest US treasury note auctions (2-year on Tuesday and 5-year on Wednesday). Speaking about the former, US Department of Treasury had no problem with placing 69bn USD of 2-year notes at 4.898%, which is lower than 4.904% before the auction. With a bid-to-cover of 2.66x (versus 2.62x on March 25th, 2.49x on February 26th and 2.57x on January 23rd) and primary dealers taking a record low of inventories, seems as if the bond market has drawn a cap for yields, at least for the time being. On the other side of the Atlantic, the ECB officials are not questioning the timing of the start of rate cuts, although they are still to come to terms with the aggregate number of cuts. All of this might be the reason why CEE€ investors tend to hold their assets and not participate in any additional sell off.

So what happens next? With US market pricing about 1.7 rate cuts this year (WIRP US submitted above), notice that market expectations are now below both median dot (3 cuts) and weighted average dot (2 cuts). Notice that according to the latest Summary of Economic Projections, median 2024 PCE inflation was expected to reach 2.4% this year and last month the read said 2.5% YoY; tomorrow BBG consensus expects a 2.6% YoY print, a close call. Speaking about Core PCE, FOMC median expects 2.6%, while BBG consensus expects to see 2.6% YoY tomorrow. Our point: PCE inflation is right where it’s supposed to be for the start of rate cuts. True, CPI came in a tad stronger, but not sufficiently to turn the narrative. Additionally, recent FED speak about the waiting game was probably targeting May meeting – and we agree, it’s too early to start or to telegraph rate cuts as soon as next week. On the other hand, there’s plenty of data until the next meeting in mid-June (two NFP prints, two CPI prints, two PCE prints). It’s very likely that Powell’s Q&A session will pledge data dependence, and when you take an unbiased look at the data, the narrative remains clear. So, yes, it makes perfect sense that CEE RM is not selling – but at spreads tight like this, it also makes very little sense to start buying as well.

At the share price before the announcement, this would imply a DY of 4.7%. The ex-date is set for 29 April 2024, while the payment date is set for 24 May 2024.

Yesterday, Valamar Riviera held its GSM meeting, during which several resolutions were approved. Firstly, Valamar Riviera approved the distribution of profit in the form of dividends. According to the resolution, EUR 0.22 DPS will be paid out from the retained earnings of the years 2016, 2019, and 2021, while 2023’s net profit will be transferred into retained earnings. At the share price before the announcement, this would imply a DY of 4.7%.

The ex-date is set for 29 April 2024, while the payment date is set for 24 May 2024. During the same meeting, the shareholders also approved the start of the new share buyback program, after the old one ended.

Below we provide you with the historical dividend per share and dividend yield of the Company.

Valamar Riviera dividend per share (EUR) and dividend yield (%) (2015 – 2024)

Source: Valamar Riviera, InterCapital Research

Yesterday, Transgaz held its GSM meeting, during which the dividend was approved. According to the resolutions of the GSM, RON 0.35 DPS has been approved for dividend payment, which at the share price before the announcement, implies a DY of 1.8%. The ex-date is set for 27 June 2024, while the payment date is set for 18 July 2024.

The General Assembly Meeting of Transgaz was held yesterday, 24 April 2024, during which the distribution of 2023’s net profit has been approved. According to the resolutions, out of the 2023 net profit of RON 168.4m, RON 65.9m will be paid out in the form of dividends, implying a payout ratio of 39%. On a per-share basis, this would imply a gross dividend of RON 0.35, implying a dividend yield of 1.8% at the share price before the announcement.

The ex-date is set for 27 June 2024, while the payment date is set for 18 July 2024. Below we provide you with the historical dividends per share and dividend yields of the Company.

Transgaz dividends per share (RON) and dividend yields (%) (2016 – 2024)

Source: Trangaz, InterCapital Research

Here you can find the dates for the upcoming events of the regional companies

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 35 | 26.4.2024 | ATPL | Atlantska Plovidba Board of Directors Meeting | Croatia |

| 36 | 26.4.2024 | ZVTG | Triglav Convocation Notice of the General Meeting of Shareholders on the distribution of profit | Slovenia |

| 37 | 26.4.2024 | SNG | Romgaz FY 2023 Audited Report | Romania |

| 38 | 26.4.2024 | ONE | One United Properties FY 2023 Audited Report | Romania |

| 39 | 26.4.2024 | TRP | TeraPlast FY 2023 Audited Report, General Meeting of Shareholders | Romania |

| 40 | 26.4.2024 | COTE | Conpet FY 2023 Audited Report | Romania |

| 41 | 26.4.2024 | TLV | Banca Transilvania General Meeting of Shareholders - second call | Romania |

| 42 | 26.4.2024 | SNN | Nuclearelectrica Annual report 2023 | Romania |

| 43 | 26.4.2024 | SNN | Nuclearelectrica Annual report 2023 Conference Call | Romania |

| 44 | 26.4.2024 | SFG | Sphera Franchise Group General Meeting of Shareholders | Romania |

| 45 | 26.4.2024 | SFG | Sphera Franchise Group Annual report 2023 | Romania |

| 46 | 29.4.2024 | KOEI | Končar Q1 2024 Results | Croatia |

| 47 | 29.4.2024 | ADPL | AD Plastik Q1 2024 Results | Croatia |

| 48 | 29.4.2024 | TEL | Transelectrica General Meeting of Shareholders | Romania |

| 49 | 29.4.2024 | H2O | Hidroelectrica Annual General Meeting of Shareholders | Romania |

| 50 | 29.4.2024 | FP | Fondul Proprietatea General Meeting of Shareholders | Romania |

| 51 | 30.4.2024 | HT | Hrvatski Telekom Q1 2024 Results, Conference Call for analysts and investors | Croatia |

| 52 | 30.4.2024 | ATPL | Atlantska Plovidba Q1 2024 Results and FY 2023 Audited Report | Croatia |

| 53 | 30.4.2024 | PODR | Podravka Q1 2024 Results | Croatia |

| 54 | 30.4.2024 | RIVP | Valamar Riviera Q1 2024 Results | Croatia |

| 55 | 30.4.2024 | ADPL | AD Plastik Q1 2024 Results Presentation | Croatia |

| 56 | 30.4.2024 | SNP | OMV Petrom Q1 2024 Results, Conference Call for Q1 2024 Results | Romania |

| 57 | 30.4.2024 | TEL | Transelectrica FY 2023 Audited Report | Romania |

| 58 | 30.4.2024 | WINE | Purcari FY 2023 Audited Report | Romania |

| 59 | 30.4.2024 | H2O | Hidroelectrica 2023 Annual Report | Romania |

| 60 | 30.4.2024 | DIGI | Digi Annual report 2023 | Romania |

| 61 | 30.4.2024 | FP | Fondul Proprietatea Annual report 2023 | Romania |

Due to the nature of these events, they are subject to change (might be postponed or canceled).