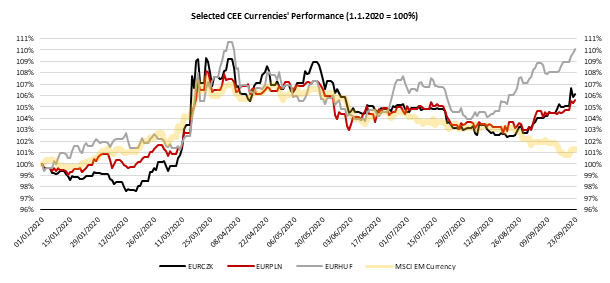

Since the beginning of September, we have witnessed significant depreciation trends of CEE currencies, especially CZK and HUF. What are the main drivers and what to expect next, read in this brief article.

In the last few weeks, we have seen equity markets dropping from their highs reached in the beginning of September, Mr Jerome Powell announced average inflation targeting while ECB’s meeting was a non-event. EURUSD lost some of its gains due to risk-off sentiment and speculations on another ECB cut. However, euro’s strength seems to start worrying ECB’s officials as it is becoming even harder to push inflation higher while eurozone’s economy does not have much forte from strong euro as well. Furthermore, we witnessed second wave of coronavirus in Europe which worries investors as some government’s are introducing new specific lockdowns.

Under mentioned circumstances, CEE currencies have lost their ground and are close to reaching levels seen in the mid-March when corona crisis fear was at its peak. Namely, EURHUF reached 365 yesterday while EURCZK breached 27.0 level, while peak stood at 368 and 27.8, respectively. It is worth looking into more details each currency and see what main reasons are.

Hungarian inflation rate rose to a decade high of 4.2% YoY last month while central bank cut its interest rates twice this year to 0.60% to fight corona crisis. Furthermore, Hungarian central bank in June still expected Hungary to rise by 0.3%-2.0% for the whole 2020 which was way too optimistic, especially when Q2 data came showing that economy lost 13.5% compared to same period in 2019. This week MNB finally admitted that economy is most likely to decrease between 5.1% and 6.8%. On the other hand, bank expects inflation to reach 3.5% level in 2021. Now, MNB is at the crossroad between helping the economy and fighting inflation and lower than expected forint. Although central bank had some success in fighting both in the last few months by increasing short-term interest rates and including FX-swaps on one side and QE program on the other, at the moment it seems that forint weakness and rise of inflation could become troubling meaning that central bank could choose stable prices as its first mandate. Their last paragraph in this week’s statement reveal that opinion. “In the Monetary Council’s assessment, the 0.60 percent base rate supports price stability, the preservation of financial stability and the recovery of economic growth in a sustainable manner. In the current rapidly changing environment, it is key to maintain short-term yields at a safe distance from a range close to zero.The Council remains committed to maintaining price stability during the coronavirus pandemic and pays particular attention to the persistence of inflationary effects arising as a result of the economic recovery. If warranted by a persistent change in the outlook for inflation, the Council will be ready to use the appropriate instruments.”. This means that in case recovery continues at the stable pace, MNB could end its QE program while increasing FX swap to curb over depreciation of the local currency. However, one should bear in mind rising cases of corona virus which could make it hard for economy to come to precrisis levels any time soon so there are tough times in front of Hungarian central bank.

Their neighbor, Czech national bank has similar problems as inflation is above CNB’s target and currency depreciated significantly while corona cases are rising at the highest pace since start of the crisis. In August, prices increased by 3.3% YoY compared to 3.4% in July and were above 2.0% ± 1.0% target band. Inflation seems to be bearable and some of the CNB’s officials expect it to come back to their target of 2.0% next year but new corona virus cases were not for Czech Minister of Health which resigned due to uncontrollable rise of new cases. Namely, Czech Republic in April had one of the lowest rates in Europe but today infections rates reversed, and Czech rates are among the highest in Europe. According to European Centre for Disease Prevention and Control, in the last 14 days, Czech Republic (218 per 100.000) stood at 4th place in whole Europe looking at the 14-days cumulative number of infections per 100.000 inhabitants. The data was enough for health minister to resign and new one to be appointed by prime minister Babiš. However, it is not clear how new health minister Mr Prymula plans to decelerate new infections as not long ago Mr Babiš vetoed restrictions on public gatherings. However, things change fast, as could be seen with ministers.

Back to CZK rate, it reacted significantly on higher infection rates, but it could be seen on the chart submitted below that the similar pace was seen with PLN as well. However, it was interesting to see at what pace did CZK lost its value this week, depreciating by almost 2.0% in a day, when health minister resigned. That was the third worst day for the local currency this year and such a strong move upwards in term of EURCZK will put CNB in the similar situation as MNB. Talking about CNB, yesterday it decided to leave interest rates unchanged at 0.25% and stated that interest rates should stay stable until mid-2021 followed by a gradual rise in rates. However, they did not comment specifically on CZK weakness besides saying that it probably lost some of its value due to deterioration of epidemiological situation. All in all, CNB did not give much support for CZK except saying that rates could be higher in the second part of 2021 but they still seem to be in ‘wait and see’ mode.

Source: Bloomberg, InterCapital

The value of the share capital of Nuclearelectrica that will result following this operation will be of RON 3.016bn.

Nuclearelectrica announced that on 22.09.2020, the Board of Directors of the company acknowledged and validated the subscriptions made within the share capital increase procedure, conducted by the company in the period 17.08.2020 – 16.09.2020.

The Board of Directors of Nuclearelectrica found that on 17.09.2020, at the end of the subscription period, on behalf of the holders in Section 2 of the Central Depository, a number of 16,186 allocation rights-SNNR03 exercised their preferential rights. There were no subscriptions in Section 1.

Therefore, in Sections 1 and 2, the following allocations took place:

- a number of 113,857 new shares, amounting to RON 1.14m, representing the contribution in kind of the Romanian State, represented by the Ministry of Economy, Energy and Business Environment

- a number of subscribed 16,186 shares, amounting to RON 0.16m, representing the cash contribution in cash of other shareholders in exercising the right of preference

In view of the foregoing, in the meeting dated 22.09.2020, the Board of Directors of the company approved the following:

- Approval of the share capital increase following the allocation of a number of 130,043 new shares, amounting to RON 1.3m, representing the contribution in kind of the Romanian State and in cash of Nuclearelectrica shareholders registered in the register of shareholders as of 13.03.2020, who have 2 subscribed shares during the subscription period.

- The cancellation of a number of 7,972, representing the difference between the maximum number of shares that were offered for subscription to the other shareholders in exercising the preference right, 24,158, and the subscribed shares, 16,186

The percentage of shares assigned of the total of publicly offered shares is 67.0006%. The value of the share capital of Nuclearelectrica that will result following this operation will be of RON 3.016bn, fully subscribed and paid by the company’s shareholders, corresponding to a number of 301,643,894 shares.